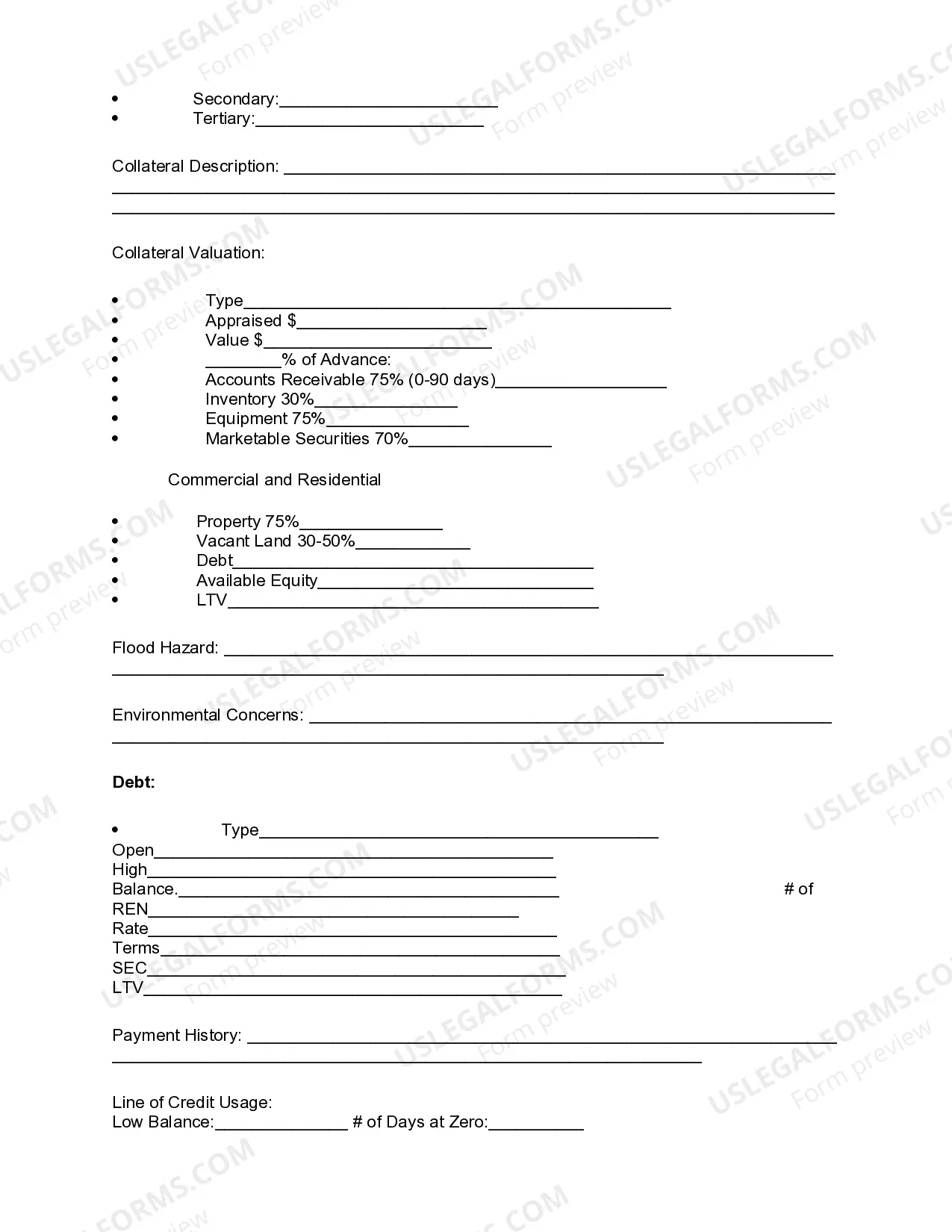

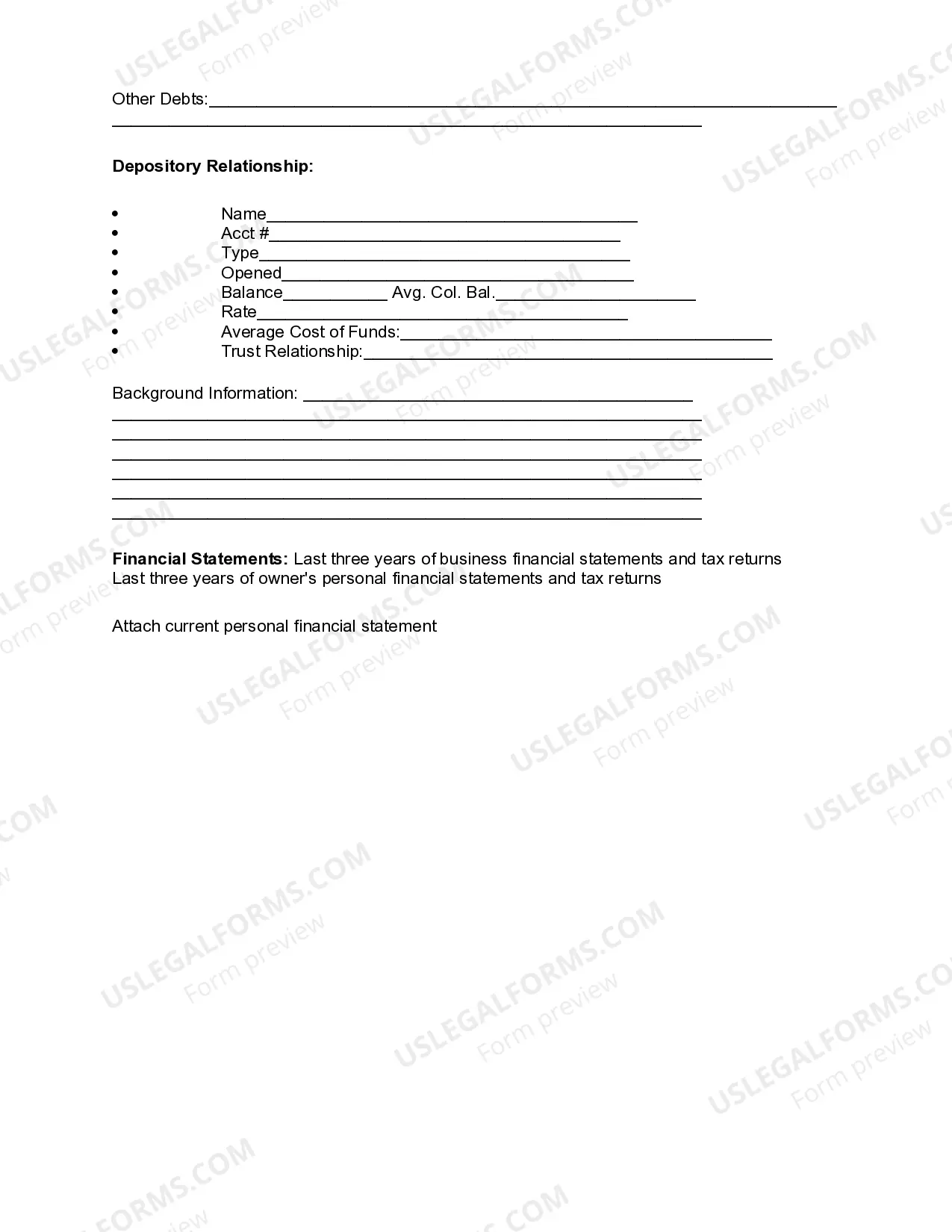

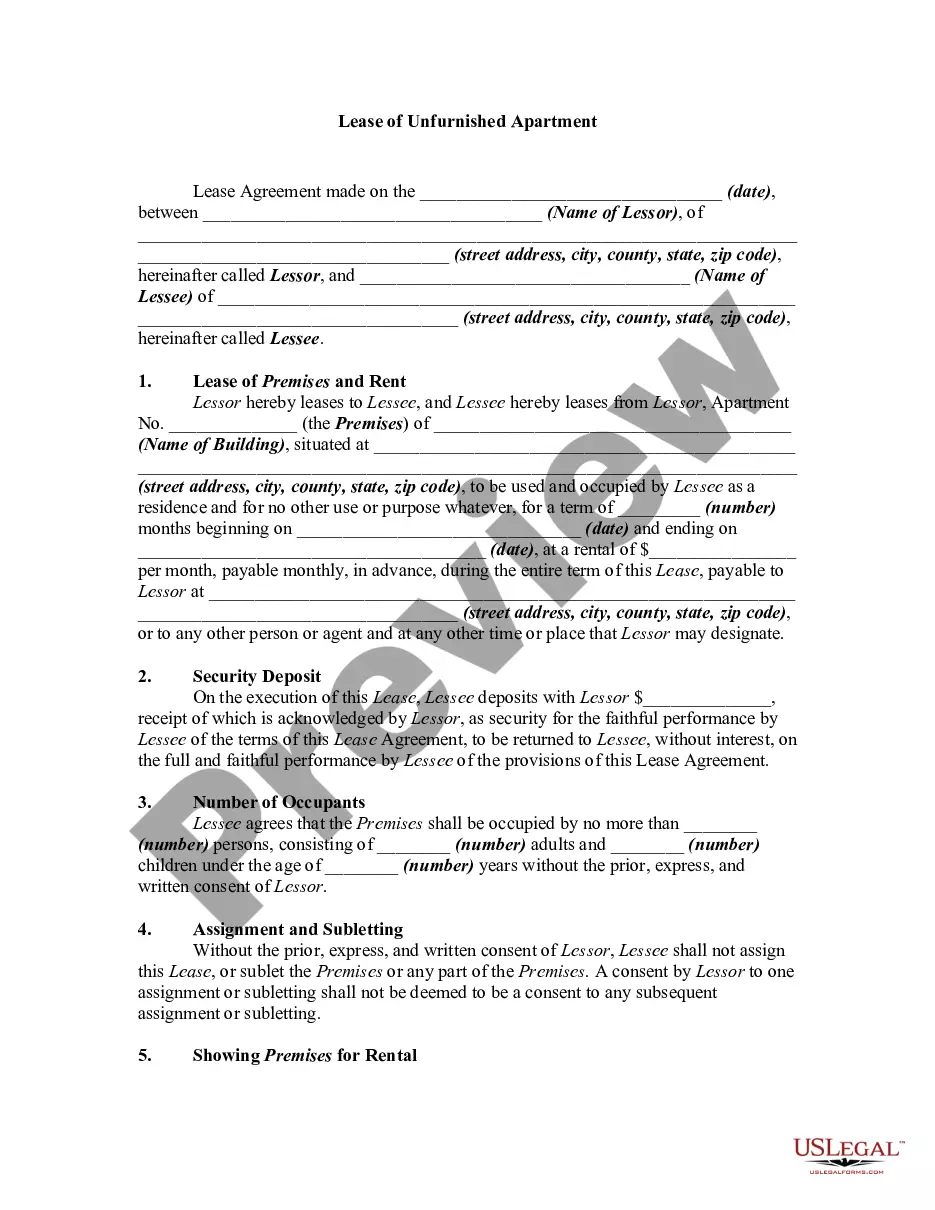

Oklahoma Review of Loan Application is a crucial step in the loan application process in the state of Oklahoma. This process ensures that the lender thoroughly evaluates and assesses the loan application to determine its eligibility for approval. The review is conducted by financial institutions, credit unions, or lenders who adhere to the state's regulations and guidelines. During the Oklahoma Review of Loan Application, various aspects are examined, including the borrower's financial information, credit history, employment stability, debt-to-income ratio, and collateral (if applicable). These factors play a significant role in evaluating the borrower's creditworthiness and ability to repay the loan. There are different types of Oklahoma Review of Loan Application based on the type of loan being applied for. Some common types include: 1. Mortgage Loan Application Review: This type of review applies to individuals seeking loans to purchase or refinance a home or other real estate properties. Lenders assess factors such as the borrower's credit score, income stability, down payment, and property valuation. 2. Personal Loan Application Review: This review is conducted for applicants looking for unsecured personal loans, typically used for various purposes like debt consolidation, home improvement, or unexpected expenses. Lenders scrutinize the applicant's creditworthiness, income, employment history, and overall financial stability. 3. Business Loan Application Review: For entrepreneurs and small business owners, this type of review is essential when seeking funding for business expansion, equipment purchase, working capital, or start-up costs. Lenders evaluate the business's financial statements, creditworthiness, cash flow, business plan, and collateral (if applicable). 4. Auto Loan Application Review: This review is specifically for individuals applying for financing to purchase a vehicle. Lenders assess the borrower's credit score, income, employment history, down payment amount, and the vehicle's value. During the Oklahoma Review of Loan Application process, it is essential to provide accurate and complete information as any fraudulent or misleading details could lead to the application's rejection. Applicants should gather all relevant financial documents, such as tax returns, employment verification, bank statements, and proof of assets. It is important to note that the specific requirements and guidelines for the Oklahoma Review of Loan Application may slightly vary depending on the lender and loan type. Therefore, it is advisable for potential borrowers to consult with their chosen financial institution or lender to ensure they understand the specific documentation and qualifications necessary for their loan application in Oklahoma.

Oklahoma Review of Loan Application

Description

How to fill out Oklahoma Review Of Loan Application?

Are you within a placement in which you need to have documents for possibly business or specific functions almost every day time? There are a variety of legal file themes available on the Internet, but getting kinds you can trust is not simple. US Legal Forms delivers thousands of kind themes, such as the Oklahoma Review of Loan Application, that are created to fulfill state and federal specifications.

If you are previously acquainted with US Legal Forms site and get a merchant account, merely log in. Afterward, it is possible to acquire the Oklahoma Review of Loan Application template.

Unless you have an account and need to begin to use US Legal Forms, abide by these steps:

- Discover the kind you will need and ensure it is for your correct town/region.

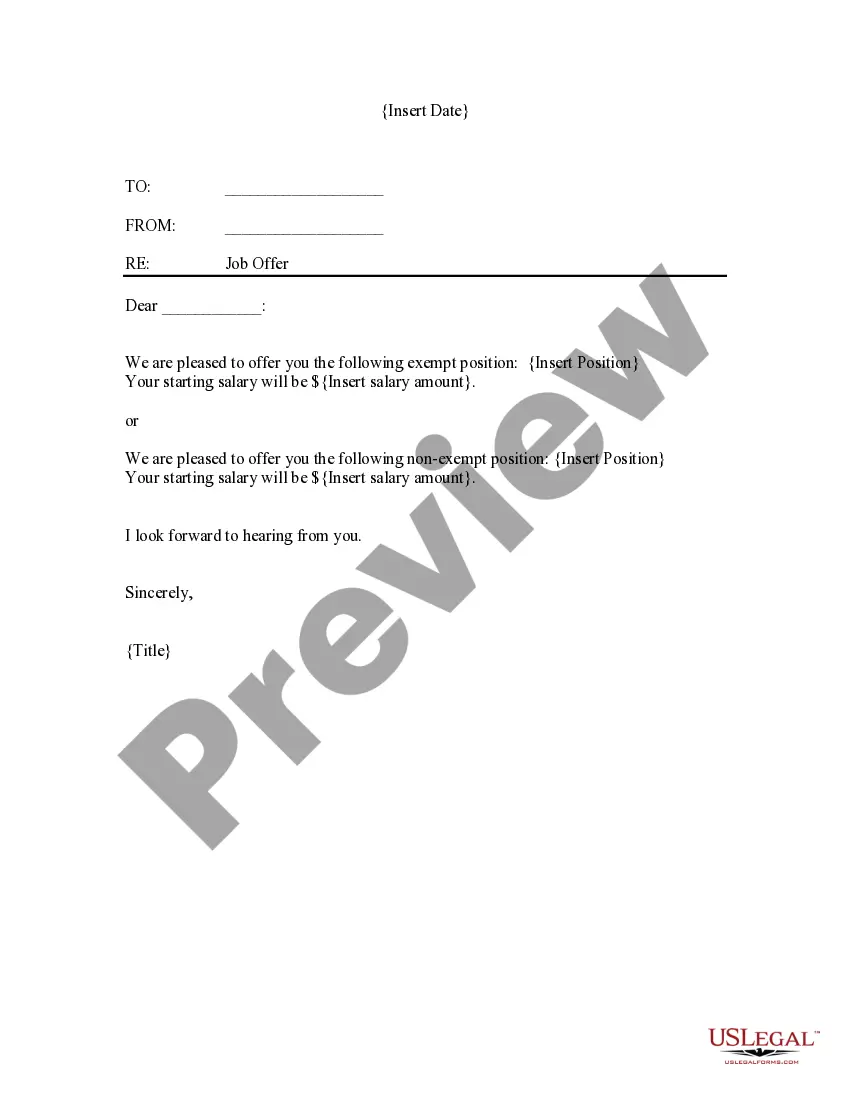

- Utilize the Preview option to check the shape.

- Read the explanation to ensure that you have selected the correct kind.

- In the event the kind is not what you are searching for, take advantage of the Look for field to find the kind that meets your needs and specifications.

- If you obtain the correct kind, simply click Buy now.

- Opt for the prices plan you need, complete the desired information and facts to produce your money, and pay money for your order utilizing your PayPal or Visa or Mastercard.

- Select a handy document formatting and acquire your backup.

Discover every one of the file themes you might have purchased in the My Forms menu. You can aquire a additional backup of Oklahoma Review of Loan Application at any time, if needed. Just click on the necessary kind to acquire or print out the file template.

Use US Legal Forms, the most substantial selection of legal forms, to conserve time as well as prevent faults. The service delivers expertly made legal file themes that you can use for an array of functions. Create a merchant account on US Legal Forms and start generating your daily life easier.

Form popularity

FAQ

When reviewing a bank loan, there are several factors you need to consider to ensure that the loan is suitable for you. Interest Rates - The interest rate is the amount of money the lender charges for borrowing the funds. ... Repayment Terms - The repayment term is the length of time you have to repay the loan.

The loan review will consist of meetings with lending staff including loan administration to understand the lending process and procedures from intake to closing. The loan review team will also be reviewing underwriting and collateral files to ascertain the underwriting, monitoring, and documentation practices.

A loan review provides an assessment of the overall quality of a loan portfolio. Specifically, a loan review: ? Assesses individual loans, including repayment risks.

What Should I Look for When Reviewing Loan Documents? Principal loan Amount. ... Loan duration. ... Interest rate. ... Repayment terms : Every loan agreement should have a repayment schedule that provides the borrower with clear instructions on how to repay the loan. ... Fees and charges. ... Collateral. ... Default. ... Collection procedures.

Check Your Budget - Before applying for a loan, it's important to assess your budget to determine if you can afford the monthly payments. Review your income and expenses to see if you can comfortably repay the loan. This will help you avoid defaulting on the loan, which can negatively impact your credit score.

Loan Approval ? After the application and supporting documents are analyzed by the lender and Credit Administration, it is presented for review and approval. A decision will be made to reject the loan request, table the discussion pending more information, or approve the loan, generally with conditions.

Loan Application And Preapproval: A Few Days The lender will look at all this information and determine whether, based on the information you provided, you meet their qualifications for getting a loan. This will typically take less than a week to complete.