Oklahoma Sample Letter for Written Acknowledgment of Bankruptcy Information

Description

How to fill out Sample Letter For Written Acknowledgment Of Bankruptcy Information?

Have you been in the position the place you need to have files for both organization or specific reasons almost every day time? There are a variety of legitimate record layouts available on the net, but getting versions you can rely is not simple. US Legal Forms provides thousands of type layouts, like the Oklahoma Sample Letter for Written Acknowledgment of Bankruptcy Information, that are published to meet state and federal requirements.

In case you are presently informed about US Legal Forms internet site and have a free account, just log in. After that, you are able to down load the Oklahoma Sample Letter for Written Acknowledgment of Bankruptcy Information web template.

If you do not come with an profile and would like to begin using US Legal Forms, follow these steps:

- Obtain the type you will need and make sure it is for that appropriate area/state.

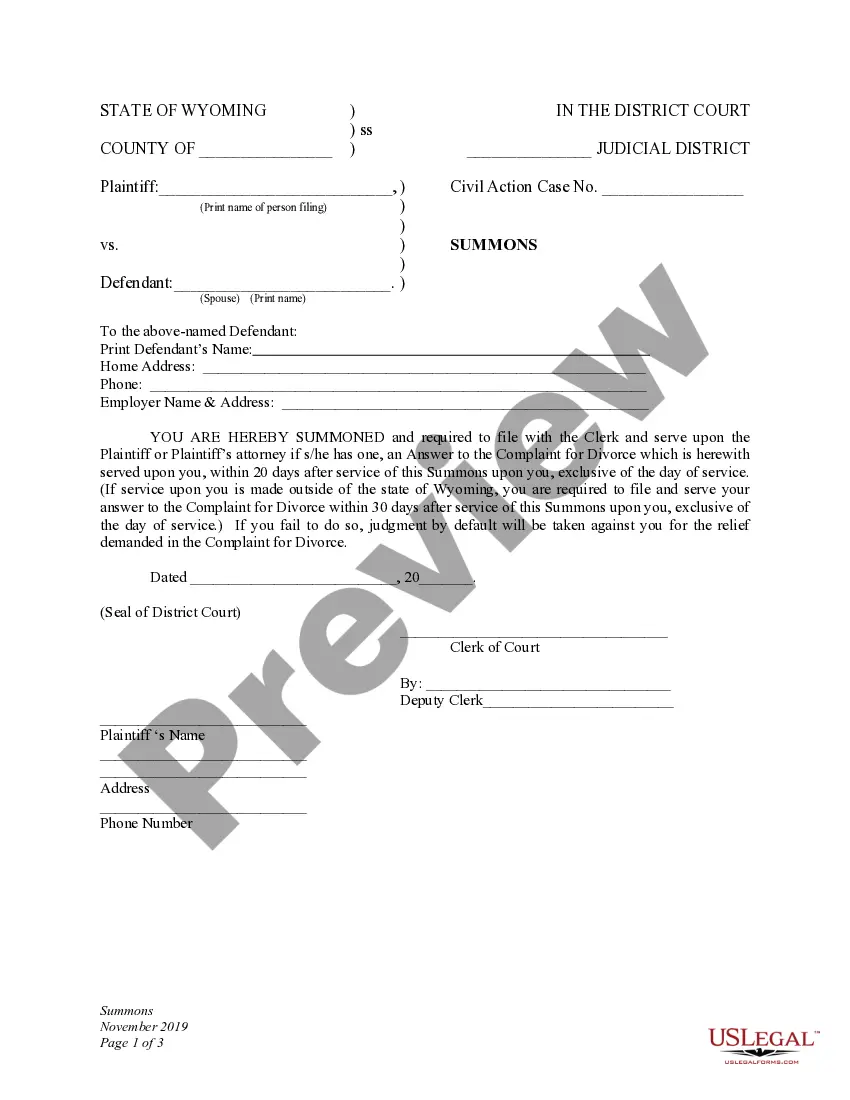

- Use the Review option to examine the form.

- Look at the outline to ensure that you have selected the proper type.

- In case the type is not what you are looking for, utilize the Search industry to discover the type that meets your needs and requirements.

- Once you get the appropriate type, click Purchase now.

- Opt for the rates program you desire, fill out the desired details to make your account, and pay for the transaction utilizing your PayPal or bank card.

- Decide on a practical document structure and down load your copy.

Get all the record layouts you might have purchased in the My Forms menu. You can get a more copy of Oklahoma Sample Letter for Written Acknowledgment of Bankruptcy Information whenever, if required. Just select the needed type to down load or print out the record web template.

Use US Legal Forms, the most substantial assortment of legitimate kinds, to conserve time as well as avoid mistakes. The assistance provides appropriately created legitimate record layouts that can be used for a range of reasons. Generate a free account on US Legal Forms and commence generating your way of life a little easier.

Form popularity

FAQ

If your total monthly income over the course of the next 60 months is less than $7,475 then you pass the means test and you may file a Chapter 7 bankruptcy. If it is over $12,475 then you fail the means test and don't have the option of filing Chapter 7.

Choose Your Debt Amount If you have so much debt that you're considering filing a Chapter 7 bankruptcy, you have enough debt to qualify. The U.S. bankruptcy code doesn't specify a minimum dollar amount someone must owe to make them eligible for a qualified filing. In short, any debt is enough debt.

What is The First Step In Filing For Bankruptcy? After you have decided to file for bankruptcy, the first step is to file a petition with the Bankruptcy Court. On the petition, all your of your debts and property must be listed as well as other schedules of assets and liabilities.

Another one of the myriad documents that you must complete when you file for bankruptcy is Official Form 108, called the "Statement of Intention." This document tells the bankruptcy trustee, the judge, and your creditors what you intend to do with certain property and certain leases.

A bankruptcy letter should be clear and concise and provide all the necessary information. It should include the name and contact information of the debtor, the date of the filing, the court where the bankruptcy was filed, the case number, and the type of bankruptcy filed.

Public Access to Court Electronic Records (PACER) is an electronic public access service that allows users to obtain case and docket information from federal appellate, district and bankruptcy courts, and the PACER Case Locator via the Internet.

First, you must prepare a voluntary bankruptcy petition and in-depth schedules of your assets, liabilities, income, and expenses. You must also furnish proof of income, copies of your most recent tax returns, and confirmation that you've participated in credit counseling before filing, as required by law.

If you need to file Chapter 7 bankruptcy, you may be able to file your bankruptcy through Upsolve. Upsolve is a non-profit organization that helps people file for Chapter 7 bankruptcy at no cost. Read about whether Chapter 7 bankruptcy is right for you and visit Upsolve's web site, upsolve.org, to see if you qualify.