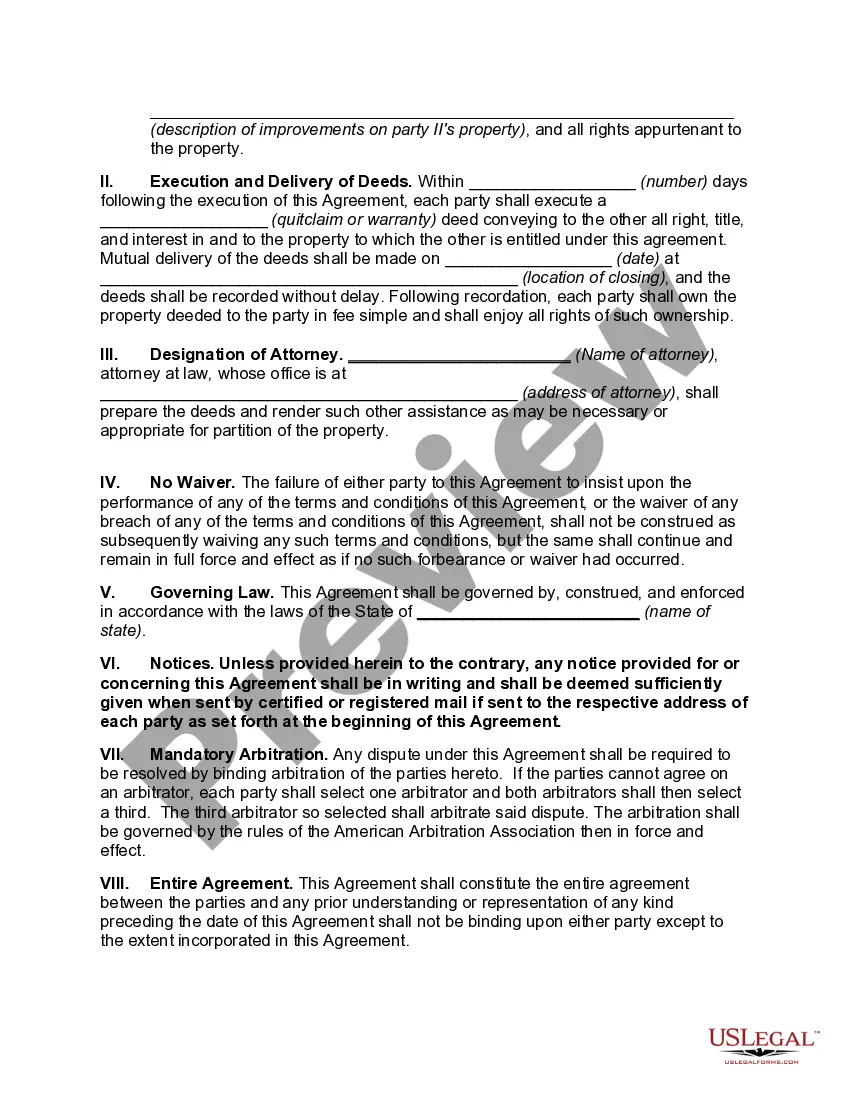

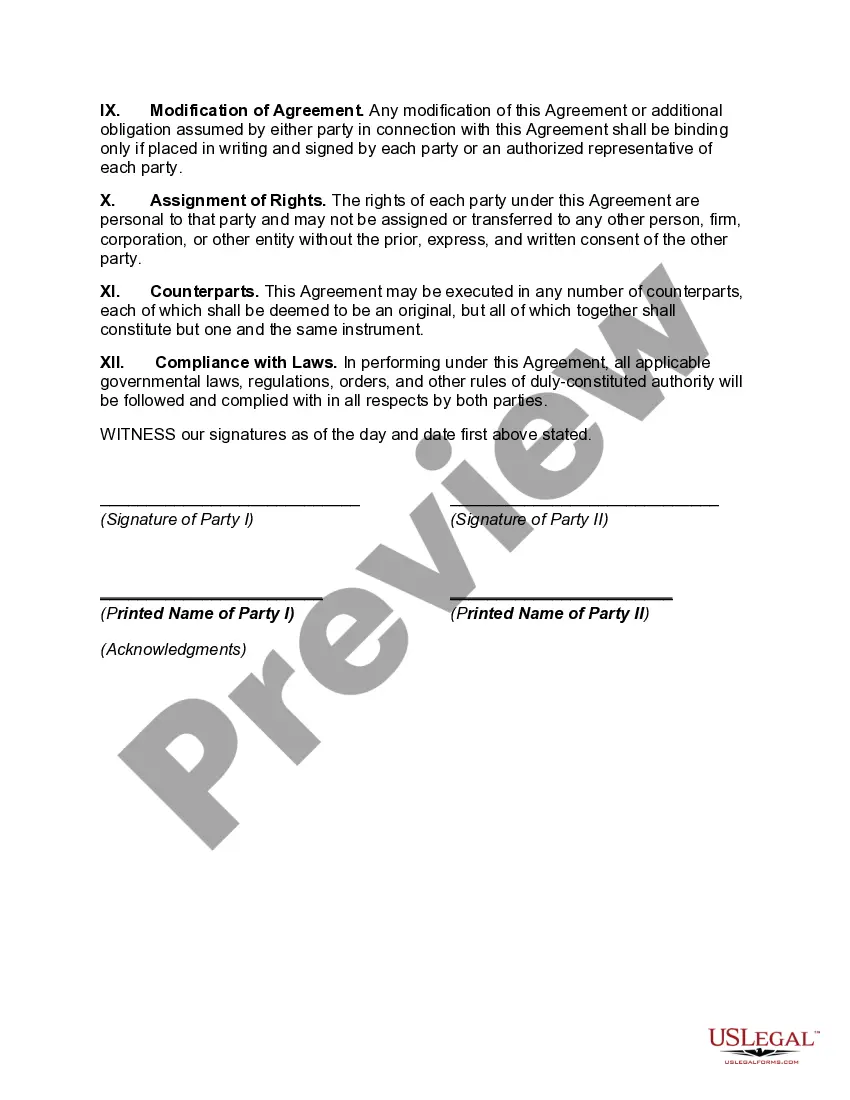

Oklahoma Agreement to Partition Real Property Between Children of Decedent

Description

How to fill out Agreement To Partition Real Property Between Children Of Decedent?

If you have to full, down load, or printing lawful file templates, use US Legal Forms, the biggest collection of lawful varieties, that can be found on the web. Utilize the site`s basic and handy search to get the files you require. Different templates for enterprise and personal reasons are categorized by classes and states, or search phrases. Use US Legal Forms to get the Oklahoma Agreement to Partition Real Property Between Children of Decedent within a few click throughs.

In case you are presently a US Legal Forms customer, log in for your bank account and then click the Obtain button to have the Oklahoma Agreement to Partition Real Property Between Children of Decedent. Also you can access varieties you formerly delivered electronically inside the My Forms tab of your own bank account.

If you use US Legal Forms the very first time, refer to the instructions under:

- Step 1. Be sure you have chosen the shape for the proper city/country.

- Step 2. Use the Preview option to examine the form`s content material. Don`t forget about to learn the outline.

- Step 3. In case you are unhappy together with the type, use the Look for discipline at the top of the display to locate other types in the lawful type template.

- Step 4. Once you have identified the shape you require, go through the Acquire now button. Select the rates plan you choose and add your credentials to sign up for the bank account.

- Step 5. Process the transaction. You can utilize your credit card or PayPal bank account to accomplish the transaction.

- Step 6. Choose the format in the lawful type and down load it on your own device.

- Step 7. Full, edit and printing or signal the Oklahoma Agreement to Partition Real Property Between Children of Decedent.

Every lawful file template you acquire is your own eternally. You have acces to every type you delivered electronically with your acccount. Go through the My Forms section and select a type to printing or down load once again.

Remain competitive and down load, and printing the Oklahoma Agreement to Partition Real Property Between Children of Decedent with US Legal Forms. There are many professional and state-particular varieties you can use for your personal enterprise or personal needs.

Form popularity

FAQ

Heirship Determinations When a landowner dies without a will, or beneficiaries are not named in the will, it may be necessary to determine the rightful heirs in Oklahoma court, including intestate succession or probate proceedings. This is known as an heirship determination.

You may have heard of a ?239 sale,? which is a reference to Oklahoma Statutes, title 58, section 239; this section is often used to sell real estate owned by a decedent while the probate case is still ongoing and not yet complete.

Oklahoma court judges generally have two options when hearing a partition lawsuit; the court must physically divide the property and give each co-owner a piece of the property in proportion to their ownership interest, or, if physical division is impossible, the court must order a sale of the property and divide the ...

The full probate procedure in Oklahoma is used if an estate is worth over $200,000. The simplified probate procedure may be available for estates worth less than $200,000.

Oklahoma's statute of limitations regarding probate litigation generally range between two to five years following the date of the testator's death, depending on the aspect of the will you're contesting; for instance, if your issue is with the conduct of an adjudicator which may have corrupted a will's intent, you will ...

Oklahoma Probate Procedure Filing a Petition begin the Oklahoma Probate Procedure. Notice of Hearing must be given to all interested parties. Hearing on Petition naming Personal Representative or Executor. The Court will issue Letters of Administration appointing a Personal Representative or Executor. Notice to Creditors.

Probate Procedure. §58-3005. Execution of power of attorney. A power of attorney must be signed by the principal or in the principal's conscious presence by another individual directed by the principal to sign the principal's name on the power of attorney.

Oklahoma probate law states that if there is a will, either a simplified probate procedure, full probate, or ancillary probate should be filed. Remember that probating the will is a legal process that takes care of creditors, taxes, and the estate's heirs and beneficiaries.

Previously, partition by appraisal only applied to inherited property. The Partition of Real Property Act, which went into effect on January 1, 2023, now allows a co-owner to buy out the interest of the co-owner requesting a partition by sale. Generally, the law favors a physical partition or a partition in kind.