Oklahoma Return Authorization Form serves as an essential document that allows individuals or businesses to initiate the process of returning an item or seeking a refund in the state of Oklahoma. This form ensures a systematic and efficient return process, ensuring both the customer and the retailer are aware of their rights and responsibilities. The Oklahoma Return Authorization Form typically includes various sections to gather relevant details. These sections may include: 1. Contact Information: This section gathers the customer's name, address, phone number, and email address. It enables the retailer to establish proper communication and identification. 2. Purchase Details: Here, customers provide information about the purchased item such as the name, description, model number, purchase date, and receipt number. These details assist the retailer in identifying the product and verifying its eligibility for return. 3. Reason for Return: This section allows customers to explain the primary reason for returning the item. Common reasons could include product defects, damaged goods, incorrect items received, change of mind, or any other specific issues. Clear and concise explanation helps the retailer better understand and resolve the problem. 4. Return Preferences: In this part, customers can express their preferences for the return process, such as requesting a refund, exchange, store credit, or repair. Retailers may also offer additional options like shipping instructions, pickup service, or drop-off location. 5. Supporting Documentation: If applicable, customers may be required to attach supporting documentation like receipts, invoices, or photographs as proof of purchase, damage, or other relevant factors. This helps reinforce their claim during the return process. It is worth noting that while the structure and sections of the Oklahoma Return Authorization Form may remain consistent, there might be variations depending on the retailer or specific return policies. Certain businesses might also have distinct return authorization forms tailored to different product categories, such as electronics, apparel, or furniture. These specialized return forms can streamline the process by capturing specific information relevant to different types of products. To ensure a hassle-free return experience, customers are advised to carefully read the retailer's return policy and follow any specific instructions provided on the Oklahoma Return Authorization Form. By adhering to these guidelines, customers can facilitate quick resolution while protecting their rights as consumers.

Oklahoma Return Authorization Form

Description

How to fill out Oklahoma Return Authorization Form?

It is possible to commit hrs on the web attempting to find the lawful document format that fits the state and federal needs you need. US Legal Forms offers thousands of lawful types that happen to be reviewed by pros. You can actually obtain or print the Oklahoma Return Authorization Form from your assistance.

If you have a US Legal Forms accounts, you can log in and click on the Down load option. Afterward, you can full, edit, print, or indicator the Oklahoma Return Authorization Form. Each and every lawful document format you acquire is your own property eternally. To get an additional backup associated with a purchased kind, proceed to the My Forms tab and click on the corresponding option.

If you use the US Legal Forms website the first time, keep to the easy guidelines listed below:

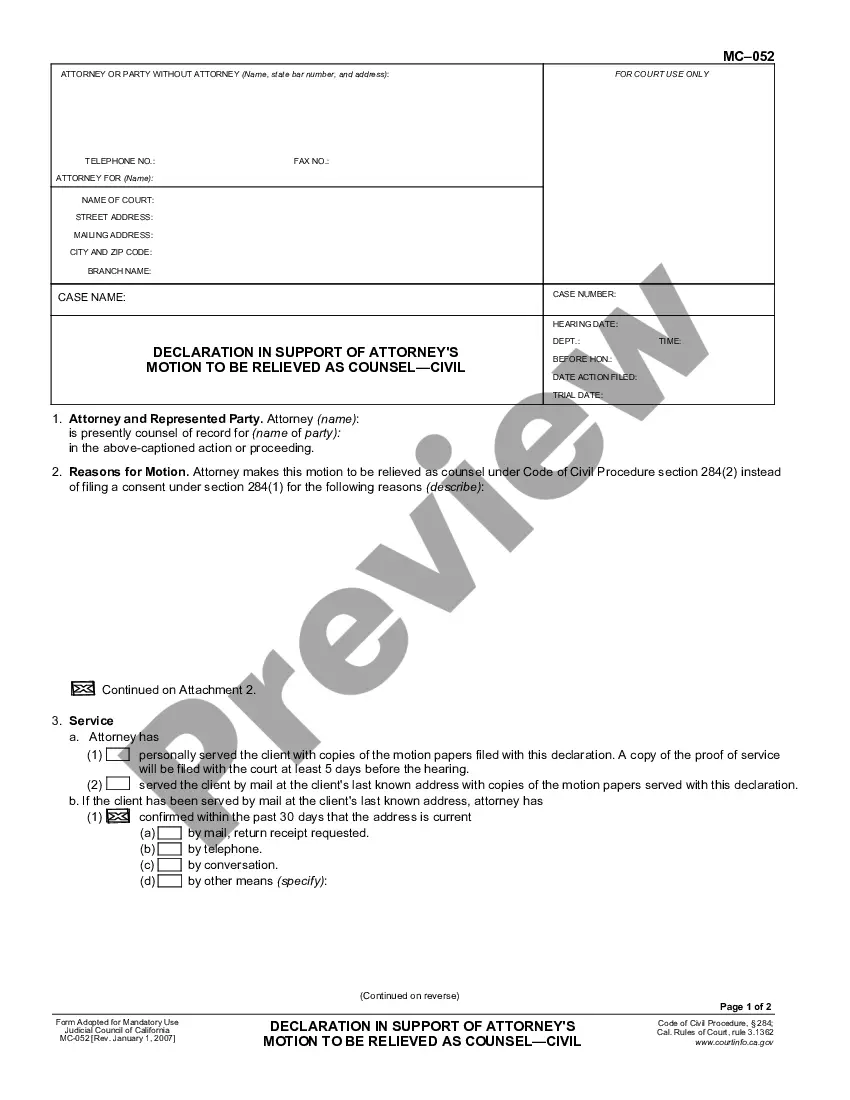

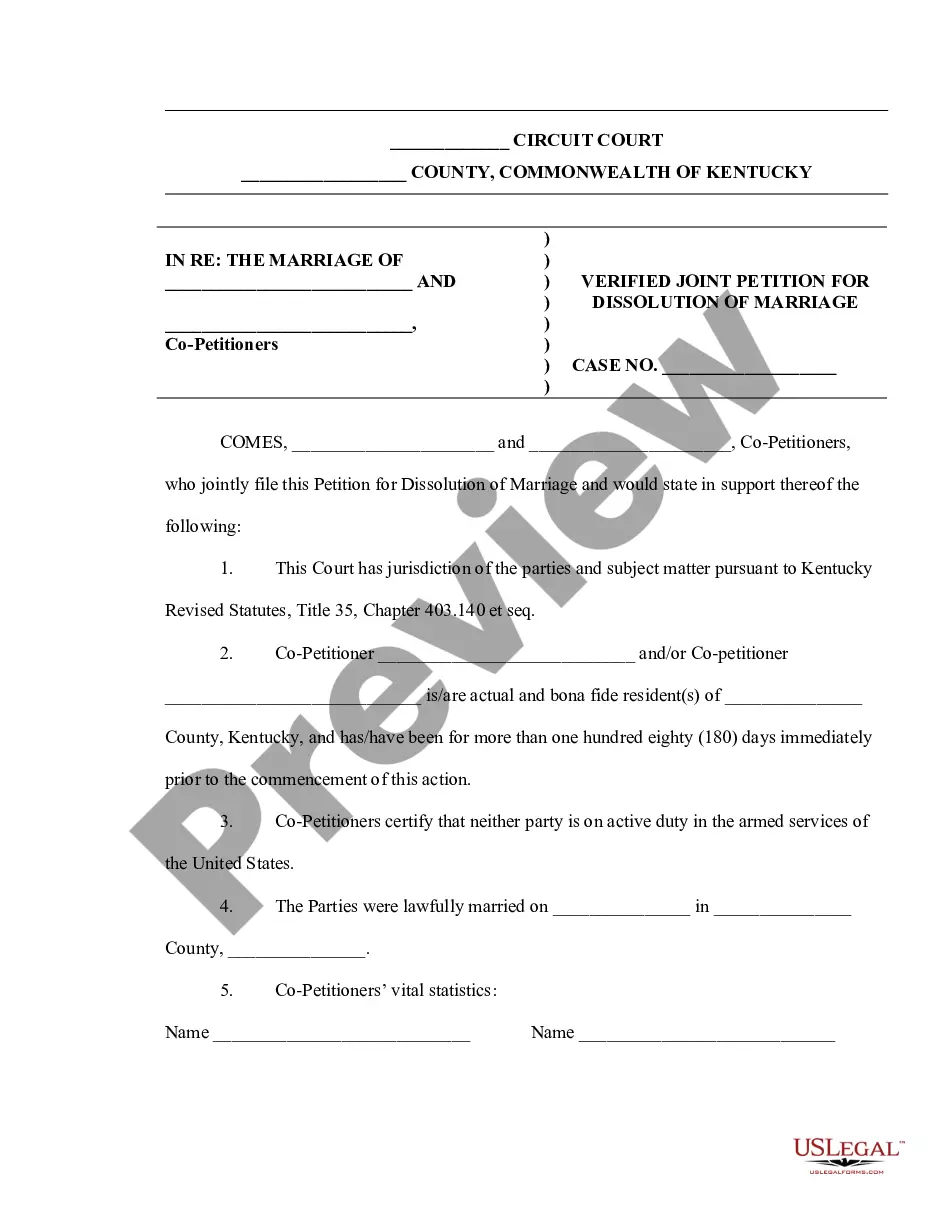

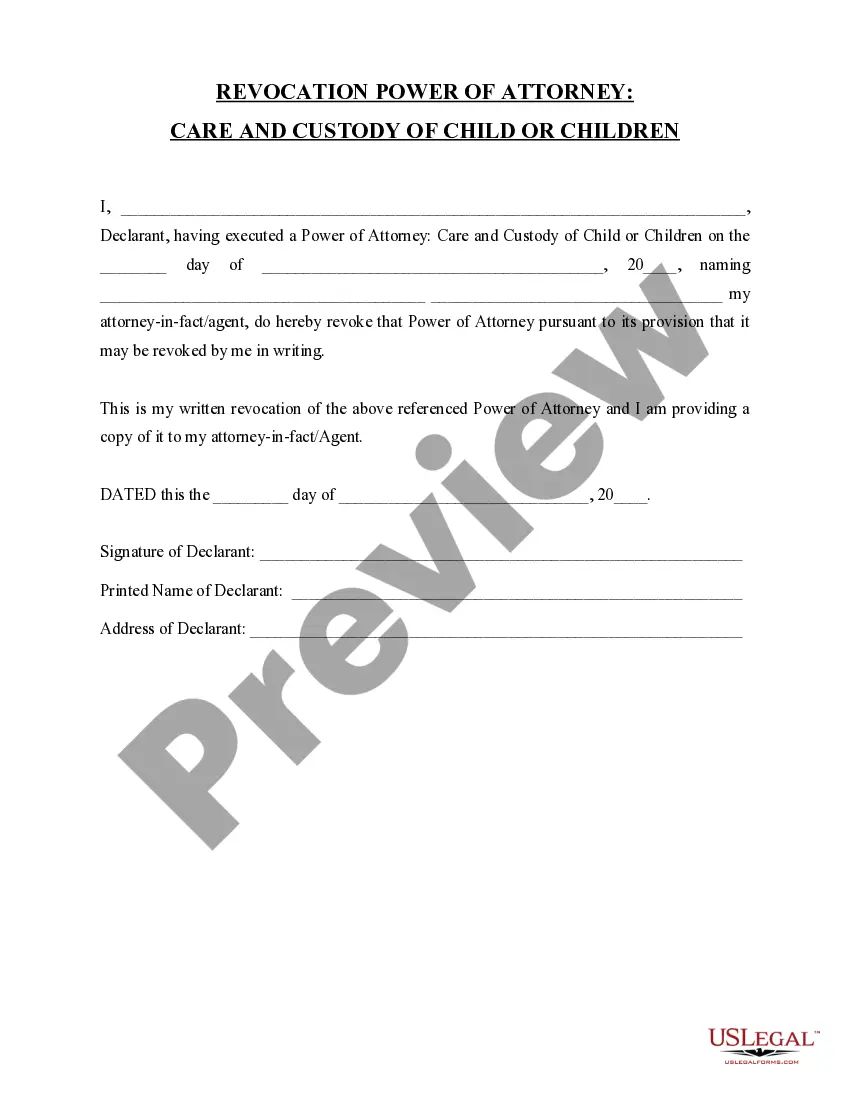

- Initial, be sure that you have chosen the correct document format for your region/area that you pick. Look at the kind outline to ensure you have selected the proper kind. If available, make use of the Review option to search through the document format at the same time.

- If you would like get an additional model in the kind, make use of the Look for discipline to find the format that suits you and needs.

- After you have located the format you need, click on Get now to continue.

- Pick the prices strategy you need, key in your accreditations, and register for an account on US Legal Forms.

- Complete the transaction. You can utilize your charge card or PayPal accounts to cover the lawful kind.

- Pick the structure in the document and obtain it to your product.

- Make changes to your document if possible. It is possible to full, edit and indicator and print Oklahoma Return Authorization Form.

Down load and print thousands of document web templates while using US Legal Forms site, which provides the most important assortment of lawful types. Use professional and condition-specific web templates to take on your organization or specific needs.

Form popularity

FAQ

Form OK-W-4 is completed so you can have as much take-home pay as possible without an income tax liability due to the state of Oklahoma when you file your return. Deductions and exemptions reduce the amount of your taxable income.

Form 511EF is the Oklahoma Individual Income Tax Declaration for Electronic Filing form.

OTC Form 500-A "Information Return - Production Payments" - Oklahoma.

Oklahoma Taxpayer Access Point (OkTAP) - FAQ.

Generally, your Oklahoma income tax is due April 15th. However: 2022 If you electronically file your return and pay electronically, your due date is extended until April 20th. To make a payment online, visit oktap.tax.ok.gov and click on the Make a Payment link.

Corporations not filing Form 200-F must file a stand-alone Oklahoma Annual Franchise Tax Return (Form 200). Corporations that remitted the maximum amount of franchise tax for the preceding tax year, or that had their corporate charter suspended, do not qualify to file a combined income and franchise tax return.

Printable 2021 Oklahoma Form 511EF (Individual Income Tax Declaration for Electronic Filing)

Oklahoma levies a franchise tax on all corporations or associations doing business in the state. Corporations are taxed $1.25 for each $1,000 of capital invested or otherwise used in Oklahoma up to a maximum levy of $20,000 (foreign corporations are assessed an additional $100 per year).

Except as otherwise provided for in the Pass-Through Entity Tax Equity Act of 2019, every nonresident with Oklahoma source gross income of $1,000 or more is required to file an Oklahoma income tax return.

PO Box 26930 Oklahoma City, OK 73126-0930 b. A courier will pick up the PO Box 26930 mail at various times each day of the week including weekends.