Oklahoma Worksheet Analyzing a Self-Employed Independent Contractor

Description

How to fill out Worksheet Analyzing A Self-Employed Independent Contractor?

Are you currently in a situation that requires documents for either business or personal reasons almost every time.

There are numerous legal document templates accessible online, but finding ones you can depend on is not easy.

US Legal Forms provides thousands of form templates, including the Oklahoma Worksheet Evaluating a Self-Employed Independent Contractor, which are created to meet state and federal requirements.

Once you find the correct form, click Purchase now.

Choose the pricing plan you prefer, provide the required information to create your account, and complete the transaction using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply sign in.

- After this, you can download the Oklahoma Worksheet Evaluating a Self-Employed Independent Contractor template.

- If you don't have an account and want to start using US Legal Forms, follow these steps.

- Select the form you need and ensure it is for the correct city/state.

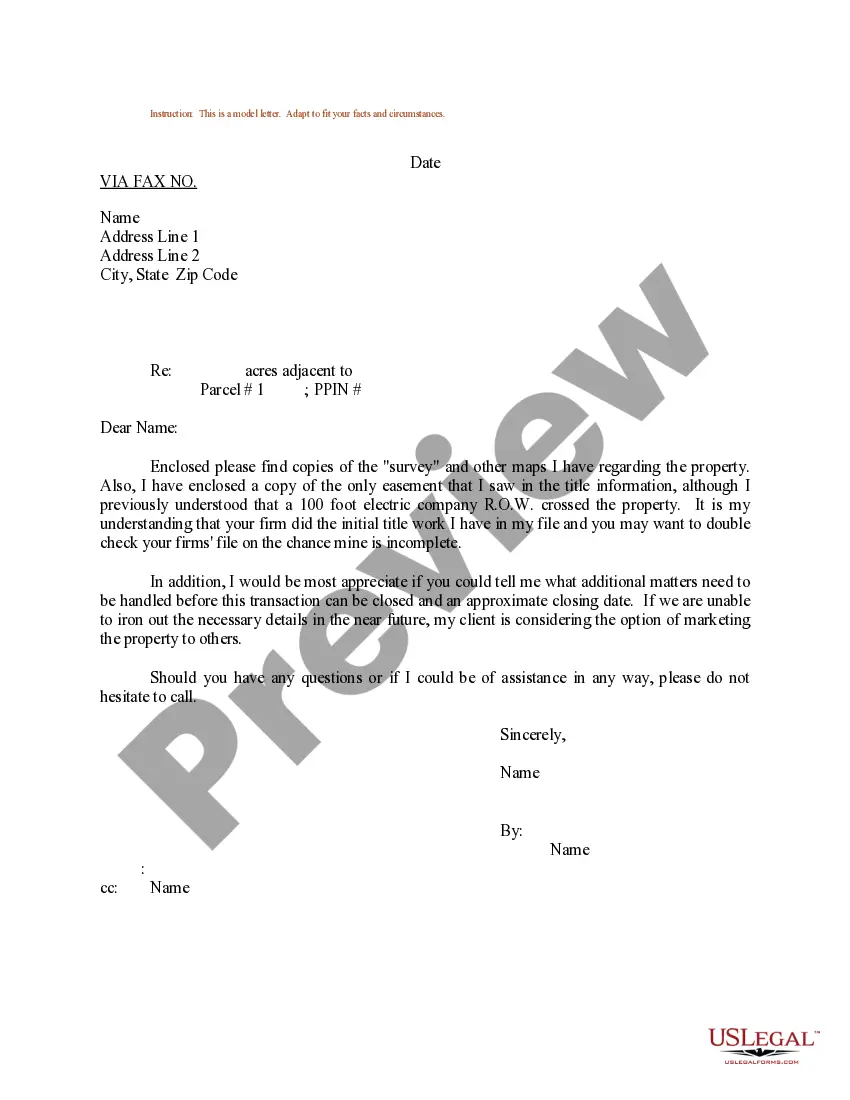

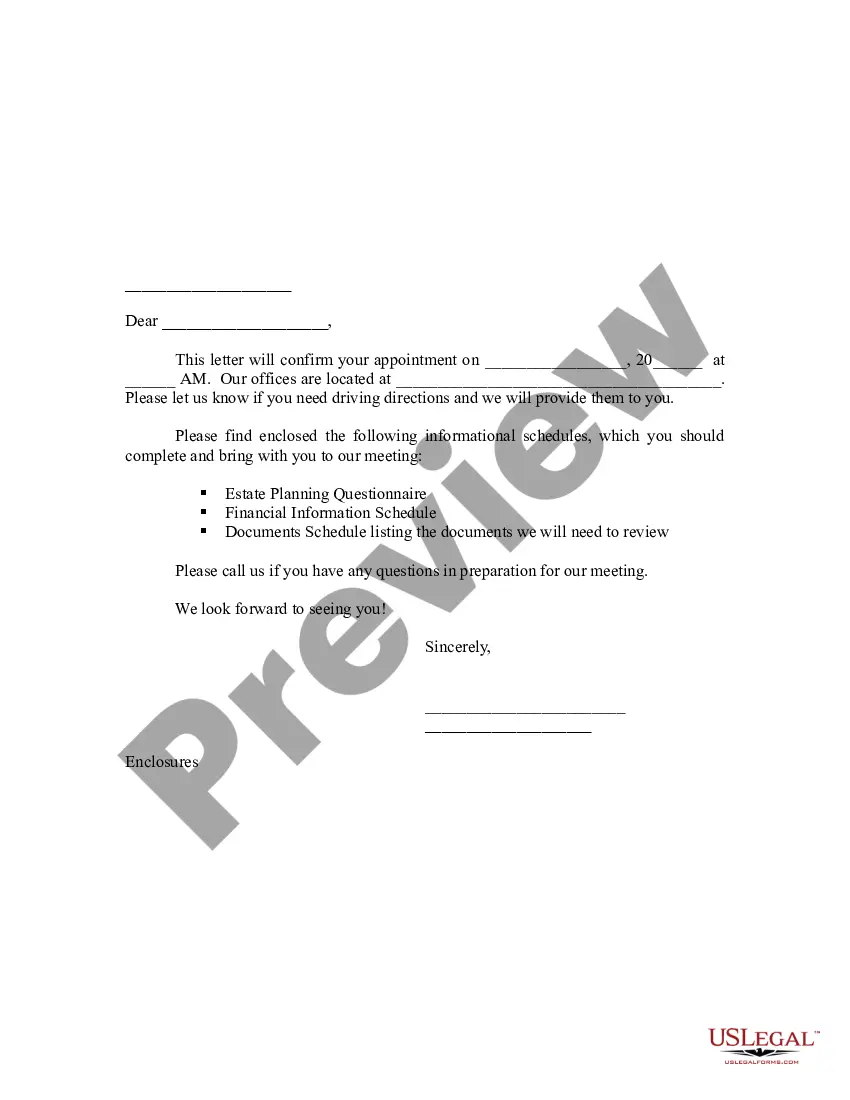

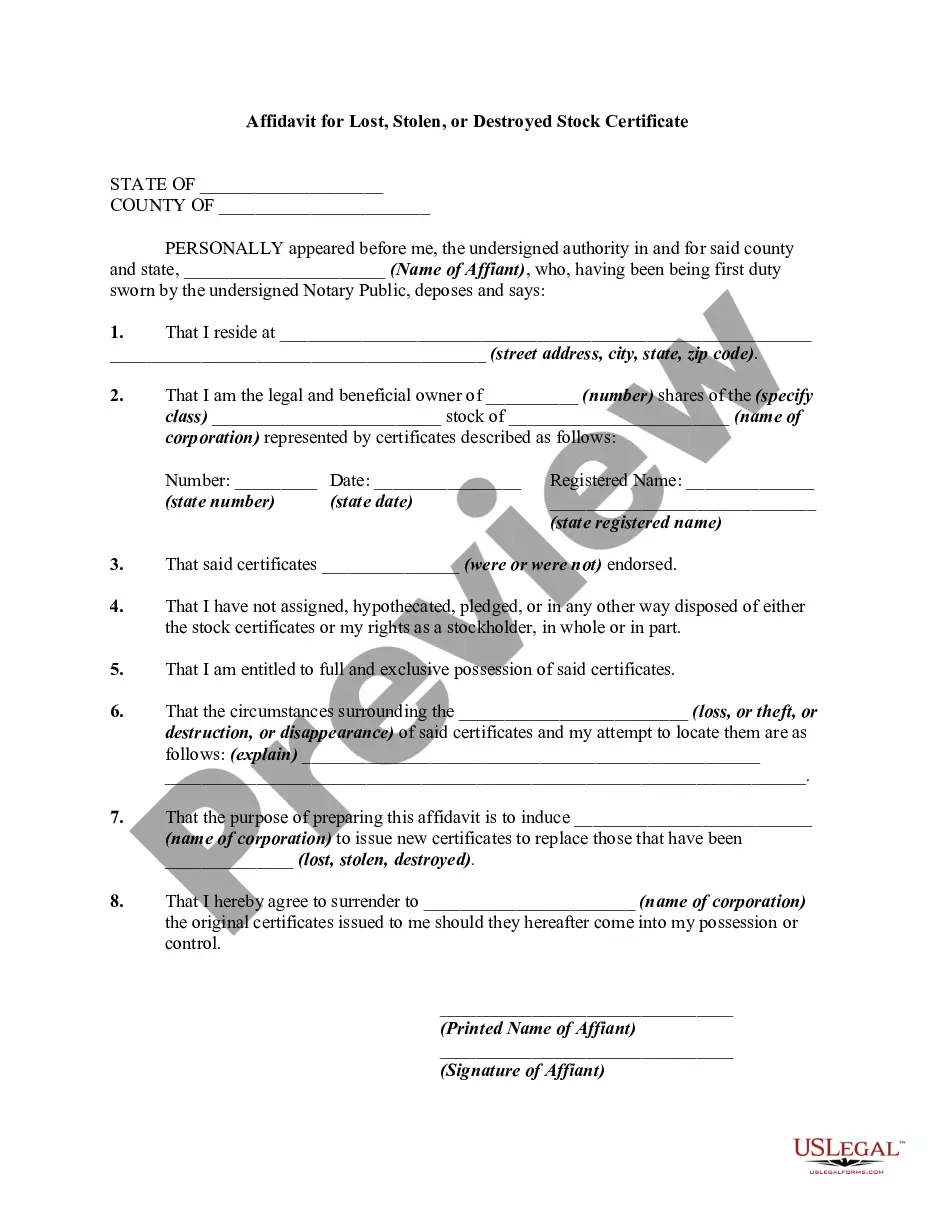

- Use the Review button to inspect the form.

- Check the description to confirm you have selected the correct form.

- If the form does not match your needs, use the Lookup field to find the form that suits your needs.

Form popularity

FAQ

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

How is self-employed income calculated for a mortgage? To calculate self-employed income during the mortgage process, lenders typically average your income over the past two years and break it down by month.

They calculate your income by adding it up and dividing by 24 (months). For example, say year one the business income is $80,000 and year two $83,000. The income used for qualifying purposes is $80,000 + $83,000 = $163,000 then divided by 24 = $6,791 per month.

Self-employment income is earned from carrying on a "trade or business" as a sole proprietor, an independent contractor, or some form of partnership. To be considered a trade or business, an activity does not necessarily have to be profitable, and you do not have to work at it full time, but profit must be your motive.

Find your net profit before taking exemptions or paying taxes (from Schedule C of your tax return) for the two most recent years you filed taxes. Add these two figures together. Divide the total by 24.

To get the DTI percentage, we divide your total monthly debt by your gross monthly income (before income taxes).

Any individual who has a 25% or greater ownership interest in a business is considered to be self-employed.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

To calculate income for a self-employed borrower, mortgage lenders will typically add the adjusted gross income as shown on the two most recent years' federal tax returns, then add certain claimed depreciation to that bottom-line figure. Next, the sum will be divided by 24 months to find your monthly household income.

They calculate your income by adding it up and dividing by 24 (months). For example, say year one the business income is $80,000 and year two $83,000. The income used for qualifying purposes is $80,000 + $83,000 = $163,000 then divided by 24 = $6,791 per month.