Oklahoma Sale of Stock: Explained with Types and Process The Oklahoma Sale of Stock refers to the legal process of transferring ownership of stocks or shares in a company from one party to another within the state of Oklahoma. This type of transaction involves the selling and purchasing of stock securities, which represent ownership and claim to the company's assets and profits. The sale of stock in Oklahoma is governed by specific laws and regulations to ensure transparency and protect the interests of both buyers and sellers. Types of Oklahoma Sale of Stock: 1. Public Stock Sales: Public stock sales in Oklahoma involve offering shares of a company to the public through an initial public offering (IPO). These stocks are traded on national stock exchanges, such as the New York Stock Exchange or NASDAQ, and individuals or institutional investors can purchase these shares through brokers or online platforms. 2. Private Stock Sales: In contrast to public stock sales, private stock sales occur directly between the buyer and seller without involving the public. Generally, these transactions take place among large institutions, private equity firms, venture capitalists, or angel investors. Private stock sales are often utilized by startups or small companies seeking capital infusion without going through the complexities associated with a public offering. 3. Secondary Market Sales: Secondary market sales involve the trading of stocks on national exchanges where investors buy or sell previously issued stocks from other shareholders. This allows investors to trade shares without the company's direct involvement. Secondary market sales also include Over-the-Counter (OTC) trading, which occurs outside the traditional exchange platforms. Oklahoma Sale of Stock Process: 1. Agreement and Negotiation: The sale of stock in Oklahoma starts with an agreement between the buyer and seller, stating the terms and conditions of the transaction. Both parties negotiate aspects such as the number of shares, stock price, and any other pertinent details. 2. Due Diligence: Before finalizing the sale, the buyer typically conducts due diligence on the company's financials, operations, and legal aspects. This step ensures the buyer has a clear understanding of the company's current status and potential risks. 3. Stock Purchase Agreement: Once due diligence is complete, a stock purchase agreement is drafted, stating the terms agreed upon by both parties. This legal document outlines the conditions of sale, payment terms, and any warranties or representations made by the seller. 4. Closing the Sale: Upon the signing of the stock purchase agreement, the closing process begins. This involves the transfer of the stock ownership officially from the seller to the buyer. In most cases, an escrow agent or attorney facilitates the transaction, ensuring compliance with all legal requirements. 5. Reporting and Compliance: After the sale, buyers and sellers of stock in Oklahoma are required to adhere to relevant regulatory reporting requirements, such as reporting changes in ownership to the Securities and Exchange Commission (SEC). In summary, the Oklahoma Sale of Stock encompasses various types of stock transactions, including public sales, private sales, and secondary market trades. Each type follows a distinct process leading to the transfer of ownership. Understanding these different aspects and adhering to legal requirements is crucial for anyone involved in the sale of stock in Oklahoma.

Oklahoma Sale of stock

Description

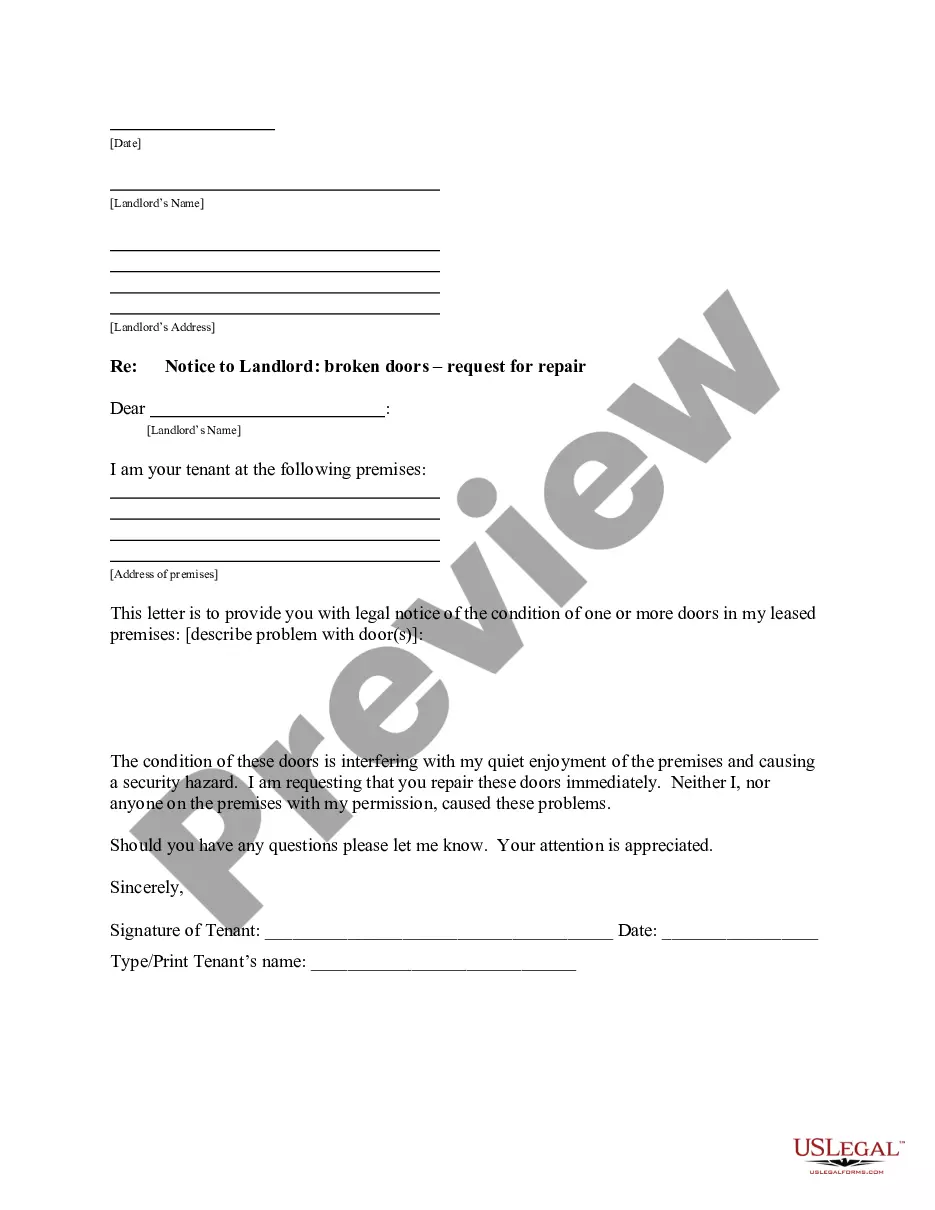

How to fill out Oklahoma Sale Of Stock?

Are you within a placement where you need to have files for either enterprise or personal uses virtually every day time? There are tons of lawful papers web templates available online, but finding versions you can trust is not straightforward. US Legal Forms provides a huge number of develop web templates, much like the Oklahoma Sale of stock, which can be written to meet federal and state requirements.

In case you are currently acquainted with US Legal Forms internet site and possess an account, merely log in. After that, you are able to down load the Oklahoma Sale of stock format.

Should you not provide an profile and want to begin to use US Legal Forms, abide by these steps:

- Obtain the develop you want and ensure it is for that correct town/area.

- Make use of the Preview key to review the shape.

- See the explanation to actually have chosen the right develop.

- When the develop is not what you are seeking, take advantage of the Look for discipline to obtain the develop that suits you and requirements.

- Whenever you discover the correct develop, click on Acquire now.

- Pick the pricing program you want, submit the required information and facts to make your bank account, and pay money for the transaction utilizing your PayPal or bank card.

- Choose a convenient file formatting and down load your copy.

Find all of the papers web templates you have bought in the My Forms food selection. You can get a extra copy of Oklahoma Sale of stock any time, if needed. Just go through the required develop to down load or printing the papers format.

Use US Legal Forms, the most considerable assortment of lawful kinds, to conserve some time and avoid blunders. The support provides skillfully manufactured lawful papers web templates which you can use for an array of uses. Produce an account on US Legal Forms and begin generating your lifestyle a little easier.

Form popularity

FAQ

For many small business owners, it's a tool to help them save for retirement or invest more in another small business. If you sell qualifying shares of a Canadian business in 2023, the LCGE is $971,190. However, as only half of the realized capital gains is taxable, the deduction limit is in fact $485,595.

$100,000 x 50% = $50,000 That means you have to pay tax on $50,000 in capital gains. In other words, you add $50,000 to your total taxable income for that year.

This tax is applied to the profit, or capital gain, made from selling assets like stocks, bonds, property and precious metals. It is generally paid when your taxes are filed for the given tax year, not immediately upon selling an asset.

Lifetime capital gains exemption limit ? For dispositions in 2022 of qualified small business corporation shares, the lifetime capital gains exemption (LCGE) limit has increased to $913,630. For more information, see What is the capital gains deduction limit?.

Capital gains are not taxed until they are realized, meaning that even if your Apple stock has increased 50x from the day you invested, you won't owe any capital gains taxes until you sell the stock. Of course, once you do sell the stock, you will face federal and state capital gains taxes.

For the 2023 tax year, individual filers won't pay any capital gains tax if their total taxable income is $44,625 or less. The rate jumps to 15 percent on capital gains, if their income is $44,626 to $492,300.

The OK form 561 is used to report sale of OK property or interest (such as stock) in a OK property, company, partnership that resulted in a capital gain.

Only 50% of a capital gain is taxable in Canada, and the taxable portion is added to your income for the year. With Canada's current income tax rates, no one pays more than 27% in capital gains tax.