Title: Exploring Oklahoma's Irrevocable Trust for Future Benefit of Trust or with Income Payable to Trust or after Specified Time Introduction: An Oklahoma Irrevocable Trust for Future Benefit of Trust or with Income Payable to Trust or after Specified Time is an estate planning tool that offers unique benefits and protection for individuals in Oklahoma. This type of trust provides the trust or with income generated by the assets held within the trust after a predetermined period. Let's delve into the details of this trust and explore any additional variations available. Key Features of Oklahoma Irrevocable Trust for Future Benefit of Trust or with Income Payable to Trust or after Specified Time: 1. Irrevocable Nature: The Oklahoma Irrevocable Trust for Future Benefit of Trust or ensures that the trust or transfers ownership and control of assets to the trust, making them inaccessible to creditors or estate taxes. This trust structure provides enhanced asset protection. 2. Future Benefit to Trust or: This trust's unique feature allows the trust or to receive income generated by the trust's assets after a specified period, usually divided into intervals or annuity payments. It allows for financial stability and a consistent income stream later in life. 3. Asset Growth Potential: While the trust or receives income payments, the assets held within the trust are allowed to grow and appreciate over time. This feature enables the trust or to benefit both from income generation and potential asset value appreciation. 4. Protection from Medicaid Spend-Down: By strategically utilizing the Oklahoma Irrevocable Trust for Future Benefit of Trust or, individuals can strategically shelter assets from Medicaid spend-down calculations, ensuring their eligibility for long-term care benefits if needed in the future. Types of Oklahoma Irrevocable Trust for Future Benefit of Trust or: 1. Standard Irrevocable Trust for Future Benefit of Trust or with Income Payable: This type of trust follows the standard structure, where income generated by the trust assets becomes payable to the trust or after a specific period, as specified in the trust agreement. It provides financial security and dependable income for the trust or's future. 2. Charitable Remainder Trust: A charitable remainder trust is a variation that allows individuals to transfer assets to the trust while retaining a charitable income tax deduction. It provides income to the trust or for a specific period, but upon termination, the remaining assets are distributed to a predetermined charitable organization. 3. Qualified Personnel Residence Trust: A qualified personnel residence trust allows the trust or to transfer a personal residence to the trust while retaining the right to use and occupy the property for a specific period. After this period elapses, the property is ultimately transferred to the beneficiaries. This trust offers potential estate tax savings while retaining the right to enjoy the property during the trust term. 4. Special Needs Trust: Designed to protect the assets of an individual with special needs, this trust type allows a trust or to provide for their disabled loved one's future needs without jeopardizing their eligibility for government assistance programs. It ensures that the trust or's assets are used to supplement rather than replace public benefits. Conclusion: The Oklahoma Irrevocable Trust for Future Benefit of Trust or with Income Payable to Trust or after Specified Time offers individuals in Oklahoma a secure and flexible estate planning strategy. With its income-generating capabilities and potential asset appreciation, this trust type provides financial stability for the trust or while offering asset protection and tax planning opportunities. Depending on individuals' specific needs, various subtypes like Charitable Remainder Trusts, Qualified Personnel Residence Trusts, and Special Needs Trusts offer additional customization options. Consult with an experienced estate planning attorney to determine the most suitable trust structure to achieve your objectives.

Oklahoma Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after Specified Time

Description

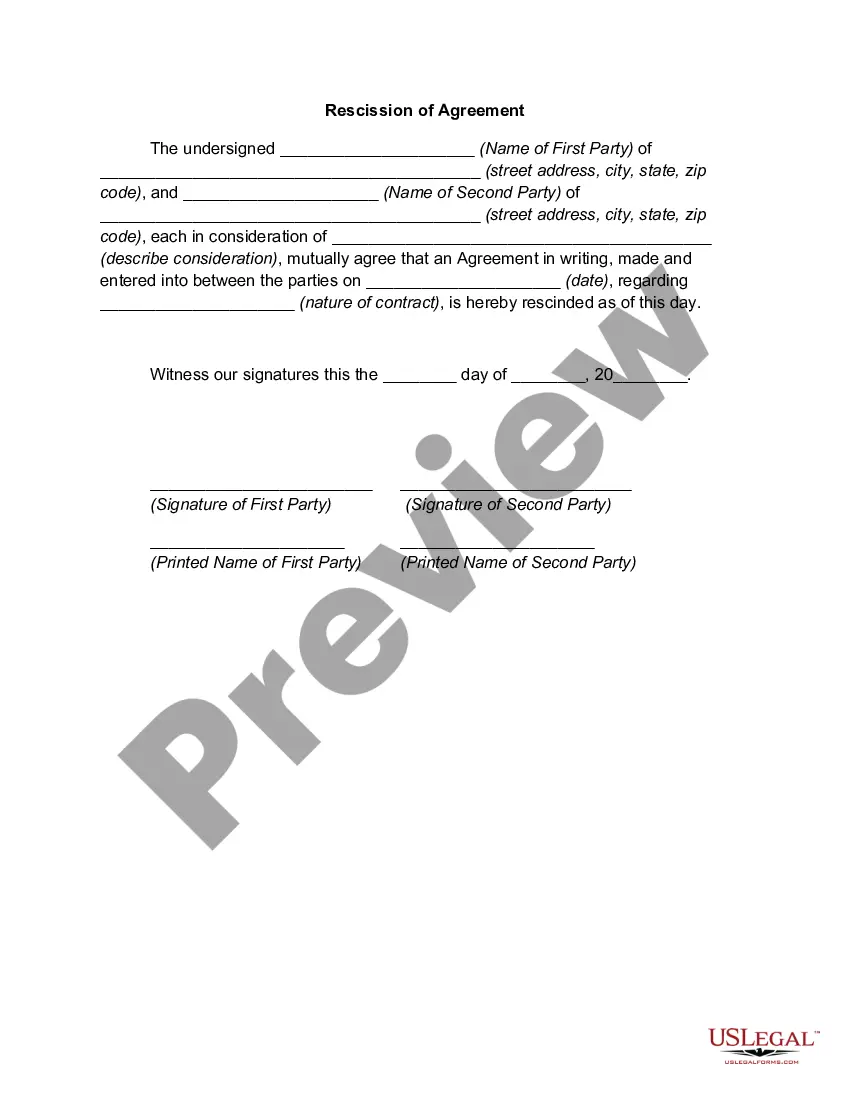

How to fill out Irrevocable Trust For Future Benefit Of Trustor With Income Payable To Trustor After Specified Time?

US Legal Forms - among the greatest libraries of lawful varieties in the USA - provides a wide array of lawful record web templates you may obtain or print out. Using the web site, you may get a huge number of varieties for organization and individual functions, sorted by categories, suggests, or keywords.You will find the most recent variations of varieties just like the Oklahoma Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after Specified Time in seconds.

If you already have a membership, log in and obtain Oklahoma Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after Specified Time in the US Legal Forms library. The Obtain option will appear on each and every develop you view. You gain access to all formerly downloaded varieties within the My Forms tab of your profile.

If you want to use US Legal Forms the first time, here are easy directions to help you get started out:

- Be sure to have chosen the proper develop for your personal area/region. Select the Preview option to analyze the form`s content material. Read the develop explanation to actually have selected the correct develop.

- In the event the develop does not suit your demands, utilize the Look for area at the top of the screen to get the one who does.

- In case you are pleased with the form, confirm your option by visiting the Get now option. Then, select the pricing plan you like and supply your accreditations to sign up on an profile.

- Method the transaction. Utilize your Visa or Mastercard or PayPal profile to perform the transaction.

- Select the formatting and obtain the form on the device.

- Make modifications. Complete, edit and print out and indicator the downloaded Oklahoma Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after Specified Time.

Every format you included with your bank account lacks an expiration particular date and is also your own eternally. So, in order to obtain or print out an additional duplicate, just visit the My Forms portion and click on around the develop you want.

Obtain access to the Oklahoma Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after Specified Time with US Legal Forms, probably the most substantial library of lawful record web templates. Use a huge number of skilled and status-particular web templates that meet your small business or individual needs and demands.

Form popularity

FAQ

The grantor (as an individual or couple) transfers their assets to an irrevocable trust. However, unlike other irrevocable trusts, the grantor can be the income beneficiary. Their children or spouse would be the residual beneficiaries.

An irrevocable trust reports income on Form 1041, the IRS's trust and estate tax return. Even if a trust is a separate taxpayer, it may not have to pay taxes. If it makes distributions to a beneficiary, the trust will take a distribution deduction on its tax return and the beneficiary will receive IRS Schedule K-1.

When a trust is irrevocable but some or all of the trust can be disbursed to or for the benefit of the individual, the look-back period applying to disbursements which could be made to or for the individual but are made to another person or persons is 36 months.

An irrevocable trust provides an alternative to simply giving an asset to a beneficiary in order to reduce your taxable estate. With a trust, you can set the timing of distributions (i.e. when the beneficiary attains 30 years of age) as well as the reasons for distributions (i.e. for education only).

But assets in an irrevocable trust generally don't get a step up in basis. Instead, the grantor's taxable gains are passed on to heirs when the assets are sold. Revocable trusts, like assets held outside a trust, do get a step up in basis so that any gains are based on the asset's value when the grantor dies.

Under current law assets in a grantor trust do not receive a step up in basis upon the grantor's death and are not included in the taxable estate of the grantor.

Some of the grantor trust rules outlined by the IRS are as follows: The power to add or change the beneficiary of a trust. The power to borrow from the trust without adequate security. The power to use the income from the trust to pay life insurance premiums.

An irrevocable trust is a very powerful tool for Medicaid Asset Protection, as it allows you to shelter assets from a nursing home after they have been in the trust for five years.

Generally, a trustee is the only person allowed to withdraw money from an irrevocable trust.

Too bad, says the IRS, unless you are an estate or trust. Under Section 663(b) of the Internal Revenue Code, any distribution by an estate or trust within the first 65 days of the tax year can be treated as having been made on the last day of the preceding tax year.