Oklahoma Receiving Order

Description

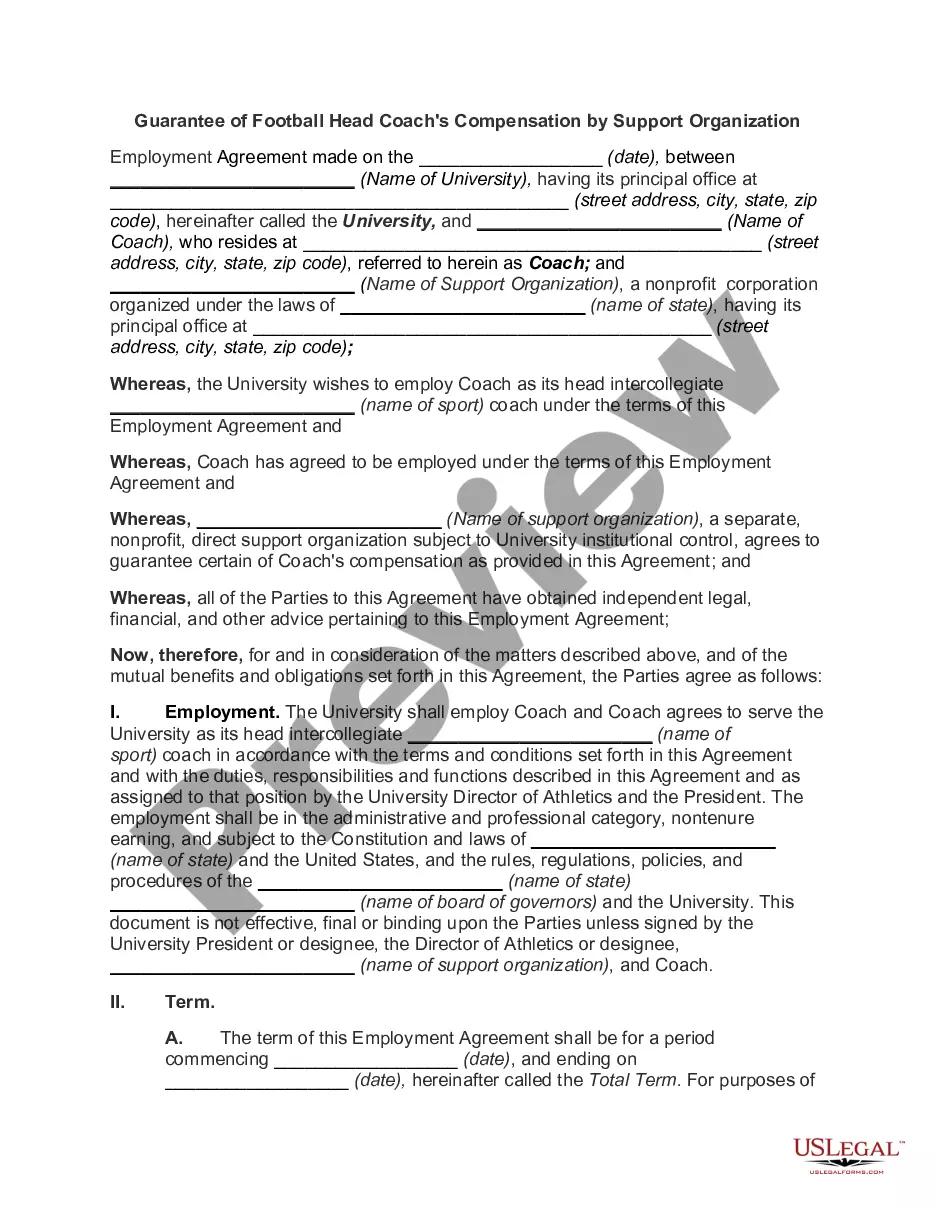

How to fill out Receiving Order?

If you desire to finalize, obtain, or print legal document templates, utilize US Legal Forms, the largest collection of legal forms, available online.

Make the most of the website's straightforward and user-friendly search to locate the documents you need.

A multitude of templates for business and personal purposes are organized by categories and states, or keywords.

Step 3. If you are dissatisfied with the form, use the Search field at the top of the screen to find other types of the legal form template.

Step 4. Once you have found the form you want, select the Get now button. Choose the pricing plan you prefer and input your information to register for an account.

- Utilize US Legal Forms to acquire the Oklahoma Receiving Order in just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click the Download button to obtain the Oklahoma Receiving Order.

- You can also access forms you have previously downloaded in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have chosen the form for the correct city/state.

- Step 2. Utilize the Review mode to inspect the contents of the form. Don’t forget to read the summary.

Form popularity

FAQ

The key distinction between a restraining order and a protective order in Oklahoma lies in their focus and intent. A protective order primarily aims to prevent domestic violence and harassment, while a restraining order can apply to various legal matters, including financial disputes. A deeper understanding of these differences will guide you in making informed decisions as you seek the right legal recourse such as an Oklahoma receiving order.

The severity of a restraining order compared to a protective order often depends on the circumstances involved. Protective orders are typically viewed as more serious because they are issued in response to threats of violence or domestic abuse. However, both orders carry legal repercussions for violations. If you are considering either option, it’s wise to explore your choices thoroughly, including the potential of obtaining an Oklahoma receiving order.

In Oklahoma, the three main types of protection include protective orders, temporary orders, and final orders. Protective orders address immediate threats of violence, temporary orders provide short-term relief while awaiting a hearing, and final orders offer long-term protection following a full court process. Each type serves a unique purpose, and knowing which one to pursue can help you effectively navigate your situation, including when seeking an Oklahoma receiving order.

In Oklahoma, the terms 'protective order' and 'restraining order' are often used interchangeably, but they serve different purposes. A protective order specifically addresses domestic violence and aims to safeguard individuals from abuse. In contrast, a restraining order may apply to various situations, including business matters. Understanding these differences is crucial when seeking legal protection or an Oklahoma receiving order.

To obtain a visitation order in Oklahoma, you must file a petition in the district court of your county. Be prepared to provide relevant details about your relationship with the child and the other parent. After filing, there will typically be a hearing where both parties can present their case. For those requiring assistance, the uslegalforms platform can offer valuable templates and guidance, simplifying the process of securing an Oklahoma receiving order.

In Oklahoma, protective orders are generally considered public records. This means that anyone can access them through the court system. It's important to understand that while the details are accessible, sensitive information may be redacted for privacy reasons. If you are interested in obtaining an Oklahoma receiving order or a protective order, you can find resources that guide you on how to navigate this process.

In Oklahoma, it is not legally permissible for one parent to keep a child from the other parent without a court order, such as an Oklahoma Receiving Order. Doing so could lead to legal consequences, as both parents typically share custody rights unless a court decides otherwise. If you find yourself in this situation, consider seeking guidance through legal resources like USLegalForms to understand your rights and options. Establishing clear court orders can help protect your interests and ensure that your child's well-being remains a top priority.

Harassment in Oklahoma is defined as unwanted behavior, such as making threats, stalking, or repeatedly contacting someone after being told to stop. This can also include disturbing someone's peace or using offensive language. If you believe you are facing harassment, the Oklahoma Receiving Order can provide the legal support needed to seek protection against such behavior.

In Oklahoma, a restraining order typically addresses issues such as financial disputes or property matters, while a protective order focuses specifically on protecting individuals from domestic abuse or threats. A protective order carries more stringent conditions based on the severity of the situation. Understanding this distinction can clarify which legal route suits your needs, especially when considering the Oklahoma Receiving Order.

To obtain a visitation order in Oklahoma, you must file a petition with the court outlining your relationship to the child and the reasons for requesting visitation. You will also need to provide a plan that prioritizes the child's best interests. The Oklahoma Receiving Order can help establish and enforce visitation rights, ensuring a structured approach to parental access.