Title: Oklahoma Loan Agreement for Car: Understanding the Different Types Introduction: In Oklahoma, a Loan Agreement for Car is a legally binding contract that outlines the terms and conditions between a borrower and a lender for an automobile loan. This document ensures clarity and protects the rights of both parties. Let's explore the different types of Oklahoma Loan Agreements for Cars. 1. Oklahoma Auto Purchase Agreement: When an individual purchases a car through financing, an Oklahoma Auto Purchase Agreement is required. This agreement lists the details of the vehicle, the loan amount, interest rate, repayment terms, and any additional fees associated with the loan. It ensures that both parties understand their obligations and financial responsibilities. 2. Oklahoma Auto Title Loan Agreement: An Oklahoma Auto Title Loan Agreement is specific to loans secured against the borrower's vehicle title. In such cases, the borrower transfers the car's title to the lender as collateral until the loan is repaid. This agreement stipulates the terms, interest rates, repayment schedule, and conditions that allow the lender to repossess the vehicle if the borrower defaults. 3. Oklahoma Car Lease Agreement: In certain situations, instead of a traditional car loan, individuals opt for leasing a vehicle. Oklahoma Car Lease Agreements outline the terms and conditions of leasing, including the monthly payments, mileage limitations, and lease duration. It also specifies any fees, insurance requirements, and the condition in which the vehicle must be returned to the lease end. 4. Oklahoma Car Refinancing Agreement: The Oklahoma Car Refinancing Agreement is used when a borrower aims to replace an existing auto loan with a new one, often with better loan terms. This agreement stipulates the terms of the refinancing, including the new interest rate, loan amount, and repayment schedule. It allows the borrower to adjust their loan to align with their current financial situation. Conclusion: The Loan Agreement for Car in Oklahoma encompasses various types that cater to specific financing needs, ensuring a clear understanding of rights and obligations for both borrowers and lenders. Whether it's an auto purchase agreement, auto title loan agreement, car lease agreement, or car refinancing agreement, it is crucial to carefully read and comprehend the terms to make informed financial decisions.

Oklahoma Loan Agreement for Car

Description

How to fill out Oklahoma Loan Agreement For Car?

You can devote hours online searching for the legitimate papers web template that meets the federal and state specifications you will need. US Legal Forms supplies 1000s of legitimate varieties which can be examined by professionals. It is possible to down load or print the Oklahoma Loan Agreement for Car from our services.

If you have a US Legal Forms accounts, you can log in and click the Obtain key. After that, you can total, edit, print, or sign the Oklahoma Loan Agreement for Car. Each legitimate papers web template you purchase is your own eternally. To obtain an additional version for any bought type, check out the My Forms tab and click the related key.

If you are using the US Legal Forms website initially, keep to the basic guidelines listed below:

- First, make sure that you have selected the correct papers web template to the state/town of your liking. See the type description to ensure you have chosen the right type. If offered, utilize the Preview key to appear through the papers web template also.

- In order to get an additional variation of the type, utilize the Lookup field to get the web template that fits your needs and specifications.

- Upon having found the web template you need, click Buy now to continue.

- Pick the prices plan you need, type in your references, and sign up for a free account on US Legal Forms.

- Full the deal. You can use your charge card or PayPal accounts to pay for the legitimate type.

- Pick the format of the papers and down load it for your product.

- Make adjustments for your papers if required. You can total, edit and sign and print Oklahoma Loan Agreement for Car.

Obtain and print 1000s of papers layouts utilizing the US Legal Forms Internet site, which provides the greatest variety of legitimate varieties. Use expert and status-specific layouts to handle your company or person requirements.

Form popularity

FAQ

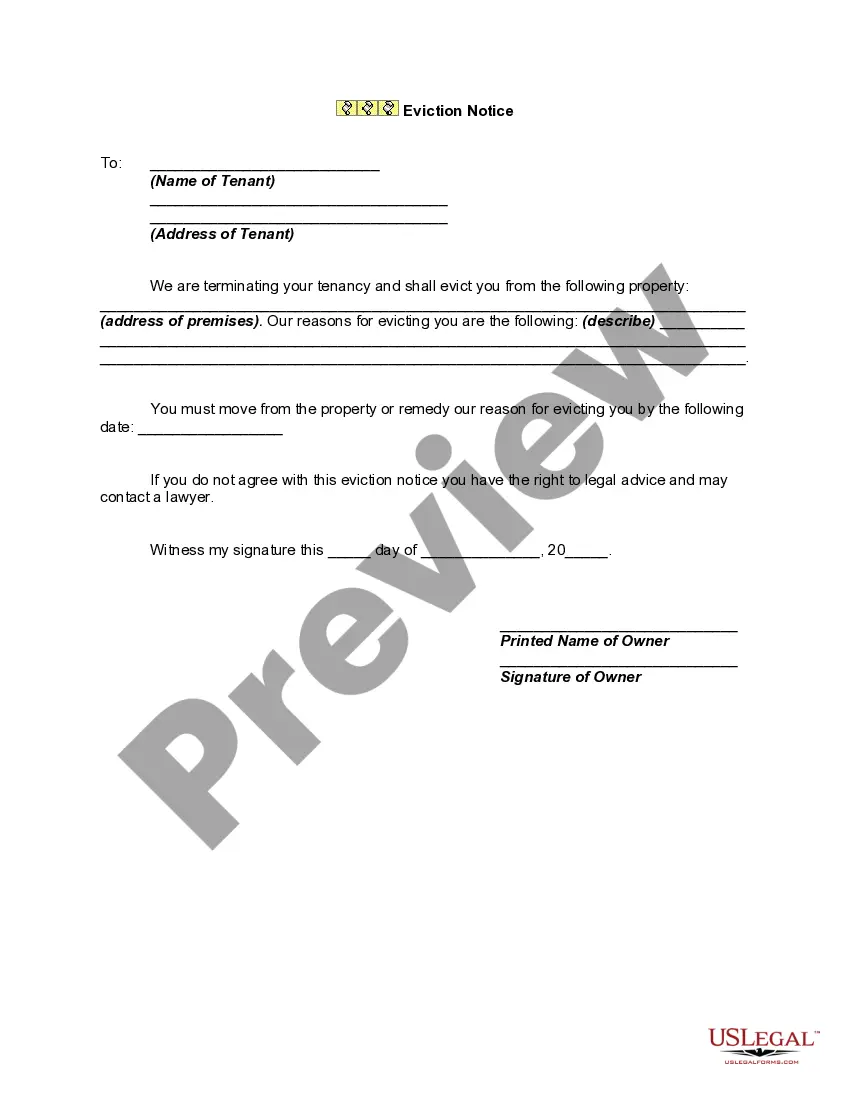

To draft a Loan Agreement, you should include the following: The addresses and contact information of all parties involved. The conditions of use of the loan (what the money can be used for) Any repayment options. The payment schedule. The interest rates.

Let's look at a quick example to illustrate the nature of a payment agreement. Person A (the debtor) borrows $5,000 from person B (the creditor). Both parties agree that person A must pay person B $1,000 a month over five months to repay the debt.

Your Payment Agreement should be relatively short and to the point and include the following essential information: Both parties' details. Who is owed the money, and who is repaying the money? Include addresses and contact details so any disputes can be resolved swiftly.

State what each side agrees to do. Clearly write out the terms of the loan. Include information about the date of the loan, the payment terms, interest, schedule of payments, late charges, default, and any other details in the agreement. Explain that the contract represents the entire agreement.

At its most basic, a promissory note should include the following things: Date. Name of the lender and borrower. Loan amount. Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral? ... Payment amount and frequency. Payment due date. Whether the loan has a cosigner, and if so, who.

Almost everyone needs a loan to buy a car, finance a home purchase, pay for a college education, or cover a medical emergency. Loans are nearly ubiquitous and so are the agreements that guarantee their repayment. Loan agreements are binding contracts between two or more parties to formalize a loan process.

Payment Agreements outline the important terms and conditions of a loan and help to document money that is owed to you or money that you owe to someone else. These documents typically specify the amount of the loan, the interest rate, the repayment terms and includes other specific provisions.

How to Write a Simple Payment Contract Letter The date that the agreement was signed and thus going into effect. The date of the first payment. The date when each payment after will be made. A grace period, if any. When a payment is considered late.