Title: Comprehensive Guide to Oklahoma Sample Letter for Payment from Estate Introduction: When dealing with an estate in Oklahoma, it is vital to address any outstanding payments promptly and professionally. Sending a well-crafted letter for payment from the estate ensures transparent communication between the estate administrator and the respective parties involved. In this article, we provide a detailed description of what Oklahoma sample letters for payment from an estate entail, their importance, and types that could arise in specific circumstances. Contents: 1. Purpose of a Letter for Payment from Estate in Oklahoma: A well-written letter for payment from an estate serves as formal documentation, requesting recipients to fulfill their outstanding obligations. It outlines the reasons for the payment, provides supporting details, and sets a deadline for compliance. This letter acts as evidence should legal action or further disputes arise. 2. Key Elements of an Oklahoma Sample Letter for Payment from Estate: a. Date: Begin the letter by mentioning the date of writing. b. Recipient's Information: Include the recipient's name, address, and contact details. c. Estate Administrator Information: Provide the administrator's name, contact information, and their relation to the estate. d. Subject Line: Use a clear and concise subject line, such as "Payment Due from [Estate Name]." e. Opening Paragraph: State the purpose of the letter, including the estate's details and outstanding payment amount. f. Body Paragraph: Provide a detailed explanation of the services rendered or goods delivered, including dates and relevant documentation. g. Payment Deadline: Clearly specify the deadline for payment, allowing the recipient ample time to remit the amount owed. h. Contact Information: Include the estate administrator's contact details in case there are any questions or concerns. i. Closing Remarks: Express appreciation for their cooperation and willingness to settle the payment promptly. j. Signature: Properly sign and print the name of the estate administrator. 3. Types of Oklahoma Sample Letters for Payment from Estate: a. Letter for Payment of Debts: Used when the estate is responsible for settling outstanding debts, such as credit card bills, loans, or medical expenses. b. Letter for Payment of Inheritance Taxes: Required if the estate owes inheritance taxes to the Oklahoma Tax Commission. c. Letter for Payment to Beneficiaries: Used to distribute assets to the beneficiaries of the estate, including cash, property, or investments. d. Letter for Payment of Outstanding Expenses: Sent when there are outstanding bills or expenses related to the estate's administration, such as funeral expenses or legal fees. e. Letter for Repayment of Loans: Utilized to ask recipients to repay any loans or advances given by the estate. f. Letter for Reimbursement of Expenses: Used to request reimbursement of administratively incurred expenses by the estate administrator. Conclusion: Writing an Oklahoma sample letter for payment from an estate ensures clarity, professionalism, and accountability. By adhering to proper protocols, estate administrators can effectively address any outstanding obligations and maintain smooth estate administration. Understanding the different types of payment letters allows administrators to take the appropriate approach based on the specific context. Remember, attention to detail and timely communication are key to resolving payment matters in Oklahoma estates.

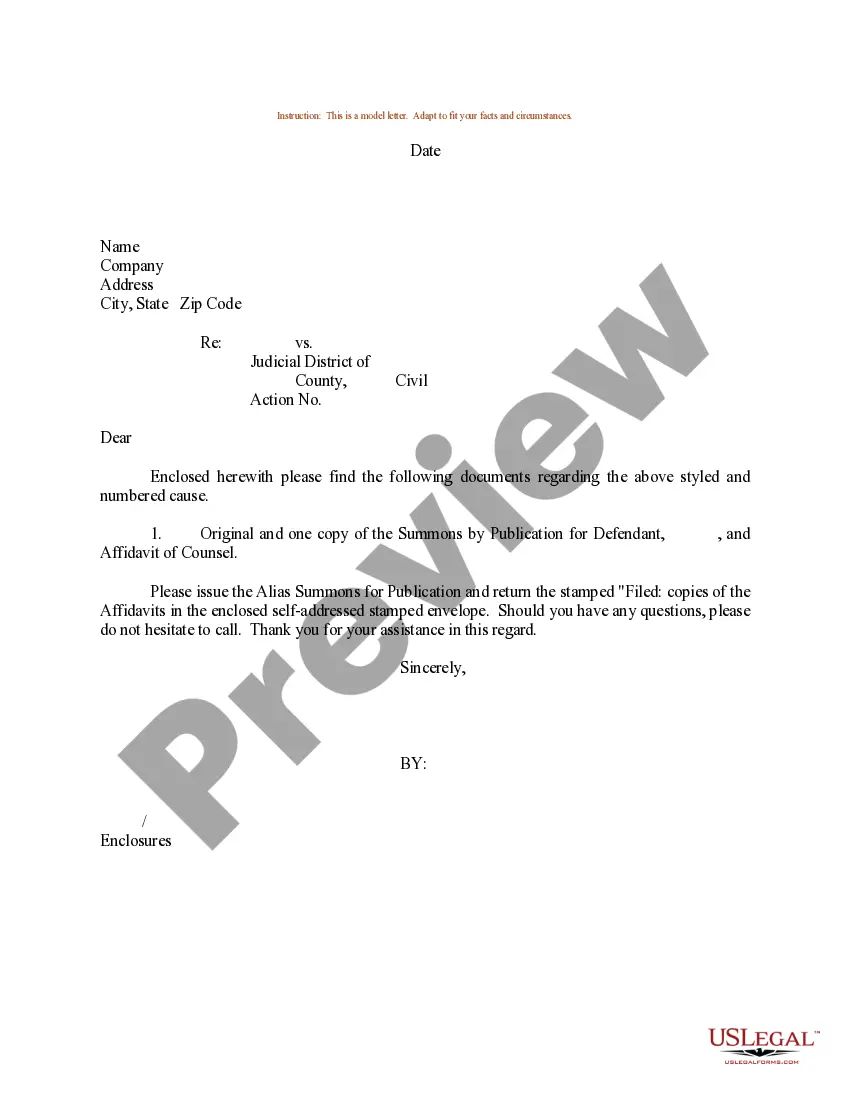

Oklahoma Sample Letter for Payment from Estate

Description

How to fill out Oklahoma Sample Letter For Payment From Estate?

US Legal Forms - among the largest libraries of lawful types in the States - offers a variety of lawful document web templates it is possible to acquire or printing. While using site, you may get a large number of types for business and personal purposes, sorted by groups, suggests, or keywords and phrases.You will discover the most recent versions of types like the Oklahoma Sample Letter for Payment from Estate within minutes.

If you have a monthly subscription, log in and acquire Oklahoma Sample Letter for Payment from Estate through the US Legal Forms local library. The Acquire key will appear on every type you view. You gain access to all in the past acquired types from the My Forms tab of your accounts.

If you want to use US Legal Forms initially, listed below are straightforward recommendations to obtain started off:

- Ensure you have chosen the best type for your personal area/state. Click on the Preview key to review the form`s articles. Browse the type information to actually have chosen the correct type.

- In the event the type does not suit your specifications, use the Lookup discipline on top of the monitor to discover the the one that does.

- In case you are pleased with the form, validate your option by simply clicking the Get now key. Then, choose the prices program you like and provide your accreditations to sign up on an accounts.

- Procedure the financial transaction. Make use of Visa or Mastercard or PayPal accounts to complete the financial transaction.

- Select the file format and acquire the form in your product.

- Make modifications. Fill out, edit and printing and signal the acquired Oklahoma Sample Letter for Payment from Estate.

Every single format you added to your account does not have an expiration time and it is yours forever. So, in order to acquire or printing an additional version, just go to the My Forms section and click on in the type you require.

Gain access to the Oklahoma Sample Letter for Payment from Estate with US Legal Forms, one of the most comprehensive local library of lawful document web templates. Use a large number of skilled and state-certain web templates that meet your company or personal requirements and specifications.

Form popularity

FAQ

The amount remaining unpaid on the debt is $ (amount due). Demand is hereby made that this money be paid. Unless payment of this amount is received by the undersigned no later than (date payment expected), a lawsuit will be brought against you in the commercial claims part of the court.

A demand letter for payment is a request for money owed that is commonly the last notice given by the creditor. The party owed should include language that motivates the debtor to make payment. Examples include giving a discount if the debtor decides to pay or threatening to send the debt to collections.

How to write demand letters Your information and the debtors' information (contact details, address etc.) The date when the debt began and the amount of money owed. Details and dates of any disputes relating to this payment. Description of the nature of the agreement and breach of contract.

A demand letter should always be polite. Using abusive or threatening language will not work in your favor ? not only will it make the defendant less likely to want to settle your claim, it could even cause damage to your actual case.

What to include in a demand letter for money owed? Include how much money you are owed. ... Include why you are owed money. ... Include your contact information so that the other party can reach you in case they would like to come to an agreement over the money owed with you or have follow up questions.

What to include in a demand letter The date the letter is being sent. Your name and address, and the name and address of the debtor. A description of the facts of the case (such as, you signed a contract for a new roof dated X date and the contractor didn't do the work) The amount you are seeking to collect (see below)

Frequently Asked Questions (FAQ) Type your letter. ... Concisely review the main facts. ... Be polite. ... Write with your goal in mind. ... Ask for exactly what you want. ... Set a deadline. ... End the letter by stating you will promptly pursue legal remedies if the other party does not meet your demand. Make and keep copies.

State why you are writing the letter. Outline the facts/story leading up to the demand letter in a chronological manner. State the legal basis for your claim. State how you will pursue legal action if your demand is not met, and include a timeline within which the demand is to be met.