Title: Oklahoma Assignment of LLC Company Interest to Living Trust: A Comprehensive Guide to its Types and Importance Introduction: Understanding the process of an Oklahoma Assignment of LLC Company Interest to a Living Trust is crucial for individuals seeking to protect their assets and ensure smooth transfers in the event of disability or death. This article aims to provide a detailed description of what this assignment entails, exploring its types, benefits, and the significance it holds for LLC owners in Oklahoma. Keywords: Oklahoma Assignment of LLC Company Interest, Living Trust, LLC owners, assets, transfer, disability, death, types, benefits, significance. 1. Definition and Purpose: An Oklahoma Assignment of LLC Company Interest to a Living Trust refers to the legal document through which an LLC owner uses a living trust to transfer their interest in the company in the event of their disability or death. This assignment serves as an effective estate planning tool, ensuring the seamless management and distribution of LLC ownership interests. 2. Types of Oklahoma Assignment of LLC Company Interest to Living Trust: a. Revocable Assignment: A revocable assignment allows an LLC owner to transfer their company interest to a living trust while retaining the ability to modify or revoke the assignment during their lifetime. This type provides flexibility and can be altered according to the owner's changing circumstances. b. Irrevocable Assignment: An irrevocable assignment, on the other hand, involves the complete and permanent transfer of LLC company interest to a living trust. Once established, the assignment cannot be modified or revoked by the owner, offering potential estate tax benefits and creditor protection. 3. Importance and Benefits: a. Asset Protection: By assigning LLC company interest to a living trust, Oklahoma LLC owners can protect their assets from potential creditors and legal judgments. This enables the assets to remain secured within the trust, safeguarding them for future generations. b. Probate Avoidance: One significant advantage of the assignment is its ability to bypass probate proceedings. Assets placed within the living trust are not subject to probate, allowing for a quicker and more efficient transfer process while maintaining privacy. c. Continuity and Management: Assigning LLC company interest to a living trust ensures a smooth transition of ownership in the event of the owner's disability or death. This ensures that management and control of the company interests continue as intended, eliminating potential disputes and interruptions. d. Privacy: Unlike the probate process, the Oklahoma Assignment of LLC Company Interest to a Living Trust remains confidential. The transfer of company interest does not become a matter of public record, providing privacy to the owner and their beneficiaries. e. Tax Planning: Depending on the underlying tax implications, assigning LLC company interest to a living trust can offer tax planning benefits. Consultation with a tax professional is advised to maximize any potential tax advantages. Conclusion: The Oklahoma Assignment of LLC Company Interest to a Living Trust serves as a valuable tool for LLC owners, allowing them to protect their assets, ensure a smooth transfer process, and provide long-term financial security for their beneficiaries. Choosing the appropriate type of assignment requires thoughtful consideration and consultation with legal and financial advisors to meet individual estate planning objectives.

Oklahoma Assignment of LLC Company Interest to Living Trust

Description

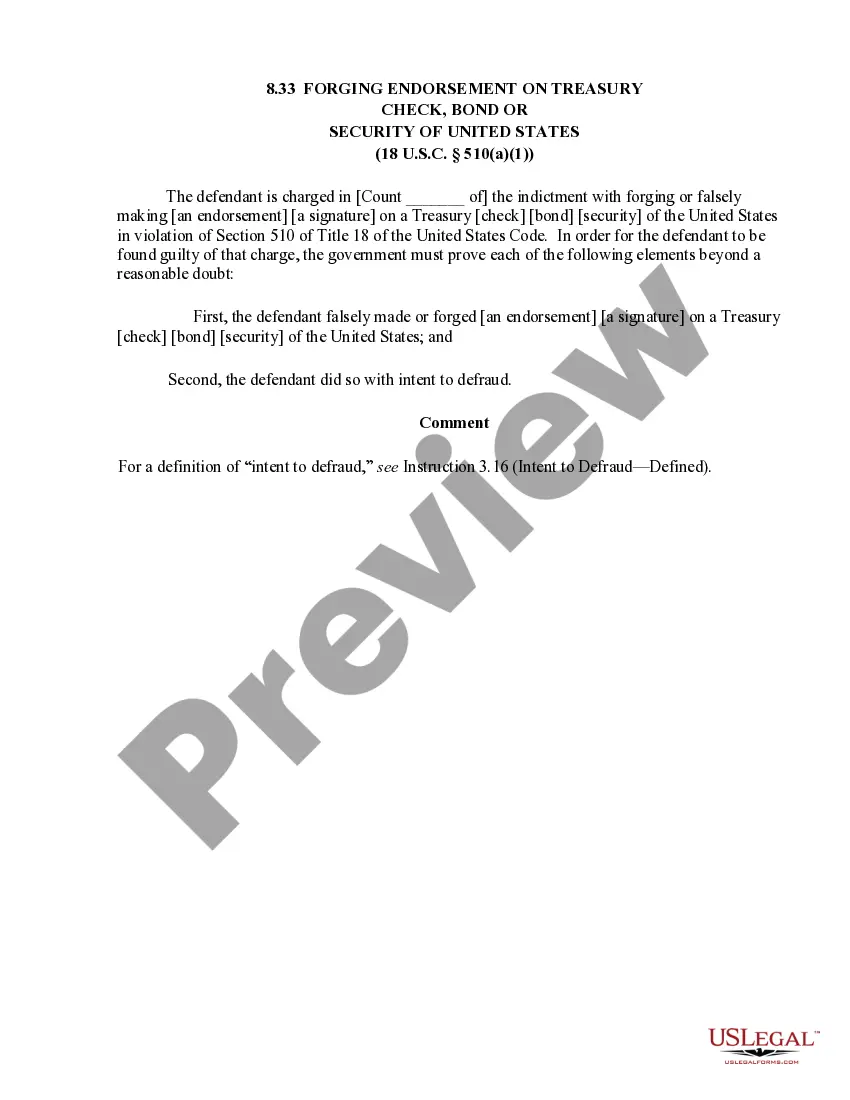

How to fill out Oklahoma Assignment Of LLC Company Interest To Living Trust?

US Legal Forms - one of many most significant libraries of lawful forms in the USA - provides a wide range of lawful papers web templates it is possible to obtain or printing. Utilizing the site, you may get a huge number of forms for organization and individual reasons, sorted by categories, says, or keywords.You will discover the most recent models of forms just like the Oklahoma Assignment of LLC Company Interest to Living Trust in seconds.

If you already possess a subscription, log in and obtain Oklahoma Assignment of LLC Company Interest to Living Trust through the US Legal Forms library. The Download option will appear on each and every type you see. You have accessibility to all previously delivered electronically forms from the My Forms tab of your bank account.

In order to use US Legal Forms the first time, allow me to share simple guidelines to help you started:

- Make sure you have picked the best type to your metropolis/region. Click on the Preview option to examine the form`s content. See the type outline to ensure that you have selected the right type.

- In case the type does not match your needs, utilize the Lookup industry on top of the monitor to obtain the one who does.

- If you are satisfied with the form, validate your option by clicking on the Acquire now option. Then, pick the pricing strategy you favor and supply your accreditations to sign up on an bank account.

- Method the purchase. Utilize your charge card or PayPal bank account to accomplish the purchase.

- Pick the formatting and obtain the form in your gadget.

- Make adjustments. Fill up, change and printing and indicator the delivered electronically Oklahoma Assignment of LLC Company Interest to Living Trust.

Each format you added to your money does not have an expiration time and is also your own eternally. So, in order to obtain or printing one more copy, just visit the My Forms area and click on the type you want.

Gain access to the Oklahoma Assignment of LLC Company Interest to Living Trust with US Legal Forms, by far the most extensive library of lawful papers web templates. Use a huge number of expert and express-certain web templates that satisfy your organization or individual demands and needs.