The Oklahoma Authorization of Consumer Report is an essential document that grants permission to entities and individuals to access a consumer's credit information and other personal data for various purposes. This legal authorization ensures that businesses comply with state and federal regulations regarding consumer privacy and protection. When an individual in Oklahoma applies for a loan, rental property, or employment, the requesting party often requires an Oklahoma Authorization of Consumer Report to assess their financial stability, background, and creditworthiness. By obtaining this document, organizations can legally access credit reports, past payment histories, employment records, and even criminal background checks relevant to the concerned individual. There are different types of Oklahoma Authorization of Consumer Report, depending on the purpose and entity involved. Some common variations include: 1. Employment Authorization: When a potential employer seeks to review a job applicant's background and credit history, they need the job candidate's consent through an Oklahoma Authorization of Consumer Report. This type of report helps employers evaluate the candidate's trustworthiness, responsibility, and financial stability. 2. Rental Application Authorization: Landlords and property management companies request an Oklahoma Authorization of Consumer Report from prospective tenants. This report enables them to assess whether an applicant will be a reliable tenant by reviewing their financial history, rental payment records, and eviction history (if any). 3. Loan Application Authorization: When individuals in Oklahoma seek to apply for loans, such as mortgages, personal loans, or student loans, financial institutions require an Oklahoma Authorization of Consumer Report. This report assists lenders in determining the applicant's creditworthiness, repayment capability, and overall financial standing. 4. Insurance Application Authorization: Insurance companies may request an Oklahoma Authorization of Consumer Report as part of their underwriting process. By reviewing an individual's credit history and past insurance claims, insurers can assess the potential risk associated with providing coverage and determine appropriate premiums. The Oklahoma Authorization of Consumer Report is a legally binding document that protects individuals' rights, ensuring their information is only accessed for legitimate purposes. By specifying the type of report needed and obtaining proper authorization, organizations and entities in Oklahoma can responsibly access consumer information while abiding by state and federal laws on consumer privacy and protection.

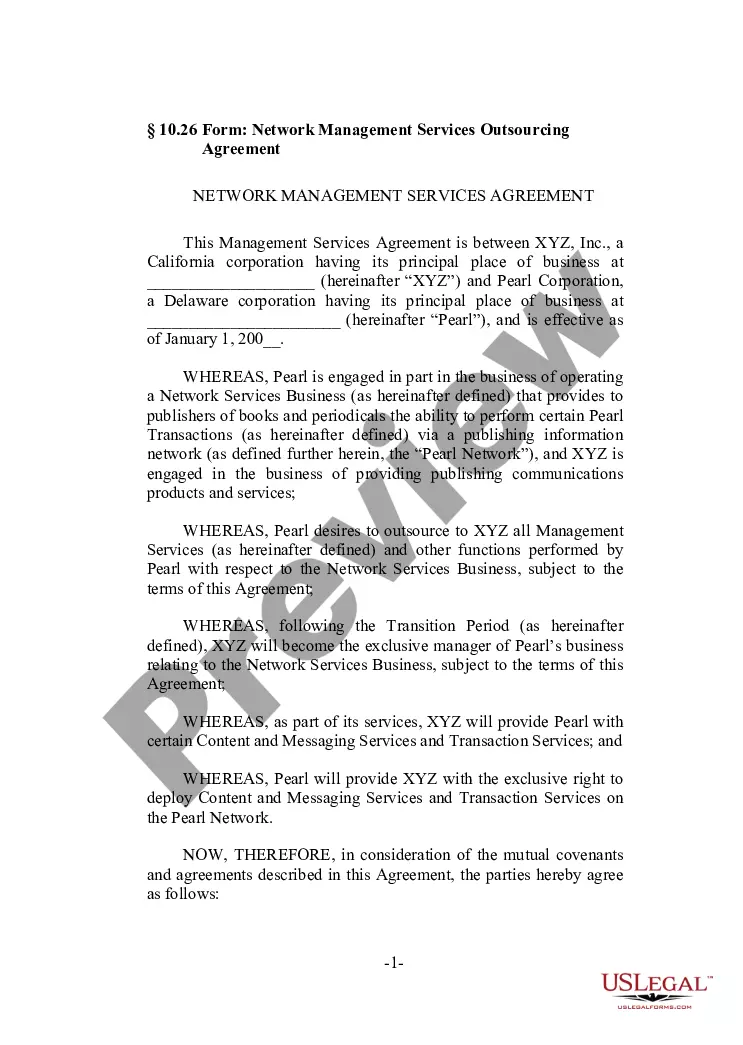

Oklahoma Authorization of Consumer Report

Description

How to fill out Oklahoma Authorization Of Consumer Report?

US Legal Forms - one of the most significant libraries of legal types in the USA - delivers a wide array of legal record themes it is possible to obtain or printing. While using internet site, you can find 1000s of types for organization and individual functions, categorized by groups, states, or key phrases.You can get the most up-to-date variations of types such as the Oklahoma Authorization of Consumer Report within minutes.

If you already have a monthly subscription, log in and obtain Oklahoma Authorization of Consumer Report through the US Legal Forms library. The Acquire switch can look on every develop you perspective. You gain access to all earlier acquired types inside the My Forms tab of your bank account.

If you want to use US Legal Forms the very first time, listed below are easy guidelines to obtain began:

- Be sure you have chosen the correct develop to your area/county. Select the Review switch to check the form`s content. Browse the develop description to ensure that you have selected the appropriate develop.

- When the develop does not match your demands, take advantage of the Lookup field towards the top of the display to get the one that does.

- In case you are content with the form, verify your decision by clicking on the Purchase now switch. Then, pick the costs prepare you favor and offer your credentials to sign up for an bank account.

- Method the purchase. Make use of charge card or PayPal bank account to perform the purchase.

- Pick the formatting and obtain the form on the product.

- Make adjustments. Complete, edit and printing and indication the acquired Oklahoma Authorization of Consumer Report.

Every single web template you included with your money lacks an expiration time and it is your own property eternally. So, if you wish to obtain or printing an additional copy, just proceed to the My Forms section and click on about the develop you want.

Obtain access to the Oklahoma Authorization of Consumer Report with US Legal Forms, one of the most extensive library of legal record themes. Use 1000s of expert and status-specific themes that meet your company or individual requirements and demands.