Oklahoma Assignment and Bill of Sale to Corporation

Description

How to fill out Assignment And Bill Of Sale To Corporation?

Have you ever found yourself in a scenario where you need documents for either business or specific purposes almost every day.

There are numerous trustworthy document templates accessible online, but locating ones you can depend on is challenging.

US Legal Forms provides thousands of template forms, such as the Oklahoma Assignment and Bill of Sale to Corporation, designed to fulfill state and federal requirements.

Access all the document templates you have purchased in the My documents section. You can download another copy of the Oklahoma Assignment and Bill of Sale to Corporation at any time if required. Simply click the desired form to download or print the document template.

Utilize US Legal Forms, one of the largest collections of legal forms, to save time and avoid mistakes. The service provides professionally crafted legal document templates that can be used for various purposes. Create an account on US Legal Forms and start simplifying your life.

- If you are already familiar with the US Legal Forms site and have an account, simply Log In.

- After logging in, you can download the Oklahoma Assignment and Bill of Sale to Corporation template.

- If you do not have an account and wish to use US Legal Forms, adhere to these instructions.

- Select the form you need and ensure it corresponds to the correct area/state.

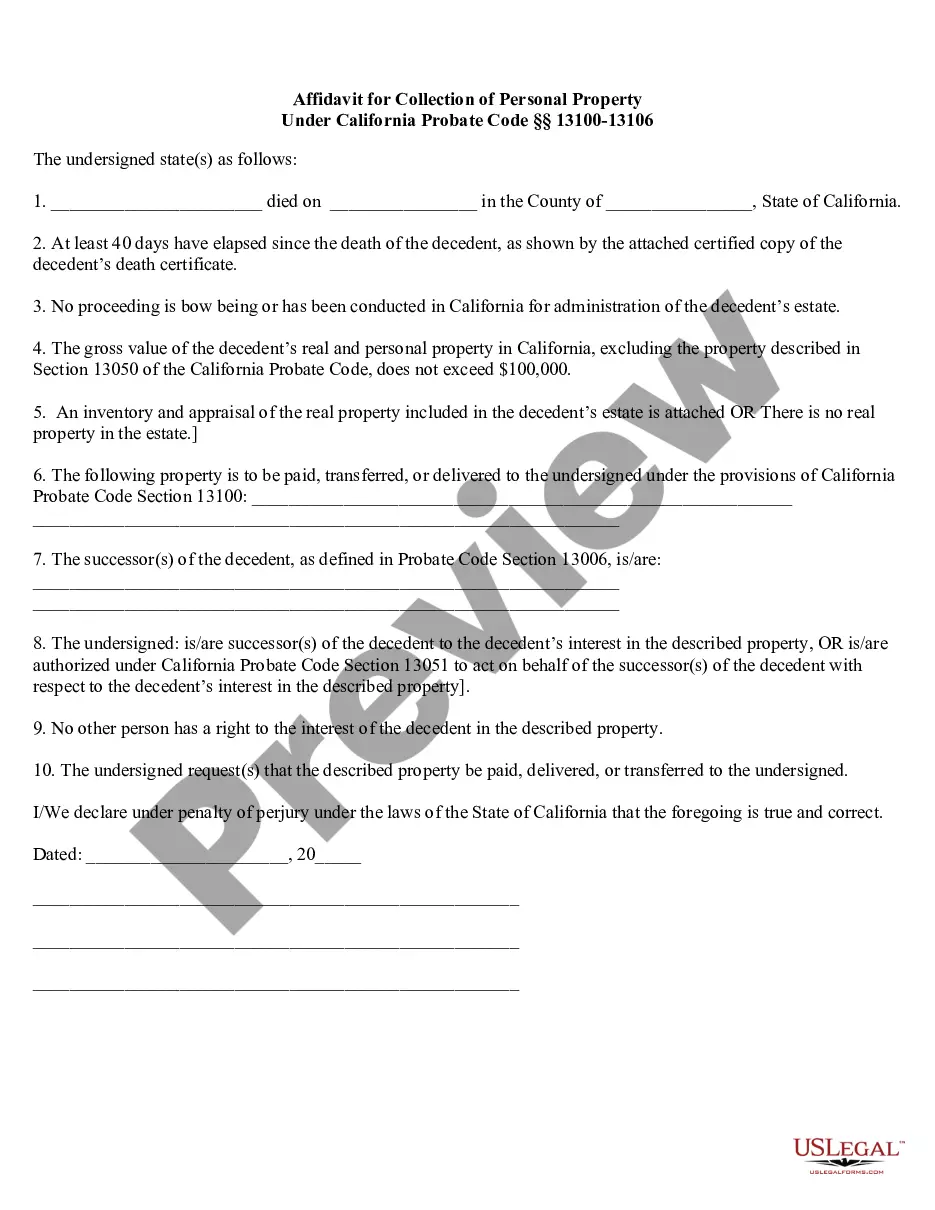

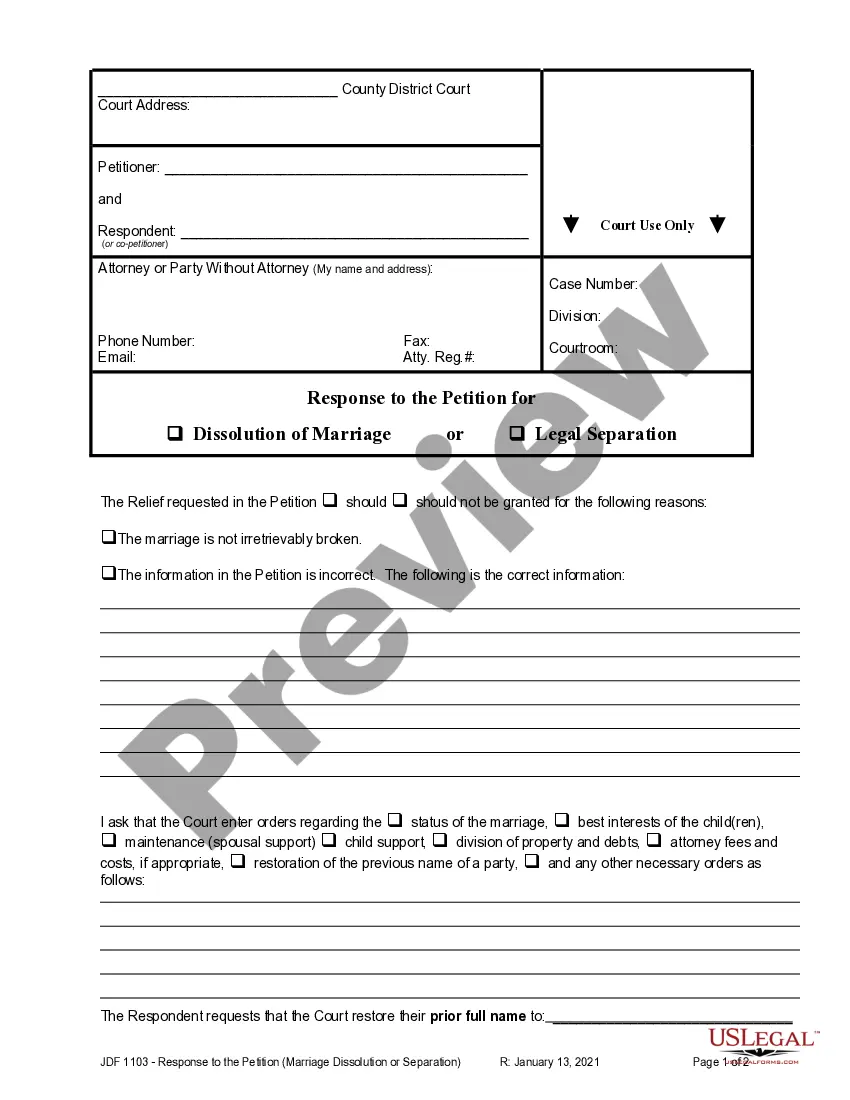

- Utilize the Review feature to inspect the form.

- Review the details to confirm you have selected the right document.

- If the form does not match what you are looking for, use the Search box to find the form that meets your needs.

- Once you locate the correct form, click on Get Now.

- Choose the pricing plan you desire, fill out the necessary information to create your account, and pay for the order using your PayPal or credit card.

- Select a convenient file format and download your copy.

Form popularity

FAQ

While it is not mandatory for the buyer to be present during a title transfer in Oklahoma, having them there can be beneficial. The buyer’s presence helps clarify any questions about the Oklahoma Assignment and Bill of Sale to Corporation and increases transparency during the transaction. If the buyer cannot attend, they should ensure that they provide all required information ahead of time. Using UsLegalForms can help both parties navigate the documentation needed for a successful title transfer.

To notarize a title in Oklahoma, both parties typically do not need to be present simultaneously. The seller can sign the title before a notary, who can then verify their identity. It’s essential to have the correct documents ready, including the Oklahoma Assignment and Bill of Sale to Corporation, to ensure a smooth notarization process. UsLegalForms offers user-friendly templates to help complete these steps easily.

In Oklahoma, both parties do not need to be present to transfer a title. The seller can complete the Oklahoma Assignment and Bill of Sale to Corporation on their own and provide the necessary documents to the buyer. However, having both parties present can streamline the process and ensure that all questions are answered immediately. It’s recommended to consult a legal professional for further guidance.

A bill of sale can still be valid in Oklahoma even if it is not notarized, as long as it meets the necessary legal requirements. However, notarization can help prevent disputes and provide additional proof of authenticity. Consider using USLegalForms to draft an Oklahoma Assignment and Bill of Sale to Corporation and ensure you create a valid document that fulfills all legal standards.

Yes, both parties are typically required to be present for a title transfer in Oklahoma. This presence helps verify identities and ensures that all parties agree to the transaction terms. When completing an Oklahoma Assignment and Bill of Sale to Corporation, being together during this process can prevent future disputes and confirm everything is in order.

While notarization is not mandatory for all bills of sale in Oklahoma, it is beneficial to enhance the document's credibility. Some specific transactions, like vehicle sales, might request notarization for a smoother title transfer. Ultimately, when creating your Oklahoma Assignment and Bill of Sale to Corporation, consider whether notarization aligns with your transaction's complexity.

In Oklahoma, a notarized bill of sale is not strictly required for most transactions. However, having the document notarized can add an extra layer of security and validity, especially when the bill of sale involves valuable items or vehicles. It is always a good practice to consider notarization when finalizing an Oklahoma Assignment and Bill of Sale to Corporation.

In Oklahoma, a bill of sale does not necessarily have to be notarized for it to be valid. However, notarization can provide additional security and serve as proof of the transaction, which can be beneficial during ownership disputes. For an Oklahoma Assignment and Bill of Sale to Corporation, it is wise to check specific requirements that may apply depending on the nature of the sale. Using platforms like uSlegalforms can help you navigate these nuances easily.

To transfer a title using only a bill of sale, ensure that the document includes specific information such as the seller's and buyer's names, the vehicle's identification number, and a description of the item being sold. In Oklahoma, you can use the bill of sale alongside the title transfer form when submitting to the local Department of Motor Vehicles. This can be particularly useful in the context of an Oklahoma Assignment and Bill of Sale to Corporation. uSlegalforms simplifies this process by providing templates and assistance to ensure all necessary details are included.

You can create a valid bill of sale without a notary in many cases, including when conducting an Oklahoma Assignment and Bill of Sale to Corporation. However, having a notary can enhance the document's credibility, especially when transferring ownership of valuable items or assets. It is recommended to check with local laws to ensure compliance with any specific requirements. If you're unsure, uSlegalforms can guide you through the process.