Oklahoma Liquidation of Partnership with Sale and Proportional Distribution of Assets

Description

How to fill out Liquidation Of Partnership With Sale And Proportional Distribution Of Assets?

US Legal Forms - one of many most significant libraries of legitimate types in America - provides a wide range of legitimate document templates you may down load or print. Utilizing the internet site, you can get a large number of types for company and individual purposes, categorized by classes, states, or keywords.You can get the latest versions of types such as the Oklahoma Liquidation of Partnership with Sale and Proportional Distribution of Assets in seconds.

If you currently have a monthly subscription, log in and down load Oklahoma Liquidation of Partnership with Sale and Proportional Distribution of Assets from the US Legal Forms catalogue. The Download option can look on each and every develop you see. You get access to all formerly downloaded types within the My Forms tab of your respective profile.

If you wish to use US Legal Forms for the first time, allow me to share easy directions to help you began:

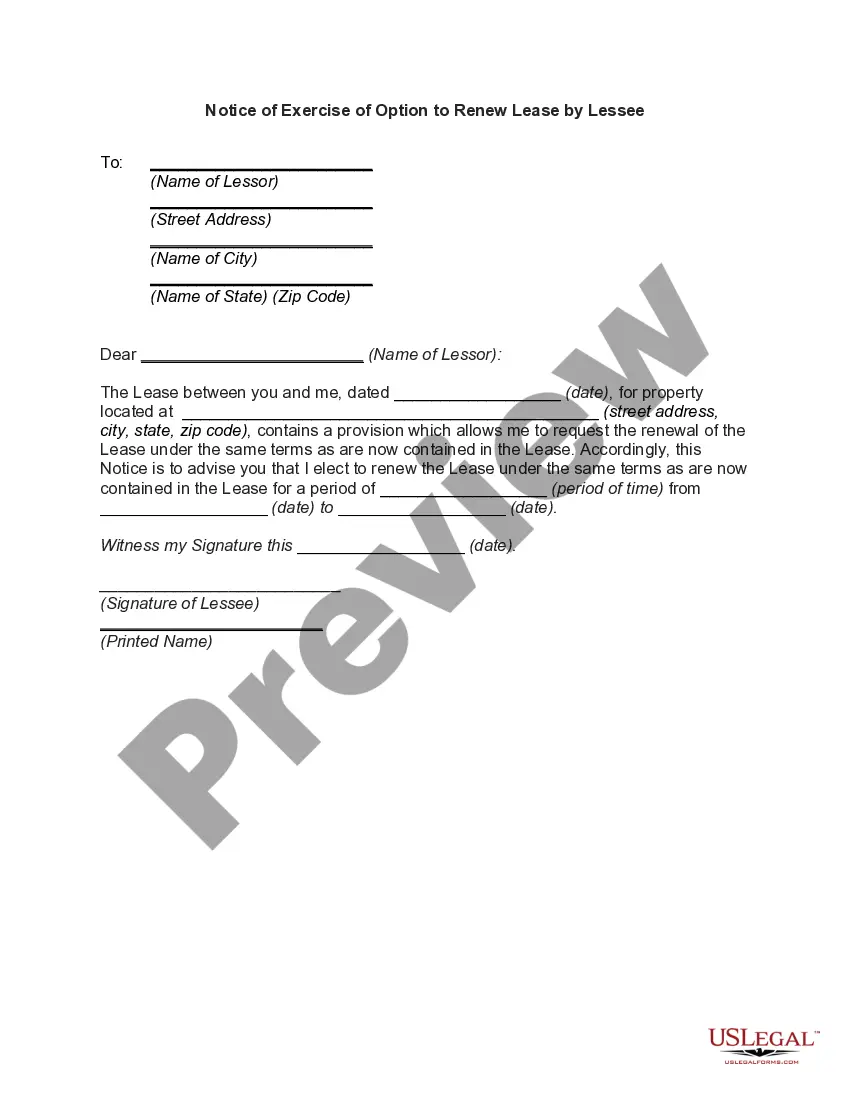

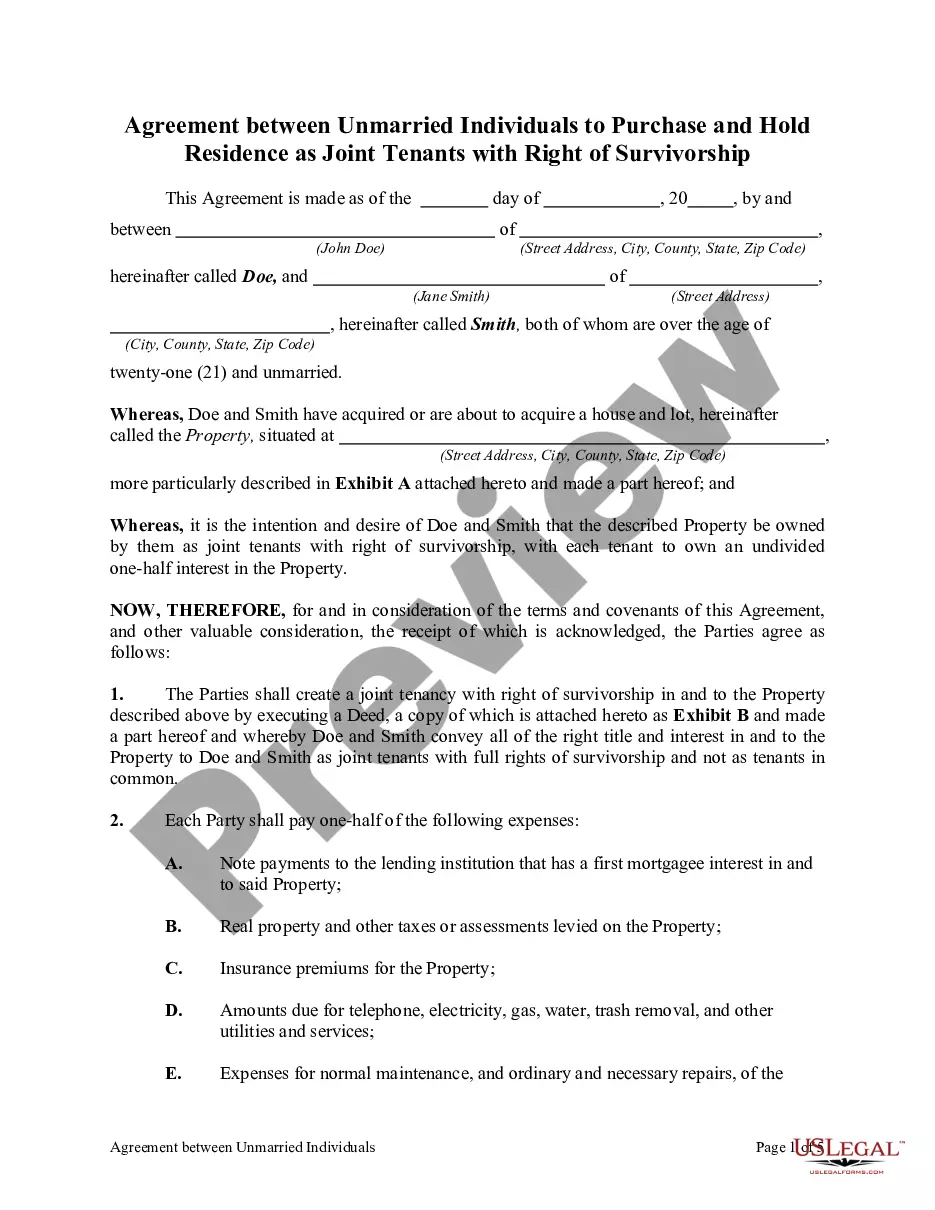

- Be sure you have selected the correct develop for your personal city/region. Go through the Preview option to examine the form`s content. Browse the develop description to actually have chosen the right develop.

- If the develop doesn`t satisfy your demands, use the Search discipline at the top of the display screen to discover the one that does.

- When you are happy with the shape, verify your choice by clicking on the Purchase now option. Then, choose the rates plan you favor and give your qualifications to sign up for an profile.

- Process the transaction. Use your credit card or PayPal profile to complete the transaction.

- Pick the structure and down load the shape on your own product.

- Make adjustments. Load, revise and print and signal the downloaded Oklahoma Liquidation of Partnership with Sale and Proportional Distribution of Assets.

Every single template you put into your account lacks an expiration particular date and is yours for a long time. So, if you want to down load or print one more duplicate, just proceed to the My Forms area and click about the develop you require.

Gain access to the Oklahoma Liquidation of Partnership with Sale and Proportional Distribution of Assets with US Legal Forms, by far the most extensive catalogue of legitimate document templates. Use a large number of professional and express-specific templates that meet your company or individual requirements and demands.

Form popularity

FAQ

In a business partnership, you can split the profits any way you want, under one conditionall business partners must be in agreement about profit-sharing. You can choose to split the profits equally, or each partner can receive a different base salary and then the partners will split any remaining profits.

If dissolution is not covered in the partnership agreement, the partners can later create a separate dissolution agreement for that purpose. However, the default rule is that any remaining money or property will be distributed to each partner according to their ownership interest in the partnership.

Liquidating distributions (cash or noncash) are a form of a return of capital. Any liquidating distribution you receive is not taxable to you until you recover the basis of your stock. After the basis of your stock is reduced to zero, you must report the liquidating distribution as a capital gain.

Typically, state law provides that the partnership must first pay partners according to their share of capital contributions (the investments in the partnership), and then distribute any remaining assets equally.

What is the partner's basis in property received in liquidation of his interest? When a partnership distributes property in a liquidating distribution, the recipient partner's outside basis reduced by any amount of cash included in the distribution is allocated to the distributed property.

Once the debts owed to all creditors are satisfied, the partnership property will be distributed to each partner according to their ownership interest in the partnership. If there was a partnership agreement, then that document controls the distribution.

Any remaining assets are then divided among the remaining partners in accordance with their respective share of partnership profits. Under the RUPA, creditors are paid first, including any partners who are also creditors.

Partnership reports distributions of all other property on Schedule K, line 19b and on Form 1065, Schedule M-2. Liquidating partner determines if he must recognize gain or loss from the transaction on his Form 1040.

Only partners who receive a liquidating distribution of cash may have an immediate taxable gain or loss to report. The value of marketable securities, such as stock investments that are traded on a public stock exchange, and decreases to your share of the partnership's debt are both treated as cash distributions.