Keywords: Oklahoma, loan agreement, family member, types Description: An Oklahoma Loan Agreement for Family Member is a legally binding contract that outlines the terms and conditions of a loan transaction between two individuals who are related by family ties. This agreement serves as a formal tool for documenting and regulating a loan arrangement, ensuring clarity, and protecting the interests of both parties involved. There are different types of Oklahoma Loan Agreements for Family Members, each catering to specific circumstances and purposes. Some common types include: 1. Promissory Note: This type of agreement defines the loan amount, interest rate (if any), repayment terms, and other essential details. It is often used when a straightforward loan is being extended, with defined repayment installments or a lump sum payment at a specified time. 2. Demand Loan Agreement: This agreement allows the lender to request repayment of the loan at any time, without providing a prior notice or setting a specific due date. It is especially useful when the funds are to be repaid when the borrower receives a certain amount of money, such as an inheritance or a tax refund. 3. Installment Loan Agreement: This agreement establishes a structured repayment plan by dividing the loan amount into regular installments, which may include principal and interest components. It ensures that the borrower repays the loan over a specific period, making it more manageable and predictable for both parties. 4. Secured Loan Agreement: This type of agreement involves a collateral, such as a property or valuable asset, provided by the borrower to secure the loan. It provides added security for the lender, as they can claim the collateral if the borrower defaults on the loan. Regardless of the type, an Oklahoma Loan Agreement requires crucial information such as the names and addresses of the borrower and lender, loan amount, interest rate (if applicable), repayment terms, consequences of default, and any additional clauses or provisions agreed upon by both parties. It is essential to consult legal counsel or utilize reliable online templates when drafting an Oklahoma Loan Agreement for Family Member to ensure compliance with state laws and to protect the rights and interests of all parties involved in the loan transaction.

Oklahoma Loan Agreement for Family Member

Description

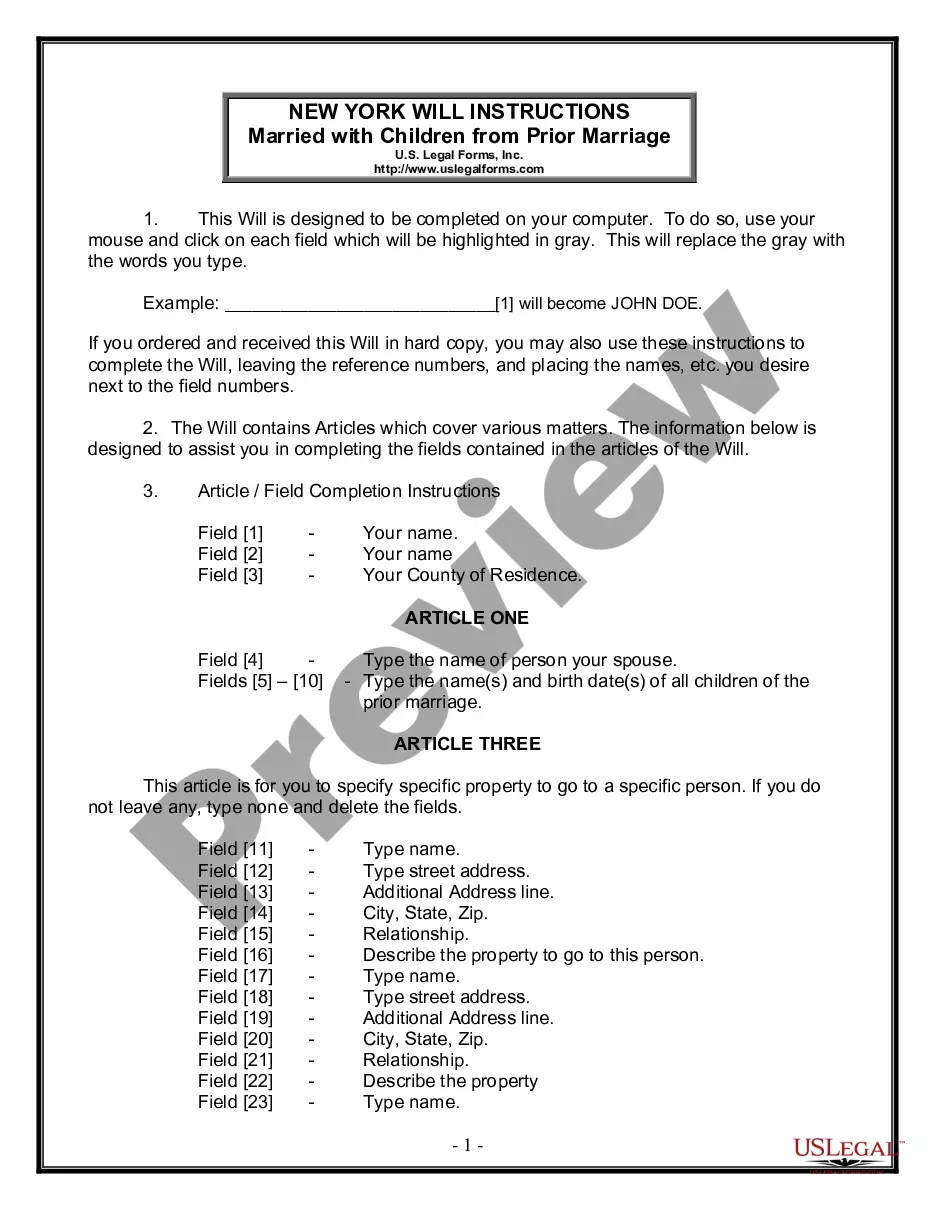

How to fill out Loan Agreement For Family Member?

US Legal Forms - one of several biggest libraries of authorized varieties in America - offers a wide array of authorized file templates you can obtain or print out. Making use of the site, you can get 1000s of varieties for enterprise and individual reasons, sorted by groups, suggests, or keywords and phrases.You can find the most recent types of varieties much like the Oklahoma Loan Agreement for Family Member in seconds.

If you already possess a registration, log in and obtain Oklahoma Loan Agreement for Family Member from your US Legal Forms catalogue. The Obtain button will appear on every single form you perspective. You gain access to all formerly saved varieties in the My Forms tab of your respective profile.

If you want to use US Legal Forms initially, here are easy recommendations to help you began:

- Ensure you have selected the proper form to your metropolis/region. Go through the Preview button to analyze the form`s articles. Read the form information to ensure that you have selected the proper form.

- In the event the form doesn`t satisfy your demands, take advantage of the Research industry near the top of the display screen to get the one which does.

- In case you are happy with the form, verify your option by simply clicking the Get now button. Then, choose the rates prepare you want and give your accreditations to register to have an profile.

- Procedure the deal. Make use of your charge card or PayPal profile to perform the deal.

- Select the structure and obtain the form in your system.

- Make modifications. Fill up, modify and print out and indicator the saved Oklahoma Loan Agreement for Family Member.

Every design you included with your bank account does not have an expiration particular date which is yours permanently. So, if you would like obtain or print out one more version, just proceed to the My Forms area and then click in the form you will need.

Get access to the Oklahoma Loan Agreement for Family Member with US Legal Forms, one of the most comprehensive catalogue of authorized file templates. Use 1000s of skilled and express-distinct templates that meet your small business or individual needs and demands.

Form popularity

FAQ

If you loan a significant amount of money to your kids ? over $10,000 ? you should consider charging interest. If you don't, the IRS can say the interest you should have charged was a gift. In that case, the interest money goes toward your annual gift-giving limit of $17,000 per individual (as of tax year 2023).

The $100,000 De Minimis Exception If the total sum of lending is less than $100,000, the IRS allows you to charge interest based on the lesser of either the AFR rate or the borrower's net investment income for the year. If their investment income was $1,000 or less, the IRS allows them to charge no interest.

Once executed a loan agreement will be legally binding and in effect.

What should be in a personal loan contract? Names and addresses of the lender and the borrower. Information about the loan co-borrower or cosigner, if it's a joint personal loan. Loan amount and the method for disbursement (lump sum, installments, etc.) Date the loan was provided. Expected repayment date.

How to make a family loan agreement The amount borrowed and how it will be used. Repayment terms, including payment amounts, frequency and when the loan will be repaid in full. The loan's interest rate. ... If the loan can be repaid early without penalty, and how much interest will be saved by early repayment.

The IRS mandates that any loan between family members be made with a signed written agreement, a fixed repayment schedule, and a minimum interest rate. (The IRS publishes Applicable Federal Rates (AFRs) monthly.)

You can take a tax deduction for a nonbusiness bad debt if: The money you gave your nephew was intended as a loan, not a gift. You must have actually loaned cash to your nephew. The entire debt is uncollectible.