Oklahoma Specific Consent Form for Qualified Joint and Survivor Annuities (JSA) is an essential document in the field of retirement planning and annuities. It is specifically designed to ensure compliance with the legal requirements set by the state of Oklahoma regarding the consent of participants in retirement plans to waive the Qualified Joint and Survivor Annuity benefit. In Oklahoma, for retirement plans governed by the Employee Retirement Income Security Act (ERICA), the law allows participants to elect a non-spousal beneficiary as the primary beneficiary for their retirement benefits. However, if a participant wishes to designate someone other than their spouse, they must obtain the spouse's written consent by completing the Oklahoma Specific Consent Form for JSA. This consent form serves as a legal agreement between the participant and their spouse, acknowledging that the participant's spouse agrees to waive their rights to the JSA benefit. The JSA benefit provides for a lifetime income stream to the participant's surviving spouse if the participant predeceases them. By waiving this benefit and choosing a non-spousal beneficiary, the participant's spouse may be giving up potential financial security in the event of the participant's death. It is important to note that there may be different types of Oklahoma Specific Consent Forms for JSA, depending on the specific retirement plan or annuity involved. Some variations may include different sections or clauses tailored to meet the requirements of the particular plan or annuity provider. It is crucial to use the correct form applicable to your retirement plan or annuity to ensure compliance with Oklahoma state laws. The purpose of the Oklahoma Specific Consent Form for JSA is to protect the rights of both the participant and their spouse. It ensures that both parties understand the implications of waiving the JSA benefit and that the decision is made knowingly and voluntarily. By using this form, retirement plan administrators can demonstrate compliance with the legal requirements and ensure that participant's beneficiary elections are properly documented. To sum up, the Oklahoma Specific Consent Form for Qualified Joint and Survivor Annuities (JSA) is a vital document in retirement planning, ensuring compliance with Oklahoma state laws for waiving the JSA benefit. It serves as a written agreement between the participant and their spouse, acknowledging the spouse's consent to waive their rights. Using the correct form is crucial to ensure compliance, and there may be variations of the form to accommodate different retirement plans or annuities.

Oklahoma Specific Consent Form for Qualified Joint and Survivor Annuities - QJSA

Description

How to fill out Oklahoma Specific Consent Form For Qualified Joint And Survivor Annuities - QJSA?

US Legal Forms - among the most significant libraries of lawful kinds in the States - provides a wide array of lawful file web templates you are able to download or printing. While using site, you will get a large number of kinds for business and personal uses, categorized by classes, claims, or keywords and phrases.You will discover the latest variations of kinds just like the Oklahoma Specific Consent Form for Qualified Joint and Survivor Annuities - QJSA within minutes.

If you already have a membership, log in and download Oklahoma Specific Consent Form for Qualified Joint and Survivor Annuities - QJSA from your US Legal Forms local library. The Down load key will appear on every develop you see. You get access to all earlier delivered electronically kinds within the My Forms tab of your accounts.

If you would like use US Legal Forms for the first time, here are straightforward recommendations to get you began:

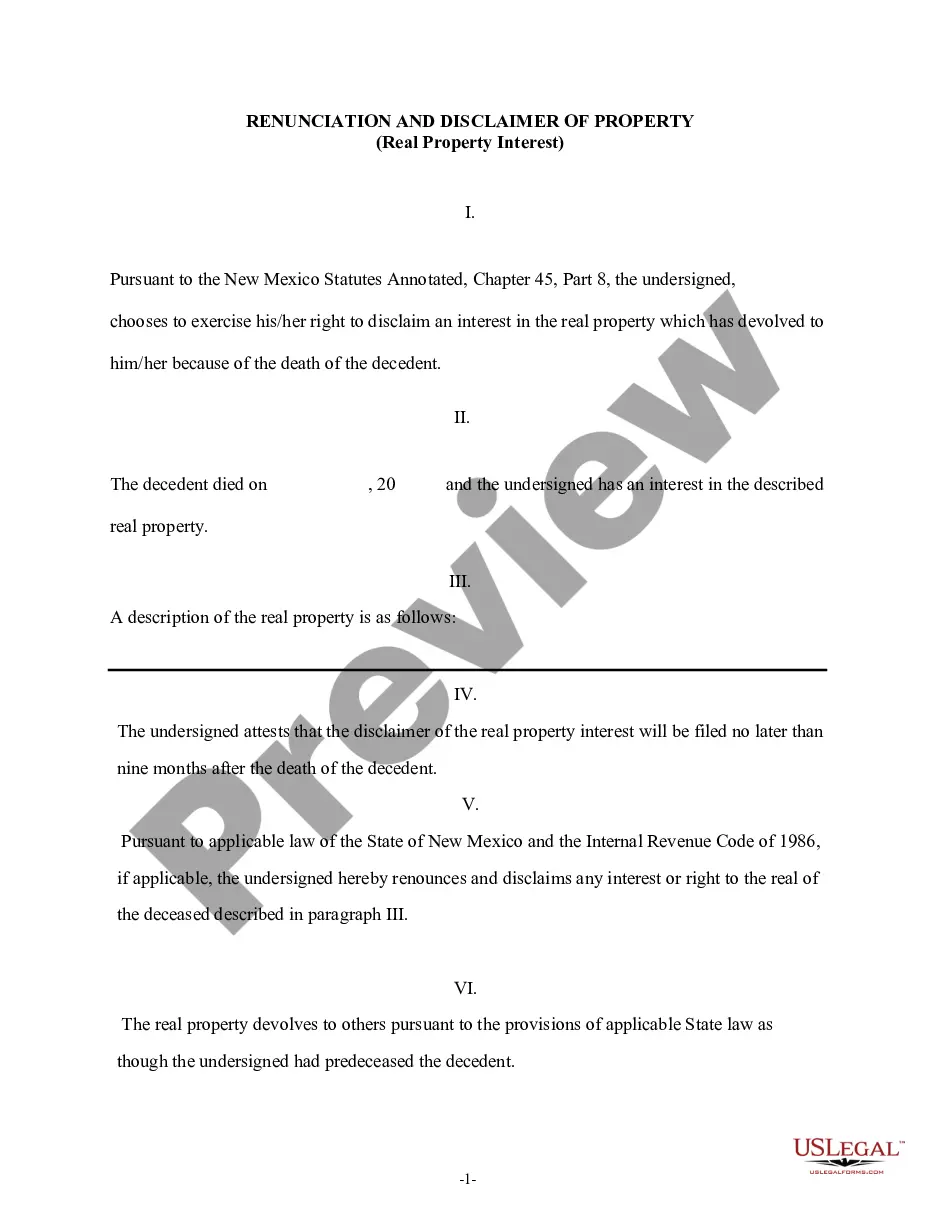

- Be sure to have chosen the right develop to your metropolis/region. Click on the Review key to examine the form`s articles. Look at the develop outline to ensure that you have selected the appropriate develop.

- If the develop does not satisfy your specifications, utilize the Research industry on top of the monitor to find the the one that does.

- Should you be content with the shape, confirm your decision by simply clicking the Acquire now key. Then, opt for the rates strategy you prefer and supply your credentials to sign up for the accounts.

- Approach the purchase. Utilize your charge card or PayPal accounts to finish the purchase.

- Choose the formatting and download the shape on your system.

- Make alterations. Fill up, revise and printing and sign the delivered electronically Oklahoma Specific Consent Form for Qualified Joint and Survivor Annuities - QJSA.

Each and every format you included with your bank account lacks an expiration date which is your own forever. So, in order to download or printing an additional copy, just proceed to the My Forms segment and then click around the develop you want.

Gain access to the Oklahoma Specific Consent Form for Qualified Joint and Survivor Annuities - QJSA with US Legal Forms, one of the most extensive local library of lawful file web templates. Use a large number of skilled and express-specific web templates that satisfy your organization or personal needs and specifications.

Form popularity

FAQ

A joint and survivor annuity is an annuity that pays out for the remainder of two people's lives. Depending on the contract, the annuity may pay 100 percent of the payments upon the death of the first annuitant or a lower percentage typically 50 or 75 percent.

QJSA rules apply to money-purchase pension plans, defined benefit plans, and target benefits. They can also apply to profit-sharing and 401(k) and 403(b) plans, but only if so elected under the plan.

A qualified pre-retirement survivor annuity (QPSA) provides monetary distribution to a surviving spouse of a deceased employee. The employee must be under a qualified plan in order for compensation to occur. The Employee Retirement Income Security Act (ERISA) dictates how payments are to be calculated.

A QJSA is when retirement benefits are paid as a life annuity (a series of payments, usually monthly, for life) to the participant and a survivor annuity over the life of the participant's surviving spouse (or a former spouse, child or dependent who must be treated as a surviving spouse under a QDRO) following the

A qualified pre-retirement survivor annuity (QPSA) is a death benefit that is paid to the surviving spouse of a deceased employee.

This special payment form is often called a qualified joint and survivor annuity or QJSA payment form. This benefit is paid to the participant each year and, on the participant's death, a survivor annuity is paid to the surviving spouse.

The QJSA payment form gives your spouse, the annuitant, a retirement payment for the rest of his or her life. Under the QJSA payment form, after your spouse dies, the contract will pay you, the surviving spouse, at least 50% percent of the retirement benefit that was paid to your spouse, the annuitant.

Qualified Joint and Survivor Annuity (QJSA) includes a level monthly payment for your lifetime and a survivor benefit for your spouse after your death equal to the percentage designated of that monthly payment.

If you do not waive the QPSA, after your death the Plan will pay your spouse the QPSA unless your spouse elects another benefit form. The QPSA will not pay benefits to other beneficiaries after your spouse dies. If you waive the QPSA, the Plan will pay your account to your designated beneficiary.