Oklahoma Convertible Note Agreement

Description

How to fill out Convertible Note Agreement?

If you wish to acquire, download, or print legal document templates, utilize US Legal Forms, the largest assortment of legal forms available online.

Take advantage of the website's straightforward and user-friendly search to find the documents you need.

Various templates for commercial and personal use are organized by categories and topics, or keywords. Use US Legal Forms to obtain the Oklahoma Convertible Note Agreement with just a few clicks.

Every legal document template you purchase belongs to you indefinitely. You can access every form you've downloaded in your account. Click the My documents section and select a form to print or download again.

Compete, download, and print the Oklahoma Convertible Note Agreement with US Legal Forms. There are millions of professional and state-specific forms available for your business or personal needs.

- If you are already a US Legal Forms customer, sign in to your account and then click the Download button to access the Oklahoma Convertible Note Agreement.

- You can also retrieve documents you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

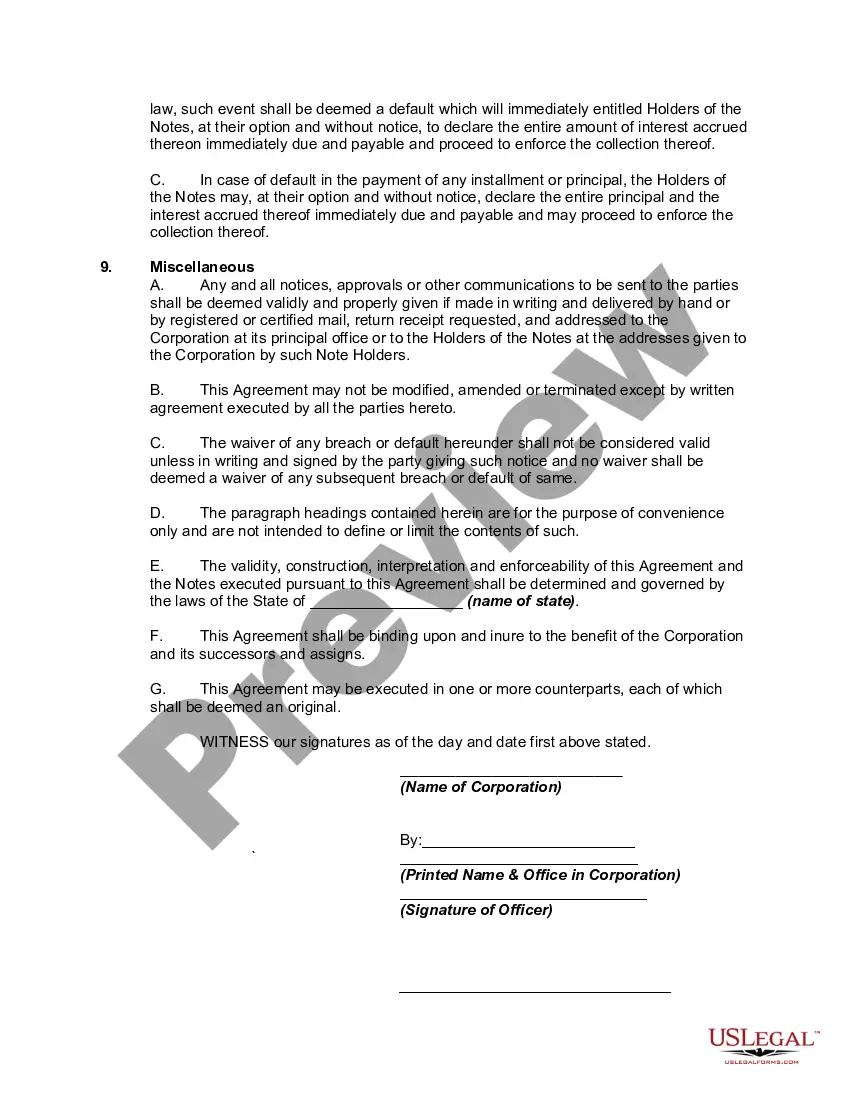

- Step 2. Use the Preview option to review the form's contents. Remember to read the details.

- Step 3. If you are not satisfied with the form, utilize the Search area at the top of the screen to find other variations of the legal form template.

- Step 4. Once you have located the form you need, click the Purchase now button. Choose your preferred pricing plan and enter your information to register for an account.

- Step 5. Complete the payment. You can use your credit card or PayPal account to finalize the transaction.

- Step 6. Choose the format of your legal form and download it to your device.

- Step 7. Complete, edit, and print or sign the Oklahoma Convertible Note Agreement.

Form popularity

FAQ

To write an effective Oklahoma Convertible Note Agreement, start by outlining the principal amount that the investor will lend. Next, include the interest rate, maturity date, and any conversion terms you desire. Clearly define the events that trigger conversion, such as future financing rounds or acquisitions. Utilizing a trusted platform like UsLegalForms can simplify this process, providing templates tailored for Oklahoma that ensure compliance and clarity.

The process for issuing convertible notes begins with crafting an Oklahoma Convertible Note Agreement that clearly defines all terms, including interest rates and conversion conditions. Once the agreement is ready, the company presents it to investors for consideration. Following this, the company can accept investments, and upon closing, the notes are issued to the investors as described in the agreement.

The settlement method of a convertible note typically occurs when the note converts into equity, often during a future financing round. This conversion is based on the terms set forth in the Oklahoma Convertible Note Agreement. For instance, the agreement may specify the conversion rate and the conditions under which it takes place.

The law governing convertible notes varies by jurisdiction, but generally, it falls under securities regulations. In Oklahoma, an Oklahoma Convertible Note Agreement must adhere to both federal and state securities laws. It is advisable to work with a legal professional who specializes in securities to ensure compliance and proper execution.

When a company issues convertible notes, it raises capital from investors while delaying equity dilution until a future date. This approach can attract early-stage investors who are interested in a share of ownership without immediate valuation concerns. An Oklahoma Convertible Note Agreement provides the structure to facilitate this investment and outlines the terms under which the notes will convert into shares.

Issuing a convertible note involves several key steps. First, a company must prepare an Oklahoma Convertible Note Agreement that outlines the terms of the note. Once finalized, the company must present this agreement to potential investors, who can then decide whether to invest, thereby converting their investment into equity at a later date.

The requirement for registration of convertible notes varies based on specific regulations and offerings. In general, an Oklahoma Convertible Note Agreement may need to comply with securities laws, which often include registration or exemption provisions. It is essential to consult with a legal expert familiar with Oklahoma laws to ensure compliance and avoid potential pitfalls.

A convertible note agreement is a legal document that sets the terms for a convertible note transaction. It includes details such as repayment conditions and the conversion mechanism into equity. Entrepreneurs and investors can create it to efficiently structure funding. Using a template for the Oklahoma Convertible Note Agreement can simplify this process.

Yes, an LLC can issue a convertible note under certain legal frameworks. The Oklahoma Convertible Note Agreement can be structured to reflect the specific needs of the LLC, provided it complies with state laws. This allows the LLC to attract investment while maintaining flexibility in equity structure.

One disadvantage of convertible notes is the potential dilution of ownership for existing shareholders when conversion occurs. This can affect control and profit sharing within a company. Additionally, if the company does not convert the notes as expected, it may lead to financial uncertainty. Understanding these implications within the Oklahoma Convertible Note Agreement is essential.