The Oklahoma Nonexempt Employee Time Report is a crucial document used by employers in Oklahoma to accurately track and record the working hours of their nonexempt employees. This report is essential for compliance with state labor laws, ensuring that employees are paid correctly for all the time they have worked. The Oklahoma Nonexempt Employee Time Report is typically divided into various sections to capture important details about the employee's work schedule. It starts with employee information such as their name, position, and employee identification number for identification purposes. The report then proceeds to accurately record the start and end times for each workday, including break times, lunch periods, and any additional approved time off. Employers use this detailed breakdown to calculate regular work hours, overtime hours, and any other applicable wage factors. The report may also include sections to document sick leave, vacation time, or any other types of paid time off an employee may take. If an employer offers different types of employment, such as part-time, full-time, or temporary positions, there might be separate versions of the Oklahoma Nonexempt Employee Time Report tailored to each category. This allows for precise tracking and differentiating between various types of employees, ensuring accurate compensation and adherence to relevant labor regulations for each employment type. Furthermore, depending on the nature of the employer's business or industry-specific requirements, there may be specialized variations of the Oklahoma Nonexempt Employee Time Report. For example, companies with shift-based work schedules, such as hospitals or manufacturing facilities, may utilize a time report that includes specific fields to document shift information, including shift start and end times. Overall, the Oklahoma Nonexempt Employee Time Report acts as a crucial tool in ensuring fair and accurate payment for nonexempt employees. It helps employers maintain compliance with Oklahoma labor laws while providing a transparent record of hours worked, overtime earned, and any other relevant time-related information. This report plays a vital role in fostering a productive and respectful employer-employee relationship while safeguarding the rights and interests of both parties.

Oklahoma Nonexempt Employee Time Report

Description

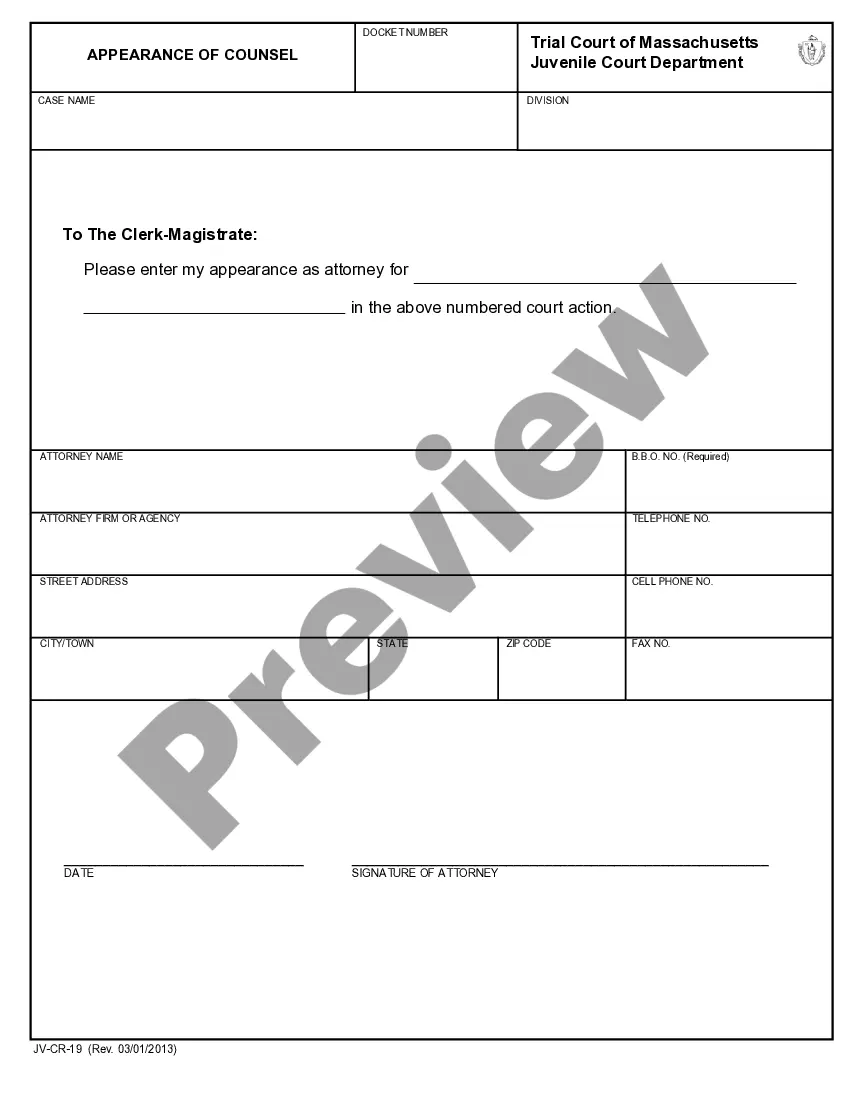

How to fill out Oklahoma Nonexempt Employee Time Report?

US Legal Forms - one of the most significant libraries of authorized kinds in the United States - delivers a wide array of authorized record templates you may acquire or print out. Using the internet site, you will get a huge number of kinds for enterprise and personal purposes, sorted by groups, says, or key phrases.You will discover the most up-to-date models of kinds such as the Oklahoma Nonexempt Employee Time Report in seconds.

If you have a registration, log in and acquire Oklahoma Nonexempt Employee Time Report from your US Legal Forms library. The Acquire switch will show up on each develop you look at. You gain access to all earlier delivered electronically kinds from the My Forms tab of your bank account.

If you would like use US Legal Forms the first time, listed below are easy recommendations to obtain started off:

- Be sure you have chosen the proper develop to your area/area. Click on the Preview switch to check the form`s content. Browse the develop outline to ensure that you have chosen the right develop.

- If the develop does not suit your requirements, use the Look for field towards the top of the display to find the one who does.

- If you are happy with the shape, confirm your choice by clicking the Get now switch. Then, choose the rates prepare you like and supply your qualifications to sign up to have an bank account.

- Approach the financial transaction. Utilize your bank card or PayPal bank account to complete the financial transaction.

- Pick the structure and acquire the shape on the gadget.

- Make modifications. Fill up, modify and print out and signal the delivered electronically Oklahoma Nonexempt Employee Time Report.

Each design you included in your money lacks an expiry day which is your own eternally. So, in order to acquire or print out yet another backup, just visit the My Forms area and click about the develop you need.

Gain access to the Oklahoma Nonexempt Employee Time Report with US Legal Forms, one of the most substantial library of authorized record templates. Use a huge number of specialist and express-distinct templates that meet up with your company or personal requirements and requirements.

Form popularity

FAQ

Oklahoma law requires that minors under age 16 must be given an uninterrupted meal or rest period of at least 30 minutes if they have worked five hours or more continuously. Although Oklahoma does not have a lunch and break law for those persons 18 and over, there are applicable federal rules for Oklahoma citizens.

Meals and BreaksOklahoma does not have any laws requiring an employer to provide a meal period or breaks to employees sixteen (16) years of age or older, thus the federal rule applies. OK Dept. of Labor Wage Law FAQ The federal rule does not require an employer to provide either a meal (lunch) period or breaks.

Salary level test. Employees who are paid less than $23,600 per year ($455 per week) are nonexempt. (Employees who earn more than $100,000 per year are almost certainly exempt.)

Examples of non-exempt employees include contractors, freelancers, interns, servers, retail associates and similar jobs. Even if non-exempt employees earn more than the federal minimum wage, they still take direction from supervisors and do not have administrative or executive positions.

Under Oklahoma law, employees under the age of 16 may not work more than 5 consecutive hours without a 30-minute rest period and must be permitted a 1-hour cumulative rest period for each 8 consecutive hours worked (OK Stat.

"Non-exempt" means an employee who is covered by the minimum wage and overtime provisions of FLSA or is granted special non-exempt status.

Then consider yourself lucky: Neither federal nor state law makes this a legal requirement. In Oklahoma, no law gives employees the right to time off to eat lunch (or another meal) or the right to take short breaks during the work day. Employees must be paid for shorter breaks they are allowed to take during the day.

Yes, Oklahoma does not have any laws which regulate/limit the number of hours an employer can work you unless you are 14 or 15 years of age. 25.

If you are a non-exempt employee, your employer must pay you at least the federal minimum wage (currently $7.25 per hour in Texas and under federal law) and must pay you overtime pay at a rate of at least one and a half times your hourly pay rate for all hours worked over 40 in each workweek.

Specifically, Oklahoma law requires that employees be paid 1.5 times their normal hourly rate when they work more than 40 hours in a single seven-day period. This requirement also applies to time worked in excess of 40 hours a week, not eight hours in one day.