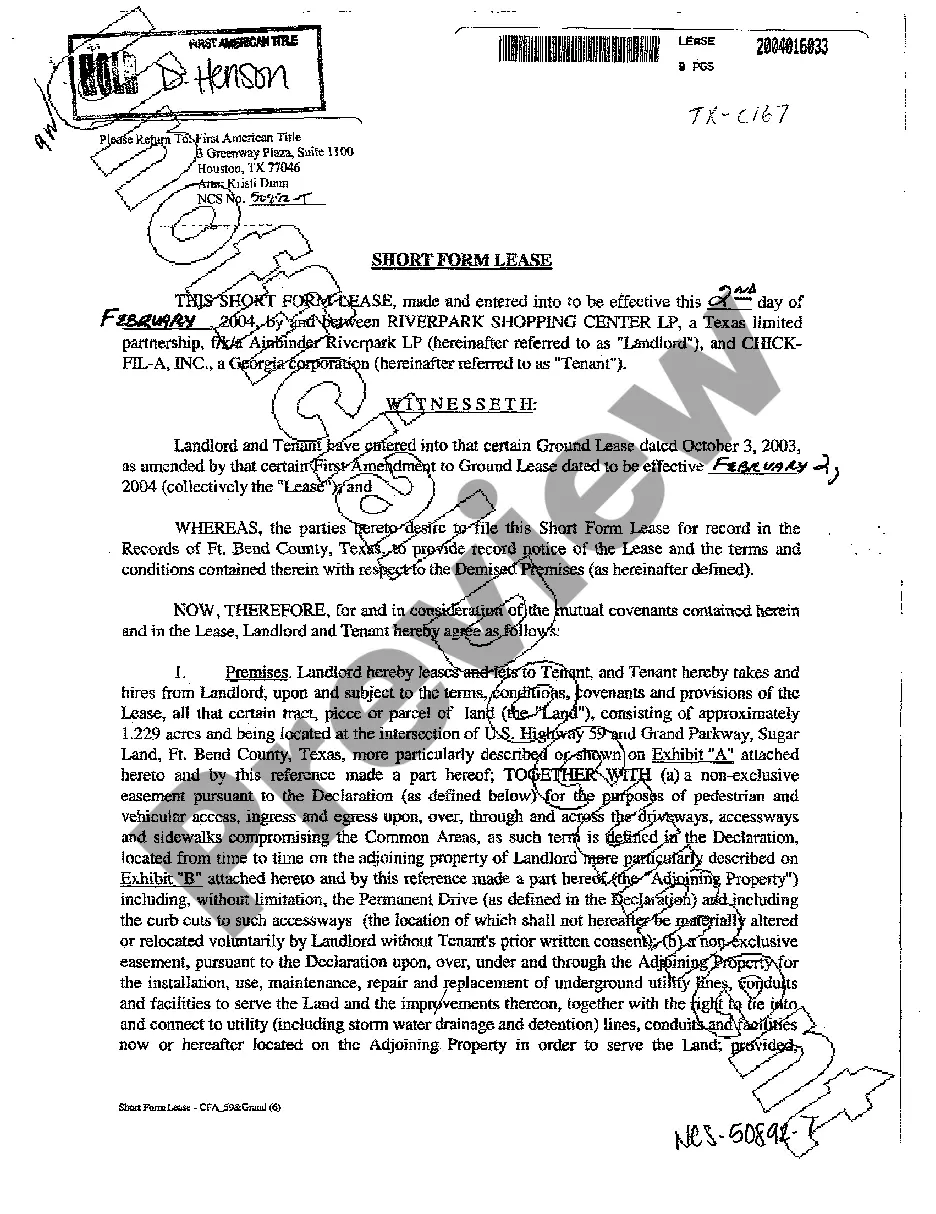

The Oklahoma Certification of Seller is an essential document that acts as evidence of compliance with various state regulations and requirements when selling certain items, particularly alcoholic beverages, cigarettes, and motor vehicles. This certification validates that the seller has met all legal obligations and can lawfully engage in the sale of the specified goods within the state of Oklahoma. Alcoholic Beverage Certification: One type of Oklahoma Certification of Seller is specific to the sale of alcoholic beverages. This certification is obtained by individuals or businesses involved in the distribution and retail of alcoholic beverages, ensuring compliance with all federal, state, and local laws governing their sale. Sellers must adhere to strict regulations, including age verification, licensing, zoning restrictions, and tax payment obligations to obtain this certification. Cigarette Certification: Another type of Oklahoma Certification of Seller is related to the sale of cigarettes. Cigarette sellers must obtain this certification to comply with state laws and regulations aimed at preventing the sale of cigarettes to minors, controlling the sales volume, and enforcing tax payment obligations. The certification process involves submitting necessary documentation, such as sales records, invoices, and proof of payment of cigarette excise taxes. Motor Vehicle Certification: The Oklahoma Certification of Seller also applies to the sale of motor vehicles. Vehicle sellers, such as automobile dealerships and private individuals, must acquire this certification to assure potential buyers that they possess legal ownership of the vehicle and comply with all state laws related to vehicle sales. The certification process typically involves providing a clear title, accurate vehicle identification information, and documentation demonstrating compliance with tax obligations. Obtaining the Oklahoma Certification of Seller guarantees that sellers are operating within the legal framework established by the state. Buyers can rely on this certification to ensure that they are transacting with legitimate sellers, minimizing the risk of fraud and illegal activities. In conclusion, the Oklahoma Certification of Seller is crucial for those engaged in the sales of alcoholic beverages, cigarettes, and motor vehicles within the state. This certification serves as proof that sellers have met all legal requirements and are authorized to engage in the sale of these specific goods. By obtaining the appropriate certification, sellers can instill trust and confidence in both buyers and regulatory authorities, ensuring a smooth and transparent transaction process.

Oklahoma Certification of Seller

Description

How to fill out Certification Of Seller?

If you need to total, down load, or print lawful record templates, use US Legal Forms, the biggest variety of lawful forms, which can be found online. Utilize the site`s basic and hassle-free search to get the papers you want. A variety of templates for organization and person reasons are sorted by groups and says, or search phrases. Use US Legal Forms to get the Oklahoma Certification of Seller with a few clicks.

If you are previously a US Legal Forms client, log in in your accounts and click the Download option to obtain the Oklahoma Certification of Seller. You can also access forms you previously saved from the My Forms tab of your respective accounts.

If you use US Legal Forms initially, refer to the instructions under:

- Step 1. Be sure you have chosen the shape for the appropriate town/country.

- Step 2. Use the Review solution to examine the form`s articles. Don`t forget about to see the description.

- Step 3. If you are unsatisfied using the type, make use of the Search area on top of the display screen to discover other versions of the lawful type web template.

- Step 4. When you have discovered the shape you want, click on the Buy now option. Opt for the pricing strategy you prefer and include your accreditations to sign up to have an accounts.

- Step 5. Approach the transaction. You can use your charge card or PayPal accounts to accomplish the transaction.

- Step 6. Select the structure of the lawful type and down load it on your system.

- Step 7. Comprehensive, modify and print or indicator the Oklahoma Certification of Seller.

Each and every lawful record web template you buy is your own property permanently. You may have acces to every type you saved in your acccount. Go through the My Forms portion and pick a type to print or down load once more.

Be competitive and down load, and print the Oklahoma Certification of Seller with US Legal Forms. There are thousands of professional and status-distinct forms you may use to your organization or person requirements.

Form popularity

FAQ

How much does it cost to apply for a sales tax permit in Oklahoma? It costs $20 to apply for an Oklahoma sales tax permit. There's also a convenience fee of $3.95 for paying with a Visa Debit card and a convenience fee of 2.5% for paying with any other type of card. Other business registration fees may apply, too.

You can easily acquire your Oklahoma Sales Tax Permit online using the Oklahoma Taxpayer Access Point (TAP) website. If you have quetions about the online permit application process, you can contact the Oklahoma Tax Commission via the sales tax permit hotline (405) 521-3160 or by checking the permit info website .

501(c)(3) qualify to be exempt from sales tax in Oklahoma. To qualify for an exemption you must complete the application and provide the necessary documentation listed under the exemption for which you are applying. Supporting documentation required.

How Much Does a Sales Tax Permit in Oklahoma Cost? Currently, there is no charge for a Vendor Use Permit in the state of Oklahoma. There is, however, a $20 charge for applying for the Sales Permit with the state of Oklahoma.

Most businesses operating in or selling in the state of Oklahoma are required to purchase a resale certificate annually. Even online based businesses shipping products to Oklahoma residents must collect sales tax. Obtaining your sales tax certificate allows you to do so.

Owners of businesses located in Oklahoma that make online retail sales to customers in the state are also required to obtain a sales tax permit and set up an account to collect and remit sales taxes.

An Oklahoma resale certificate (also commonly known as a resale license, reseller permit, reseller license and tax exemption certificate) is a tax-exempt form that permits a business to purchase goods from a supplier, that are intended to be resold without the reseller having to pay sales tax on them.

You can easily acquire your Oklahoma Sales Tax Permit online using the Oklahoma Taxpayer Access Point (TAP) website. If you have quetions about the online permit application process, you can contact the Oklahoma Tax Commission via the sales tax permit hotline (405) 521-3160 or by checking the permit info website .

Can I use a blanket resale exemption certificate in Oklahoma? Oklahoma does permit the use of a blanket resale certificate, which means a single certificate on file with the vendor can be re-used for all exempt purchases made from that vendor. A new certificate does not need to be made for each transaction.