Oklahoma Property Claimed as Exempt - Schedule C - Form 6C - Post 2005

Description

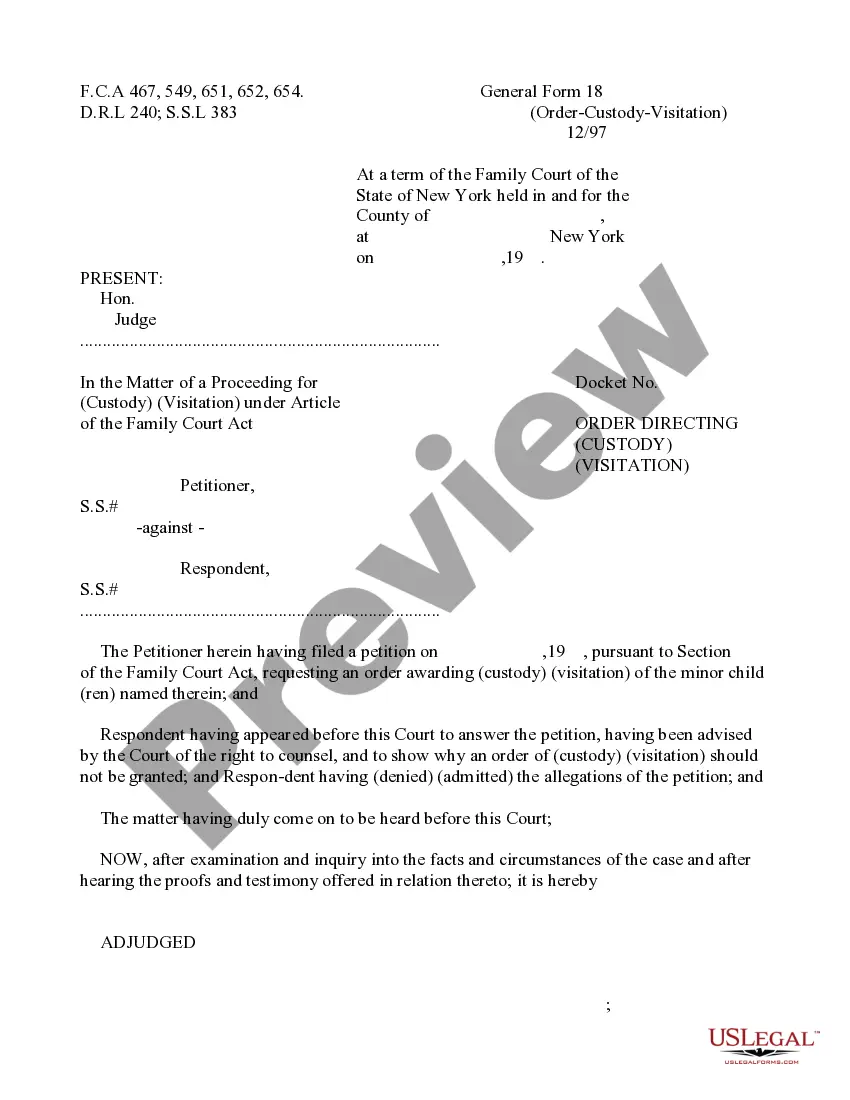

How to fill out Property Claimed As Exempt - Schedule C - Form 6C - Post 2005?

Have you been in the placement where you need paperwork for sometimes business or individual functions almost every day time? There are plenty of legal file web templates available online, but getting types you can trust isn`t simple. US Legal Forms offers 1000s of form web templates, such as the Oklahoma Property Claimed as Exempt - Schedule C - Form 6C - Post 2005, which are created to satisfy state and federal needs.

When you are presently informed about US Legal Forms site and also have an account, merely log in. After that, you are able to acquire the Oklahoma Property Claimed as Exempt - Schedule C - Form 6C - Post 2005 template.

Should you not offer an bank account and would like to begin using US Legal Forms, adopt these measures:

- Find the form you want and ensure it is for that proper metropolis/region.

- Use the Preview key to examine the shape.

- Look at the outline to ensure that you have selected the appropriate form.

- In the event the form isn`t what you are seeking, use the Research discipline to find the form that meets your needs and needs.

- Once you get the proper form, just click Buy now.

- Pick the costs plan you want, fill out the specified details to create your bank account, and pay for the order with your PayPal or charge card.

- Choose a handy paper file format and acquire your backup.

Get each of the file web templates you may have purchased in the My Forms menus. You can get a further backup of Oklahoma Property Claimed as Exempt - Schedule C - Form 6C - Post 2005 any time, if possible. Just select the essential form to acquire or printing the file template.

Use US Legal Forms, one of the most comprehensive collection of legal varieties, in order to save some time and stay away from mistakes. The services offers expertly made legal file web templates that can be used for a variety of functions. Produce an account on US Legal Forms and start producing your daily life easier.

Form popularity

FAQ

(Official Form 106C) lists the property that you believe you are entitled to keep. If you do not claim the property on this form, it will not be exempted, despite your rights under the law. Before filling out this form, you have to decide whether you will use your state exemptions or the federal exemptions.