The Oklahoma Agreement of Merger is a legally binding document that outlines the terms and conditions of merging between VP Oil, Inc., VP Acquisition Corp., Big Piney Oil and Gas Co., Big Piney Acquisition Corp., and National Energy Group, Inc. This merger is a significant strategic move that aims to consolidate resources, enhance operational efficiency, and foster growth in the energy sector. The agreement encompasses various types and aspects of the merger. One type is the "Share Exchange Agreement," where VP Oil, Inc. and VP Acquisition Corp. agree to exchange their shares for the shares of Big Piney Oil and Gas Co. and Big Piney Acquisition Corp., respectively. This enables them to combine their assets, corporate structures, and market presence. Another type is the "Asset Purchase Agreement," which involves the acquisition of specific oil and gas assets by VP Oil, Inc. and VP Acquisition Corp. from Big Piney Oil and Gas Co. and Big Piney Acquisition Corp. respectively. This agreement allows VP Oil, Inc. and VP Acquisition Corp. to expand their portfolio of resources and extend their footprint in the Oklahoma energy market. The Oklahoma Agreement of Merger also includes provisions related to the rationalization of operations, managerial roles, and future growth plans. It delineates the responsibility distribution among the merged entities, ensuring a smooth transition and seamless integration. Additionally, it establishes the governance structure, board composition, and decision-making processes for the newly formed entity. By executing this merger, VP Oil, Inc., VP Acquisition Corp., Big Piney Oil and Gas Co., Big Piney Acquisition Corp., and National Energy Group, Inc. aim to achieve synergy, economies of scale, and enhanced competitive advantage in the Oklahoma energy landscape. The combined entity anticipates a more robust market position, increased production capacity, improved technological capabilities, and a strengthened financial base. This merger demonstrates the commitment of these companies to adapt to changing market dynamics, optimize resource utilization, and capitalize on emerging opportunities. With a shared vision, extensive industry experience, and complementary strengths, the merged entity is set to become a major player in the energy sector, aligning with the evolving needs of the market and delivering value to shareholders, customers, and stakeholders. The Oklahoma Agreement of Merger between VP Oil, Inc., VP Acquisition Corp., Big Piney Oil and Gas Co., Big Piney Acquisition Corp., and National Energy Group, Inc. exemplifies the strategic foresight of these entities, as they navigate the dynamic energy industry and position themselves for long-term success.

Oklahoma Agreement of Merger by VP Oil, Inc., VP Acquisition Corp., Big Piney Oil and Gas Co., Big Piney Acquisition Corp., and National Energy Group, Inc.

Description

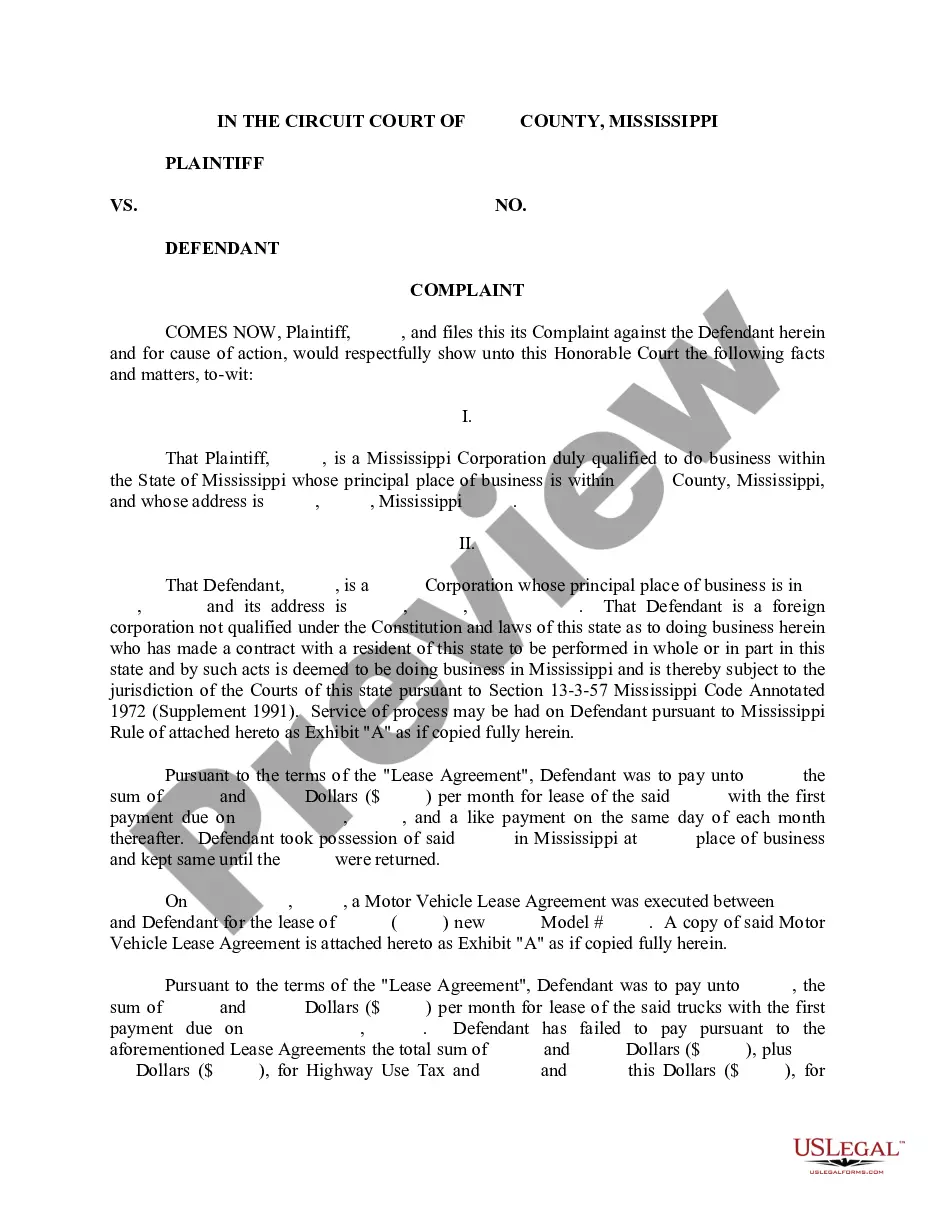

How to fill out Oklahoma Agreement Of Merger By VP Oil, Inc., VP Acquisition Corp., Big Piney Oil And Gas Co., Big Piney Acquisition Corp., And National Energy Group, Inc.?

Discovering the right authorized record template might be a have a problem. Obviously, there are a variety of themes available online, but how would you get the authorized type you need? Use the US Legal Forms site. The assistance provides a large number of themes, such as the Oklahoma Agreement of Merger by VP Oil, Inc., VP Acquisition Corp., Big Piney Oil and Gas Co., Big Piney Acquisition Corp., and National Energy Group, Inc., which you can use for organization and personal requires. All the forms are checked by specialists and meet federal and state needs.

In case you are previously signed up, log in for your bank account and click the Acquire button to have the Oklahoma Agreement of Merger by VP Oil, Inc., VP Acquisition Corp., Big Piney Oil and Gas Co., Big Piney Acquisition Corp., and National Energy Group, Inc.. Make use of bank account to check throughout the authorized forms you possess acquired in the past. Check out the My Forms tab of the bank account and have one more duplicate of the record you need.

In case you are a brand new user of US Legal Forms, listed here are basic instructions that you can adhere to:

- Initial, make certain you have selected the right type for your metropolis/state. It is possible to look through the shape using the Preview button and read the shape information to guarantee this is basically the right one for you.

- When the type is not going to meet your preferences, utilize the Seach area to find the correct type.

- When you are certain the shape is proper, select the Get now button to have the type.

- Opt for the pricing plan you would like and type in the required info. Build your bank account and pay money for the order making use of your PayPal bank account or credit card.

- Pick the data file format and down load the authorized record template for your product.

- Total, change and produce and indication the obtained Oklahoma Agreement of Merger by VP Oil, Inc., VP Acquisition Corp., Big Piney Oil and Gas Co., Big Piney Acquisition Corp., and National Energy Group, Inc..

US Legal Forms will be the greatest local library of authorized forms in which you will find numerous record themes. Use the company to down load professionally-made documents that adhere to state needs.