Oklahoma Second Mortgage with Mortgagor's Recertification of Representations, Warranties, and Covenants in First Mortgage is a legal document that outlines the terms and conditions of a second mortgage loan in the state of Oklahoma. This type of mortgage is commonly used by homeowners who need additional funds while still retaining their existing first mortgage. The purpose of this document is to establish the rights and obligations of the parties involved, specifically the lender (mortgagee) and the borrower (mortgagor). It includes a section where the mortgagor reaffirms and recertifies the representations, warranties, and covenants made in the first mortgage agreement. Key points covered in an Oklahoma Second Mortgage with Mortgagor's Recertification may include: 1. Loan Amount and Terms: The loan amount will be specified in the agreement. The terms of repayment, including the interest rate, payment schedule, and any applicable fees or penalties, will also be outlined. 2. Collateral: The property used as collateral for the second mortgage loan will be described in detail, including its legal description and physical location. 3. Mortgagor's Recertification: This section reiterates and confirms that the borrower still meets the requirements and has not breached any terms of the first mortgage agreement. It may include statements regarding property condition, occupancy status, insurance coverage, and absence of liens or encumbrances. 4. Default and Remedies: The document will outline how default is defined and the actions the lender can take in case of default, such as foreclosure or acceleration of the loan. 5. Subordination: If there are multiple mortgages on the property, the second mortgage may acknowledge that it is subordinate to the first mortgage, meaning that in the event of foreclosure, the first mortgage lender will have priority in receiving the proceeds from the sale of the property. Different types of Oklahoma Second Mortgage with Mortgagor's Recertification of Representations, Warranties, and Covenants in First Mortgage may include variations depending on the specific circumstances or requirements of the parties involved. These could include: 1. Fixed-Rate Second Mortgage: This type of mortgage offers a fixed interest rate for the duration of the loan, providing predictable monthly payments. 2. Home Equity Line of Credit (HELOT): Instead of receiving a lump sum, the borrower can access funds as needed within a set credit limit. This flexibility allows for borrowing and repayment multiple times during a specific period. 3. Hybrid Second Mortgage: In this type, the borrower may have a combination of a fixed-rate loan and a revolving line of credit, enjoying the benefits of both options. It is essential for all parties involved to carefully review the Oklahoma Second Mortgage with Mortgagor's Recertification of Representations, Warranties, and Covenants in First Mortgage before signing, ensuring they fully understand their rights and obligations. Consulting with a legal professional or mortgage specialist is highly recommended navigating the complexities of this type of mortgage transaction.

Oklahoma Second Mortgage with Mortgagor's Recertification of Representations, Warranties and Covenants in First Mortgage

Description

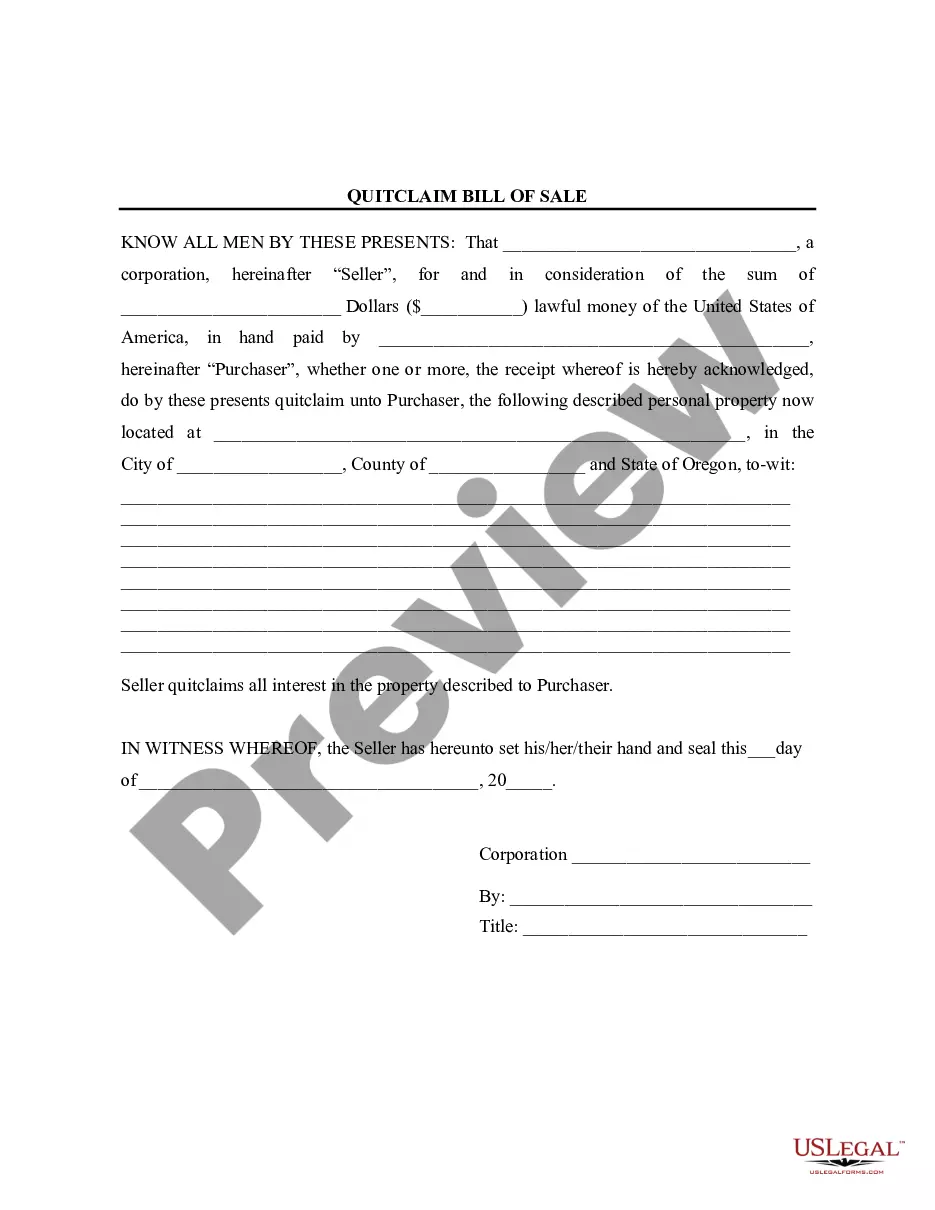

How to fill out Oklahoma Second Mortgage With Mortgagor's Recertification Of Representations, Warranties And Covenants In First Mortgage?

You are able to spend hrs on-line trying to find the authorized file format that meets the state and federal needs you want. US Legal Forms provides a huge number of authorized types that happen to be evaluated by experts. It is simple to acquire or print out the Oklahoma Second Mortgage with Mortgagor's Recertification of Representations, Warranties and Covenants in First Mortgage from the services.

If you currently have a US Legal Forms profile, you can log in and click on the Down load switch. Following that, you can full, revise, print out, or sign the Oklahoma Second Mortgage with Mortgagor's Recertification of Representations, Warranties and Covenants in First Mortgage. Every single authorized file format you get is your own permanently. To have an additional backup of the acquired form, go to the My Forms tab and click on the related switch.

Should you use the US Legal Forms web site the first time, keep to the basic recommendations listed below:

- First, be sure that you have selected the proper file format for that county/metropolis that you pick. Browse the form outline to make sure you have chosen the appropriate form. If offered, use the Review switch to look through the file format at the same time.

- In order to discover an additional variation of the form, use the Look for field to obtain the format that meets your requirements and needs.

- Once you have located the format you want, simply click Purchase now to move forward.

- Find the rates program you want, key in your credentials, and sign up for your account on US Legal Forms.

- Full the transaction. You may use your Visa or Mastercard or PayPal profile to cover the authorized form.

- Find the format of the file and acquire it in your gadget.

- Make adjustments in your file if possible. You are able to full, revise and sign and print out Oklahoma Second Mortgage with Mortgagor's Recertification of Representations, Warranties and Covenants in First Mortgage.

Down load and print out a huge number of file templates while using US Legal Forms site, which offers the most important variety of authorized types. Use professional and status-specific templates to take on your business or personal requirements.

Form popularity

FAQ

Legally, there isn't a limit on how many times you can refinance your home loan. However, mortgage lenders do have a few mortgage refinance requirements you'll need to meet each time you apply for a loan, and some special considerations are important to note if you want a cash-out refinance.

There's no limit to the number of conventional mortgages you can have for a primary residence. However, you can only have one primary residence at a time. And you're limited to two mortgages if you're using first-time homebuyer conventional loans such as Fannie Mae Home Ready or Freddie Mac Home Possible.

Generally, you can get a maximum of two simultaneous mortgages on a single property. You will have a first mortgage ? called the first-position mortgage ? and you can get a second mortgage ? called the second-position mortgage.

A Second Mortgage sits behind the first, so a second mortgagee is in a higher risk position. If the property needed to be sold the first mortgagee would receive their principal, interest and costs before the second mortgagee receive any of their principal, interest and costs.

Although second mortgages are often difficult to qualify for with bad credit, it's not impossible. Obtaining a second mortgage with a low credit score likely means that you'll be paying higher interest rates or using a co-signer on your loan.

How does getting a second mortgage work? It's where a loan secured on the property is given from a source other than the original lender. The second lender takes second priority to the first lender. This means if the property ever needs to be sold, the first lender will have first call on equity in the property.

The term ?second? means that if you can no longer pay your mortgages and your home is sold to pay off the debts, this loan is paid off second. If there is not enough equity to pay off both loans completely, your second mortgage loan lender may not get the full amount it is owed.

Second mortgages are called that because they are secondary to the main, primary mortgage used for the home purchase. In the event of a foreclosure, the primary mortgage gets fully paid off before any second mortgages get a dime. They are second liens, behind the first lien of the primary mortgage.