An Oklahoma Independent Contractor Services Agreement with Accountant is a legally binding contract between an independent contractor and an accountant hired to provide professional services in the state of Oklahoma. This agreement outlines the terms and conditions of the working relationship, ensuring clarity and protection for both parties involved. The agreement generally includes the following key elements: 1. Parties: Clearly state the names and addresses of both the independent contractor and the accountant. This section also identifies the legal capacity of both parties. 2. Scope of Services: Define the specific services the accountant will provide as an independent contractor. This may include tax preparation, financial analysis, bookkeeping, or any other accounting-related tasks required by the client. 3. Compensation: Outline how the accountant will be paid for their services, whether it is an hourly rate, fixed fee, or a combination of both. Additionally, mention the payment schedule and any penalties for late or non-payment. 4. Independent Contractor Status: Highlight that the accountant will be considered an independent contractor and not an employee of the client. Clarify the responsibilities and obligations that come with this status, such as paying their own taxes and maintaining appropriate licenses or certifications. 5. Confidentiality and Non-Disclosure: Include provisions stating that the accountant will maintain the confidentiality of the client's financial information and any other sensitive data acquired during the engagement. This safeguards the client's privacy and prevents the misuse or unauthorized disclosure of confidential information. 6. Termination: Specify the conditions under which either party can terminate the agreement. This may include breach of contract, non-performance, or any other agreed-upon reasons. Outline the notice period required to terminate the agreement and any consequences or liabilities associated with termination. 7. Intellectual Property Rights: Address the ownership of intellectual property rights in relation to any work created or delivered by the accountant during the engagement. Determine whether the client will have full ownership or if specific licensing arrangements need to be made. Types of Oklahoma Independent Contractor Services Agreement with Accountant: 1. Tax Consulting Services Agreement: Specifically tailored for accountants providing tax-related services, including income tax planning, preparation, and filing. This agreement may focus more on the complex tax regulations specific to Oklahoma. 2. Bookkeeping Services Agreement: This agreement is designed for independent contractors hired to handle bookkeeping tasks for businesses based in Oklahoma. It outlines the responsibilities associated with maintaining accurate financial records and handling daily financial transactions. 3. Financial Analysis Services Agreement: Targeting accountants who provide in-depth financial analysis and reporting services to clients in Oklahoma. This agreement emphasizes the scope and methodology of financial analysis, which can aid in making informed business decisions. Remember, it is essential to consult legal professionals or attorneys when drafting or signing any legal agreement to ensure compliance with state laws and regulations.

Oklahoma Independent Contractor Services Agreement with Accountant

Description

How to fill out Oklahoma Independent Contractor Services Agreement With Accountant?

US Legal Forms - among the greatest libraries of legal types in the United States - gives an array of legal papers templates you can download or print out. Utilizing the web site, you can find 1000s of types for business and individual reasons, sorted by types, states, or keywords.You will discover the most up-to-date types of types like the Oklahoma Independent Contractor Services Agreement with Accountant within minutes.

If you already have a registration, log in and download Oklahoma Independent Contractor Services Agreement with Accountant from your US Legal Forms collection. The Obtain option will appear on each kind you see. You have accessibility to all formerly downloaded types from the My Forms tab of the account.

If you would like use US Legal Forms initially, allow me to share easy instructions to help you started:

- Make sure you have selected the correct kind for the city/area. Go through the Preview option to check the form`s articles. Browse the kind outline to ensure that you have chosen the proper kind.

- In case the kind does not suit your specifications, take advantage of the Look for discipline on top of the screen to discover the the one that does.

- When you are happy with the shape, verify your selection by clicking the Purchase now option. Then, opt for the pricing program you prefer and supply your references to register on an account.

- Procedure the financial transaction. Make use of Visa or Mastercard or PayPal account to finish the financial transaction.

- Find the file format and download the shape in your system.

- Make modifications. Fill out, revise and print out and indicator the downloaded Oklahoma Independent Contractor Services Agreement with Accountant.

Each design you put into your money lacks an expiry date and is also your own property permanently. So, if you would like download or print out one more duplicate, just proceed to the My Forms area and click on on the kind you want.

Get access to the Oklahoma Independent Contractor Services Agreement with Accountant with US Legal Forms, the most substantial collection of legal papers templates. Use 1000s of skilled and status-particular templates that meet up with your company or individual requires and specifications.

Form popularity

FAQ

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

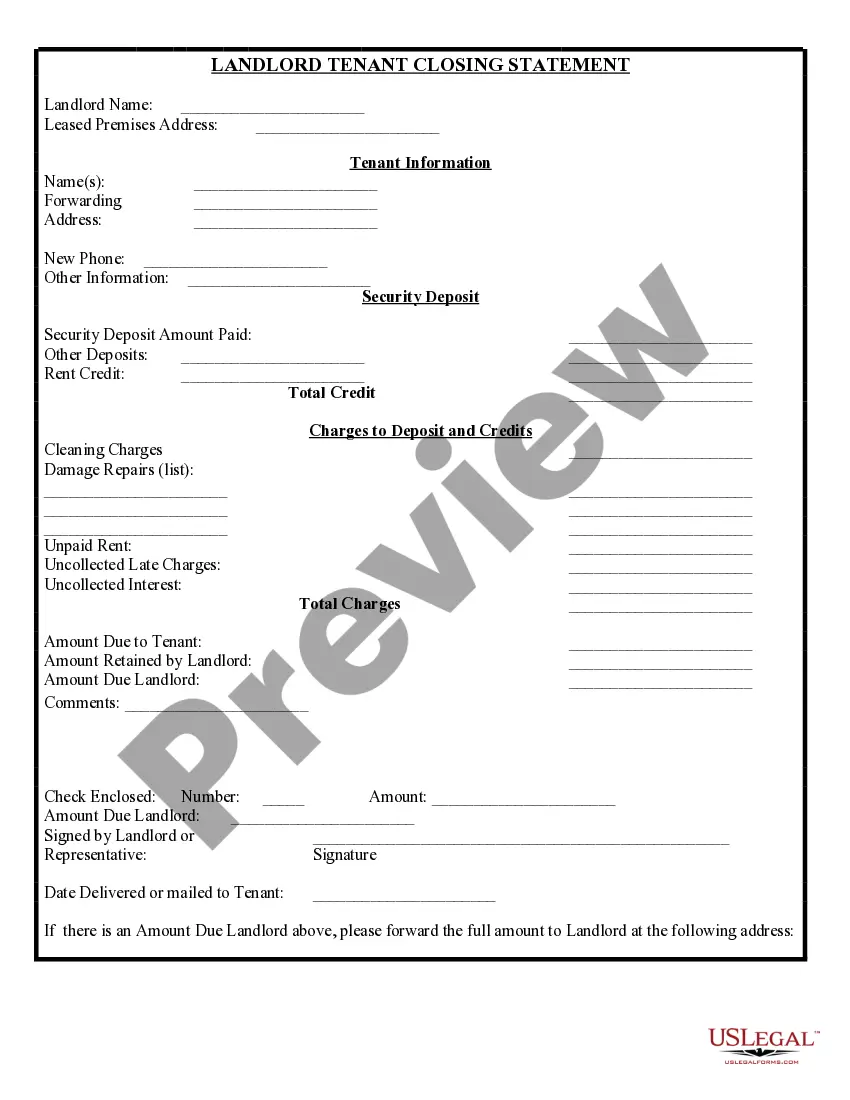

Accountants and their clients often use Accounting Contracts as a means of defining the scope and payment terms for work to be done. Signed by the client and the accountant, this essential document can help each party to set expectations and reduce the risk of disagreements.

Bookkeepers and accountants are independent contractors when they: Are hired (temporary or potentially for a long period of time) to accomplish a specific result and are not subject to direction or control over the methods or means to accomplish it.

Here are some steps you may use to guide you when you write an employment contract:Title the employment contract.Identify the parties.List the term and conditions.Outline the job responsibilities.Include compensation details.Use specific contract terms.Consult with an employment lawyer.Employment.More items...?

An Accounting Contract is a legal agreement between a client (individual or company) and an accountant, regarding the accounting needs of the client. Use this document to clarify your rights and responsibilities concerning the accounting services, define the scope of these services, and determine the deadlines.

Small to mid-size businesses might employ their own bookkeepers. But in recent years, many have started offering bookkeeping services on a self-employed basis. This is good for businesses, as it means they can get all the benefits of a bookkeeper without having to employ a full-time member of staff.

People such as doctors, dentists, veterinarians, lawyers, accountants, contractors, subcontractors, public stenographers, or auctioneers who are in an independent trade, business, or profession in which they offer their services to the general public are generally independent contractors.

Ten Tips for Making Solid Business Agreements and ContractsGet it in writing.Keep it simple.Deal with the right person.Identify each party correctly.Spell out all of the details.Specify payment obligations.Agree on circumstances that terminate the contract.Agree on a way to resolve disputes.More items...

So if you're paying unlicensed California accountants or bookkeepers as independent contractors, you're probably going to have to rehire them as employees regardless of whether or not your firm is located in California.

How to Become an Independent BookkeeperGet Your Degree. No one's going to trust you with their money if you haven't studied accounting and bookkeeping.Gain Practical Experience.Add Some Credentials.Handle Your Legal Issues.Start Marketing Yourself.