Title: Understanding Oklahoma Charitable Trusts with Creation Contingent upon Qualification for Tax Exempt Status Introduction: Oklahoma Charitable Trusts with Creation Contingent upon Qualification for Tax Exempt Status are legal entities established in Oklahoma for charitable purposes. These trusts are subject to state laws and regulations, primarily aimed at providing benefits to charitable organizations while ensuring compliance with tax-exempt status requirements. This detailed description aims to explain the concept, requirements, and types of Oklahoma Charitable Trusts with Creation Contingent upon Qualification for Tax Exempt Status. Keywords: Oklahoma, charitable trust, creation contingent, tax-exempt status, legal entity, state laws, regulations, compliance. 1. Overview of Oklahoma Charitable Trusts: Oklahoma charitable trusts are legal arrangements created by individuals or organizations to set aside assets for charitable purposes. These trusts are governed by the Oklahoma Uniform Trust Code and must follow specific guidelines to maintain their tax-exempt status. Keywords: Oklahoma charitable trust, legal arrangements, assets, charitable purposes, Oklahoma Uniform Trust Code, tax-exempt status. 2. Creation Contingent upon Qualification for Tax-Exempt Status: Oklahoma Charitable Trusts with Creation Contingent upon Qualification for Tax Exempt Status are established with the explicit provision that the trust can only come into existence if it obtains tax-exempt status from the Internal Revenue Service (IRS). Keywords: Creation contingent, Tax-exempt status, IRS, trust existence. 3. Purpose of Tax-Exempt Status: Tax-exempt status allows charitable trusts to enjoy certain financial benefits by exempting them from federal and state income taxes. It enables the trust to allocate more funds towards fulfilling its charitable objectives, maximizing the impact of their donations. Keywords: Tax-exempt status, financial benefits, federal income tax, state income tax, charitable objectives, impactful donations. 4. Requirements for Oklahoma Charitable Trusts: To qualify for tax-exempt status, Oklahoma Charitable Trusts must meet certain requirements outlined by the IRS. Some common requirements include obtaining 501(c)(3) status, maintaining proper administration, reporting timely financial information, and ensuring proper disbursement and utilization of funds for charitable purposes. Keywords: Tax-exempt status requirements, 501(c)(3) status, administration, financial reporting, fund disbursement, charitable purposes. 5. Types of Oklahoma Charitable Trusts: a) Charitable Lead Trust (CLT): This type of trust enables the trust or to donate a fixed amount or a percentage of assets to a charitable organization for a specific period. After this period, the remaining assets are distributed to beneficiaries named by the trust or. b) Charitable Remainder Trust (CRT): CRT allows the trust or to transfer assets to the trust, which then provides income to the beneficiaries for a designated period. After the trust term ends, the remaining assets are passed onto the charitable organization. Keywords: Charitable Lead Trust, CLT, Charitable Remainder Trust, CRT, trust or, beneficiaries, assets, designated period. Conclusion: Oklahoma Charitable Trusts with Creation Contingent upon Qualification for Tax Exempt Status are an effective way to support charitable causes while enjoying tax benefits. By complying with the state laws and IRS requirements, these trusts can efficiently utilize funds for the betterment of society. Whether it is a Charitable Lead Trust or Charitable Remainder Trust, incorporating a charitable trust can have a lasting and profound impact on the causes you care about. Keywords: Oklahoma charitable trusts, tax benefits, compliance, society's betterment, lasting impact, Charitable Lead Trust, Charitable Remainder Trust.

Oklahoma Charitable Trust with Creation Contingent upon Qualification for Tax Exempt Status

Description

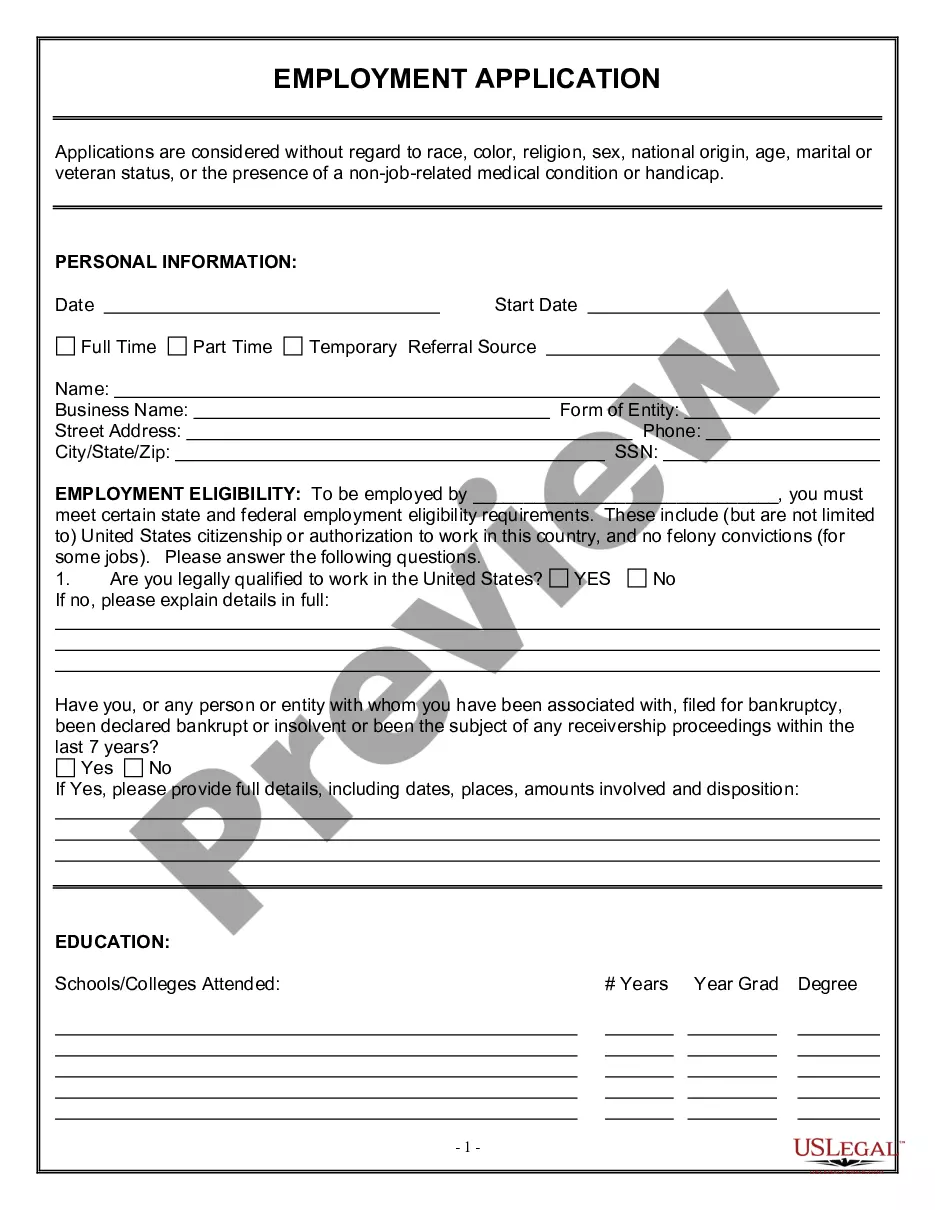

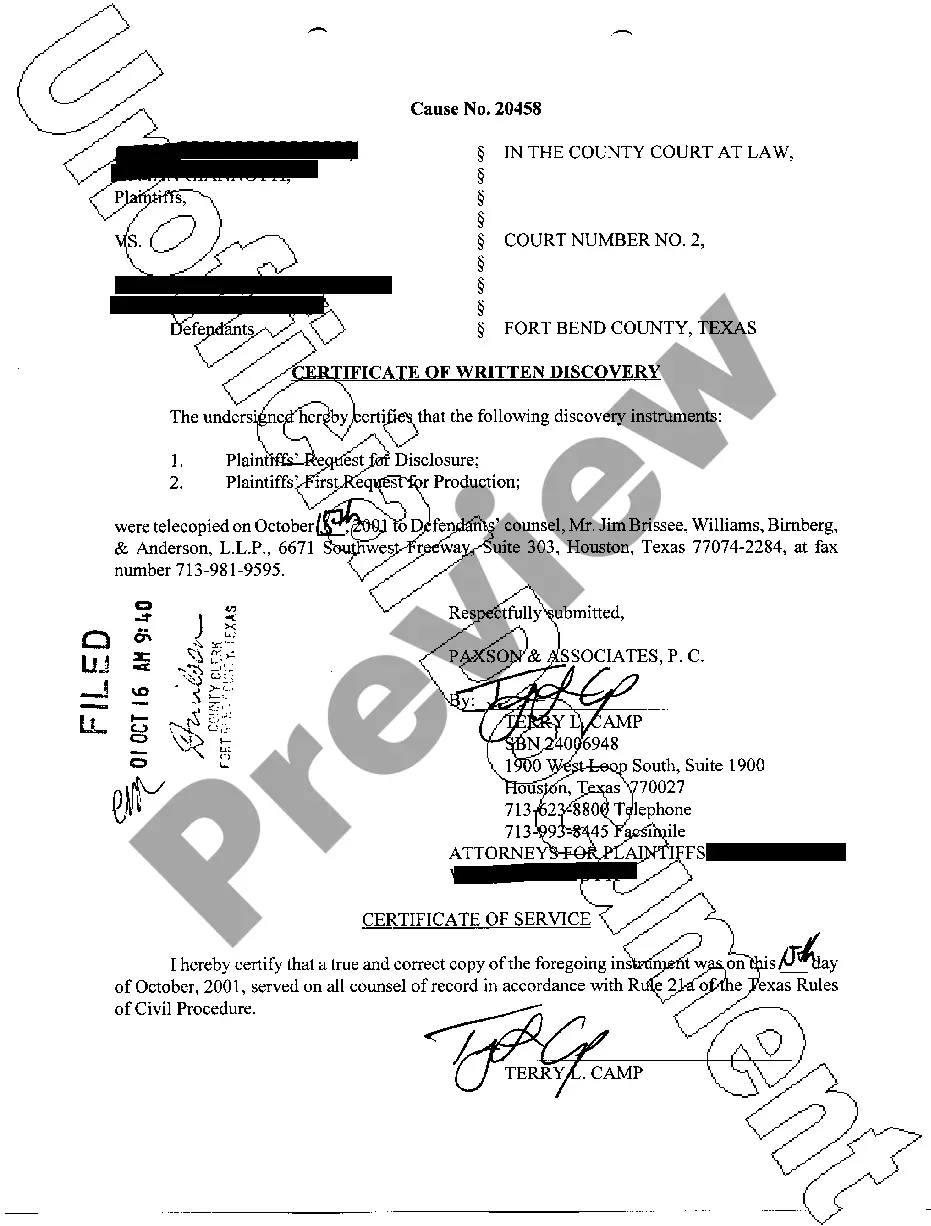

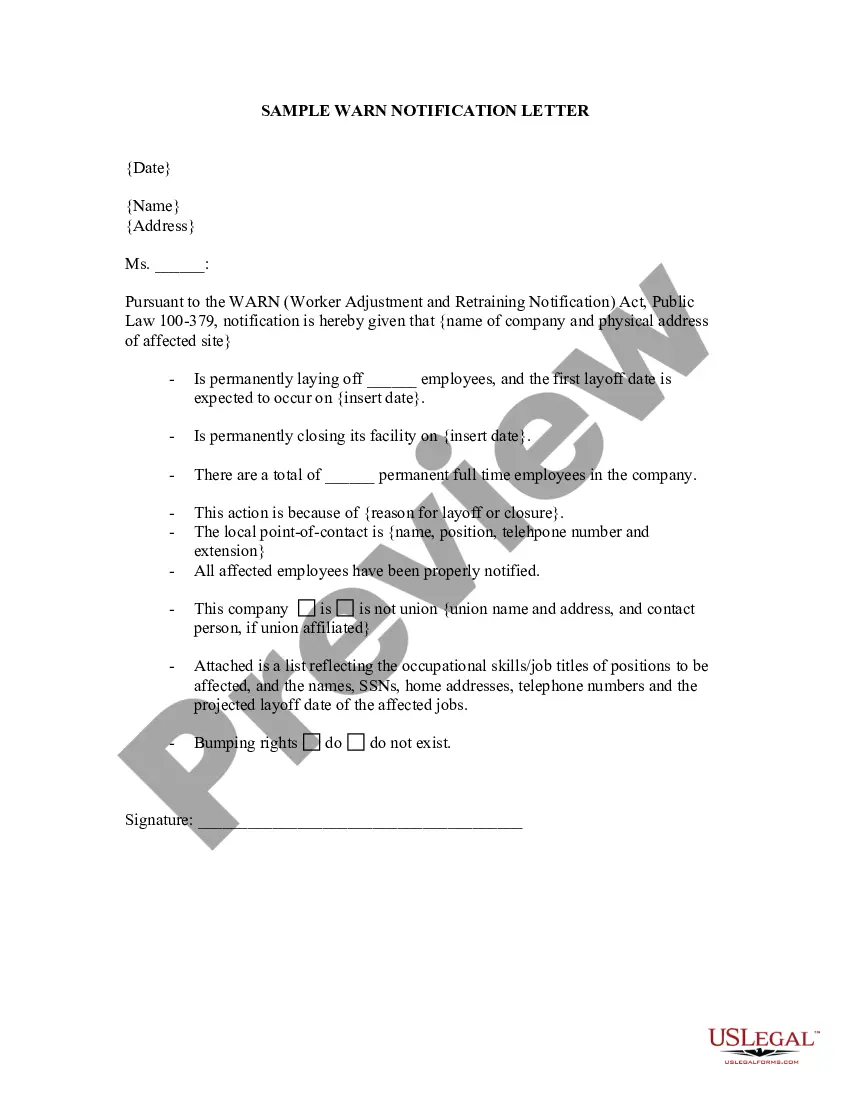

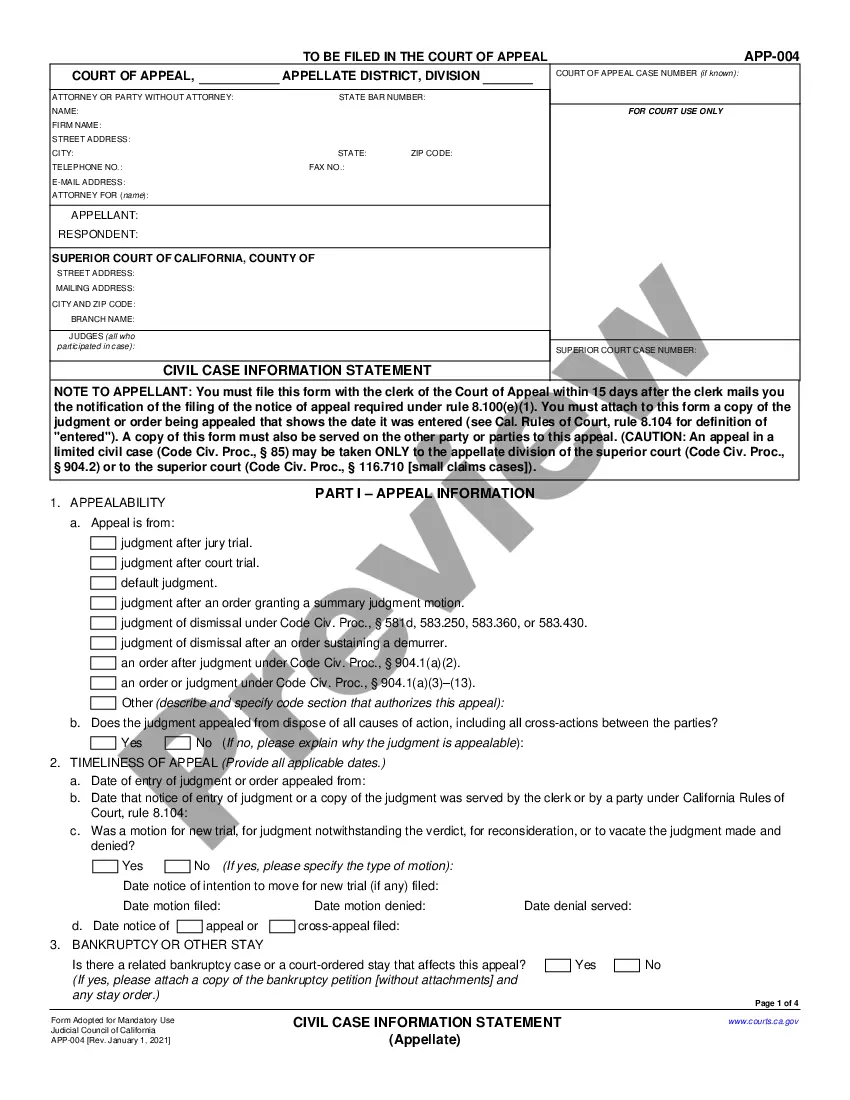

How to fill out Oklahoma Charitable Trust With Creation Contingent Upon Qualification For Tax Exempt Status?

US Legal Forms - among the biggest libraries of lawful kinds in the States - provides a variety of lawful record web templates you are able to down load or print. Utilizing the internet site, you may get a huge number of kinds for company and person reasons, categorized by types, suggests, or keywords and phrases.You can find the most up-to-date versions of kinds like the Oklahoma Charitable Trust with Creation Contingent upon Qualification for Tax Exempt Status within minutes.

If you already possess a monthly subscription, log in and down load Oklahoma Charitable Trust with Creation Contingent upon Qualification for Tax Exempt Status from your US Legal Forms catalogue. The Acquire button will show up on every single form you view. You get access to all previously downloaded kinds from the My Forms tab of your respective profile.

If you would like use US Legal Forms the very first time, here are straightforward recommendations to help you started off:

- Make sure you have selected the proper form for the city/region. Click the Preview button to analyze the form`s content. Look at the form description to ensure that you have chosen the appropriate form.

- In case the form doesn`t fit your specifications, make use of the Lookup industry towards the top of the screen to obtain the one who does.

- If you are satisfied with the form, affirm your selection by simply clicking the Purchase now button. Then, choose the prices plan you favor and provide your accreditations to register for an profile.

- Approach the transaction. Make use of your charge card or PayPal profile to perform the transaction.

- Select the formatting and down load the form on your system.

- Make adjustments. Load, modify and print and sign the downloaded Oklahoma Charitable Trust with Creation Contingent upon Qualification for Tax Exempt Status.

Every single template you added to your bank account lacks an expiration time and it is your own for a long time. So, if you would like down load or print one more version, just visit the My Forms segment and then click on the form you need.

Get access to the Oklahoma Charitable Trust with Creation Contingent upon Qualification for Tax Exempt Status with US Legal Forms, by far the most extensive catalogue of lawful record web templates. Use a huge number of expert and condition-particular web templates that meet your business or person demands and specifications.

Form popularity

FAQ

There Are Three Main Types of Charitable Organizations Most organizations are eligible to become one of the three main categories, including public charities, private foundations and private operating foundations.

IRS 557 provides details on the different categories of nonprofit organizations. Public charities, foundations, social advocacy groups, and trade organizations are common types of nonprofit organization.

501(c)(3) organizations are nonprofit groups with a dedicated mission. Most people are familiar with them as churches and charities, but they also include private foundations. As long as they operate to support their mission, they receive favorable tax treatment, such as avoiding federal income and unemployment taxes.

501(c)(3) organizations are prohibited from engaging in any political campaign intervention activities. 501(c)(6) organizations may engage in political campaign intervention activities so long as such activities do not represent their primary activity.

To be tax-exempt under section 501(c)(3) of the Internal Revenue Code, an organization must be organized and operated exclusively for exempt purposes set forth in section 501(c)(3), and none of its earnings may inure to any private shareholder or individual.

Exempt Organization TypesCharitable Organizations.Churches and Religious Organizations.Private Foundations.Political Organizations.Other Nonprofits.

File Form 1023 with the IRS. Most nonprofit corporations apply for tax-exempt status under Sec. 501(c)(3).

The IRS groups the 501(c)(9), 501(c)(4), and 501(c)(17) together when the latter two are employees' associations.

Today, there are over 1.6 million nonprofit organizations in the United States that are categorized into 27 different types of designations. Here is a general overview of each type of nonprofit organization: Social Advocacy Groups: Advocate or lobby for a certain social or political cause. Classified under 501(c)(4).

A first important distinction to make is that granting nonprofit status is done by the state, while applying for tax-exempt designation (such as 501(c)(3), the charitable tax-exemption) is granted by the federal government in the form of the IRS.