The Oklahoma Exchange Agreement is a legal arrangement executed between Danielson Holding Corp., Mission American Insurance Co., and CCP Shareholders. This agreement entails a detailed exchange of assets, shares, or holdings between these parties, all of whom have a significant presence and involvement in the insurance industry. Danielson Holding Corp., a prominent insurance company, is involved in this agreement alongside Mission American Insurance Co., another established player in the insurance sector. Additionally, CCP Shareholders, who have a stake in both companies, are also party to this exchange agreement. This exchange agreement can take various forms, depending on the specific objectives and circumstances of the involved parties. For example, it could involve the exchange of shares or stocks, where Danielson Holding Corp. and Mission American Insurance Co. mutually agree to transfer a predetermined number of shares to one another. This type of exchange helps the companies diversify their portfolios and potentially strengthen their market positions. Furthermore, the Oklahoma Exchange Agreement could also include the exchange of particular assets or business units. In this scenario, Danielson Holding Corp. and Mission American Insurance Co. might decide to transfer certain divisions, subsidiaries, or assets to each other, allowing for strategic alignment or consolidation of resources. Such exchanges enable the parties involved to enhance their operating efficiency, complement their existing offerings, or enter new market segments. It is important to note that the terms and conditions of the Oklahoma Exchange Agreement may vary based on the negotiations between the parties involved and the corresponding regulatory requirements. These agreements are typically regulated by applicable laws and overseen by relevant regulatory authorities to ensure fairness, transparency, and protection for all parties. In conclusion, the Oklahoma Exchange Agreement by Danielson Holding Corp., Mission American Insurance Co., and CCP Shareholders represents a comprehensive agreement that facilitates the exchange of assets, shares, or holdings between these prominent players in the insurance industry. Through such agreements, these companies seek to achieve strategic objectives, enhance their competitiveness, and capitalize on potential synergies for mutual benefit.

Oklahoma Exchange Agreement by Danielson Holding Corp., Mission American Insurance Co., and KCP Shareholders

Description

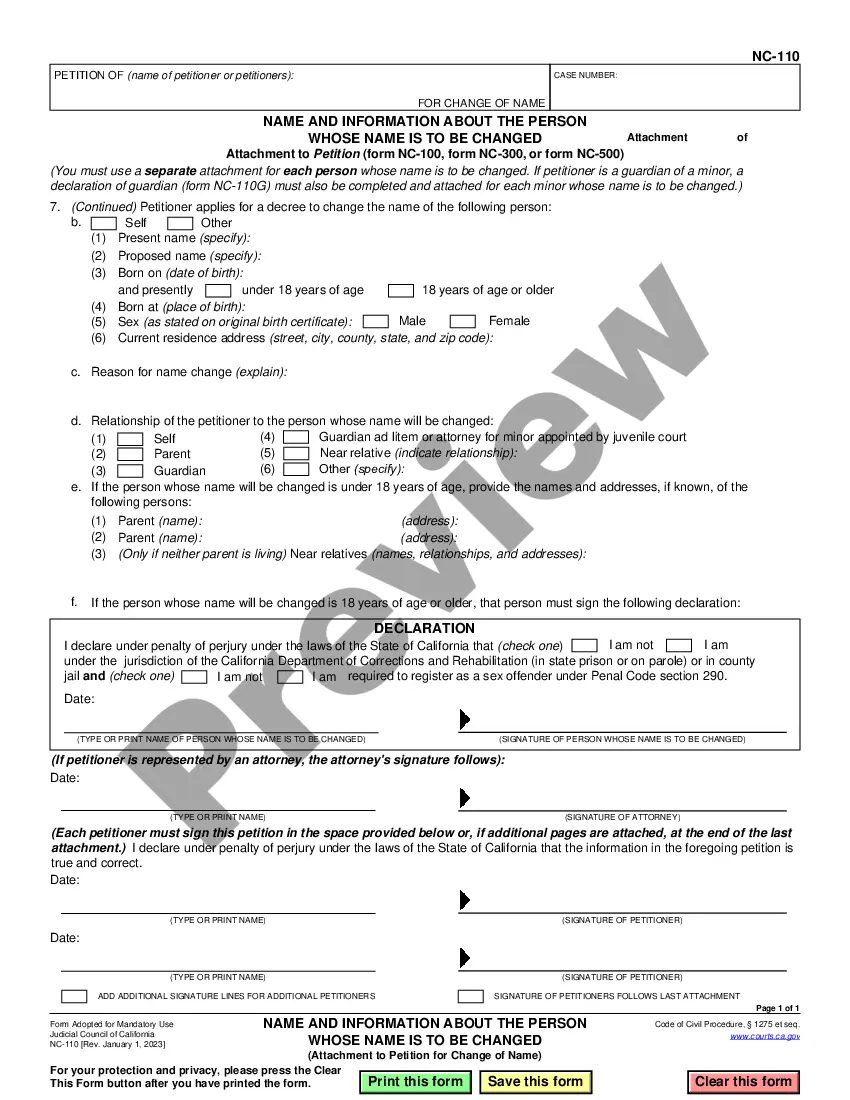

How to fill out Oklahoma Exchange Agreement By Danielson Holding Corp., Mission American Insurance Co., And KCP Shareholders?

Have you been inside a position that you require documents for both business or personal uses virtually every time? There are plenty of lawful file themes available on the net, but finding versions you can rely is not easy. US Legal Forms provides 1000s of develop themes, like the Oklahoma Exchange Agreement by Danielson Holding Corp., Mission American Insurance Co., and KCP Shareholders, which can be published in order to meet state and federal requirements.

In case you are previously knowledgeable about US Legal Forms website and possess your account, merely log in. Next, it is possible to obtain the Oklahoma Exchange Agreement by Danielson Holding Corp., Mission American Insurance Co., and KCP Shareholders design.

Should you not provide an accounts and need to begin to use US Legal Forms, abide by these steps:

- Get the develop you need and ensure it is for the right town/area.

- Take advantage of the Preview button to check the form.

- See the description to ensure that you have selected the appropriate develop.

- When the develop is not what you are looking for, use the Look for discipline to get the develop that fits your needs and requirements.

- If you obtain the right develop, just click Acquire now.

- Opt for the pricing strategy you need, submit the specified information to create your bank account, and pay money for an order utilizing your PayPal or credit card.

- Choose a hassle-free data file structure and obtain your copy.

Discover all the file themes you possess purchased in the My Forms menu. You can get a more copy of Oklahoma Exchange Agreement by Danielson Holding Corp., Mission American Insurance Co., and KCP Shareholders anytime, if possible. Just click the required develop to obtain or printing the file design.

Use US Legal Forms, probably the most considerable selection of lawful kinds, to conserve some time and steer clear of mistakes. The service provides appropriately created lawful file themes that you can use for a variety of uses. Generate your account on US Legal Forms and initiate creating your way of life easier.