The Oklahoma Exempt Survey is a comprehensive assessment carried out in the state of Oklahoma to determine the eligibility of individuals or entities for tax exemptions. These surveys serve as a means to verify whether certain exemptions can be granted based on specific criteria set by the state's tax regulations. The Oklahoma Exempt Survey is primarily conducted by the Oklahoma Tax Commission and aims to identify organizations or individuals that meet the qualifications for various exemptions, such as sales tax exemptions, property tax exemptions, or income tax exemptions. By completing this survey, businesses and individuals can provide the necessary information to determine their eligibility for exemptions, and subsequently minimize their tax liabilities. There are different types of Oklahoma Exempt Surveys that cater to specific tax exemptions. Some of these surveys include: 1. Sales Tax Exempt Survey: This type of survey pertains to determining whether a business qualifies for sales tax exemptions. Businesses may be exempted from paying sales tax if they engage in activities that are considered exempt under Oklahoma tax laws, such as selling certain medical equipment, educational materials, or agricultural products. 2. Property Tax Exempt Survey: This survey focuses on evaluating whether an entity or individual meets the requirements to be granted property tax exemptions. In Oklahoma, certain properties may be eligible for exemption from property taxes, such as non-profit organizations, religious institutions, or government-owned properties. 3. Income Tax Exempt Survey: This survey targets individuals or entities seeking exemptions from state income taxes. For example, individuals belonging to specific religious orders or organizations dedicated solely to charitable purposes may be exempted from paying income tax. 4. Energy Tax Exempt Survey: This survey is designed to determine whether certain entities qualify for exemptions from energy taxes. In Oklahoma, energy tax exemptions may be granted to companies engaged in specific energy-related activities or industries, such as renewable energy generation or energy conservation projects. Completing the Oklahoma Exempt Survey accurately and providing all the required information is crucial for individuals or businesses to ensure that they receive the appropriate tax exemptions they are eligible for. Failing to complete the survey or omitting relevant details may result in the denial of exemptions or potential penalties. It is important to consult with tax professionals or research the specific requirements pertaining to the type of exemption sought in order to complete the Oklahoma Exempt Survey correctly.

Oklahoma Exempt Survey

Description

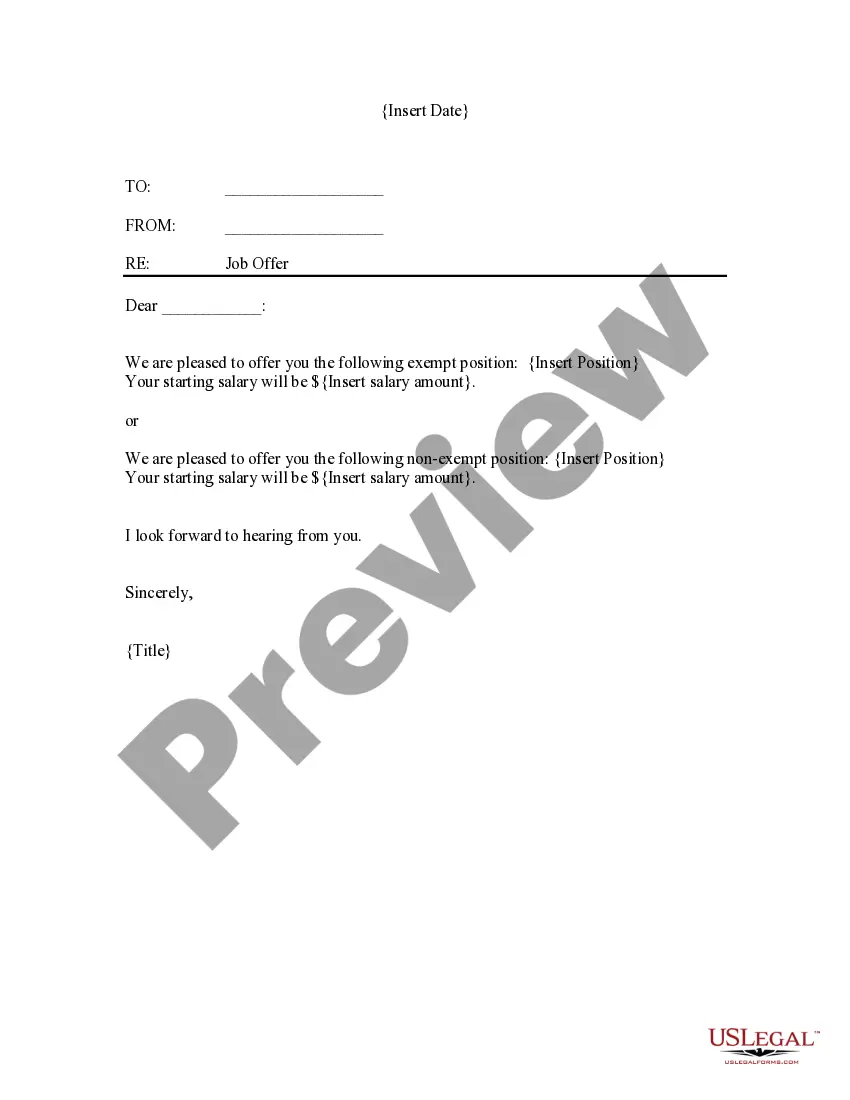

How to fill out Oklahoma Exempt Survey?

Discovering the right authorized record format might be a struggle. Needless to say, there are plenty of layouts available online, but how will you get the authorized develop you require? Utilize the US Legal Forms internet site. The service gives 1000s of layouts, like the Oklahoma Exempt Survey, that you can use for enterprise and private needs. All the kinds are checked out by pros and meet up with federal and state specifications.

When you are previously authorized, log in to the account and click on the Down load switch to obtain the Oklahoma Exempt Survey. Use your account to appear with the authorized kinds you might have ordered in the past. Check out the My Forms tab of your own account and obtain another backup of the record you require.

When you are a new customer of US Legal Forms, allow me to share straightforward instructions that you should adhere to:

- Initially, make certain you have chosen the right develop for the town/region. You may examine the shape while using Review switch and browse the shape explanation to make certain this is basically the best for you.

- In the event the develop is not going to meet up with your preferences, utilize the Seach industry to discover the appropriate develop.

- When you are sure that the shape would work, select the Acquire now switch to obtain the develop.

- Choose the pricing strategy you would like and enter in the required information. Build your account and pay money for an order utilizing your PayPal account or Visa or Mastercard.

- Choose the document format and down load the authorized record format to the product.

- Full, edit and printing and indicator the obtained Oklahoma Exempt Survey.

US Legal Forms may be the biggest local library of authorized kinds where you can find numerous record layouts. Utilize the company to down load expertly-created documents that adhere to express specifications.