The Oklahoma Statement of Financial Affairs — Form 7 is a crucial document required by individuals or entities filing for bankruptcy in Oklahoma. This form provides a detailed snapshot of an individual's or business's financial situation, including their assets, liabilities, income, and expenses. It helps the bankruptcy court and creditors assess the debtor's financial position accurately. There are different types of Oklahoma Statement of Financial Affairs — Form 7, which may include: 1. Personal Bankruptcy — Form 7: This form applies to individuals filing for bankruptcy, whether it is under Chapter 7 (liquidation) or Chapter 13 (reorganization). It asks for information regarding income, expenses, assets, debts, transfers of property, financial transactions, and other relevant financial data to evaluate the debtor's financial standing. 2. Business Bankruptcy — Form 7: This form is specifically designed for businesses filing for bankruptcy, such as corporations, partnerships, or sole proprietorship. It requires detailed information about the business's financial affairs, including business assets, liabilities, income, expenses, business transactions, and any related parties or affiliates. Both forms usually consist of a series of questions pertaining to the debtor's financial situation. Some key information covered in the Oklahoma Statement of Financial Affairs — Form 7 may include: a. Identification: The form collects information about the debtor's name, address, taxpayer identification number, and bankruptcy case number. b. Assets: Debtors need to list all their assets, such as real estate holdings, vehicles, bank accounts, investments, personal property, retirement accounts, and any other valuable possessions. c. Liabilities: This section requires disclosure of all outstanding debts and obligations, including mortgages, car loans, credit card debts, student loans, taxes owed, and any pending lawsuits or legal judgments. d. Income: Debtors must report their current income sources, employment details, wages, self-employment income, rental income, pension, and any other sources of regular earnings. e. Expenses: The form asks for a breakdown of monthly living expenses, including housing costs, utilities, transportation, groceries, medical expenses, insurance premiums, child support, alimony, and other essential expenditures. f. Transfers and Preferences: Debtors are required to disclose any recent property transfers or payments made to creditors, as these may impact the bankruptcy proceedings. g. Financial History: The form may inquire about the debtor's financial history, such as previous bankruptcies, foreclosures, repossessions, and any other relevant financial events. h. Business-related Details: In case of business bankruptcy, additional sections will request information about the business structure, ownership, partners or shareholders, business assets and liabilities, financial records, and business-related transactions. Filling out the Oklahoma Statement of Financial Affairs — Form 7 accurately and thoroughly is crucial, as any misrepresentation or omission of information can have serious legal consequences. It is recommended to seek professional guidance from a bankruptcy attorney or financial advisor to ensure compliance with the filing requirements and maximize the benefits of the bankruptcy process.

Oklahoma Statement of Financial Affairs - Form 7

Description

How to fill out Oklahoma Statement Of Financial Affairs - Form 7?

Have you been in the placement the place you will need documents for both organization or person functions virtually every day? There are a variety of lawful file web templates accessible on the Internet, but discovering ones you can trust isn`t straightforward. US Legal Forms delivers a huge number of type web templates, just like the Oklahoma Statement of Financial Affairs - Form 7, which can be composed in order to meet federal and state specifications.

Should you be previously acquainted with US Legal Forms site and possess an account, merely log in. After that, you may down load the Oklahoma Statement of Financial Affairs - Form 7 format.

Unless you come with an profile and wish to begin to use US Legal Forms, follow these steps:

- Find the type you want and make sure it is for that proper metropolis/region.

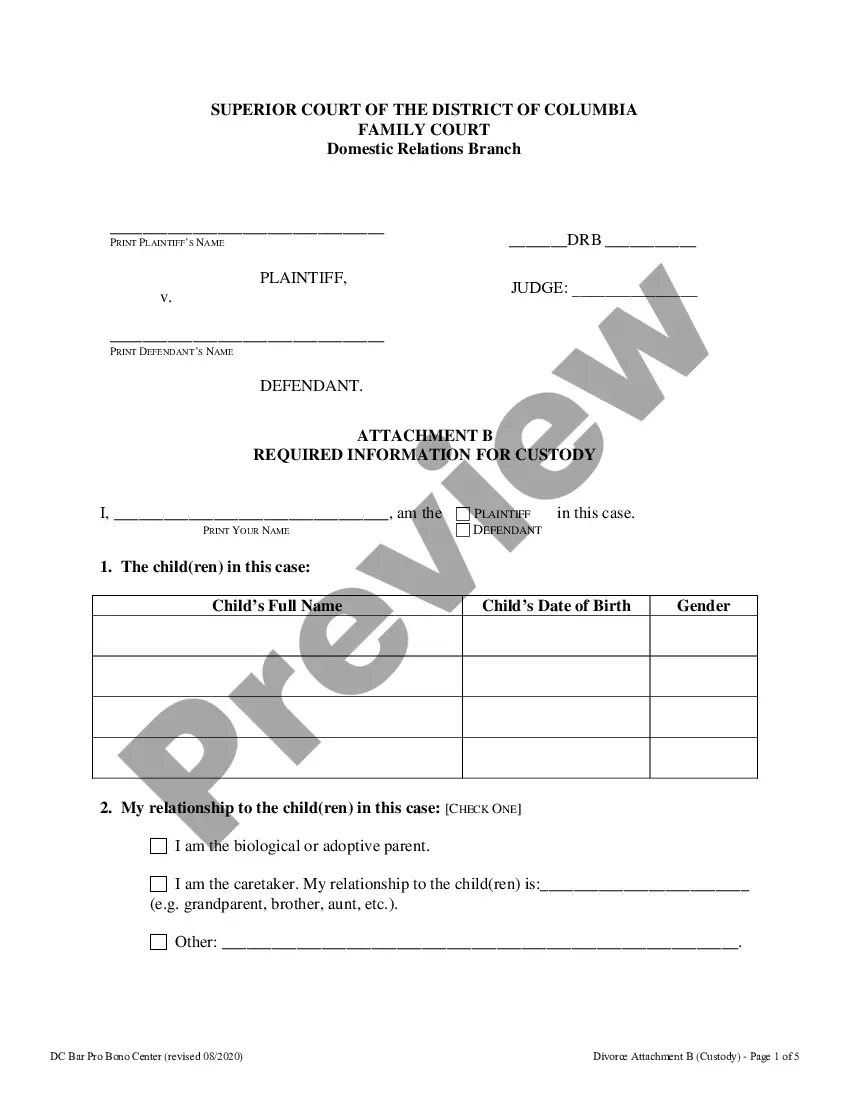

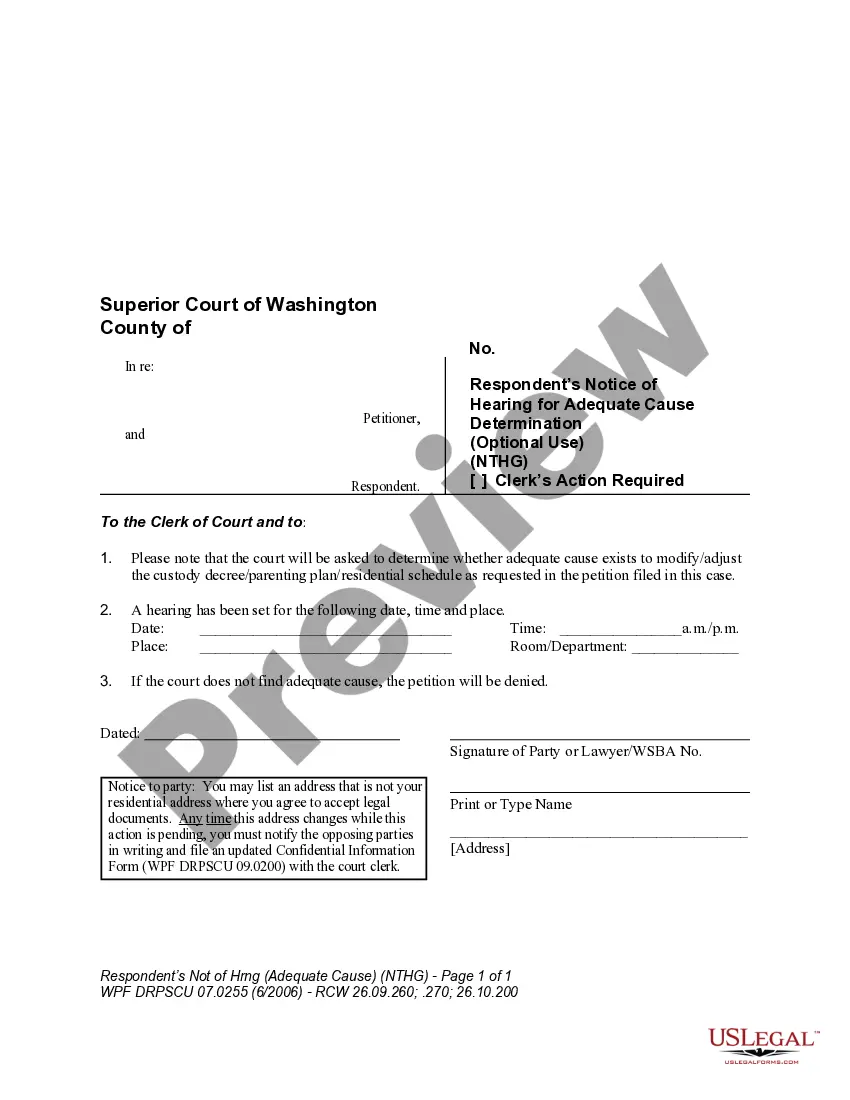

- Utilize the Preview key to check the form.

- Read the description to actually have chosen the correct type.

- In case the type isn`t what you`re trying to find, use the Lookup area to find the type that suits you and specifications.

- When you find the proper type, click on Get now.

- Choose the rates prepare you need, complete the specified information to create your bank account, and pay money for your order with your PayPal or charge card.

- Select a practical data file structure and down load your duplicate.

Discover all of the file web templates you have bought in the My Forms menus. You can obtain a further duplicate of Oklahoma Statement of Financial Affairs - Form 7 anytime, if necessary. Just go through the essential type to down load or print the file format.

Use US Legal Forms, the most substantial selection of lawful types, to save lots of time and avoid errors. The support delivers skillfully manufactured lawful file web templates that can be used for a variety of functions. Generate an account on US Legal Forms and commence producing your way of life easier.

Form popularity

FAQ

A:The filing fee for Chapter 7 is $335. For a Chapter 13, the fee is $310. Attorney's fees usually vary based on the complexity of the case. There may be a small additional fee charged by the trustee for filing bankruptcy, and an additional fee for the mandatory classes.

Statement of Financial Af·?fairs. : a written statement filed by a debtor in bankruptcy that contains information regarding especially financial records, location of any accounts, prior bankruptcy, and recent or current debt. called also statement of affairs.

Form 7, the Statement of Financial Affairs, contains a series of questions which direct the debtor to answer by furnishing information. If the answer to a question is "None," or the question is not applicable, an affirmative statement to that effect is required.

While it may feel odd to pay fees to tell the courts you don't have enough money, you typically have to pay court fees to file for bankruptcy. The filing fee for a Chapter 7 bankruptcy is $338, while the filing fee for a Chapter 13 bankruptcy is $313.

When you file for Chapter 7 bankruptcy, you will have to complete a form called the Statement of Intention for Individuals Filing Under Chapter 7. On this form, you tell the court whether you want to keep your secured and leased property?such as your car, boat, or home?or let it go back to the creditor.

The vast majority?as much as 99%?of people who file Chapter 7 bankruptcy have their debts completely discharged and are under no obligation to repay their creditors. Debts you might still have to repay can include: Spousal support. Child support.

The court cannot take most property that ordinary individuals have. Oklahoma law exempts your home, your car, your clothing, your household items and various other items. There are limits on the value of the property that you can keep, but they are well above what most individuals have.

Oklahoma exemptions protect 75% of wages earned in the 90 days preceding the bankruptcy filing.