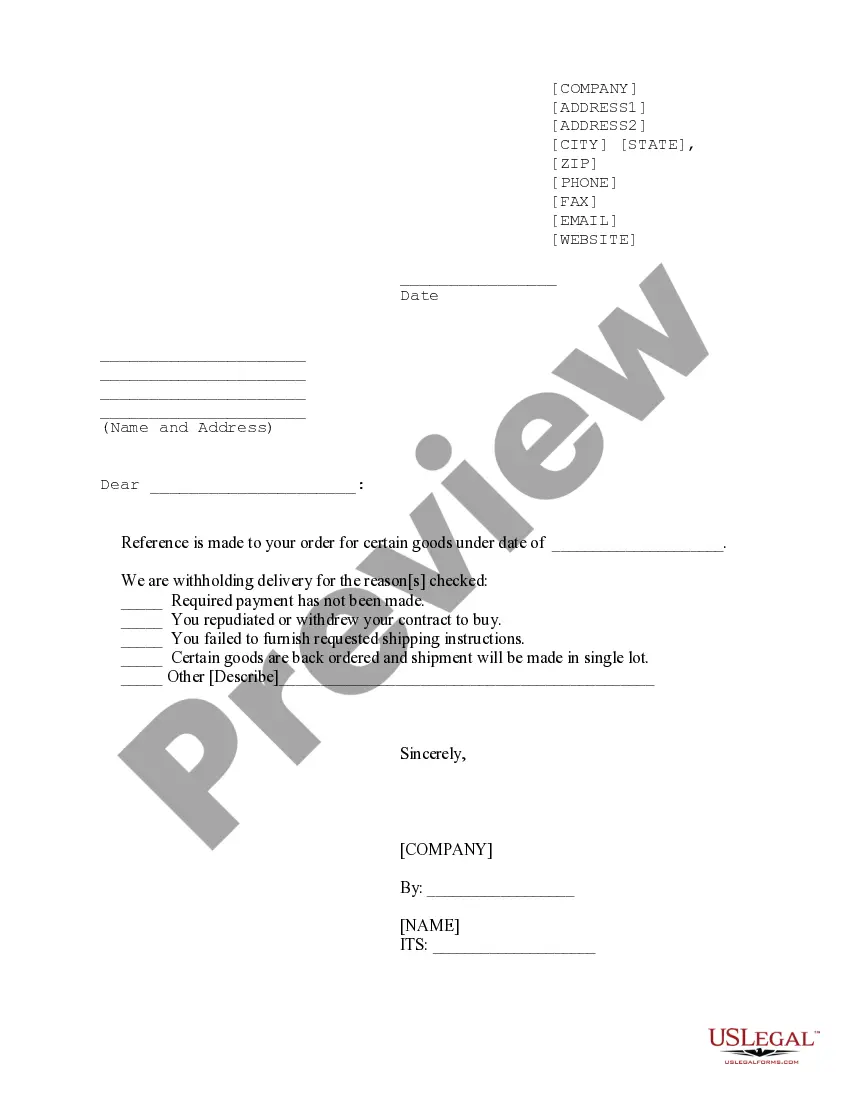

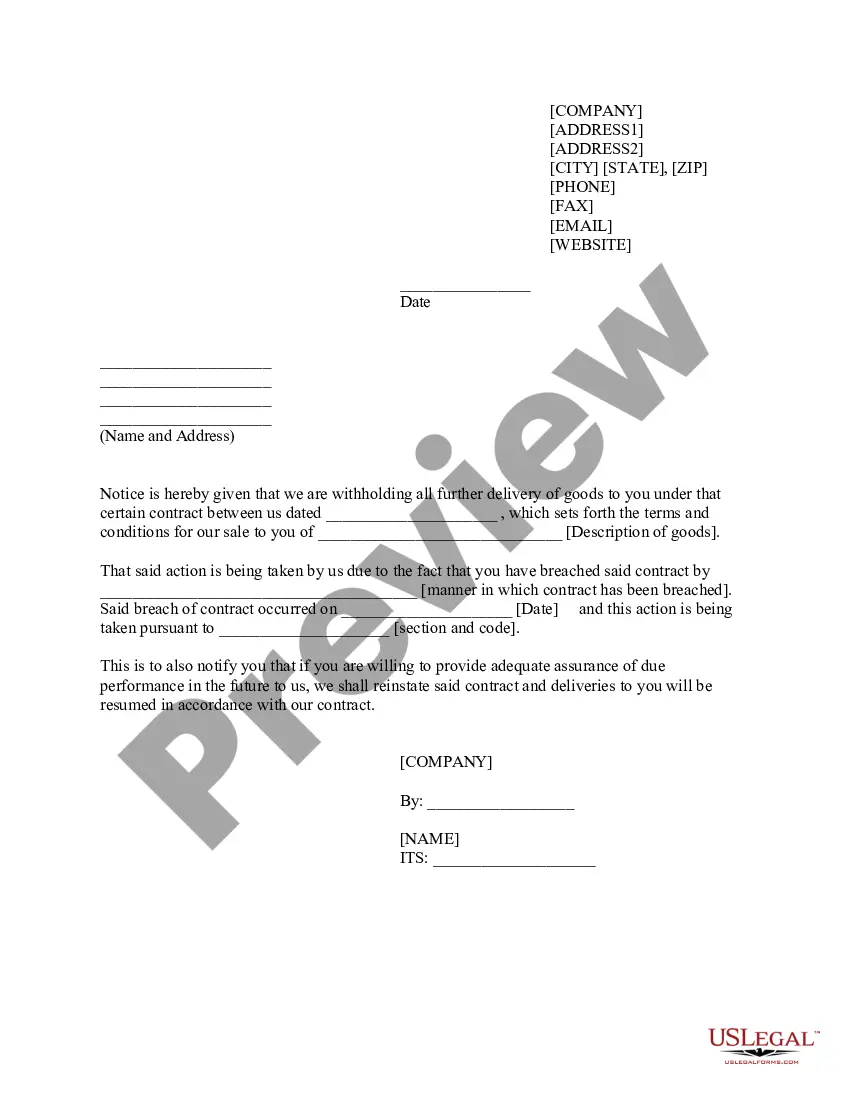

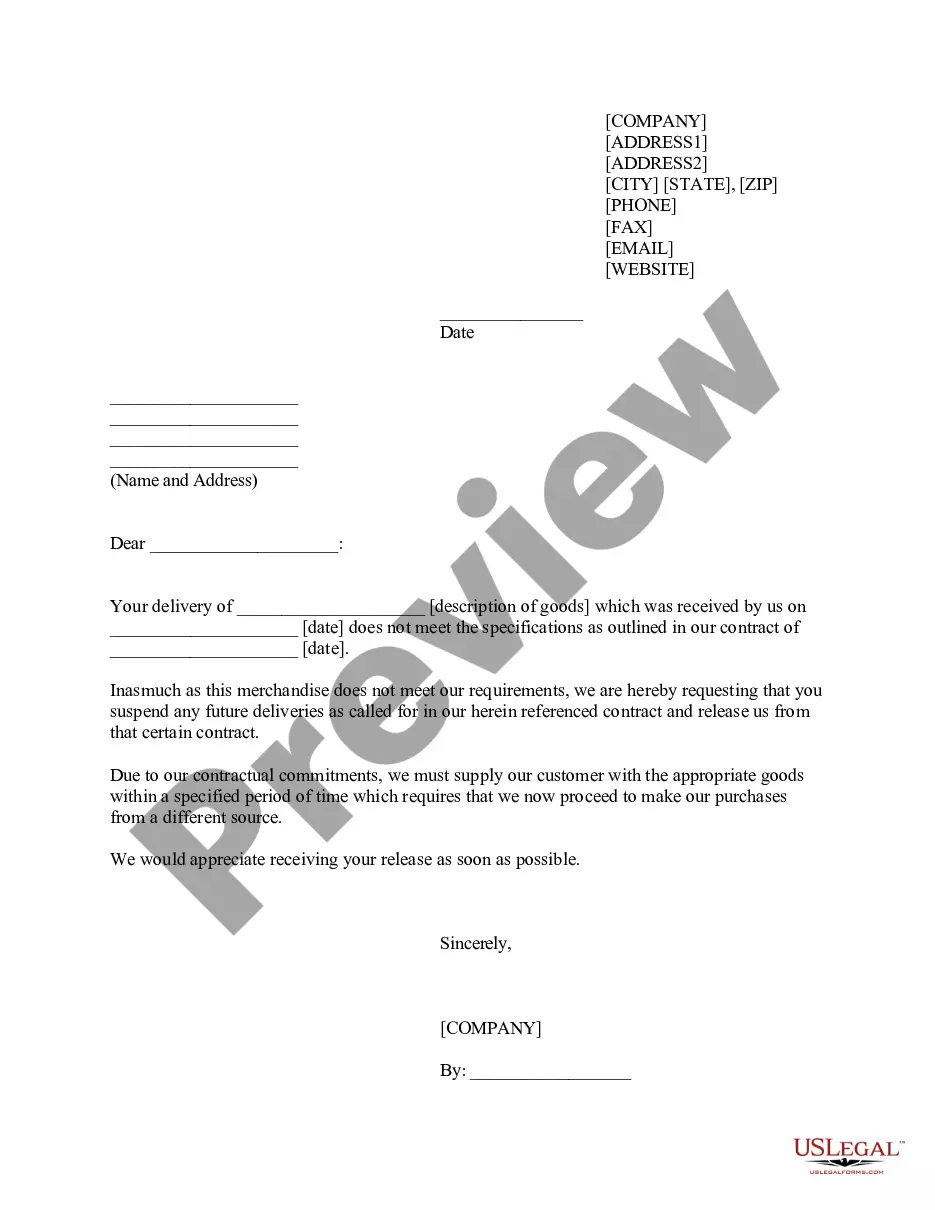

Oklahoma Withheld Delivery Notice

Description

How to fill out Withheld Delivery Notice?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a variety of legal form templates that you can download or print.

Using the site, you can access thousands of forms for both business and personal needs, categorized by type, state, or keywords.

You can quickly obtain the latest versions of forms such as the Oklahoma Withheld Delivery Notice.

If the form does not meet your needs, utilize the Search field at the top of the screen to find the one that does.

If you're satisfied with the form, confirm your choice by clicking the Purchase now button. Then, choose the payment plan you want and provide your details to register for an account.

- If you possess a membership, Log In to download the Oklahoma Withheld Delivery Notice from the US Legal Forms library.

- The Download button will be visible on each form you view.

- You can find all previously downloaded forms in the My documents section of your account.

- If you're using US Legal Forms for the first time, here are simple steps to get started.

- Ensure you have chosen the correct form for your region/location. Click the Preview button to inspect the form's content.

- Read the form description to confirm that you have selected the right form.

Form popularity

FAQ

Instructions for Completing the 511-NR Income Tax Form 2022 Form 511-NR: Oklahoma Nonresident and Part-Year Resident Income Tax Return Form 2022 2021 Income Tax Table 2022 This form is also used to file an amended return.

This Form can be used to file a: Tax Return, Tax Amendment, Change of Address. Place an X in the Amended Return check-box at the top of the form. On Form 511, you should enter any amounts you paid with your original, accepted return, plus any amounts paid after it was filed on line 30.

2021 Form 511-EF Oklahoma Individual Income Tax Declaration for Electronic Filing.

501(c)(3) qualify to be exempt from sales tax in Oklahoma. To qualify for an exemption you must complete the application and provide the necessary documentation listed under the exemption for which you are applying. Supporting documentation required.

This Form can be used to file a: Tax Return, Tax Amendment, Change of Address. Place an X in the Amended Return check-box at the top of the form. On Form 511, you should enter any amounts you paid with your original, accepted return, plus any amounts paid after it was filed on line 30.

Use Form 511-NR. Except as otherwise provided for in the Pass-Through Entity Tax Equity Act of 2019, every nonresident with gross income from Oklahoma sources of $1,000 or more is required to file an Oklahoma income tax return. Use Form 511NR.

The Oklahoma resident, filing a joint federal return with a nonresident civilian spouse, may file an Oklahoma return as married filing separate. The resident will file on Form 511 using the married filing separate rates and reporting only his/her income and deductions.

Form OK-W-4 is completed so you can have as much take-home pay as possible without an income tax liability due to the state of Oklahoma when you file your return. Deductions and exemptions reduce the amount of your taxable income.

through entity shall withhold income tax at the rate of five percent (5%) from a nonresident member's share of the Oklahoma share of income of the entity distributed to each nonresident member and pay the withheld amount on or before the due date of the passthrough entity's income tax return, including