The Oklahoma Fair Credit Act Disclosure Notice is a legal requirement designed to protect consumers' rights when it comes to credit reporting and the use of credit information. This notice outlines important details about the collection, use, and sharing of consumer credit information by financial institutions and credit reporting agencies operating in Oklahoma. Under the Oklahoma Fair Credit Act, financial institutions and credit reporting agencies are obligated to provide consumers with a clear and concise notice of their credit reporting practices. This notice must be provided to individuals upon application for credit, within a reasonable time after receiving an application, or no later than 30 days after opening a new credit account. The Oklahoma Fair Credit Act Disclosure Notice typically includes the following information: 1. Identification: The notice should clearly state the name and contact information of the financial institution or credit reporting agency responsible for providing the notice. 2. Purpose: It explains that the purpose of the notice is to inform consumers about the institution's credit reporting practices, including the collection, use, and sharing of credit information. 3. Right to Disclosure: The notice informs consumers of their right to obtain a copy of their credit report, free of charge, once every 12 months, from each nationwide credit reporting agency. 4. Opt-Out Options: It describes any opt-out options available to consumers, such as the ability to request to be excluded from certain pre-approved credit offers or telemarketing solicitations. 5. Sharing Practices: The notice discloses whether the financial institution or credit reporting agency shares consumers' credit information with affiliates or non-affiliated third parties, and for what purposes. 6. Consumer Protections: It provides information on the consumer's right to dispute inaccurate or incomplete information in their credit reports, along with the process for resolving such disputes. There aren't different types of Oklahoma Fair Credit Act Disclosure Notices, but various financial institutions and credit reporting agencies may customize the format and wording of the notice to meet their specific requirements, as long as they adhere to the guidelines outlined in the Oklahoma Fair Credit Act. Keywords: Oklahoma, Fair Credit Act, Disclosure Notice, credit reporting, credit information, financial institutions, credit reporting agencies, collection, use, sharing, consumer rights, application for credit, contact information, purpose, right to disclosure, opt-out options, sharing practices, consumer protections, inaccurate information, incomplete information.

Oklahoma Fair Credit Act Disclosure Notice

Description

How to fill out Oklahoma Fair Credit Act Disclosure Notice?

US Legal Forms - among the greatest libraries of legal kinds in America - gives an array of legal document web templates you are able to download or print. Making use of the site, you may get a huge number of kinds for enterprise and individual functions, sorted by categories, says, or keywords and phrases.You will discover the most recent versions of kinds much like the Oklahoma Fair Credit Act Disclosure Notice within minutes.

If you already possess a subscription, log in and download Oklahoma Fair Credit Act Disclosure Notice from your US Legal Forms catalogue. The Obtain option will appear on each develop you look at. You get access to all in the past acquired kinds within the My Forms tab of your own account.

If you would like use US Legal Forms the very first time, listed below are simple guidelines to help you get started off:

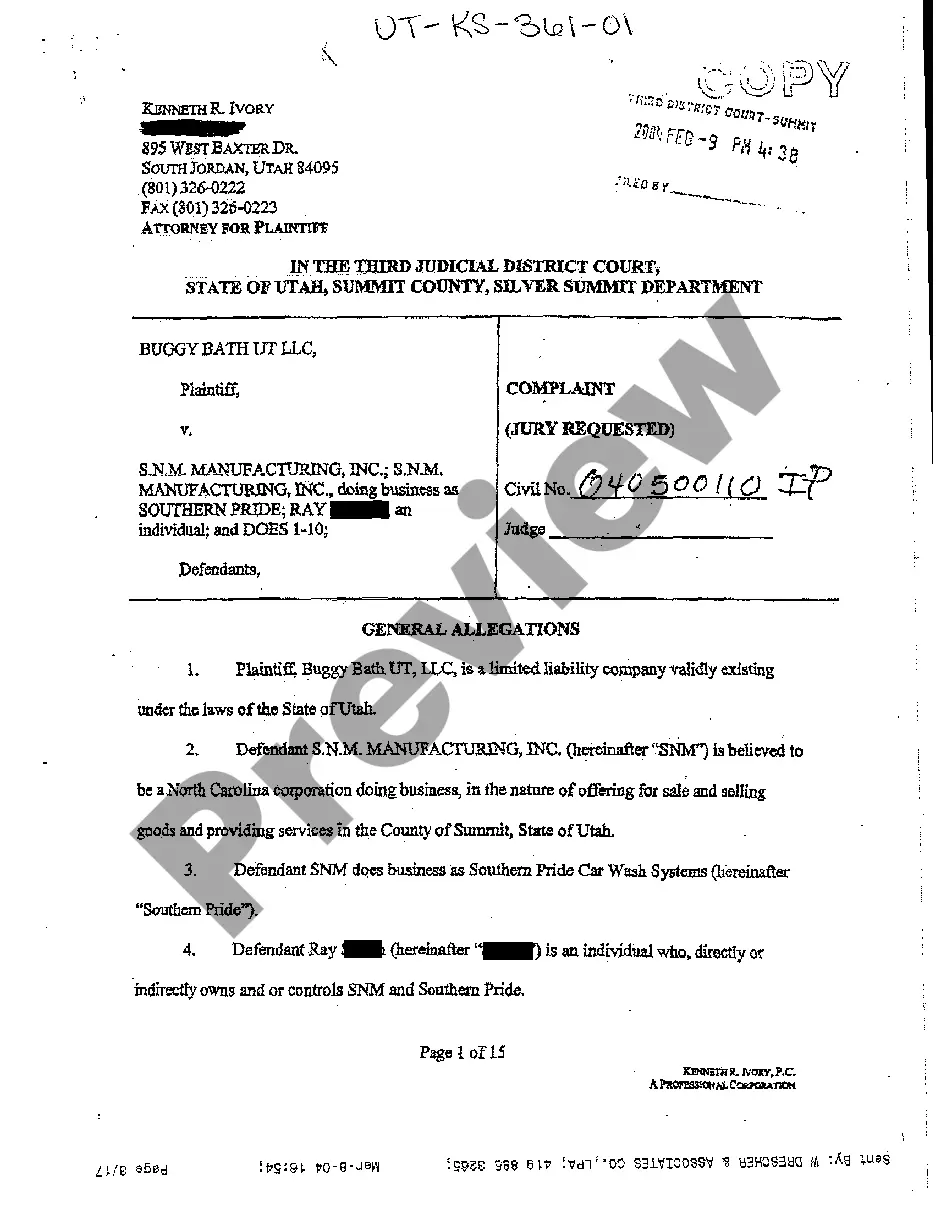

- Be sure you have chosen the best develop to your metropolis/region. Click the Review option to check the form`s articles. Look at the develop outline to ensure that you have selected the proper develop.

- When the develop does not satisfy your requirements, use the Research field at the top of the display screen to discover the one who does.

- In case you are happy with the shape, validate your decision by visiting the Purchase now option. Then, select the pricing plan you want and give your accreditations to register for the account.

- Procedure the deal. Use your bank card or PayPal account to finish the deal.

- Choose the formatting and download the shape on your own system.

- Make adjustments. Complete, modify and print and indicator the acquired Oklahoma Fair Credit Act Disclosure Notice.

Each and every design you added to your money lacks an expiry date and is your own property permanently. So, in order to download or print one more copy, just check out the My Forms section and click on in the develop you require.

Gain access to the Oklahoma Fair Credit Act Disclosure Notice with US Legal Forms, probably the most extensive catalogue of legal document web templates. Use a huge number of professional and status-particular web templates that fulfill your organization or individual requires and requirements.

Form popularity

FAQ

The Fair Credit Reporting Act (FCRA) is a federal law that requires you to make a disclosure to employees or applicants informing them that you will obtain a consumer report about them for employment consideration purposes.

The Fair Credit Reporting Act describes the kind of data that the bureaus are allowed to collect. That includes the person's bill payment history, past loans, and current debts.

Under the FCRA, an employer may not run a background check on a prospective employee without first providing "a clear and conspicuous disclosure . . . in a document that consists solely of that disclosure, that a consumer report may be obtained for employment purposes." For efficiency, many employers include all

The FCRA gives you the right to be told if information in your credit file is used against you to deny your application for credit, employment or insurance. The FCRA also gives you the right to request and access all the information a consumer reporting agency has about you (this is called "file disclosure").

Access to Your Credit Report The act requires credit reporting agencies to provide you with any information in your credit file upon request once a year. You must have proper identification. You have a right to a free copy of your credit report within 15 days of your request.

On July 21, 2010, Congress passed the Dodd-Frank Wall Street Reform and Consumer Protection Act (Dodd-Frank Act). Section 1100F of the Dodd-Frank Act amended the FCRA to require disclosure of credit scores and information relating to credit scores for both risk-based pricing and FCRA adverse action notices.

Disclosures to consumers. (a) Every consumer reporting agency shall, upon request and proper identification of any consumer, clearly and accurately disclose to the consumer: (1) The nature and substance of all information (except medical information) in its files on the consumer at the time of the request.

The Fair Credit Reporting Act describes the kind of data that the bureaus are allowed to collect. That includes the person's bill payment history, past loans, and current debts.

Under the FCRA, an employer may not run a background check on a prospective employee without first providing "a clear and conspicuous disclosure . . . in a document that consists solely of that disclosure, that a consumer report may be obtained for employment purposes." For efficiency, many employers include all

The Act (Title VI of the Consumer Credit Protection Act) protects information collected by consumer reporting agencies such as credit bureaus, medical information companies and tenant screening services. Information in a consumer report cannot be provided to anyone who does not have a purpose specified in the Act.