Title: Oklahoma Letter of Notice to Borrower of Assignment of Mortgage — Comprehensive Guide and Types Explained Introduction: In the state of Oklahoma, when a mortgage loan is assigned or transferred to a different lender or entity, it is crucial to formally notify the borrower involved to ensure transparency and establish proper communication. The Oklahoma Letter of Notice to Borrower of Assignment of Mortgage serves this purpose. This detailed description delves into the concept of this notification letter, its importance, and highlights different types of such letters commonly used in Oklahoma. Keywords: Oklahoma, Letter of Notice, Borrower, Assignment, Mortgage, Types, Notification, Communication I. Understanding the Oklahoma Letter of Notice to Borrower of Assignment of Mortgage: The Oklahoma Letter of Notice to Borrower of Assignment of Mortgage is a legal document created to inform and notify the borrower that their mortgage loan has been assigned or transferred to another lender or mortgage service. This notice is typically sent promptly after the transfer occurs and aims to ensure that the borrower is aware of the change and can direct future payments accordingly. Keywords: Legal document, Inform, Notify, Mortgage loan, Assigned, Transferred, Lender, Mortgage service, Change, Payments II. Importance of the Notice Letter: 1. Transparency and Open Communication: The letter establishes transparency between the borrower and the new lender or mortgage service, improving communication channels and promoting a smooth transition. 2. Payment Instructions: The notice letter provides clear instructions to the borrower regarding where and how to make future mortgage payments, ensuring no confusion arises during the transfer process. 3. Liability and Legal Rights: By receiving the letter, borrowers are aware of their rights and obligations towards the newly assigned mortgage holder, protecting both parties' legal interests. Keywords: Transparency, Communication, Smooth transition, Payment instructions, Confusion, Transfer process, Liability, Legal rights, Legal interests III. Types of Oklahoma Letters of Notice to Borrower of Assignment of Mortgage: 1. Basic Notice Letter: This letter simply notifies the borrower that their mortgage loan has been assigned to a new lender or service, providing relevant contact information and payment instructions. 2. Introduction Letter: In some cases, lenders may include an introduction letter alongside the basic notice to acquaint borrowers with their new mortgage service or lender, highlighting key details about the company. 3. Assumption Agreement Notice: If the transfer involves a borrower assuming the mortgage, an additional notice letter is issued to inform them of their assumption responsibilities and any obligations associated with the mortgage assumption. Keywords: Basic, Notice letter, Introduction letter, Mortgage service, Lender, Assumption agreement, Responsibilities, Mortgage assumption Conclusion: The Oklahoma Letter of Notice to Borrower of Assignment of Mortgage plays a critical role in the mortgage transfer process. It facilitates effective communication, ensures transparency, and provides borrowers with necessary information and instructions. By understanding the importance of this notice letter and its various types, borrowers can navigate the mortgage transfer smoothly, protecting their rights and obligations. Keywords: Critical role, Effective communication, Transparency, Information, Instructions, Mortgage transfer, Navigating smoothly, Rights, Obligations.

Oklahoma Letter of Notice to Borrower of Assignment of Mortgage

Description

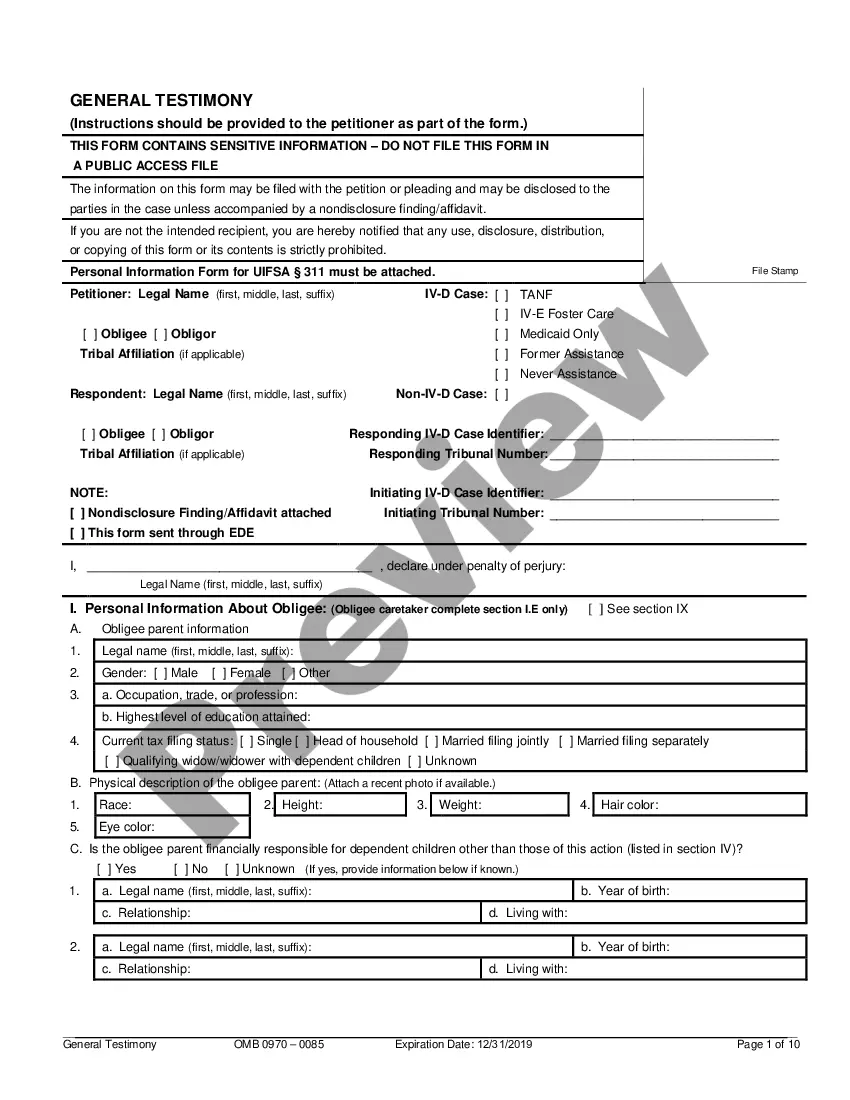

How to fill out Oklahoma Letter Of Notice To Borrower Of Assignment Of Mortgage?

If you have to comprehensive, down load, or print legitimate file layouts, use US Legal Forms, the biggest assortment of legitimate kinds, which can be found online. Utilize the site`s simple and handy look for to discover the papers you need. Various layouts for enterprise and personal functions are sorted by categories and states, or keywords and phrases. Use US Legal Forms to discover the Oklahoma Letter of Notice to Borrower of Assignment of Mortgage with a few click throughs.

If you are previously a US Legal Forms client, log in to your profile and click the Acquire button to have the Oklahoma Letter of Notice to Borrower of Assignment of Mortgage. You can also gain access to kinds you in the past saved inside the My Forms tab of your profile.

If you use US Legal Forms the first time, refer to the instructions listed below:

- Step 1. Make sure you have chosen the shape for your proper area/nation.

- Step 2. Use the Review option to look through the form`s articles. Don`t neglect to see the outline.

- Step 3. If you are not happy using the kind, use the Look for field at the top of the display screen to locate other variations of your legitimate kind web template.

- Step 4. When you have identified the shape you need, go through the Purchase now button. Opt for the rates strategy you choose and add your references to register for the profile.

- Step 5. Approach the financial transaction. You can utilize your bank card or PayPal profile to complete the financial transaction.

- Step 6. Pick the file format of your legitimate kind and down load it in your gadget.

- Step 7. Complete, change and print or sign the Oklahoma Letter of Notice to Borrower of Assignment of Mortgage.

Each and every legitimate file web template you get is your own permanently. You might have acces to every single kind you saved in your acccount. Go through the My Forms portion and pick a kind to print or down load once again.

Remain competitive and down load, and print the Oklahoma Letter of Notice to Borrower of Assignment of Mortgage with US Legal Forms. There are millions of expert and condition-particular kinds you can utilize for the enterprise or personal demands.

Form popularity

FAQ

The purpose of the mortgage or deed of trust is to provide security for the loan that's evidenced by a promissory note. Loan Transfers. Banks often sell and buy mortgages from each other. An "assignment" is the document that is the legal record of this transfer from one mortgagee to another.

A recorded mortgage must be discharged by a certificate signed by the mortgagee, his personal representatives or assigns, acknowledged or proved and certified as prescribed by the chapter on ?recording transfers,? stating that the mortgage has been paid, satisfied, or discharged.

To put simply, the deed is the legal document that proves who holds title to a property, while a mortgage is an agreement between a financial lender and borrower to repay the amount borrowed to purchase a home.

You are not the property owner when your name appears on the mortgage but not on the deed. Your role on the mortgage is merely that of a co-signer. Because your name appears on the mortgage, you are responsible for making the payments on the loan, just like the property owner.

What Does Assignment Of Mortgage Mean? An assignment of mortgage is a legal term that refers to the transfer of the security instrument that underlies your mortgage loan ? aka your home. When a lender sells the mortgage on, an investor effectively buys the note, and the mortgage is assigned to them at this time.

If it does not have an assignment or failed to record it as required by state law, this may result in the dismissal of the foreclosure action. Recording rules may require that the foreclosing party record the assignment before starting the foreclosure.

An assignment of mortgage is a legal term that refers to the transfer of the security instrument that underlies your mortgage loan ? aka your home. When a lender sells the mortgage on, an investor effectively buys the note, and the mortgage is assigned to them at this time.