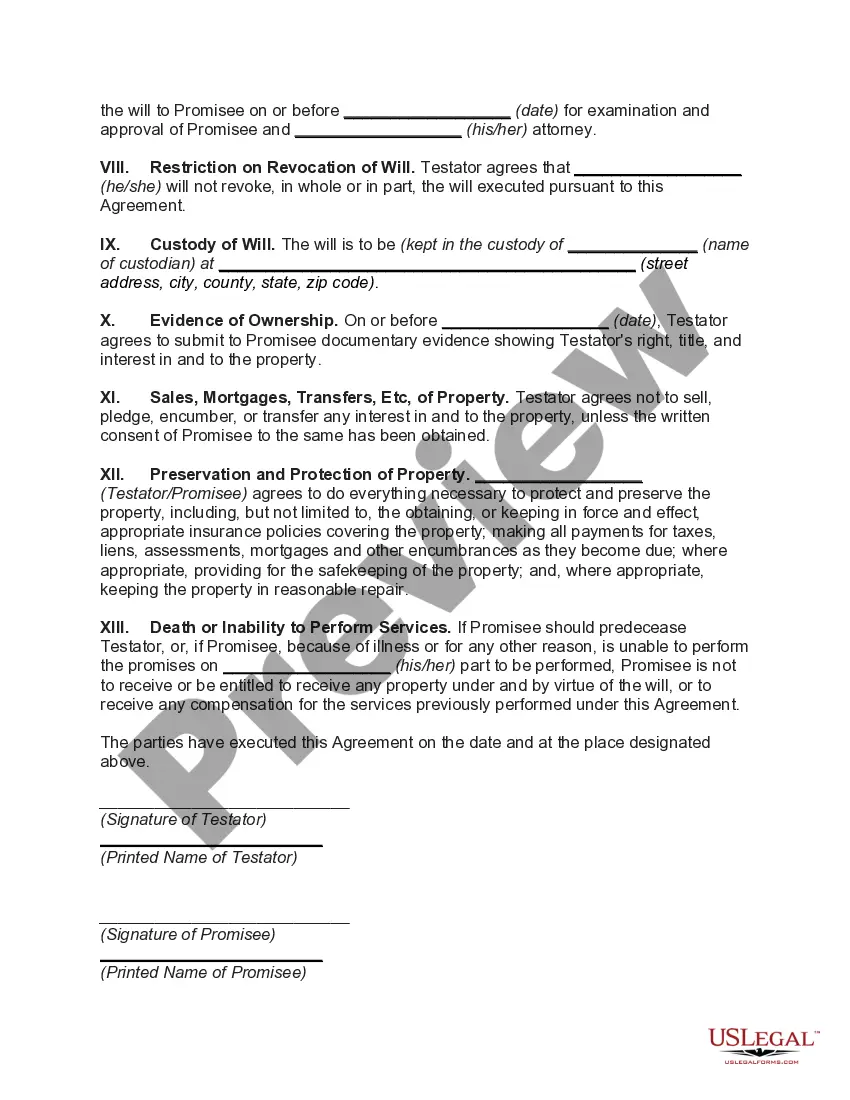

Title: Understanding the Oklahoma Agreement to Devise or Bequeath Property to a Person Performing the Personal Services of Lifetime Care for a Future Testator Introduction: The Oklahoma Agreement to Devise or Bequeath Property to a Person Performing the Personal Services of Lifetime Care for a Future Testator is a legal document that sets out the terms and conditions for transferring property to an individual who provides lifetime care to the testator. This agreement ensures that the caregiver is properly compensated for their services by entitling them to receive specific assets or property as part of their compensation. In Oklahoma, this agreement is recognized as a valid legal instrument and is subject to specific laws and regulations. Key Features and Importance: 1. Personal Services Agreement: The Oklahoma Agreement to Devise or Bequeath Property focuses on the personal services provided by an individual to the testator during their lifetime, often referred to as lifetime care. This agreement recognizes the value of the caregiver's services, as they often play a vital role in the health, well-being, and quality of life of the testator. 2. Lifetime Care Compensation: The primary purpose of this agreement is to ensure the caregiver's entitlement to specific property or assets in recognition of their personal services provided to the testator. The property or asset transferred can include real estate, financial accounts, stocks, bonds, or any other valuable possessions. 3. Future Testator's Intention: The Oklahoma Agreement to Devise or Bequeath Property is designed to serve the testator's intentions for their assets, clearly expressing their desire to compensate the caregiver for their services with a specific allocation of property. 4. Legal Formalities: To be legally binding, the agreement must adhere to the statutory requirements of Oklahoma law. It must be in writing, signed by the testator in the presence of at least two competent witnesses, and should clearly identify the caregiver and the property/assets involved. Additionally, it may be necessary to consult with an attorney to ensure compliance with all legal formalities. Types of Oklahoma Agreements to Devise or Bequeath Property: 1. Real Estate-based Agreement: This type of agreement focuses on the transfer of real estate properties, such as residential homes, land, or commercial buildings, to the caregiver in exchange for the lifetime care services provided. 2. Financial Account-based Agreement: In this scenario, the agreement involves the transfer of financial accounts, such as savings accounts, investment portfolios, or retirement funds, to compensate the caregiver for their lifetime care services. 3. Mixed Asset-based Agreement: This agreement encompasses a combination of various assets, including real estate, financial accounts, and other valuable possessions, which are distributed to the caregiver according to the terms specified. Conclusion: The Oklahoma Agreement to Devise or Bequeath Property to a Person Performing the Personal Services of Lifetime Care for a Future Testator is a legally recognized and binding document that ensures proper compensation for caregivers providing lifetime care services. It acknowledges the testator's intentions and provides peace of mind to both the testator and the caregiver in terms of asset distribution. Consulting an attorney experienced in estate planning is recommended to draft a comprehensive agreement that complies with all legal requirements.

Oklahoma Agreement to Devise or Bequeath Property to a Person Performing the Personal Services of Lifetime Care for a Future Testator

Description

How to fill out Oklahoma Agreement To Devise Or Bequeath Property To A Person Performing The Personal Services Of Lifetime Care For A Future Testator?

If you wish to total, download, or printing lawful document layouts, use US Legal Forms, the biggest variety of lawful kinds, that can be found on the web. Use the site`s simple and practical research to get the paperwork you need. A variety of layouts for organization and personal reasons are categorized by types and says, or keywords. Use US Legal Forms to get the Oklahoma Agreement to Devise or Bequeath Property to a Person Performing the Personal Services of Lifetime Care for a Future Testator with a handful of clicks.

If you are already a US Legal Forms client, log in in your accounts and click the Obtain key to find the Oklahoma Agreement to Devise or Bequeath Property to a Person Performing the Personal Services of Lifetime Care for a Future Testator. You can also gain access to kinds you formerly delivered electronically within the My Forms tab of your respective accounts.

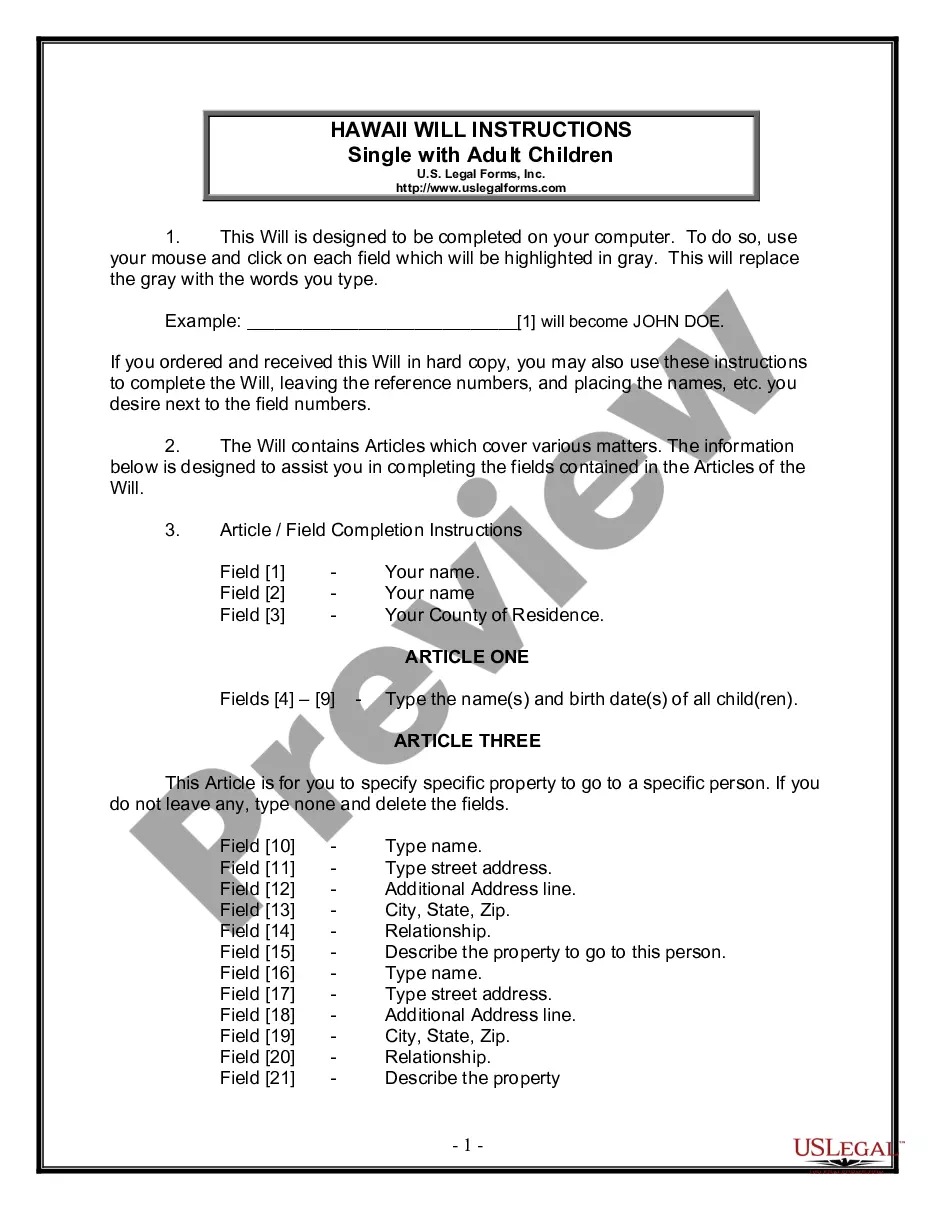

If you work with US Legal Forms for the first time, follow the instructions beneath:

- Step 1. Be sure you have selected the form for your right area/region.

- Step 2. Make use of the Review method to check out the form`s information. Don`t forget to read the explanation.

- Step 3. If you are not satisfied with all the type, make use of the Search discipline at the top of the display to get other types from the lawful type web template.

- Step 4. Upon having identified the form you need, click on the Acquire now key. Pick the pricing prepare you choose and put your accreditations to sign up for the accounts.

- Step 5. Method the purchase. You can use your Мisa or Ьastercard or PayPal accounts to accomplish the purchase.

- Step 6. Find the format from the lawful type and download it in your product.

- Step 7. Comprehensive, modify and printing or indication the Oklahoma Agreement to Devise or Bequeath Property to a Person Performing the Personal Services of Lifetime Care for a Future Testator.

Each lawful document web template you get is the one you have eternally. You may have acces to each type you delivered electronically within your acccount. Go through the My Forms segment and pick a type to printing or download once more.

Compete and download, and printing the Oklahoma Agreement to Devise or Bequeath Property to a Person Performing the Personal Services of Lifetime Care for a Future Testator with US Legal Forms. There are millions of professional and condition-distinct kinds you may use for your organization or personal requirements.

Form popularity

FAQ

An Oklahoma small estate affidavit is a document that is used by a person to claim a right to the property of a deceased person, known as a decedent. The filer, known as the affiant, has to file this affidavit with the individual or entity that has control over the property itself.

If you die without a will in Oklahoma, your assets will go to your closest relatives under state "intestate succession" laws.

The purpose of an Affidavit of Heirship is to put the county records on notice for mineral owners who are deceased that did not have probate proceedings administered to their estate.

In Oklahoma, these forms of joint ownership are available: Joint tenancy. Property owned in joint tenancy automatically passes to the surviving owners when one owner dies. No probate is necessary.

Creating a revocable living trust is one of the best ways to avoid probate in Oklahoma. The benefit of holding property in a revocable living trust is that the property is not part of your probate estate after your death. (However, it is counted as a part of your estate for federal estate tax purposes.)

The Oklahoma probate process includes repaying the decedent's creditors to the extent possible from the assets of the decedent and transferring the decedent's property to the heirs in accordance with the will or Oklahoma intestate law.

If the decedent leave no issue, the estate goes one-half (1/2) to the surviving husband or wife, and the remaining one-half (1/2) to the decedent's father or mother, or, if he leave both father and mother, to them in equal shares; but if there be no father or mother, then said remaining one-half (1/2) goes, in equal

If you have both a spouse and children, the spouse inherits the first $50,000 of the property covered by intestate rules, in addition to half of the remainder. If you do not have a spouse or children, your parents inherit everything. If you have no spouse, children, or parents, your siblings inherit everything.

The statute allowing for an affidavit of tangible personal property to transfer an estate's personal assets also allows for an affidavit of death and heirship to transfer severed mineral interests to an heir. The affidavit must be filed with the county clerk in the county where the property is located.

Your spouse inherits everything. Your spouse inherits 50 percent; your children inherit the rest. Your spouse inherits half of all property acquired by joint effort during your marriage and the remaining half is equally split among all of your children. Anything else is inherited by your children.