Oklahoma Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation is a legal document that outlines the rights and responsibilities of shareholders in a close corporation in Oklahoma, specifically regarding the allocation of dividends among shareholders. A close corporation refers to a privately held corporation with a limited number of shareholders, typically family members or a small group of investors. The primary purpose of this agreement is to establish a framework for distributing dividends among shareholders, which may be different from the pro rata distribution method commonly used in traditional corporations. It allows shareholders to determine specific allocation rules based on various factors such as ownership percentages, capital contributions, or seniority. This type of shareholders' agreement recognizes the unique nature of close corporations, where there is often a close relationship or shared responsibilities among shareholders. It provides flexibility in determining how dividends are distributed, allowing for a more customized approach that aligns with the specific needs and goals of the shareholders involved. Different types of Oklahoma Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation may include: 1. Percentage-based Allocation: This type of agreement distributes dividends based on each shareholder's ownership percentage in the close corporation. Shareholders receive dividends in proportion to their ownership stake, ensuring a fair distribution of profits. 2. Capital Contribution-based Allocation: In this scenario, the allocation of dividends is determined based on the capital contributions made by each shareholder. Shareholders who have contributed a larger amount of capital will receive a higher portion of dividends, reflecting their greater financial stake in the corporation. 3. Seniority-based Allocation: This type of agreement allocates dividends based on the seniority of shareholders, giving priority to those who have been associated with the corporation for a longer duration. Senior shareholders may be entitled to a larger share of dividends, recognizing their greater experience and contribution to the success of the close corporation over time. 4. Customized Allocation: Shareholders may choose to create a unique allocation system based on specific criteria defined by the shareholders' agreement. This could involve combining different allocation methods or developing an entirely different approach that suits the specific circumstances and goals of the close corporation. Overall, the Oklahoma Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation provides a framework for distributing dividends that reflects the shareholders' desires and recognizes the unique dynamics of close corporations. It facilitates transparency, fairness, and effective governance among shareholders, ultimately contributing to the smooth functioning and success of the close corporation.

Oklahoma Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation

Description

How to fill out Oklahoma Shareholders' Agreement With Special Allocation Of Dividends Among Shareholders In A Close Corporation?

US Legal Forms - one of many greatest libraries of legal forms in the States - delivers a wide array of legal record layouts you can obtain or produce. While using internet site, you can find thousands of forms for business and individual reasons, categorized by categories, states, or search phrases.You will find the latest models of forms just like the Oklahoma Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation within minutes.

If you currently have a monthly subscription, log in and obtain Oklahoma Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation from your US Legal Forms collection. The Obtain button can look on each type you perspective. You have access to all previously downloaded forms within the My Forms tab of the account.

In order to use US Legal Forms the first time, listed here are simple directions to help you get began:

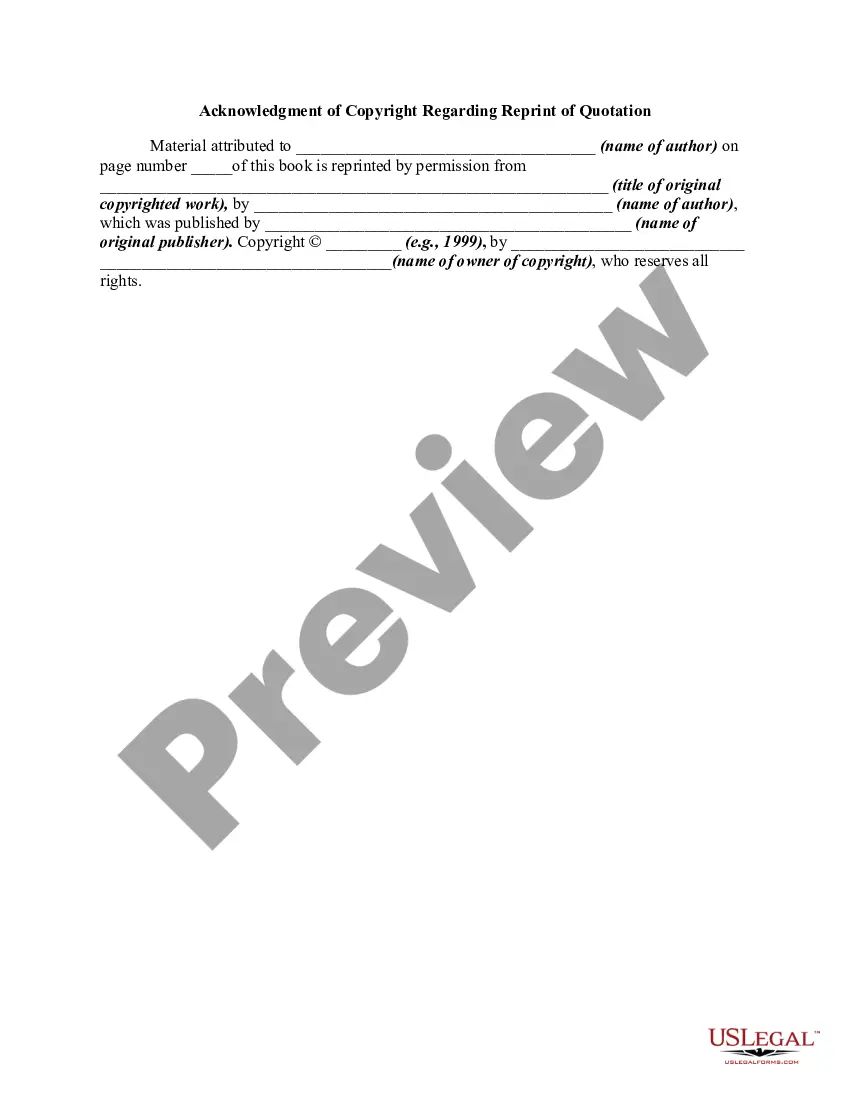

- Ensure you have picked out the right type for your town/county. Go through the Preview button to examine the form`s content. Look at the type information to ensure that you have chosen the proper type.

- In the event the type does not suit your requirements, use the Search discipline near the top of the monitor to find the the one that does.

- In case you are content with the shape, confirm your selection by clicking on the Get now button. Then, select the costs prepare you favor and supply your qualifications to register for the account.

- Method the purchase. Make use of your bank card or PayPal account to complete the purchase.

- Pick the structure and obtain the shape on the device.

- Make adjustments. Fill out, change and produce and sign the downloaded Oklahoma Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation.

Every single design you included with your money does not have an expiration time and is your own eternally. So, if you wish to obtain or produce one more backup, just go to the My Forms portion and then click around the type you need.

Obtain access to the Oklahoma Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation with US Legal Forms, the most considerable collection of legal record layouts. Use thousands of professional and express-certain layouts that meet up with your small business or individual needs and requirements.