Oklahoma Self-Employed Independent Contractor Agreement

Description

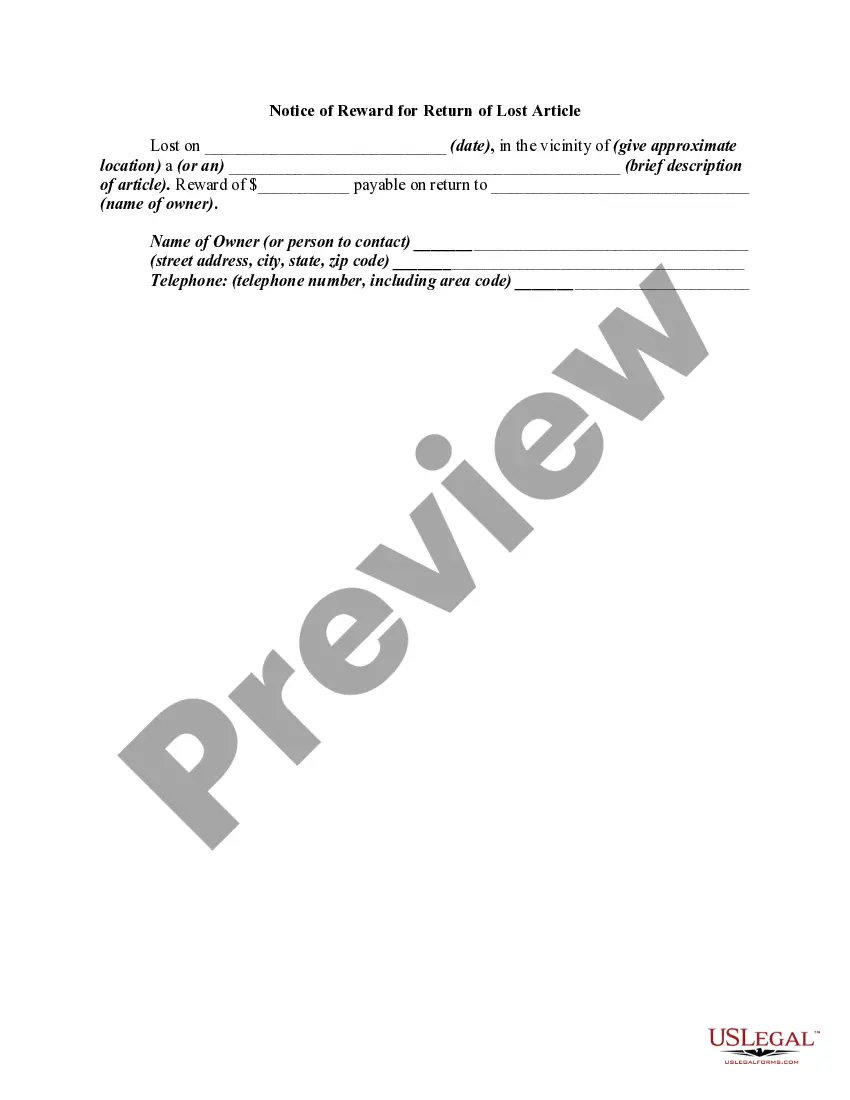

How to fill out Self-Employed Independent Contractor Agreement?

If you intend to finalize, obtain, or create legitimate document templates, utilize US Legal Forms, the largest assortment of legal forms available online.

Take advantage of the site's straightforward and convenient search feature to find the documents you need.

Various templates for business and personal purposes are categorized by type and claims, or keywords.

Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the legal form template.

Step 4. Once you have found the form you need, select the Purchase now option. Choose your preferred payment plan and enter your details to register for an account.

- Use US Legal Forms to access the Oklahoma Self-Employed Independent Contractor Agreement with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to retrieve the Oklahoma Self-Employed Independent Contractor Agreement.

- You can also find templates you previously saved under the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps outlined below.

- Step 1. Verify that you have selected the form for the correct region/country.

- Step 2. Utilize the Review function to examine the content of the form. Make sure to read the summary.

Form popularity

FAQ

The IRS says that someone is self-employed if they meet one of these conditions:Someone who carries on a trade or business as a sole proprietor or independent contractor,A member of a partnership that carries on a trade or business, or.Someone who is otherwise in business for themselves, including part-time business.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

A 1099 employee is a US self-employed worker that reports their income to the IRS on a 1099 tax form. Freelancers, gig workers, and independent contractors are all considered 1099 employees.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

An independent contractor is: one who engages to perform certain service for another, according to his own manner and method, free from control and direction of his employer in all matters connected with the performance of the service, except as to the result or product of the work. Defined by Oklahoma Case Law.

The law does not require you to complete a contract with your self-employed or freelance workers - a verbal contract can exist even when there is nothing in writing.

The three types of self-employed individuals include:Independent contractors. Independent contractors are individuals hired to perform specific jobs for clients, meaning that they are only paid for their jobs.Sole proprietors.Partnerships.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax. To find out what your tax obligations are, visit the Self-Employed Individuals Tax Center.

How Do You Become Self-Employed?Think of a Name for Your Self-Employed Business. Consider what services you will offer, and then pick a name that describes what you do.Choose a Self-Employed Business Structure and Get a Proper License.Open a Business Bank Account.Advertise Your Independent Contractor Services.