Oklahoma Checklist - Action to Improve Collection of Accounts

Description

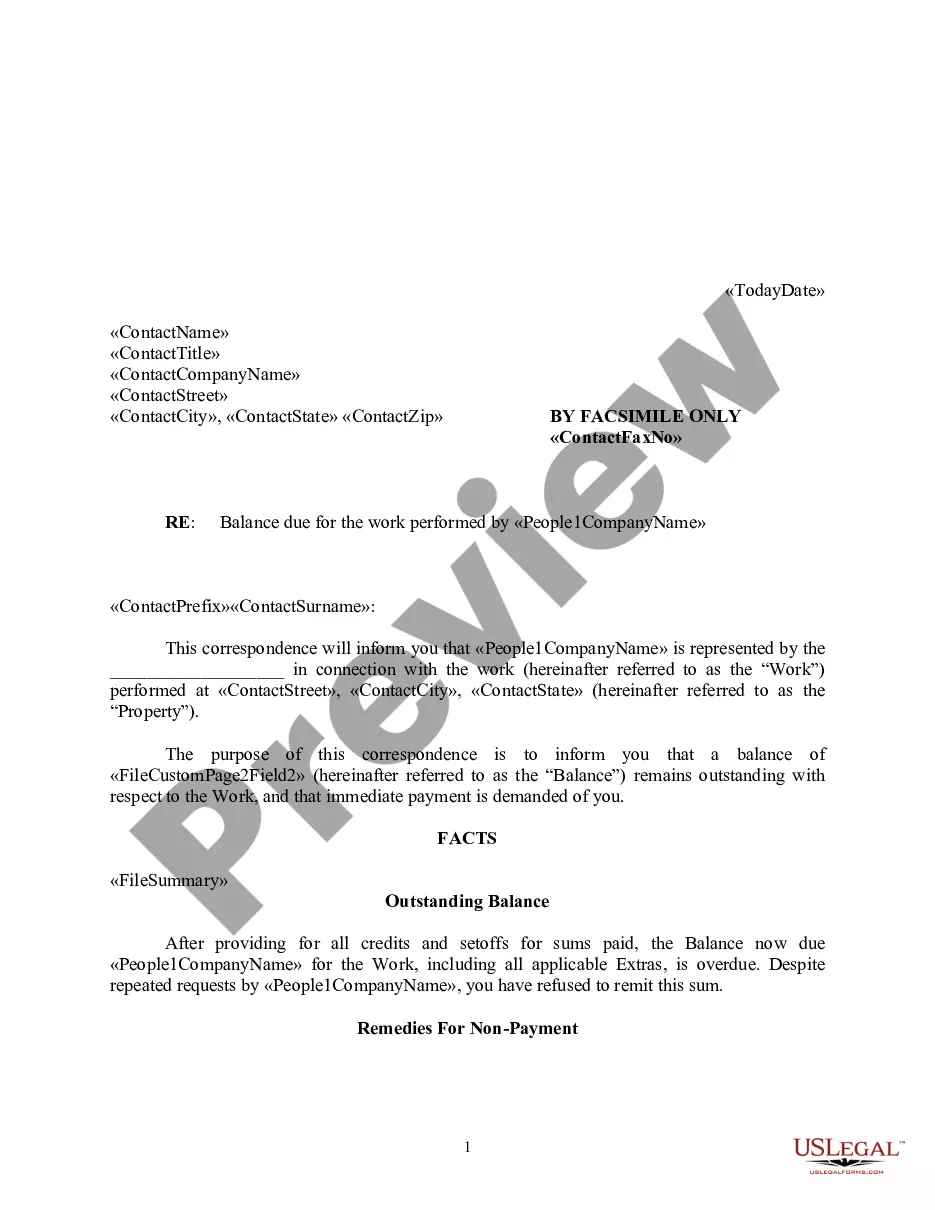

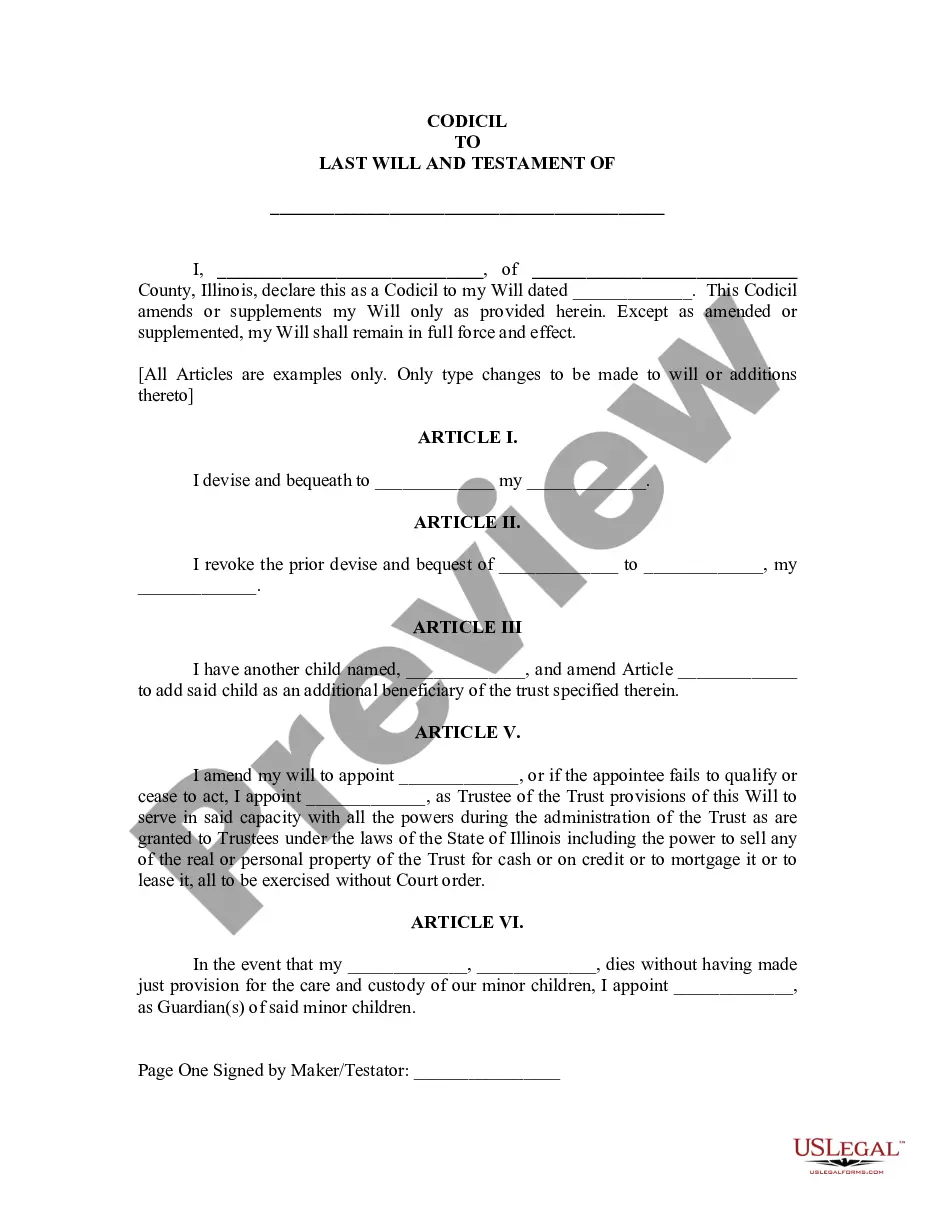

How to fill out Checklist - Action To Improve Collection Of Accounts?

Are you currently in a situation where you require documents for either business or personal purposes almost every day.

There are many legal document templates accessible online, but locating trustworthy ones can be challenging.

US Legal Forms offers thousands of template options, such as the Oklahoma Checklist - Action to Improve Collection of Accounts, designed to meet state and federal requirements.

When you find the appropriate form, click Get now.

Select the payment plan you want, fill in the necessary details to create your account, and complete the purchase using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Afterward, you can download the Oklahoma Checklist - Action to Improve Collection of Accounts template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- 1. Obtain the form you need and ensure it is suitable for your specific city/region.

- 2. Use the Preview option to examine the form.

- 3. Check the description to make sure you have selected the correct form.

- 4. If the form is not what you are looking for, use the Search field to find the form that meets your needs and specifications.

Form popularity

FAQ

Improving your debt collection period starts with a structured approach. Use the Oklahoma Checklist - Action to Improve Collection of Accounts to identify areas needing attention. By implementing clear follow-up procedures and communicating effectively with your clients, you reduce delays in payment. Additionally, using tools like those offered by US Legal Forms can help streamline your processes and enhance your overall collection effectiveness.

Collection strategies can be improved by regularly analyzing payment trends and customer behaviors, allowing businesses to tailor their approaches. Additionally, leveraging technology for reminders and payment tracking enhances efficiency. By adopting the Oklahoma Checklist - Action to Improve Collection of Accounts, organizations can systematically refine their collection strategies, ensuring they are proactive and effective.

The 5 C's of accounts receivable management include Customer, Credit, Capacity, Capital, and Condition. Understanding each 'C' helps businesses assess their customers and make informed decisions regarding credit policies. Implementing the Oklahoma Checklist - Action to Improve Collection of Accounts ensures that companies can effectively manage each aspect of these 5 C's, leading to better collection outcomes.

To improve accounts receivable (AR) collection, businesses should focus on enhancing their customer relationships and establishing clear credit policies. Developing a consistent follow-up schedule for overdue payments also plays a crucial role. By following the Oklahoma Checklist - Action to Improve Collection of Accounts, companies can structure their collection efforts and increase the likelihood of timely payments.

Several strategies can help improve the collection of receivables, including maintaining clear communication with customers and offering multiple payment options. Regularly reviewing accounts and identifying slow payers is also essential. By utilizing the Oklahoma Checklist - Action to Improve Collection of Accounts, businesses can prioritize these strategies and streamline their collection efforts effectively.

Improving the collection of accounts receivable involves implementing efficient billing and follow-up practices. Businesses should review their invoicing methods and ensure they are clear and timely. Additionally, evaluating payment terms and utilizing the Oklahoma Checklist - Action to Improve Collection of Accounts can guide companies in developing strategies that encourage prompt payments from clients.

The collection process in accounts receivable includes several key steps, starting from invoicing to payment follow-ups. Initially, businesses send out invoices promptly after the service or product delivery. Next, they monitor payments and send reminders for overdue accounts. Utilizing the Oklahoma Checklist - Action to Improve Collection of Accounts can enhance this process by providing structured steps to effectively manage and collect outstanding debts.