In Oklahoma, individuals have the right to challenge the information present on their credit reports issued by Experian, TransUnion, and/or Equifax if they believe it to be inaccurate or misleading. The state provides a legal framework for consumers to dispute any discrepancies, potentially leading to the removal or correction of such information. There are several types of challenges that can be pursued in Oklahoma when it comes to credit reports. These include: 1. Identity Theft: If a person's identity has been compromised and fraudulent accounts or inaccurate information have been reported, an Oklahoma consumer can challenge these entries on their credit reports. This process helps victims of identity theft restore their creditworthiness by having fraudulent entries removed. 2. Inaccurate or Outdated Information: Individuals can challenge any incorrect or outdated information on their credit reports. Common inaccuracies may include incorrectly reported late payments, accounts mistakenly listed as delinquent, or incorrect personal details such as addresses or employment history. By filing disputes, consumers can seek rectification of these errors. 3. Disputed Debts: If a consumer has disputed a debt with a creditor, but the debt is still reported as valid on their credit report, they can challenge this entry to ensure its accuracy. It is essential to provide documentation supporting the dispute to increase the chances of a successful challenge. To initiate an Oklahoma challenge to a credit report, the following steps can be taken: 1. Obtain a Copy of the Credit Report: Request a free copy of the credit report from each of the three major credit bureaus — Experian, TransUnion, and Equifax. This can be done annually at no cost through AnnualCreditReport.com. 2. Identify Inaccuracies: Carefully review the credit reports to identify any inaccurate or misleading information. Make note of the entries that need to be challenged along with supporting evidence. 3. Document the Dispute: Prepare a written document outlining the discrepancies and providing evidence to support the challenge. This may include bank statements, canceled checks, or any other relevant paperwork that verifies the incorrectness of the reported item. 4. Contact the Credit Bureaus: Send the dispute letter along with the supporting documentation to the credit bureaus reporting the inaccurate information. It is advisable to send the letter via certified mail with a return receipt for documentation purposes. 5. Investigation Process: Once the credit bureaus receive the dispute, they have 30 days to investigate and respond to the consumer regarding the results of their investigation. If they find the challenged information to be inaccurate or unable to be verified, it must be corrected or removed from the credit report. It is important to note that consumers can also seek assistance from credit repair companies or legal professionals who specialize in credit disputes. These professionals can provide guidance on the specific Oklahoma laws and regulations surrounding credit report challenges and help individuals navigate the process effectively.

Oklahoma Challenge to Credit Report of Experian, TransUnion, and/or Equifax

Description

How to fill out Oklahoma Challenge To Credit Report Of Experian, TransUnion, And/or Equifax?

Are you currently inside a position that you need to have paperwork for sometimes company or specific uses just about every time? There are plenty of authorized papers templates available online, but discovering types you can depend on is not effortless. US Legal Forms offers a huge number of kind templates, much like the Oklahoma Challenge to Credit Report of Experian, TransUnion, and/or Equifax, which can be written to meet federal and state requirements.

Should you be presently acquainted with US Legal Forms website and possess an account, just log in. Following that, you may obtain the Oklahoma Challenge to Credit Report of Experian, TransUnion, and/or Equifax design.

If you do not come with an accounts and wish to start using US Legal Forms, adopt these measures:

- Obtain the kind you need and make sure it is for that proper area/area.

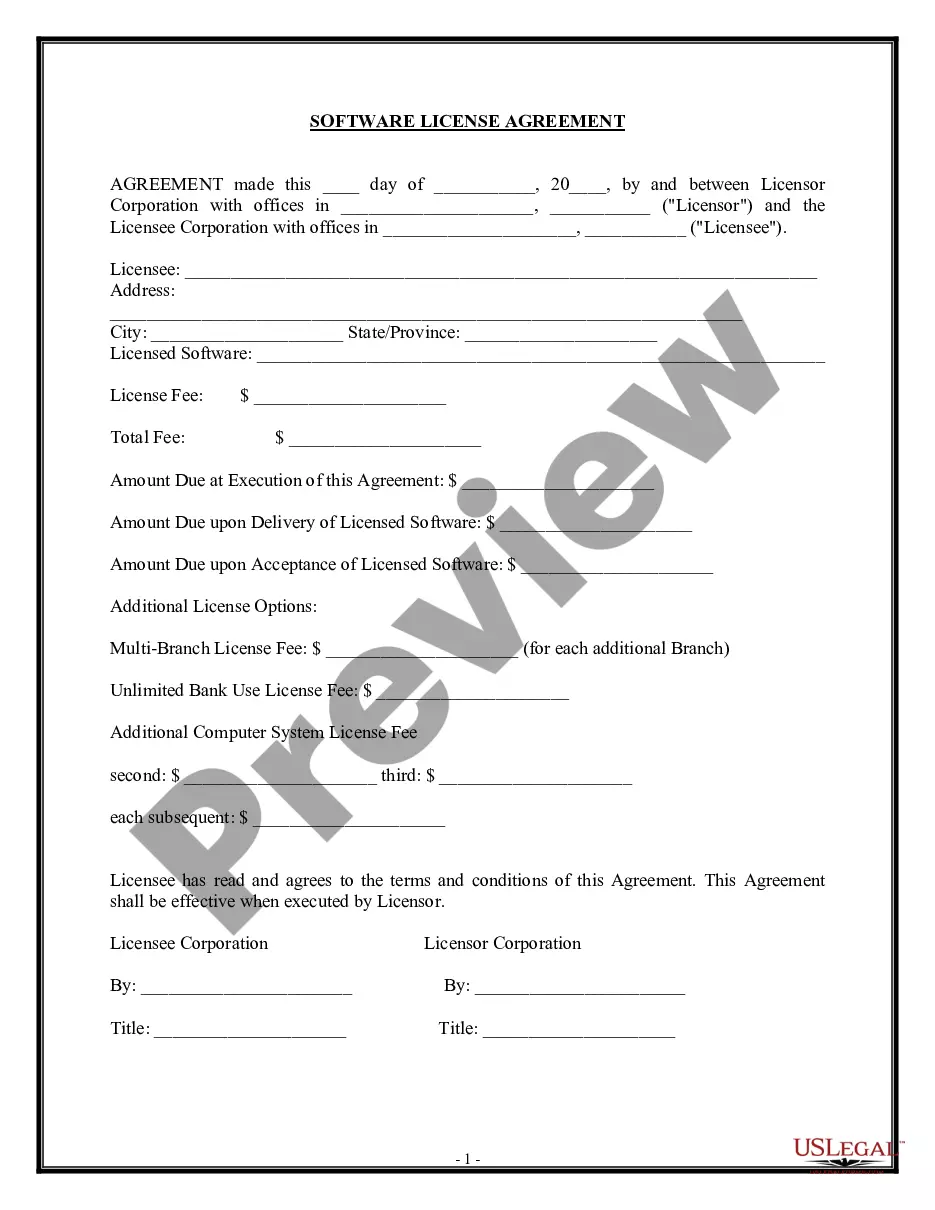

- Utilize the Preview option to check the form.

- See the explanation to actually have selected the right kind.

- In the event the kind is not what you`re trying to find, take advantage of the Research discipline to discover the kind that suits you and requirements.

- When you obtain the proper kind, click Get now.

- Choose the prices prepare you need, fill out the required details to produce your account, and purchase your order making use of your PayPal or charge card.

- Choose a hassle-free file formatting and obtain your version.

Get all the papers templates you may have bought in the My Forms food selection. You can get a more version of Oklahoma Challenge to Credit Report of Experian, TransUnion, and/or Equifax whenever, if needed. Just select the necessary kind to obtain or printing the papers design.

Use US Legal Forms, by far the most comprehensive selection of authorized varieties, to save lots of efforts and avoid blunders. The assistance offers skillfully manufactured authorized papers templates which can be used for a selection of uses. Generate an account on US Legal Forms and start making your way of life a little easier.