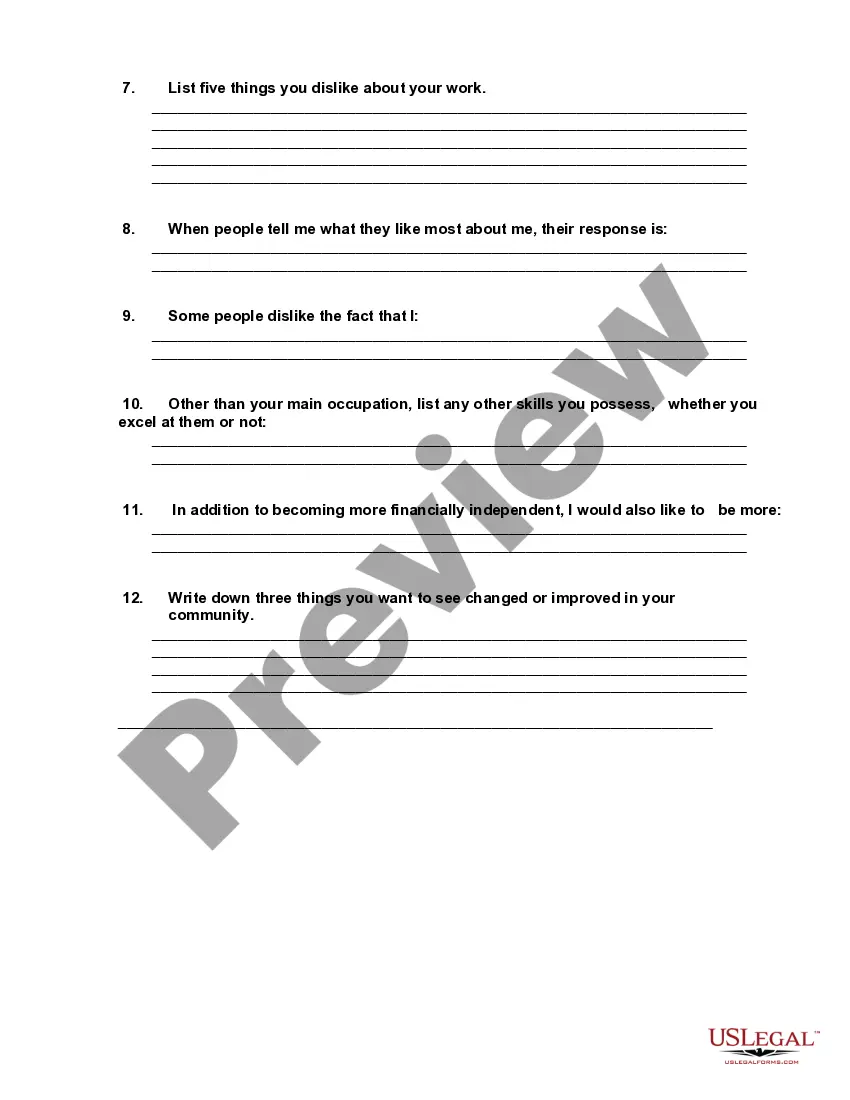

The Oklahoma Self-Assessment Worksheet is a comprehensive tool designed to help individuals analyze their personal or business financial situation and determine their tax liabilities accurately. This worksheet is specifically crafted for residents of Oklahoma, considering the state tax regulations and laws. The Oklahoma Self-Assessment Worksheet covers various aspects of personal and business finances, including income, deductions, tax credits, and other relevant factors. It allows taxpayers to document and calculate their taxable income, ensuring they claim all eligible deductions and credits while complying with the state's tax requirements. Different types of Oklahoma Self-Assessment Worksheets may exist, tailored for specific taxpayer categories or situations. Some common variations include: 1. Individual Income Tax Worksheet: This type of worksheet assists individual taxpayers in assessing their income, deductions, and exemptions, helping them report accurate information on their Oklahoma state income tax return. 2. Self-Employment Tax Worksheet: Designed for self-employed individuals or freelancers, this worksheet aids in calculating their self-employment income, self-employment tax liability, and any applicable deductions or credits for their business. 3. Small Business Tax Worksheet: Specifically created for small business owners operating within the state, this worksheet helps them evaluate their business income, expenses, and any tax credits or deductions that can be claimed based on Oklahoma tax laws. 4. Property Tax Assessment Worksheet: This type of worksheet is aimed at property owners in Oklahoma, enabling them to determine their property's taxable value, exemptions, and potential tax savings based on its assessment. Using the Oklahoma Self-Assessment Worksheet can simplify the tax filing process, reduce the chances of errors or omissions, and enable individuals and businesses to meet their tax obligations accurately. It ensures taxpayers consider all relevant information while preparing their returns, allowing them to maximize deductions and credits, potentially reducing their overall tax liability. To obtain the most accurate results, it is recommended to consult the official Oklahoma Tax Commission website or seek professional tax advice. Remember, accurate completion of the Oklahoma Self-Assessment Worksheet is crucial for meeting the state's tax requirements and avoiding any penalties or legal consequences.

Oklahoma Self-Assessment Worksheet

Description

How to fill out Oklahoma Self-Assessment Worksheet?

You are able to commit hours online looking for the authorized file format that meets the state and federal requirements you will need. US Legal Forms provides a huge number of authorized varieties that happen to be evaluated by pros. You can easily acquire or print out the Oklahoma Self-Assessment Worksheet from your assistance.

If you have a US Legal Forms bank account, you are able to log in and click on the Down load option. Following that, you are able to full, revise, print out, or signal the Oklahoma Self-Assessment Worksheet. Every authorized file format you purchase is your own forever. To get one more copy of any obtained develop, visit the My Forms tab and click on the corresponding option.

Should you use the US Legal Forms internet site the first time, stick to the basic instructions listed below:

- First, ensure that you have chosen the best file format for your region/area of your choosing. Browse the develop information to make sure you have chosen the appropriate develop. If offered, make use of the Review option to search through the file format too.

- If you would like get one more variation in the develop, make use of the Lookup discipline to find the format that fits your needs and requirements.

- When you have located the format you desire, simply click Get now to continue.

- Pick the costs prepare you desire, type in your qualifications, and register for a merchant account on US Legal Forms.

- Total the financial transaction. You should use your bank card or PayPal bank account to purchase the authorized develop.

- Pick the formatting in the file and acquire it for your device.

- Make modifications for your file if needed. You are able to full, revise and signal and print out Oklahoma Self-Assessment Worksheet.

Down load and print out a huge number of file themes utilizing the US Legal Forms web site, which offers the most important collection of authorized varieties. Use specialist and express-distinct themes to tackle your business or individual requires.

Form popularity

FAQ

The self-assessment portion of the performance review is an opportunity to share your own perspective on your performance, actions, and choices. It also paints a picture to your manager of how you view yourself in relation to your team and the company as a whole. Simply put, self-assessments offer plenty of benefits.

How to get started writing your self-evaluationReflect on feedback.Make a list of your top accomplishments and identify areas for improvements.Gather analytics to show impact.Make a commitment to improve.Set a SMART goal for yourself.Create a plan of action.Communication.Job Performance.More items...

Before You Begin Writing Your Self-Evaluation1 Know how the self-evaluation is going to be used.2 Write out a list of your accomplishments.3 Gather analytics if you can.4 Write out a list of your struggles.5 Narrow your accomplishments list down.6 Don't forget to align your review with your manager's or team's goals.More items...?

The self-assessment portion of the performance review is an opportunity to share your own perspective on your performance, actions, and choices. It also paints a picture to your manager of how you view yourself in relation to your team and the company as a whole. Simply put, self-assessments offer plenty of benefits.

4 Tips for Writing an Effective Self-EvaluationBe specific and provide examples. Specificity helps contextualize claims.Back up your contributions with metrics.Frame weaknesses as opportunities.Keep track of your accomplishments throughout the year.

Tips for conducting self-assessmentsReflect on your accomplishments. As you sit down to conduct your self-assessment, start with your accomplishments.Remain honest. As you assess yourself, try to remain honest.Find ways to grow.Use metrics.Keep it professional.Use positive phrases.Be specific.

Here is a list of steps to follow when developing and implementing an employee self-evaluation: Choose a format. Include relevant questions. Distribute regularly....Choose a format. Employee self-evaluations are generally structured in two formats:Include relevant questions.Distribute regularly.Review answers with employees.

How to get started writing your self-evaluationReflect on feedback.Make a list of your top accomplishments and identify areas for improvements.Gather analytics to show impact.Make a commitment to improve.Set a SMART goal for yourself.Create a plan of action.Communication.Job Performance.More items...

assessment template provides individuals with a way to evaluate their performance. It presents an excellent opportunity for workers to draw up a list of their strengths and weaknesses, so they can target areas to improve. In the workplace, selfassessment is often used as part of a wider review.

Positive Sample Answer I always meet my deadlines and effectively manage my workload. I believe I have a strong ability to prioritize the most important tasks. I am also aware of my lack of experience and thus I leave enough time to review completed tasks before I submit them to my manager.