Title: Unveiling Different Types of Oklahoma Sample Letters for Tax Exemption — A Review of a Sample Letter Received from the Tax Collector Introduction: When it comes to tax exemption in Oklahoma, understanding the intricacies of the process and being aware of the different types of sample letters can be immensely helpful. In this article, we will provide you with a detailed review of a sample letter received from the tax collector. Exploring its key components and highlighting various types of Oklahoma sample letters for tax exemption, we aim to empower you with the knowledge needed to navigate the tax exemption landscape effectively. Review of a Sample Letter Received from the Tax Collector: 1. Content Details: The sample letter received from the tax collector serves as a crucial communication tool for taxpayers seeking tax exemption in Oklahoma. It typically contains the following key elements: — Introduction: The letter begins by addressing the recipient and stating the purpose of the communication. — Identification: It includes the taxpayer's details such as name, address, and Taxpayer Identification Number (TIN). — Exemption Request: The letter clearly outlines the specific grounds on which the taxpayer is seeking exemption. — Supporting Documents: The tax collector may require certain documentation to process the exemption request, which is often mentioned in the letter. — Contact Information: The letter concludes by providing the tax collector's contact details for any inquiries or clarifications. 2. Types of Oklahoma Sample Letters for Tax Exemption: 2.1 Religious Organization Tax Exemption Letter: This type of sample letter is specifically designed for religious organizations seeking tax exemption, as per the guidelines laid out by the Oklahoma Tax Commission. It emphasizes the religious purpose, mission, and requirements for qualifying for tax exemption. 2.2 Charitable Organization Tax Exemption Letter: Charitable organizations in Oklahoma can utilize this sample letter to demonstrate eligibility for tax exemption. It highlights the organization's charitable activities, proof of 501(c)(3) status, and compliance with state and federal regulations. 2.3 Disabled Person Tax Exemption Letter: Individuals with certain disabilities may be eligible for tax exemption in Oklahoma. The sample letter for this category emphasizes the nature of the disability, medical records, and any government certifications or approvals supporting the exemption request. 2.4 Agricultural Exemption Letter: Farmers, ranchers, and agricultural businesses can make use of this sample letter to apply for tax exemptions on agricultural equipment, land, or other eligible items. It outlines the agricultural activities undertaken and provides evidence of the exemption criteria being met. Conclusion: Having a proper understanding of the types of Oklahoma sample letters for tax exemption is imperative for taxpayers. By reviewing a sample letter received from the tax collector and exploring various categories, individuals can gain insight into the necessary components that should be included to increase their chances of approval. Whether you are seeking exemption as a religious organization, a charity, an individual with disabilities, or an agricultural entity, tailor your letter to the specific requirements outlined by the Oklahoma Tax Commission to ensure a successful outcome.

Oklahoma Sample Letter for Tax Exemption - Review of Sample Letter Received from Tax Collector

Description

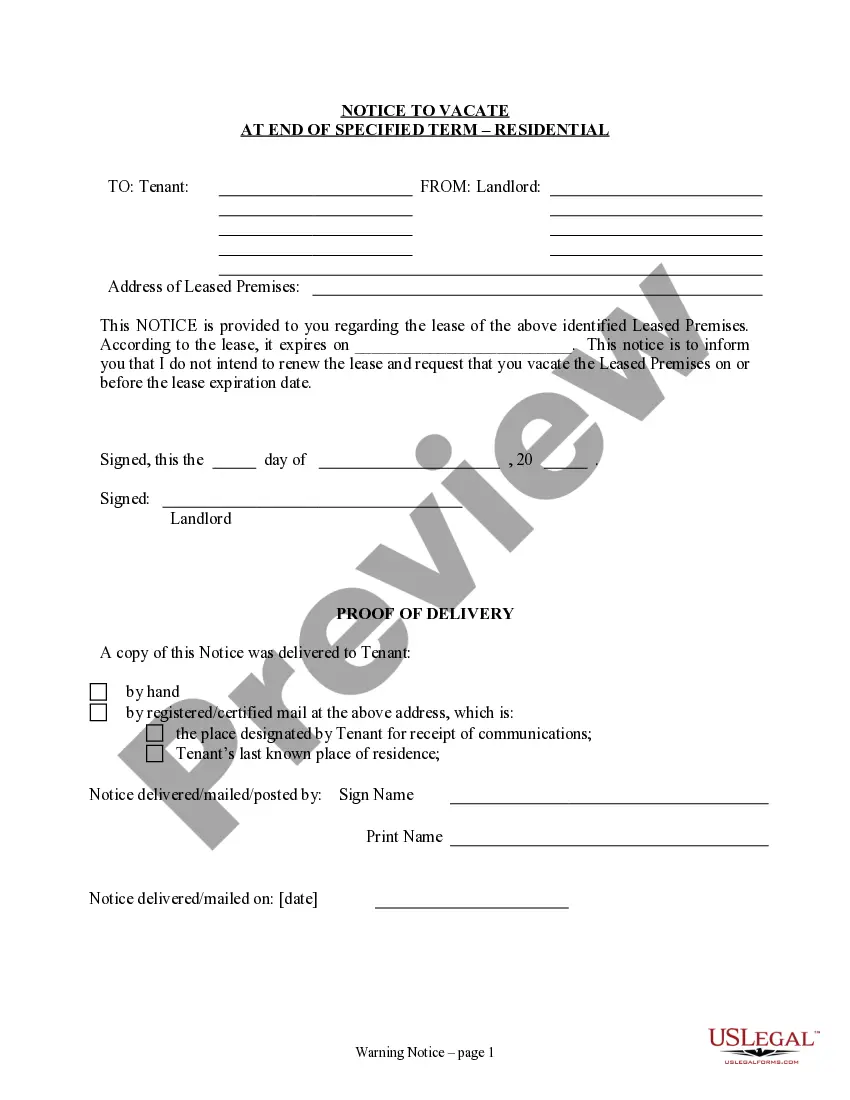

How to fill out Sample Letter For Tax Exemption - Review Of Sample Letter Received From Tax Collector?

Are you currently inside a placement that you require papers for sometimes enterprise or personal uses just about every working day? There are a lot of authorized papers themes available online, but discovering kinds you can trust is not straightforward. US Legal Forms provides thousands of develop themes, just like the Oklahoma Sample Letter for Tax Exemption - Review of Sample Letter Received from Tax Collector, which can be created to meet state and federal demands.

When you are currently informed about US Legal Forms website and have a free account, simply log in. Next, you may down load the Oklahoma Sample Letter for Tax Exemption - Review of Sample Letter Received from Tax Collector format.

If you do not offer an profile and wish to begin to use US Legal Forms, follow these steps:

- Find the develop you want and ensure it is for your correct city/county.

- Use the Preview key to analyze the form.

- Read the explanation to actually have selected the correct develop.

- In case the develop is not what you`re searching for, make use of the Look for industry to get the develop that meets your needs and demands.

- If you get the correct develop, just click Acquire now.

- Opt for the costs plan you would like, complete the desired information and facts to create your bank account, and buy your order making use of your PayPal or credit card.

- Pick a handy data file format and down load your duplicate.

Get each of the papers themes you may have bought in the My Forms food list. You can get a additional duplicate of Oklahoma Sample Letter for Tax Exemption - Review of Sample Letter Received from Tax Collector anytime, if necessary. Just click the required develop to down load or printing the papers format.

Use US Legal Forms, one of the most comprehensive collection of authorized types, in order to save efforts and avoid faults. The services provides expertly manufactured authorized papers themes which can be used for a range of uses. Make a free account on US Legal Forms and start generating your daily life easier.

Form popularity

FAQ

To use the exemption, farmers and ranchers must obtain a permit card issued by the Oklahoma Tax Commission and use it when they purchase tax-exempt items for their farm or ranch. Any person who misuses their permit is subject to a $500 penalty from the tax commission per instance.

If you are buying products to resell in the state of Oklahoma, you can qualify for a sales tax exemption on that purchase by presenting your Oklahoma resale/exemption certificate.

Tax-exempt goods Some goods are exempt from sales tax under Oklahoma law. Examples include purchases made with food stamps, prescription drugs, and some manufacturing equipment.

If you have any questions concerning the validity of a document or a claimed exemption, or need to verify sales tax and agricultural exemption permits - contact 405.521. 3160.

How do I get a card showing I'm exempt from Oklahoma Sales Tax? The card is FREE. FIRST, you need a letter certifying you are eligible. Call the Oklahoma Department of Veteran's Affairs at 1-888-655-2838.

Nearly all items used in production agriculture are exempt from sales tax in the state including seed, feed, fertilizer, livestock pharmaceuticals and farm machinery.

How do I renew my Oklahoma agricultural exemption? If you are applying for an Ag Permit or wish to renew your Ag Permit the state now has required all Oklahoma County Taxpayers to apply/renew online. You will need to provide a 1040F (or another proof of farming for profit as a new requirement when applying or renewing.

Click the Register Now button at the top-right of the screen to create an OkTAP account. 2. Click the Step 1 of 3: Personal Information link (A) and enter your information in the pop- up window.