Keywords: Oklahoma Jury Instruction, 4.4.1 Rule 10(b) — 5(a), Device, Scheme, Artifice to Defraud, Insider Trading Oklahoma Jury Instruction — 4.4.1 Rule 10(b— - 5(a) Device, Scheme, or Artifice to Defraud Insider Trading is a legal guideline used in Oklahoma courts to educate the jury about the various forms and elements of fraud related to insider trading. This instruction helps the jury understand the specific actions, intentions, and deceitful methods involved in illegal insider trading activities. Insider trading refers to the buying or selling of securities based on confidential information not yet made available to the public. It is considered illegal as it gives unfair advantages to those who possess such information, undermining the integrity and fairness of financial markets. The instruction, under the Oklahoma 4.4.1 Rule 10(b) — 5(a), covers different types of devices, schemes, or artifices used by individuals engaged in insider trading to defraud others in pursuit of personal gains. These can include: 1. Tipping: This involves the unauthorized disclosure of material non-public information to another person, providing them with an advantage in trading securities. The tipper and the tipped can both be held liable under insider trading laws. 2. Trading on confidential information: This refers to the buying or selling of securities by an individual who possesses undisclosed material information, making it illegal for them to trade on such information to gain personal profits. 3. Misappropriation of information: This type of insider trading occurs when a person misuses confidential information entrusted to them for personal trading purposes. It typically involves individuals in a fiduciary or confidential relationship misappropriating information for personal gain. 4. Front-running: This form of insider trading involves a person trading securities for personal gain before executing orders for their clients or in anticipation of big market-moving trades. Front-runners exploit their access to pending orders and execute their trades ahead of others to benefit from price movements. These are just a few examples of the various ways individuals may engage in insider trading to defraud others. Each case is evaluated on its own merit, and the jury is responsible for determining whether the accused individual's actions constitute a device, scheme, or artifice to defraud. It is important to note that legal definitions and interpretations may vary in different jurisdictions, and this description focuses on the Oklahoma 4.4.1 Rule 10(b) — 5(a) instruction specifically.

Oklahoma Jury Instruction - 4.4.1 Rule 10(b) - 5(a) Device, Scheme Or Artifice To Defraud Insider Trading

Description

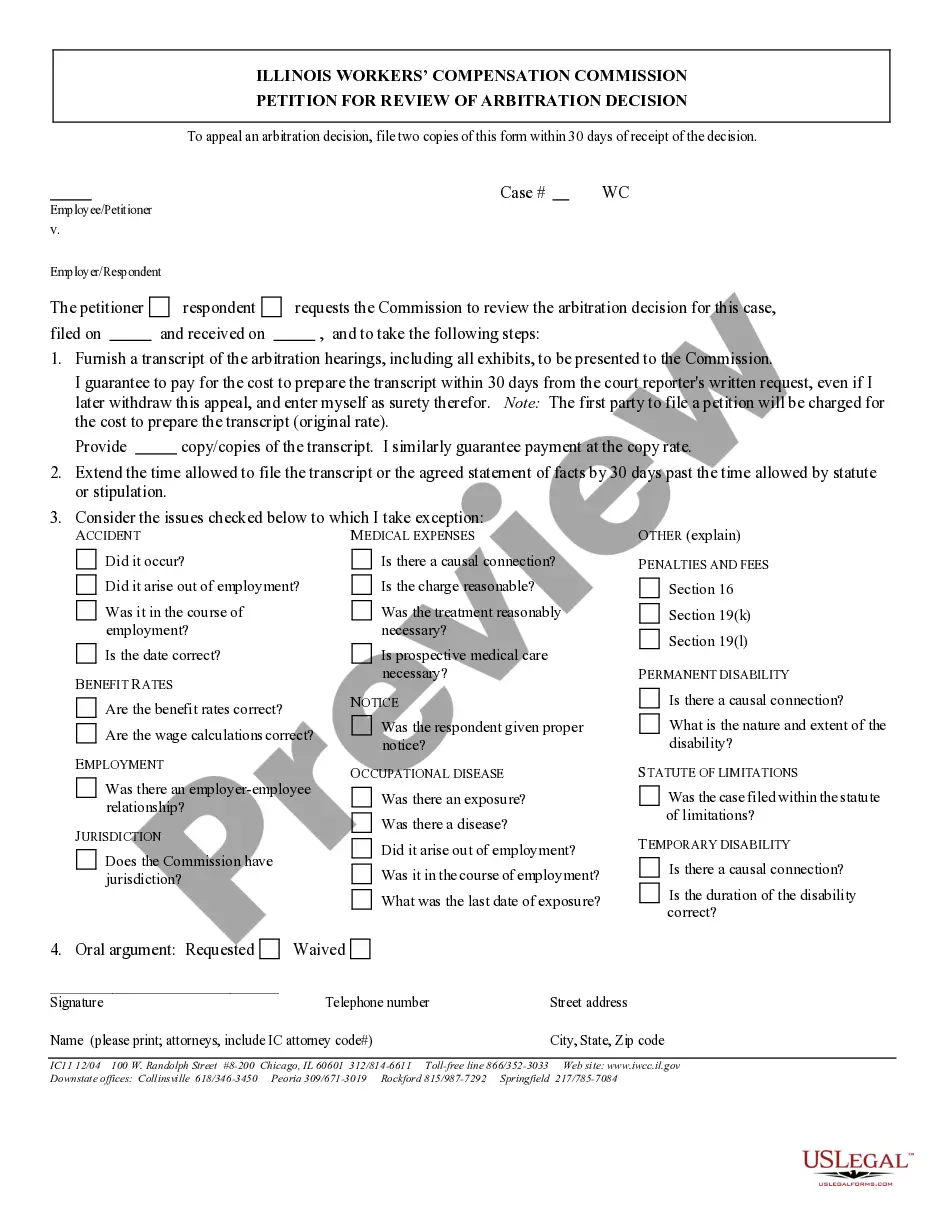

How to fill out Oklahoma Jury Instruction - 4.4.1 Rule 10(b) - 5(a) Device, Scheme Or Artifice To Defraud Insider Trading?

You are able to commit several hours online searching for the legitimate file web template that meets the federal and state requirements you need. US Legal Forms gives thousands of legitimate kinds which are examined by experts. You can easily acquire or print the Oklahoma Jury Instruction - 4.4.1 Rule 10(b) - 5(a) Device, Scheme Or Artifice To Defraud Insider Trading from your assistance.

If you have a US Legal Forms account, you are able to log in and click on the Acquire button. Afterward, you are able to total, modify, print, or indicator the Oklahoma Jury Instruction - 4.4.1 Rule 10(b) - 5(a) Device, Scheme Or Artifice To Defraud Insider Trading. Every single legitimate file web template you get is yours for a long time. To obtain an additional version associated with a obtained type, visit the My Forms tab and click on the corresponding button.

Should you use the US Legal Forms internet site the very first time, follow the straightforward recommendations listed below:

- Very first, make certain you have selected the proper file web template for the area/town of your choosing. Look at the type explanation to ensure you have selected the appropriate type. If offered, take advantage of the Preview button to look from the file web template as well.

- If you want to find an additional variation of the type, take advantage of the Look for area to obtain the web template that fits your needs and requirements.

- After you have found the web template you desire, simply click Purchase now to carry on.

- Choose the pricing prepare you desire, key in your credentials, and sign up for a merchant account on US Legal Forms.

- Total the purchase. You can utilize your credit card or PayPal account to cover the legitimate type.

- Choose the structure of the file and acquire it to the system.

- Make alterations to the file if required. You are able to total, modify and indicator and print Oklahoma Jury Instruction - 4.4.1 Rule 10(b) - 5(a) Device, Scheme Or Artifice To Defraud Insider Trading.

Acquire and print thousands of file templates while using US Legal Forms Internet site, that offers the largest selection of legitimate kinds. Use professional and express-specific templates to tackle your small business or specific requires.

Form popularity

FAQ

The idea behind a limiting instruction is that it is better to admit relevant and probative evidence, even in a limited capacity, and take the chance that the jury will properly apply it in its decision making, rather than to exclude it altogether.

The Texas Pattern Jury Charges series is widely accepted by attorneys and judges as the most authoritative guide for drafting questions, instructions, and definitions in a broad variety of cases.

The judge will advise the jury that it is the sole judge of the facts and of the credibility (believability) of witnesses. He or she will note that the jurors are to base their conclusions on the evidence as presented in the trial, and that the opening and closing arguments of the lawyers are not evidence.

Jury instructions are instructions for jury deliberation that are written by the judge and given to the jury. At trial, jury deliberation occurs after evidence is presented and closing arguments are made.

PATTERN JURY INSTRUCTIONS WHICH PROVIDE A BODY OF BRIEF, UNIFORM INSTRUCTIONS THAT FULLY STATE THE LAW WITHOUT NEEDLESS REPETION ARE PRESENTED; BASIC, SPECIAL, OFFENSE, AND TRIAL INSTRUCTIONS ARE INCLUDED.