Oklahoma Agreement and Plan of Merger for conversion of corporation into Maryland Real Estate Investment Trust

Description

How to fill out Agreement And Plan Of Merger For Conversion Of Corporation Into Maryland Real Estate Investment Trust?

US Legal Forms - one of many biggest libraries of lawful forms in America - gives a wide range of lawful document templates you are able to download or print. While using website, you may get a large number of forms for company and individual uses, categorized by groups, says, or key phrases.You can get the most recent types of forms much like the Oklahoma Agreement and Plan of Merger for conversion of corporation into Maryland Real Estate Investment Trust within minutes.

If you have a membership, log in and download Oklahoma Agreement and Plan of Merger for conversion of corporation into Maryland Real Estate Investment Trust from the US Legal Forms catalogue. The Obtain switch will show up on each develop you look at. You gain access to all formerly saved forms inside the My Forms tab of your account.

If you would like use US Legal Forms initially, allow me to share basic directions to help you began:

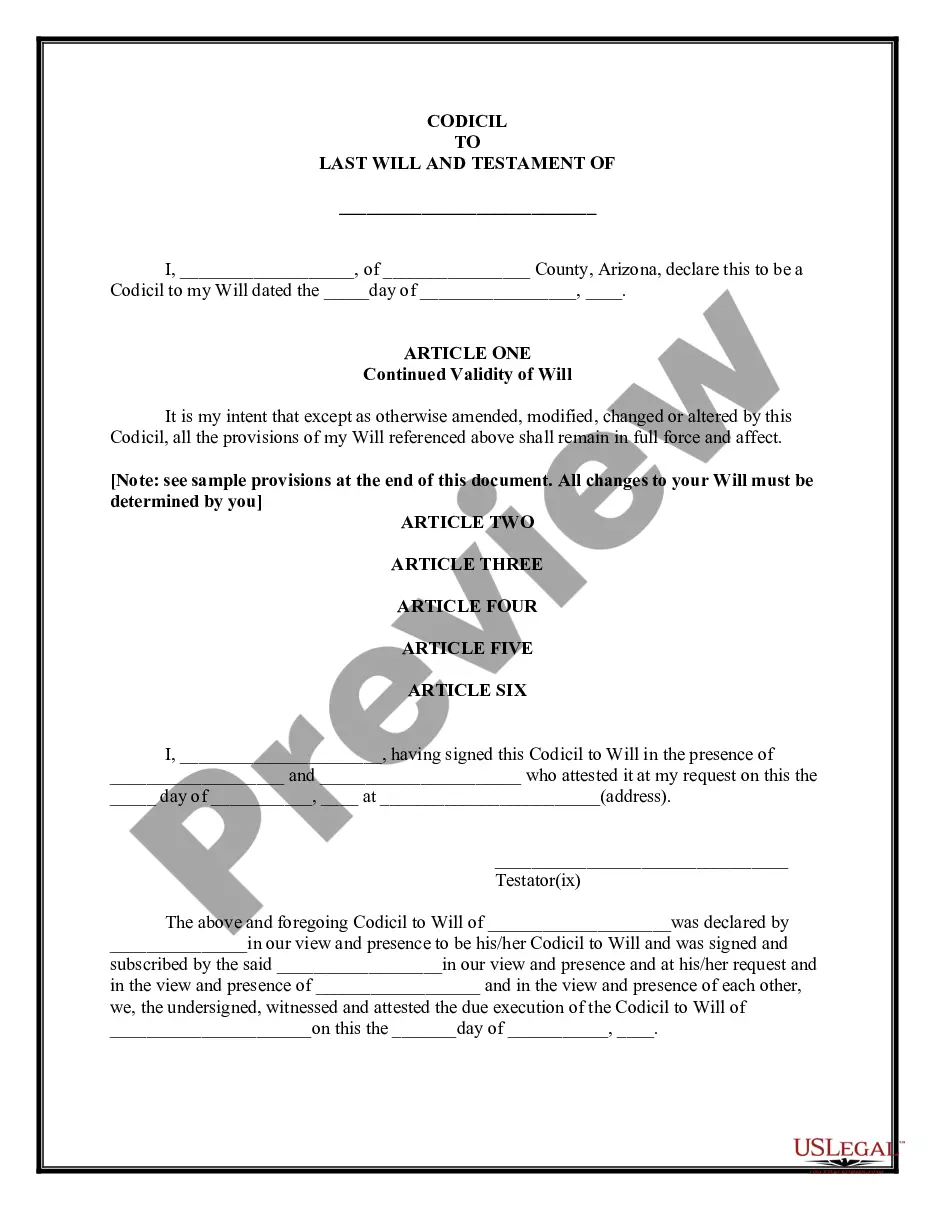

- Be sure you have picked the proper develop for the town/county. Click on the Preview switch to review the form`s content material. Look at the develop explanation to actually have chosen the appropriate develop.

- If the develop doesn`t match your needs, make use of the Research area towards the top of the screen to find the one that does.

- Should you be satisfied with the form, confirm your choice by visiting the Purchase now switch. Then, choose the pricing strategy you like and offer your references to register for an account.

- Procedure the purchase. Use your bank card or PayPal account to complete the purchase.

- Pick the formatting and download the form on the device.

- Make modifications. Fill out, change and print and sign the saved Oklahoma Agreement and Plan of Merger for conversion of corporation into Maryland Real Estate Investment Trust.

Every template you included with your money does not have an expiration time and it is your own forever. So, in order to download or print another duplicate, just visit the My Forms section and click in the develop you will need.

Gain access to the Oklahoma Agreement and Plan of Merger for conversion of corporation into Maryland Real Estate Investment Trust with US Legal Forms, by far the most considerable catalogue of lawful document templates. Use a large number of specialist and status-certain templates that satisfy your company or individual requires and needs.