Oklahoma Compensation Administration Checklist

Description

How to fill out Compensation Administration Checklist?

If you need to examine, download, or create official document templates, utilize US Legal Forms, the most extensive assortment of legal forms available online.

Employ the site’s straightforward and user-friendly search to locate the documents you require.

Different templates for business and personal purposes are categorized by groups and states, or keywords.

Step 4. Once you have found the form you need, click the Get now button. Choose your preferred pricing plan and provide your credentials to create an account.

Step 5. Complete the purchase. You may use your credit card or PayPal account to finish the transaction.

- Utilize US Legal Forms to access the Oklahoma Compensation Administration Checklist in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to obtain the Oklahoma Compensation Administration Checklist.

- You can also retrieve forms you previously downloaded in the My documents section of your account.

- For first-time users of US Legal Forms, follow the steps below.

- Step 1. Ensure you have selected the form for your specific city/state.

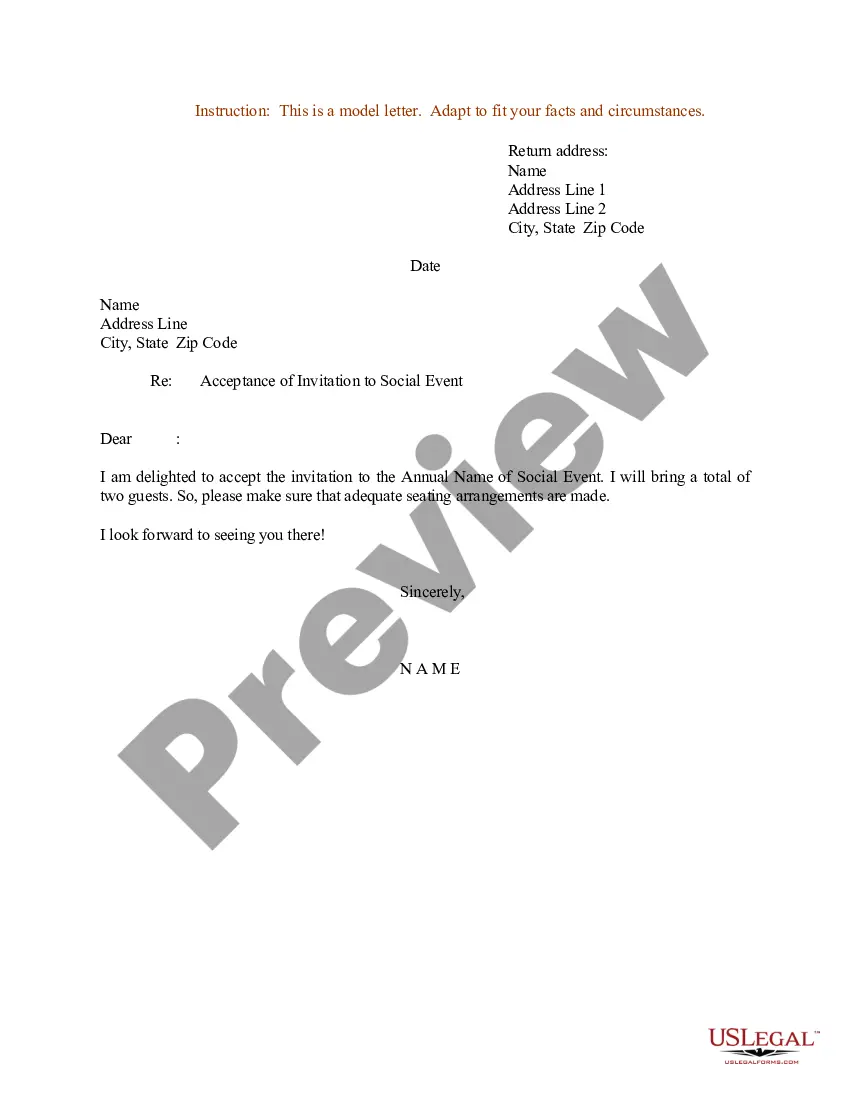

- Step 2. Use the Preview option to review the form’s content. Do not forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search bar at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

To be eligible for COP, you must submit a CA-1 within 30 days of the injury. If disabled and claiming COP, you must submit medical evidence supporting your disability to your employing agency within 10 workdays.

Federal Employee's Notice of Traumatic Injury and Claim for Continuation of Pay/Compensation. The Form CA-1 was developed to ensure regulatory compliance and to be more customer friendly. The form must be completed by the injured employee, a witness, and the injured employee's supervisor.

Form CA-1 must be complete in a detailed manner; that is, you are expected to describe how you sustained your injuries, what you were doing and so on, or how you fell sick. You are also required to input the date, or, if you gradually became sick, indicate the time period.

The CA-1 form, with original signatures, will be filed in the district injury compensation (HRM) office. If your injury did not result in lost time from work or any medical expense, or first aid treatment only, your claim will not be submitted to OWCP for creation of a case.

The things to include in an employee's personnel file are:Job application, CV and cover letter.Education and past employment info.Role description.Job offer letter and employment contract.Emergency contact information.Training records.Payroll and benefits information (but not bank details)Performance appraisal forms.More items...?

How to fill out Form W-2Box A: Employee's Social Security number.Box B: Employer Identification Number (EIN)Box C: Employer's name, address, and ZIP code.Box D:Boxes E and F: Employee's name, address, and ZIP code.Box 1: Wages, tips, other compensation.Box 2: Federal income tax withheld.Box 3: Social Security wages.More items...?

You must file CA-1 within 30 days of the injury, and. your absence from work (caused by the injury) must be within 45 days of the injury.