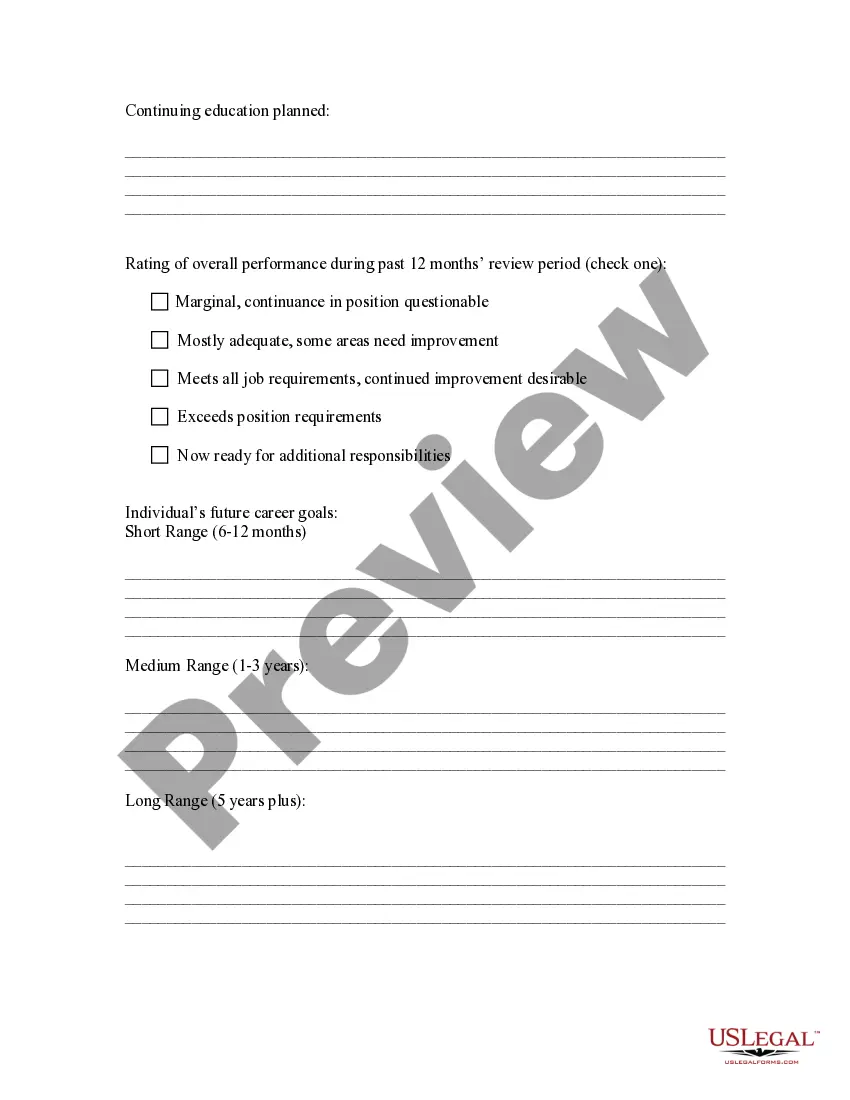

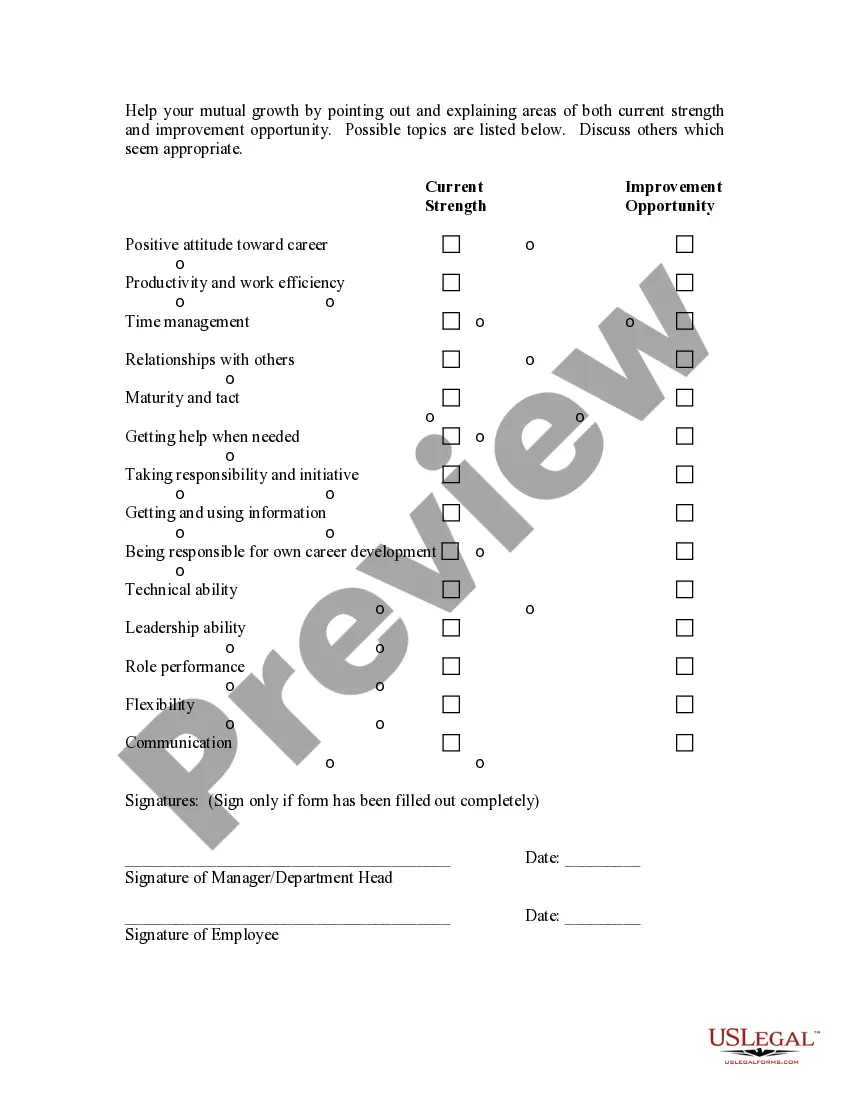

The Oklahoma Model Performance Evaluation — Appraisal Form is a comprehensive tool used in the evaluation process of various types of employees in Oklahoma. It provides a structured approach to assess the performance and competence of hourly, exempt, nonexempt, and managerial employees. This form ensures fairness and consistency in evaluating employee performance and serves as a basis for performance-related decisions such as promotions, salary adjustments, and training needs identification. Designed to accommodate the diverse roles and responsibilities of different employee categories, the Oklahoma Model Performance Evaluation — Appraisal Form consists of specific sections tailored to capture relevant information for each type of employee. For hourly employees, the form includes sections to examine their punctuality, productivity, and adherence to work schedules. It also takes into consideration their ability to follow instructions, teamwork, and overall contribution to achieving departmental goals. Exempt employees, who typically hold positions exempt from overtime pay, are evaluated on a broader set of criteria. These may include job knowledge, problem-solving skills, decision-making abilities, communication skills, leadership qualities, and their ability to multitask and maintain a high level of professionalism. Nonexempt employees, on the other hand, typically receive overtime pay. The appraisal form for nonexempt employees may focus more on their attendance, compliance with break and rest periods, accuracy in timekeeping, adherence to organizational policies, and the quality of work they deliver within their assigned hours. For managerial employees, the assessment criteria encompass various aspects of leadership and management skills. This may include their ability to mentor and develop their teams, effectively delegate tasks, communicate organizational goals, manage conflicts, make strategic decisions, and achieve desired outcomes. By tailoring the Oklahoma Model Performance Evaluation — Appraisal Form to different employee categories, organizations can gather more accurate and relevant data, enabling fair and objective assessments. This form allows employers to identify areas of improvement, offer constructive feedback, and provide appropriate resources for development. Implementing these evaluations contributes to the growth and success of both employees and the organization as a whole.

The Oklahoma Model Performance Evaluation — Appraisal Form is a comprehensive tool used in the evaluation process of various types of employees in Oklahoma. It provides a structured approach to assess the performance and competence of hourly, exempt, nonexempt, and managerial employees. This form ensures fairness and consistency in evaluating employee performance and serves as a basis for performance-related decisions such as promotions, salary adjustments, and training needs identification. Designed to accommodate the diverse roles and responsibilities of different employee categories, the Oklahoma Model Performance Evaluation — Appraisal Form consists of specific sections tailored to capture relevant information for each type of employee. For hourly employees, the form includes sections to examine their punctuality, productivity, and adherence to work schedules. It also takes into consideration their ability to follow instructions, teamwork, and overall contribution to achieving departmental goals. Exempt employees, who typically hold positions exempt from overtime pay, are evaluated on a broader set of criteria. These may include job knowledge, problem-solving skills, decision-making abilities, communication skills, leadership qualities, and their ability to multitask and maintain a high level of professionalism. Nonexempt employees, on the other hand, typically receive overtime pay. The appraisal form for nonexempt employees may focus more on their attendance, compliance with break and rest periods, accuracy in timekeeping, adherence to organizational policies, and the quality of work they deliver within their assigned hours. For managerial employees, the assessment criteria encompass various aspects of leadership and management skills. This may include their ability to mentor and develop their teams, effectively delegate tasks, communicate organizational goals, manage conflicts, make strategic decisions, and achieve desired outcomes. By tailoring the Oklahoma Model Performance Evaluation — Appraisal Form to different employee categories, organizations can gather more accurate and relevant data, enabling fair and objective assessments. This form allows employers to identify areas of improvement, offer constructive feedback, and provide appropriate resources for development. Implementing these evaluations contributes to the growth and success of both employees and the organization as a whole.