Oklahoma Loan Agreement for Personal Loan

Description

How to fill out Loan Agreement For Personal Loan?

If you wish to complete, obtain, or print out authorized file themes, use US Legal Forms, the greatest collection of authorized varieties, which can be found on the Internet. Utilize the site`s easy and practical search to discover the paperwork you want. Numerous themes for business and person purposes are categorized by groups and states, or keywords and phrases. Use US Legal Forms to discover the Oklahoma Loan Agreement for Personal Loan in just a couple of clicks.

If you are currently a US Legal Forms consumer, log in for your accounts and click on the Down load switch to obtain the Oklahoma Loan Agreement for Personal Loan. You can even gain access to varieties you previously delivered electronically inside the My Forms tab of your accounts.

Should you use US Legal Forms initially, follow the instructions beneath:

- Step 1. Be sure you have chosen the form for your proper town/country.

- Step 2. Use the Review method to look through the form`s information. Do not overlook to see the information.

- Step 3. If you are not happy with all the develop, utilize the Look for industry on top of the monitor to find other models of your authorized develop format.

- Step 4. Once you have located the form you want, click on the Purchase now switch. Select the rates strategy you like and include your references to sign up for the accounts.

- Step 5. Procedure the purchase. You can use your charge card or PayPal accounts to complete the purchase.

- Step 6. Choose the formatting of your authorized develop and obtain it in your system.

- Step 7. Comprehensive, change and print out or sign the Oklahoma Loan Agreement for Personal Loan.

Each authorized file format you acquire is your own permanently. You possess acces to each and every develop you delivered electronically within your acccount. Click the My Forms segment and decide on a develop to print out or obtain again.

Remain competitive and obtain, and print out the Oklahoma Loan Agreement for Personal Loan with US Legal Forms. There are many skilled and state-particular varieties you can utilize for the business or person requires.

Form popularity

FAQ

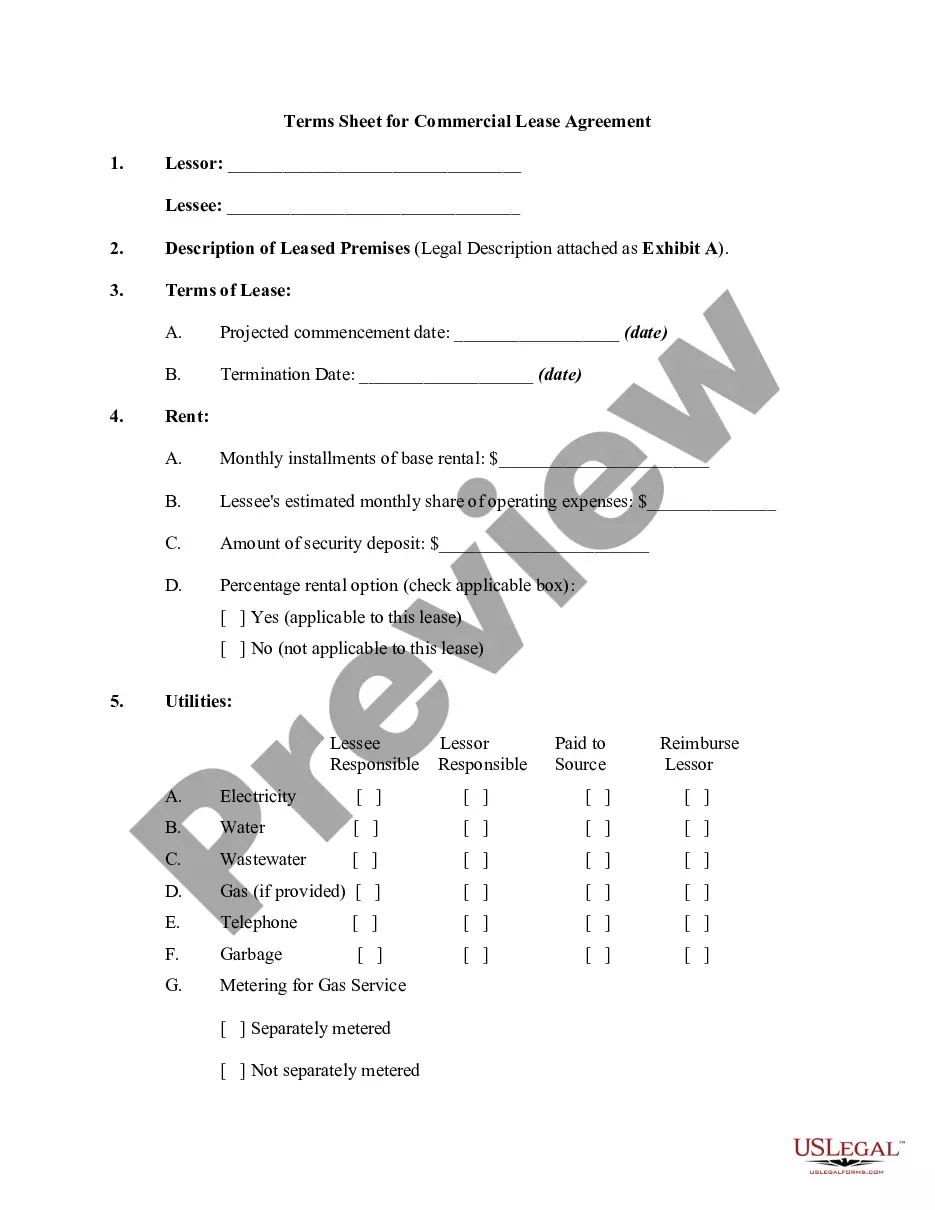

Loan agreements typically include covenants, value of collateral involved, guarantees, interest rate terms and the duration over which it must be repaid.

There are 10 basic provisions that should be in a loan agreement. Identity of the parties. The names of the lender and borrower need to be stated. ... Date of the agreement. ... Interest rate. ... Repayment terms. ... Default provisions. ... Signatures. ... Choice of law. ... Severability.

What a personal loan agreement should include Legal names and address of both parties. Names and address of the loan cosigner (if applicable). Amount to be borrowed. Date the loan is to be provided. Repayment date. Interest rate to be charged (if applicable). Annual percentage rate (if applicable).

For a personal loan agreement to be enforceable, it must be documented in writing, as well as signed and dated by all parties involved. It's also a good idea to have the document notarized or signed by a witness.

Include key terms of the loan, such as the lender and borrower's contact information, the reason for the loan, what is being loaned, the interest rate, the repayment plan, what would happen if the borrower can't make the payments, and more. The amount of the loan, also known as the principal amount.

First and foremost, understand that personal loan agreements fall into the classification of contracts. Technically, you don't have to notarize these documents. But if you want to make this document legally binding, then notarization is the best course of action.

A loan agreement should be structured to include information about the borrower and the lender, the loan amount, and repayment terms, including interest charges and a timeline for repaying the loan. It should also spell out penalties for late payments or default and should be clear about expectations between parties.