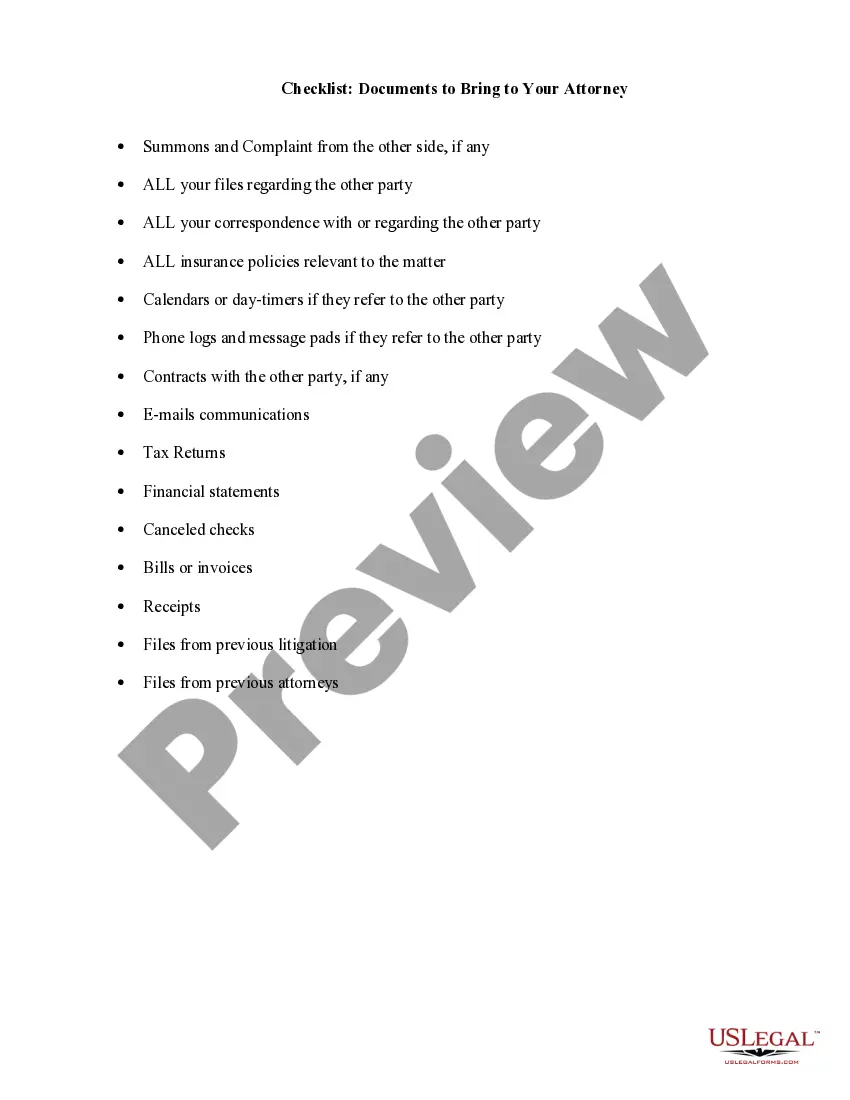

Oklahoma Checklist of Matters to be Considered in Drafting a Verification of an Account

Description

How to fill out Checklist Of Matters To Be Considered In Drafting A Verification Of An Account?

Selecting the ideal authorized document template can be challenging. Of course, there are numerous templates available online, but how do you find the legal form you need? Utilize the US Legal Forms site. This service offers thousands of templates, including the Oklahoma Checklist of Matters to Consider in Drafting a Verification of an Account, which you can use for both business and personal purposes.

All of the forms are reviewed by experts and comply with state and federal requirements. If you are already registered, Log In to your account and click the Obtain button to acquire the Oklahoma Checklist of Matters to Consider in Drafting a Verification of an Account. Use your account to explore the legal forms you may have purchased earlier. Visit the My documents tab in your account to obtain another copy of the document you need.

If you are a new user of US Legal Forms, here are simple steps for you to follow: First, ensure you have selected the correct form for your city/region. You can preview the form using the Preview option and read the form description to confirm it is suitable for you.

- If the form does not meet your needs, utilize the Search feature to find the appropriate form.

- Once you are confident that the form is suitable, click on the Buy now button to purchase the form.

- Choose the pricing plan you desire and enter the required information.

- Create your account and purchase the order using your PayPal account or credit card.

- Select the file format and download the legal document template to your device.

- Complete, edit, print, and sign the obtained Oklahoma Checklist of Matters to Consider in Drafting a Verification of an Account.

Form popularity

FAQ

'Request for documents' refers to a legal process where one party asks another to provide specific documents or evidence pertinent to the case. This procedure is crucial for ensuring all relevant information is made available to both sides. Including this concept in your Oklahoma Checklist of Matters to be Considered in Drafting a Verification of an Account can be highly beneficial in constructing a well-supported legal argument.

Rule 13 in Oklahoma pertains to the rules surrounding counterclaims in civil procedures. This rule allows parties to bring up any related claims against one another, which can significantly impact the outcome of a case. Familiarizing yourself with Rule 13 is important when developing your Oklahoma Checklist of Matters to be Considered in Drafting a Verification of an Account to ensure that all potential issues are addressed.