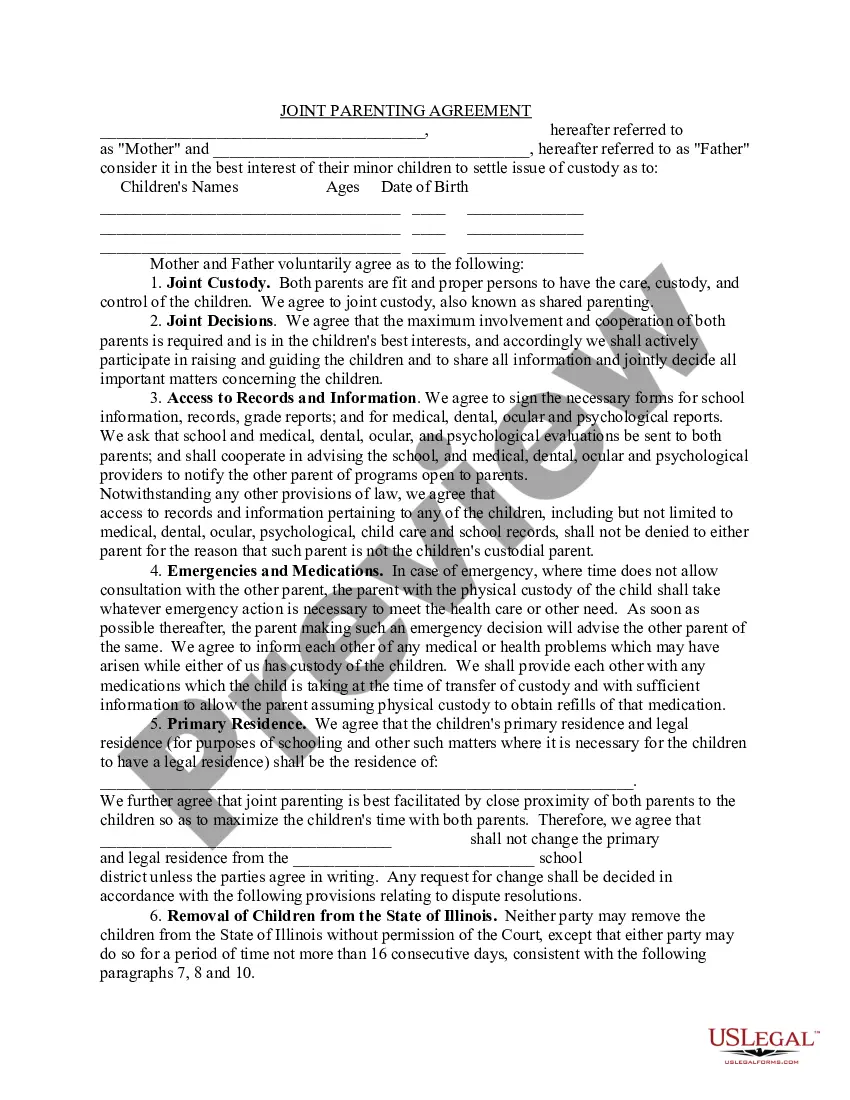

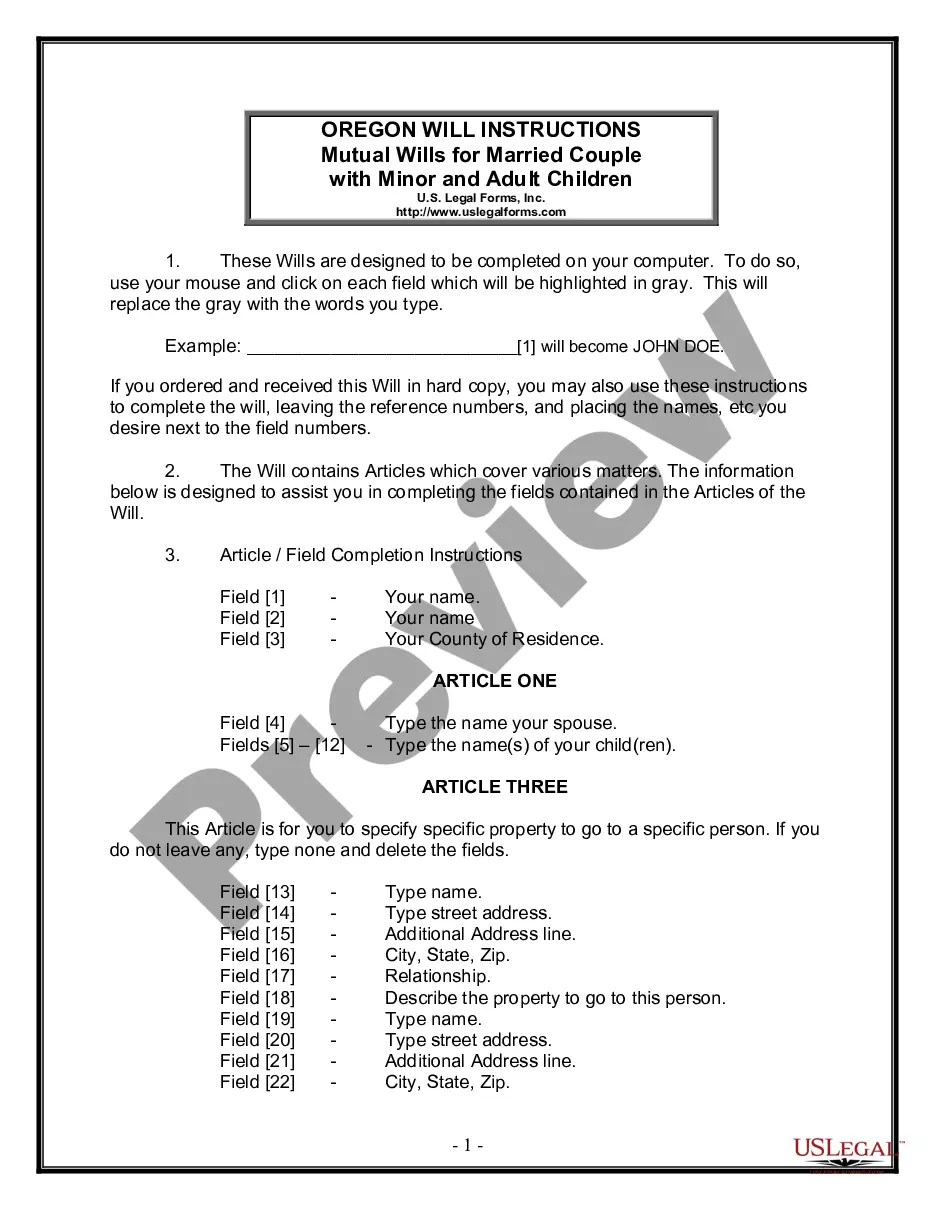

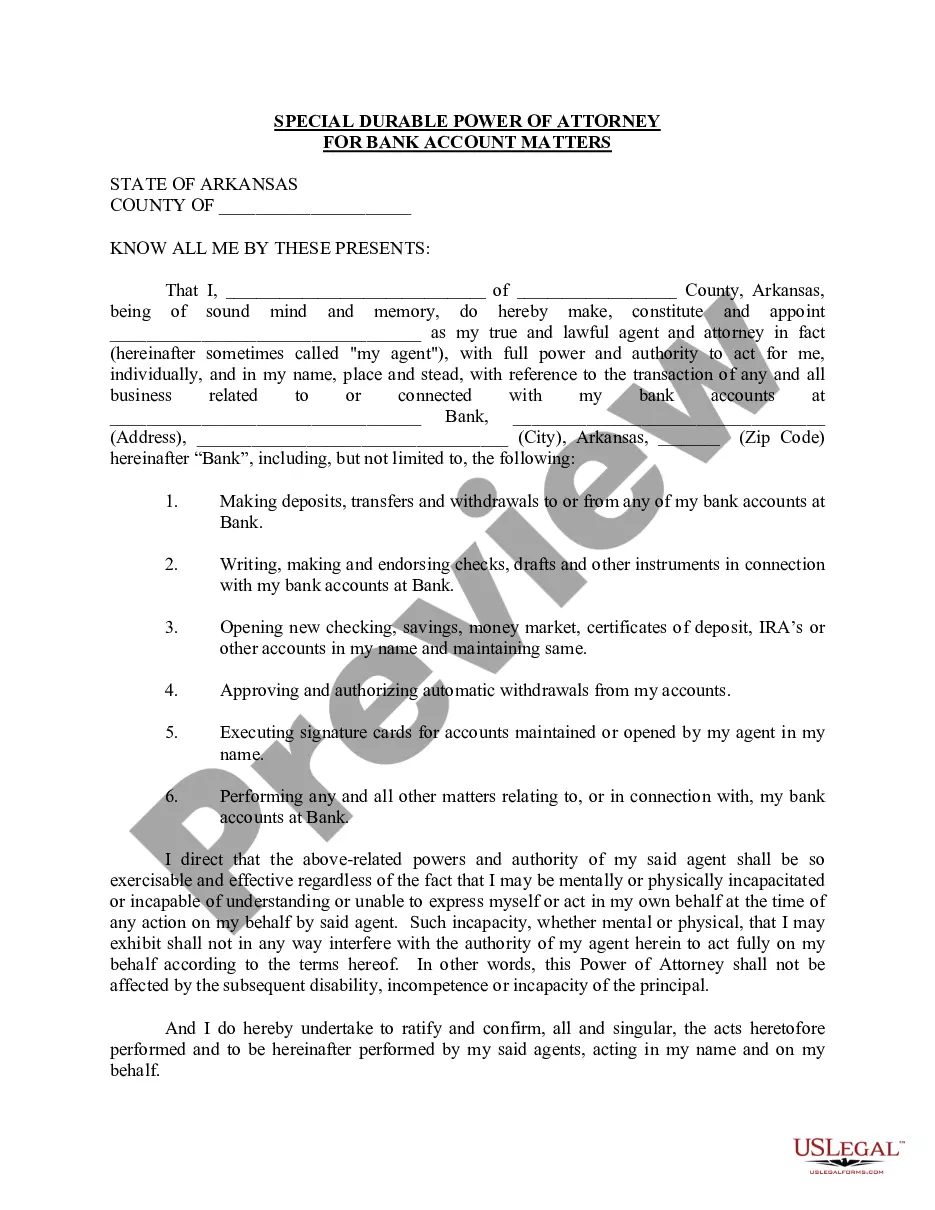

Oklahoma Credit Application: A Detailed Description The Oklahoma Credit Application is an essential document used by individuals and businesses in the state of Oklahoma to apply for credit and request financial assistance from lenders or financial institutions. This comprehensive application serves as a critical assessment tool for lenders to evaluate the creditworthiness of potential borrowers. The Oklahoma Credit Application collects various personal and financial information necessary for lenders to make informed decisions. The application typically includes the following key sections: 1. Personal Information: This section requires the applicant's full name, contact details, social security number, date of birth, driver's license number, and current address. Providing accurate personal information is crucial in carrying out background checks and verifying the identity of the applicant. 2. Employment and Income Details: Lenders need to assess the applicant's employment stability and income stream to determine their repayment capacity. This section requests information such as the applicant's current employer's name, address, job title, length of employment, monthly salary, and other sources of income. 3. Financial Information: Applicants will need to disclose their current assets, liabilities, and existing credit obligations. This section includes details such as bank account information, investments, outstanding debts, mortgages, and other financial obligations. 4. Credit History: Lenders assess an applicant's creditworthiness by reviewing their credit history. This section requires information about any previous bankruptcies, foreclosures, or late payments. 5. Loan Details: Applicants need to specify the loan purpose, desired loan amount, and desired repayment term. This section also includes the type of collateral, if applicable, that the applicant is willing to provide to secure the loan. Different Types of Oklahoma Credit Applications: 1. Personal Credit Application: This application type is suitable for individuals seeking personal loans, such as auto loans, student loans, or personal lines of credit. It focuses on the borrower's personal financial information, credit history, and repayment capacity. 2. Business Credit Application: Designed for businesses, this application gathers the necessary details for acquiring commercial loans, equipment financing, or lines of credit. It includes both personal and business financial information, along with additional details like business ownership structure, tax identification number, and annual revenue. 3. Mortgage Loan Application: Specifically created for individuals or businesses looking to secure a mortgage loan for real estate or property purchase. It includes detailed information about the property in question, alongside personal and financial details of the applicant. 4. Credit Card Application: This application enables individuals to request a credit card from a financial institution. It focuses on personal financial information and credit history, allowing the lender to determine the credit limit and terms associated with the credit card. Completing an Oklahoma Credit Application accurately and honestly is crucial, as any false information provided may result in the denial of credit or legal consequences. It is important to carefully read and understand the terms and conditions associated with the application before submitting it to the lender.

Oklahoma Credit Application

Description

How to fill out Oklahoma Credit Application?

US Legal Forms - one of many most significant libraries of legitimate kinds in the United States - offers a variety of legitimate record web templates you may obtain or produce. Making use of the website, you can get a large number of kinds for company and specific uses, categorized by classes, claims, or search phrases.You will find the latest variations of kinds such as the Oklahoma Credit Application in seconds.

If you already possess a monthly subscription, log in and obtain Oklahoma Credit Application through the US Legal Forms collection. The Download option will show up on every develop you look at. You have access to all in the past saved kinds inside the My Forms tab of your respective profile.

If you would like use US Legal Forms the very first time, allow me to share easy recommendations to help you get started off:

- Make sure you have chosen the best develop for your city/region. Select the Preview option to review the form`s content. Browse the develop outline to ensure that you have selected the right develop.

- In case the develop doesn`t match your demands, make use of the Lookup area towards the top of the screen to obtain the one which does.

- Should you be satisfied with the shape, validate your decision by simply clicking the Acquire now option. Then, choose the prices strategy you prefer and supply your qualifications to register for an profile.

- Procedure the transaction. Make use of your bank card or PayPal profile to perform the transaction.

- Choose the file format and obtain the shape on your own gadget.

- Make alterations. Fill up, edit and produce and signal the saved Oklahoma Credit Application.

Each format you included with your bank account does not have an expiration time and is your own for a long time. So, if you would like obtain or produce another backup, just proceed to the My Forms portion and click on about the develop you require.

Obtain access to the Oklahoma Credit Application with US Legal Forms, probably the most substantial collection of legitimate record web templates. Use a large number of expert and state-specific web templates that meet up with your organization or specific demands and demands.