The Oklahoma Testamentary Trust Provision for the Establishment of a Trust for a Charitable Institution for the Care and Treatment of Disabled Children is a legal provision that allows individuals to create a trust in their wills for the purpose of supporting a charitable institution dedicated to the care and treatment of disabled children. This provision ensures that the assets and funds intended for the trust are administered and used exclusively for the benefit of disabled children in need. There are different types of Oklahoma Testamentary Trust Provisions that can be established for this purpose. Some of these variations may include: 1. Irrevocable Charitable Trust: This type of trust cannot be altered or revoked after its creation. It guarantees that the assets designated for the charitable institution and the care of disabled children remain intact and dedicated to the cause. 2. Revocable Charitable Trust: Unlike an irrevocable trust, a revocable trust can be modified or revoked at any time by the trust creator. This type of provision gives the individual more flexibility and control over the trust's assets during their lifetime. 3. Specific or General Beneficiary Trust: Depending on the specific needs and goals of the trust creator, they may choose to establish a specific beneficiary trust that benefits one particular charitable institution dedicated to disabled children's care. On the other hand, a general beneficiary trust can benefit multiple charitable institutions with similar purposes. 4. Income or Principal Trust: An income trust typically focuses on distributing only the income generated by the trust's assets, while preserving the principal amount for future use. A principal trust, on the other hand, allows both income and principal to be distributed for the designated purposes. When establishing an Oklahoma Testamentary Trust Provision for the Establishment of a Trust for a Charitable Institution for the Care and Treatment of Disabled Children, it is crucial to consult with an attorney experienced in trusts and estate planning. This will ensure that the trust provision aligns with the desires of the trust creator, complies with Oklahoma state laws, and accurately represents their intent of supporting disabled children through a charitable institution.

Oklahoma Testamentary Trust Provision for the Establishment of a Trust for a Charitable Institution for the Care and Treatment of Disabled Children

Description

How to fill out Oklahoma Testamentary Trust Provision For The Establishment Of A Trust For A Charitable Institution For The Care And Treatment Of Disabled Children?

Have you been in the placement that you will need files for possibly organization or specific purposes virtually every working day? There are a lot of legitimate file templates available online, but discovering kinds you can rely isn`t simple. US Legal Forms offers a huge number of kind templates, much like the Oklahoma Testamentary Trust Provision for the Establishment of a Trust for a Charitable Institution for the Care and Treatment of Disabled Children, which are published to fulfill federal and state specifications.

In case you are previously familiar with US Legal Forms site and get an account, basically log in. Next, it is possible to obtain the Oklahoma Testamentary Trust Provision for the Establishment of a Trust for a Charitable Institution for the Care and Treatment of Disabled Children template.

If you do not provide an bank account and need to start using US Legal Forms, follow these steps:

- Discover the kind you will need and ensure it is to the proper city/region.

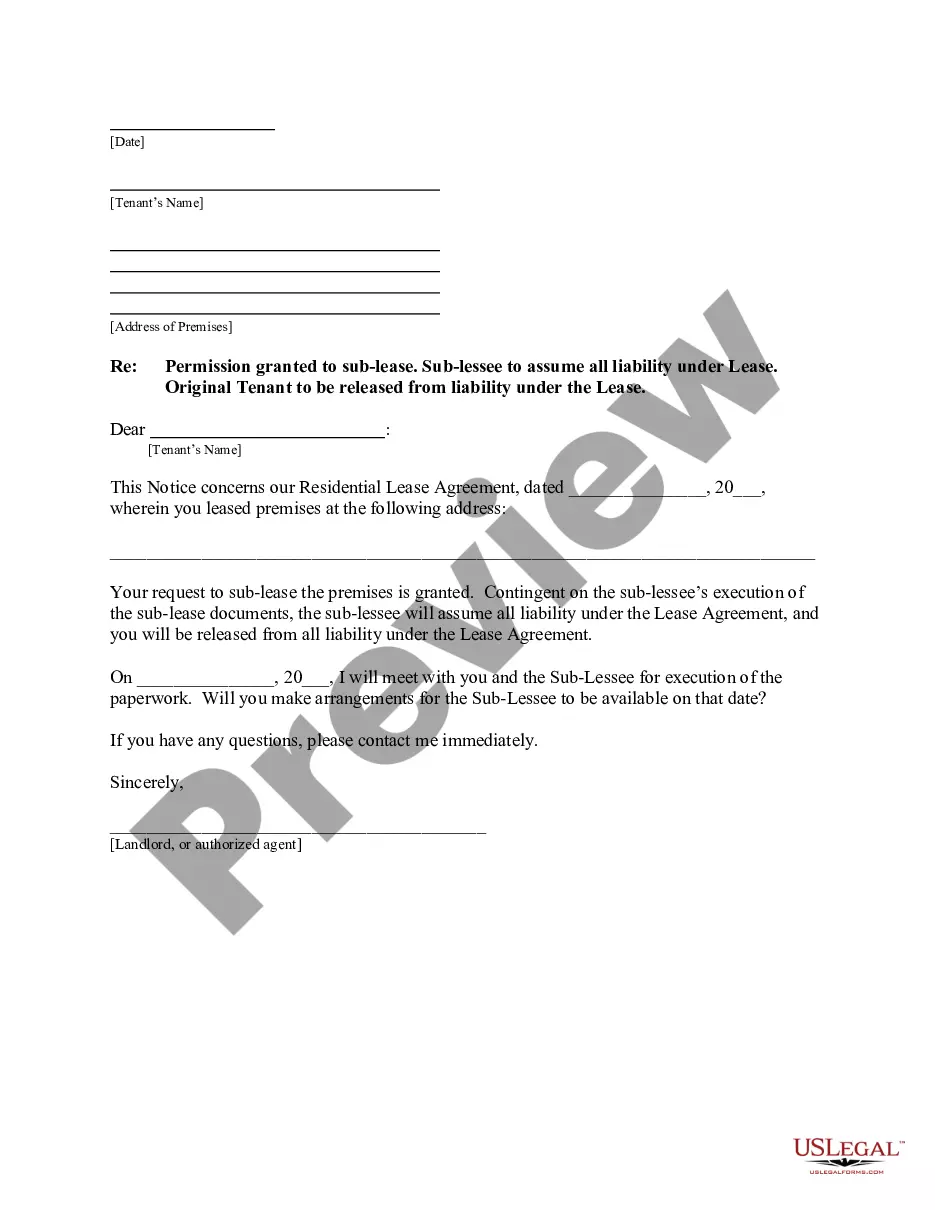

- Make use of the Review option to review the form.

- See the description to actually have chosen the appropriate kind.

- If the kind isn`t what you are trying to find, use the Lookup area to discover the kind that fits your needs and specifications.

- Whenever you discover the proper kind, click Get now.

- Select the pricing plan you desire, fill out the specified information and facts to produce your money, and buy the order making use of your PayPal or credit card.

- Decide on a hassle-free paper file format and obtain your backup.

Get each of the file templates you possess purchased in the My Forms menu. You may get a extra backup of Oklahoma Testamentary Trust Provision for the Establishment of a Trust for a Charitable Institution for the Care and Treatment of Disabled Children at any time, if necessary. Just go through the essential kind to obtain or produce the file template.

Use US Legal Forms, one of the most extensive assortment of legitimate types, to conserve some time and steer clear of blunders. The assistance offers appropriately made legitimate file templates which you can use for a range of purposes. Produce an account on US Legal Forms and initiate producing your way of life easier.

Form popularity

FAQ

Testamentary trusts are discretionary trusts established in Wills, that allow the trustees of each trust to decide, from time to time, which of the nominated beneficiaries (if any) may receive the benefit of the distributions from that trust for any given period.

A testamentary trust is a trust or estate that is generally created on and as result of the death of the person. The terms of the trust are established by the will or by court order in relation to the deceased individual's estate under provincial or territorial law.

For a valid trust to be created the founder must intend to create one, he must express his intention in a mode apt to create an obligation, the property subject to the trust must be defined with reasonable certainty, the trust object, which may either be personal or impersonal must be defined with reasonable certainty

Ten of the most effective ways to build trustValue long-term relationships. Trust requires long-term thinking.Be honest.Honor your commitments.Admit when you're wrong.Communicate effectively.Be vulnerable.Be helpful.Show people that you care.More items...?

A trust may be created by:Every person who is competent to contracts: This includes an individual, AOP, HUF, company, etc.If a trust is to be created by on or behalf of a minor, then the permission of a Principal Civil Court of original jurisdiction is required.14-Apr-2022

One of the drawbacks of a testamentary trust is the considerable responsibility it puts on the trustee. He must meet regularly with the probate court to demonstrate his safe handling of the trust, and depending on your wishes, his tasks may go on for many years.

Living trusts and testamentary trustsA living trust (sometimes called an inter vivos trust) is one created by the grantor during his or her lifetime, while a testamentary trust is a trust created by the grantor's will.

A testamentary trust is a trust contained in a last will and testament. It provides for the distribution of all or part of an estate and often proceeds from a life insurance policy held on the person establishing the trust. There may be more than one testamentary trust per will.

All trusts are required to contain at least the following elements:Trusts must identify the grantor, trustee and beneficiary. The grantor and trustee must be identified because they are parties to the contract.The trust res must be identified.The trust must contain the signature of both the grantor and the trustee.

All trusts are required to contain at least the following elements:Trusts must identify the grantor, trustee and beneficiary. The grantor and trustee must be identified because they are parties to the contract.The trust res must be identified.The trust must contain the signature of both the grantor and the trustee.