The Oklahoma Accounts Receivable Write-Off Approval Form is a document used by organizations in the state of Oklahoma to request authorization for writing off a specific amount owed to them as bad debt. This form plays a crucial role in maintaining accurate financial records and ensuring compliance with accounting standards. The primary purpose of the Oklahoma Accounts Receivable Write-Off Approval Form is to seek approval from designated authorities or management for removing an unpaid invoice or outstanding balance from the accounts receivable ledger. This action is taken when it becomes clear that the debtor is unable or unwilling to pay the debt, making further collection efforts unproductive. This form provides a comprehensive overview of the debt, including important details such as the debtor's name, contact information, outstanding amount, invoice number, and the reason for requesting the write-off. The person completing the form must justify the write-off by explaining the efforts made to collect the debt, any communication with the debtor, and the overall impact on the financial statements. Depending on the organization's specific requirements, there may be different types or variations of the Oklahoma Accounts Receivable Write-Off Approval Form. Some common variations include: 1. Standard Write-Off Approval Form: This is the most frequently used form and covers the typical scenarios where the debt is deemed uncollectible due to bankruptcy, insolvency, or the debtor's disappearance. 2. Small Balance Write-Off Approval Form: This form is used when the outstanding amount is relatively small and falls below a certain threshold defined by the organization. It simplifies the approval process for minor bad debts. 3. Fraudulent Activity Write-Off Approval Form: In cases involving fraud or deliberate nonpayment, this specialized form is used to seek approval for write-offs resulting from fraudulent activities by debtors. 4. Legal Action Write-Off Approval Form: This form is utilized when legal action has been taken against the debtor, but it is determined that pursuing further collection efforts is not feasible due to high legal costs or the potential for inadequate recovery. In summary, the Oklahoma Accounts Receivable Write-Off Approval Form is a vital tool for managing bad debts and maintaining accurate financial records. It enables organizations to seek permission for removing uncollectible debts from their accounts receivable ledger, safeguarding the integrity of their financial statements. Various types of this form exist to cater to different circumstances and ensure streamlined approval processes.

Oklahoma Accounts Receivable Write-Off Approval Form

Description

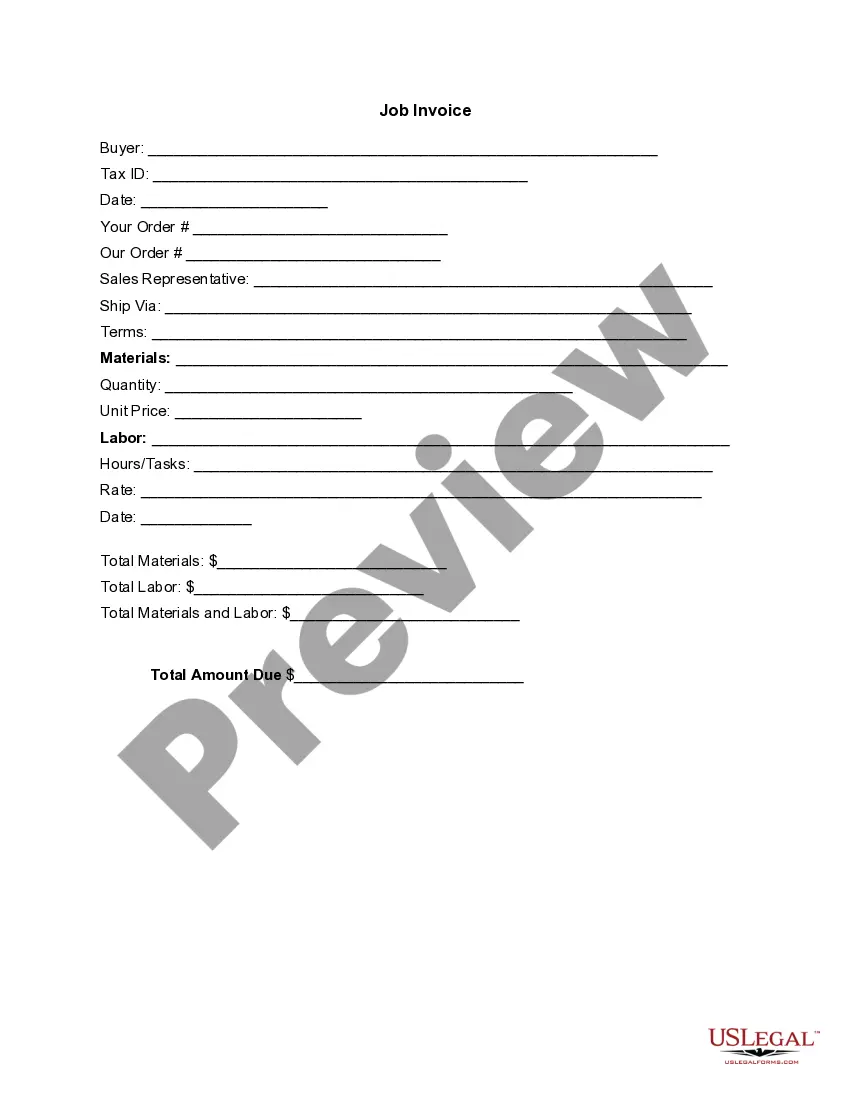

How to fill out Oklahoma Accounts Receivable Write-Off Approval Form?

Finding the right lawful record web template could be a have difficulties. Naturally, there are a variety of web templates accessible on the Internet, but how would you get the lawful form you want? Utilize the US Legal Forms site. The services provides a huge number of web templates, like the Oklahoma Accounts Receivable Write-Off Approval Form, which you can use for company and personal requires. All of the forms are checked out by specialists and fulfill federal and state specifications.

If you are already registered, log in to the accounts and click on the Download button to find the Oklahoma Accounts Receivable Write-Off Approval Form. Make use of your accounts to search throughout the lawful forms you possess purchased earlier. Check out the My Forms tab of the accounts and obtain another backup of your record you want.

If you are a whole new customer of US Legal Forms, listed below are straightforward instructions that you can stick to:

- Initial, ensure you have selected the correct form for the town/area. You may check out the form while using Review button and look at the form outline to guarantee this is basically the right one for you.

- When the form will not fulfill your requirements, utilize the Seach field to discover the correct form.

- Once you are certain that the form is acceptable, click on the Purchase now button to find the form.

- Select the prices plan you need and enter in the required information and facts. Create your accounts and purchase the transaction with your PayPal accounts or bank card.

- Pick the document format and obtain the lawful record web template to the product.

- Total, change and print and signal the acquired Oklahoma Accounts Receivable Write-Off Approval Form.

US Legal Forms may be the greatest library of lawful forms for which you can see numerous record web templates. Utilize the service to obtain appropriately-manufactured paperwork that stick to condition specifications.