The Oklahoma Separation Notice for 1099 Employees is an important document required by the state of Oklahoma when a business owner or employer decides to terminate or separate from a contractor who is classified as a 1099 employee for tax purposes. This notice serves as a legal record of the separation and outlines the specific details regarding the termination. The Oklahoma Separation Notice for 1099 Employees typically includes key information such as the employee's name, address, Social Security number, and the date of separation. It also details the reason for separation, which can vary from completion of a project or contract, to unsatisfactory performance, or any other valid reason as defined by the employer's policies. Providing an accurate and detailed reason for separation is crucial, as it helps both parties understand the circumstances of the separation and provides documentation for any potential disputes or future reference. It is important to note that the Oklahoma Separation Notice for 1099 Employees does not create an employment relationship between the employer and the contractor. It merely serves as a record of the termination and outlines the terms of separation. While there may not be different types of Oklahoma Separation Notice for 1099 Employees, variations may exist depending on the industry or specific requirements of the employer. However, regardless of any potential variations, the core purpose of the form remains the same — to provide a formal record of the separation, ensuring compliance with state employment regulations. In conclusion, the Oklahoma Separation Notice for 1099 Employees is a crucial document that formalizes the termination or separation of a contractor classified as a 1099 employee. By accurately detailing the reason for separation and providing key personnel information, this notice helps protect both the employer and the contractor, creating a legal record of the separation and ensuring compliance with state regulations.

Oklahoma Separation Notice for 1099 Employee

Description

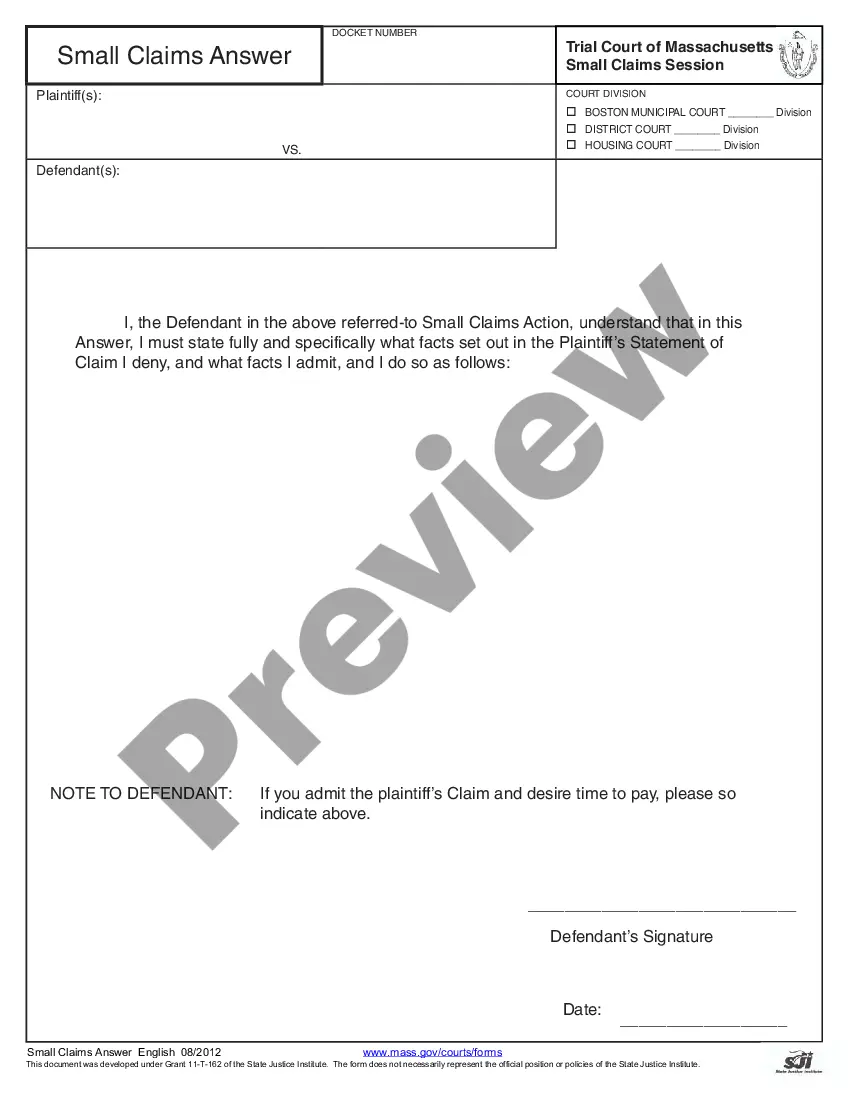

How to fill out Oklahoma Separation Notice For 1099 Employee?

If you have to complete, down load, or print legitimate papers templates, use US Legal Forms, the biggest variety of legitimate types, which can be found online. Use the site`s easy and hassle-free look for to obtain the files you want. A variety of templates for company and specific functions are categorized by groups and claims, or keywords and phrases. Use US Legal Forms to obtain the Oklahoma Separation Notice for 1099 Employee within a few click throughs.

In case you are previously a US Legal Forms consumer, log in in your accounts and click on the Obtain button to find the Oklahoma Separation Notice for 1099 Employee. You may also gain access to types you formerly delivered electronically within the My Forms tab of the accounts.

If you work with US Legal Forms the first time, refer to the instructions below:

- Step 1. Be sure you have chosen the form to the proper town/region.

- Step 2. Use the Review method to look through the form`s content material. Do not neglect to read through the description.

- Step 3. In case you are unhappy with the kind, take advantage of the Research field on top of the monitor to find other models of your legitimate kind design.

- Step 4. Once you have found the form you want, click on the Buy now button. Choose the costs program you prefer and add your credentials to register to have an accounts.

- Step 5. Method the financial transaction. You can use your bank card or PayPal accounts to perform the financial transaction.

- Step 6. Find the format of your legitimate kind and down load it on your gadget.

- Step 7. Comprehensive, modify and print or sign the Oklahoma Separation Notice for 1099 Employee.

Every single legitimate papers design you acquire is your own property permanently. You might have acces to every kind you delivered electronically within your acccount. Click the My Forms segment and pick a kind to print or down load again.

Compete and down load, and print the Oklahoma Separation Notice for 1099 Employee with US Legal Forms. There are many skilled and express-particular types you can use for your company or specific requires.

Form popularity

FAQ

An independent contractor is: one who engages to perform certain service for another, according to his own manner and method, free from control and direction of his employer in all matters connected with the performance of the service, except as to the result or product of the work. Defined by Oklahoma Case Law.

Collecting Unemployment After Being Fired If, however, you were fired for misconduct, you will be disqualified from receiving benefits. Under Oklahoma law, misconduct includes dishonesty, violating a safety rule, willfully violating or neglecting your job duties, and unexplained absences.

Independent contractors still have a remedy if they're injured at work. As with any injured party, the independent contractor can file a personal injury lawsuit against the company or other third parties for negligence.

PUA provides unemployment benefits to people who are unable to work because of a COVID-19 related reason but are not eligible for traditional unemployment. Independent contractors, freelancers, and self-employed individuals may be eligible for PUA.

Since Unemployment Insurance (UI) is an insurance paid by Oklahoma employers, it is not available for self-employed, contract, or gig workers.

If you quit your job voluntarily, you will typically not be able to collect Oklahoma unemployment benefits. However, if you had good cause for quitting say, because of unsafe work conditions or unfair treatment you may qualify for unemployment benefits.

Self-employed Oklahomans, gig-workers and independent contractors are eligible for Pandemic Unemployment Assistance thanks to the CARES Act.

Independent Contractors - Independent contractors are not "employees" and therefore are not covered under Oklahoma workers' compensation law.

Self-employed Oklahomans, gig-workers and independent contractors are eligible for Pandemic Unemployment Assistance thanks to the CARES Act.

Independent contractors are not considered employees and are exempt from workers' comp coverage. The state of Oklahoma uses a complex, multipart test to determine if a worker is a contractor vs. an employee.