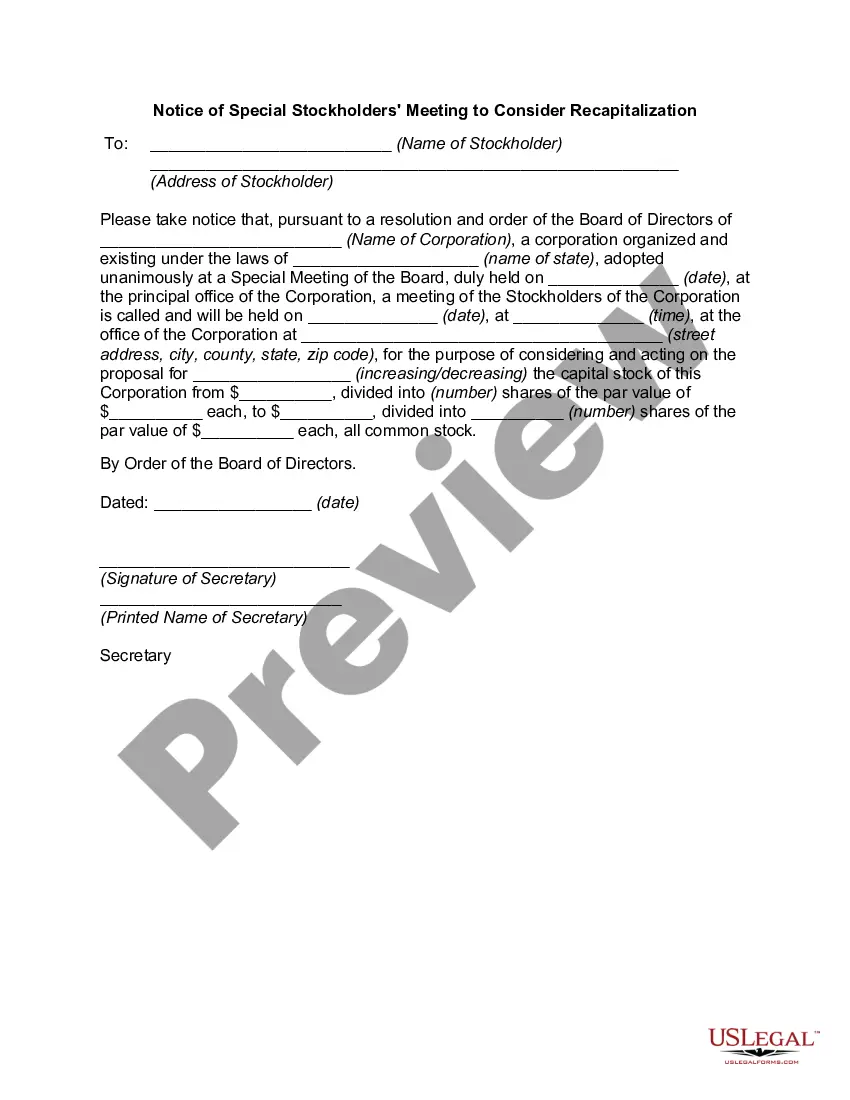

Oklahoma Notice of Special Stockholders' Meeting to Consider Recapitalization

Description

How to fill out Notice Of Special Stockholders' Meeting To Consider Recapitalization?

You may commit hrs on-line attempting to find the legal record design that fits the state and federal needs you will need. US Legal Forms offers 1000s of legal kinds which can be examined by experts. It is possible to down load or produce the Oklahoma Notice of Special Stockholders' Meeting to Consider Recapitalization from my assistance.

If you currently have a US Legal Forms account, it is possible to log in and click on the Acquire button. Next, it is possible to comprehensive, edit, produce, or indication the Oklahoma Notice of Special Stockholders' Meeting to Consider Recapitalization. Every legal record design you get is your own property forever. To obtain another backup of any purchased kind, go to the My Forms tab and click on the related button.

If you work with the US Legal Forms site the very first time, keep to the easy guidelines beneath:

- Initial, be sure that you have chosen the best record design to the region/city of your choice. Read the kind description to ensure you have chosen the proper kind. If offered, utilize the Preview button to look from the record design at the same time.

- If you want to find another variation in the kind, utilize the Search discipline to get the design that suits you and needs.

- After you have discovered the design you would like, click on Buy now to move forward.

- Choose the prices program you would like, type your references, and register for an account on US Legal Forms.

- Total the deal. You should use your credit card or PayPal account to cover the legal kind.

- Choose the file format in the record and down load it in your device.

- Make adjustments in your record if possible. You may comprehensive, edit and indication and produce Oklahoma Notice of Special Stockholders' Meeting to Consider Recapitalization.

Acquire and produce 1000s of record web templates while using US Legal Forms Internet site, which offers the most important assortment of legal kinds. Use professional and condition-certain web templates to handle your business or individual demands.

Form popularity

FAQ

The first shareholder meeting is an organizational meeting where shareholders ratify and approve the actions of the incorporators. Shareholders also approve shares values, appoint directors and officers if needed, and wrap up other initial tasks.

Special meetings of the shareholders may be called for any purpose or purposes, at any time, by the Chief Executive Officer; by the Chief Financial Officer; by the Board or any two or more members thereof; or by one or more shareholders holding not less than 10% of the voting power of all shares of the corporation

Legal Definition of special meeting : a meeting held for a special and limited purpose specifically : a corporate meeting held occasionally in addition to the annual meeting to conduct only business described in a notice to the shareholders.

Special meeting is a meeting called by shareholders to discuss specific matters stated in the notice of the meeting. It is a meeting of shareholders outside the usual annual general meeting.

The term shareholders refers to the people directly involved in the corporation who are participating in the company's gains or losses. The special meeting aims to enable the shareholders to know the company's affairs and vote on the management's recommendations in the proposed resolution.

The notice for the postponement of the annual stockholders' meeting should be sent at least 2 weeks prior to the date of the postponed meeting unless a different period is required under the bylaws, laws or regulations. The notice should also include the reason for the postponement.

Notice to Shareholders Most states require notice of any shareholder meeting be mailed to all shareholders at least 10 days prior to the meeting. The notice should contain the date, time and location of the meeting as well as an agenda or explanation of the topics to be discussed.

Regular meetings of stockholders or members shall be held annually on a date fixed in the bylaws, or if not so fixed, on any date after April 15 of every year as determined by the board of directors or trustees: Provided, That written notice of regular meetings shall be sent to all stockholders or members of record

Special meetings of the shareholders may be called for any purpose or purposes, at any time, by the Chief Executive Officer; by the Chief Financial Officer; by the Board or any two or more members thereof; or by one or more shareholders holding not less than 10% of the voting power of all shares of the corporation

If the Model constitution applies, members must be given at least 14 days' notice of an AGM or 21 days' notice if a special resolution is to be proposed. The statutory purpose of the AGM is the submission of the association's financial statements (and if required the auditor's report) to the meeting.