Oklahoma Letter to Shareholders

Description

How to fill out Letter To Shareholders?

Choosing the right legal papers template could be a have difficulties. Naturally, there are a variety of themes available online, but how can you find the legal kind you need? Make use of the US Legal Forms web site. The assistance provides thousands of themes, including the Oklahoma Letter to Shareholders, which can be used for business and personal needs. Every one of the forms are inspected by professionals and meet up with federal and state requirements.

If you are already authorized, log in to the bank account and then click the Obtain key to get the Oklahoma Letter to Shareholders. Use your bank account to look through the legal forms you possess bought formerly. Visit the My Forms tab of your respective bank account and obtain another backup of your papers you need.

If you are a brand new customer of US Legal Forms, allow me to share straightforward guidelines so that you can comply with:

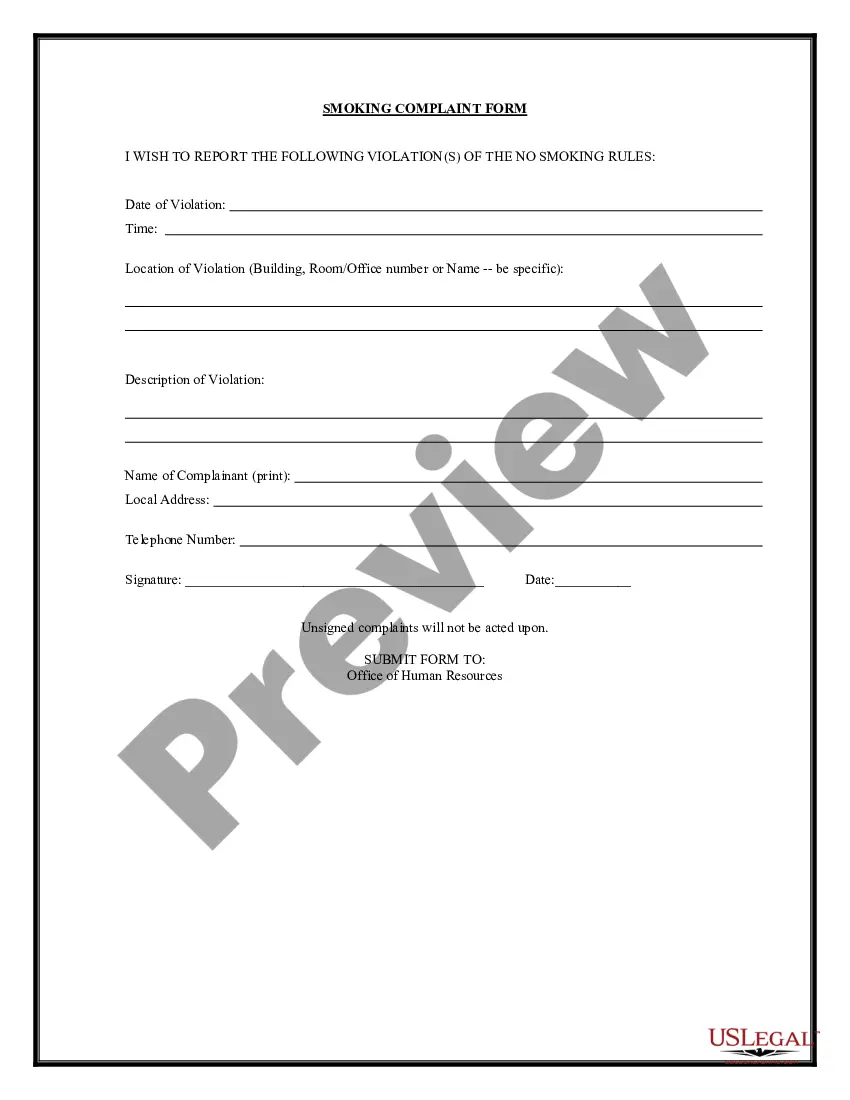

- Very first, be sure you have chosen the right kind for the city/area. You can look over the shape while using Review key and look at the shape information to ensure it is the right one for you.

- If the kind does not meet up with your requirements, make use of the Seach area to discover the proper kind.

- When you are certain that the shape is suitable, select the Acquire now key to get the kind.

- Select the rates plan you want and type in the needed information and facts. Build your bank account and purchase the order making use of your PayPal bank account or bank card.

- Opt for the document structure and download the legal papers template to the device.

- Comprehensive, revise and produce and signal the attained Oklahoma Letter to Shareholders.

US Legal Forms is the largest library of legal forms that you can see numerous papers themes. Make use of the service to download professionally-manufactured files that comply with state requirements.

Form popularity

FAQ

An Oklahoma annual report must be filed by businesses registered in Oklahoma with the secretary of state's office. The type of report, cost, and frequency depend on the specific business entity.

Calculating apportionment for income Identify your gross income for the quarter. ... Calculate your company's book value. ... Divide your gross income figure by the number of days in the relevant quarter. ... Multiply this number by the number of days in the year. ... Finally, divide your final figure by the value of your business.

The apportionment requirement dictates that the tax quota allocable to each state must be exactly the same, because the population is the same.

Apportionment is the determination of the percentage of a business' profits subject to a given jurisdiction's corporate income or other business taxes. U.S. states apportion business profits based on some combination of the percentage of company property, payroll, and sales located within their borders.

Oklahoma's apportionment formula consists of sales, payroll and property weighted equally and a throwback rule which takes out-of-state sales and lumps them into a corporation's Oklahoma income when the corporation makes sales in a state that does not tax the income.

Every corporation organized under the laws of this state, or qualified to do or doing business in Oklahoma in a corporate or organized capacity by virtue or creation of organization under the laws of this state or any other state, territory, district, or a foreign country, including associations, joint stock companies ...

For example, if your total income was $50,000 and you earned $30,000 in a second state where you moved during the year, your apportionment percentage is 30,000 divided by 50,000, or 60 percent. You generally use the apportionment percentage in one of two common methods to calculate your state income tax.

Section 7-17-3 - What constitutes "Nexus" (a) If a corporation has one or more of the following activities in Oklahoma, it is considered to have "nexus" and shall be subject to Oklahoma income taxes: (1) Maintenance of any business location in Oklahoma, including any kind of office.