Oklahoma Ratification and Approval of Indemnity Agreements

Description

How to fill out Ratification And Approval Of Indemnity Agreements?

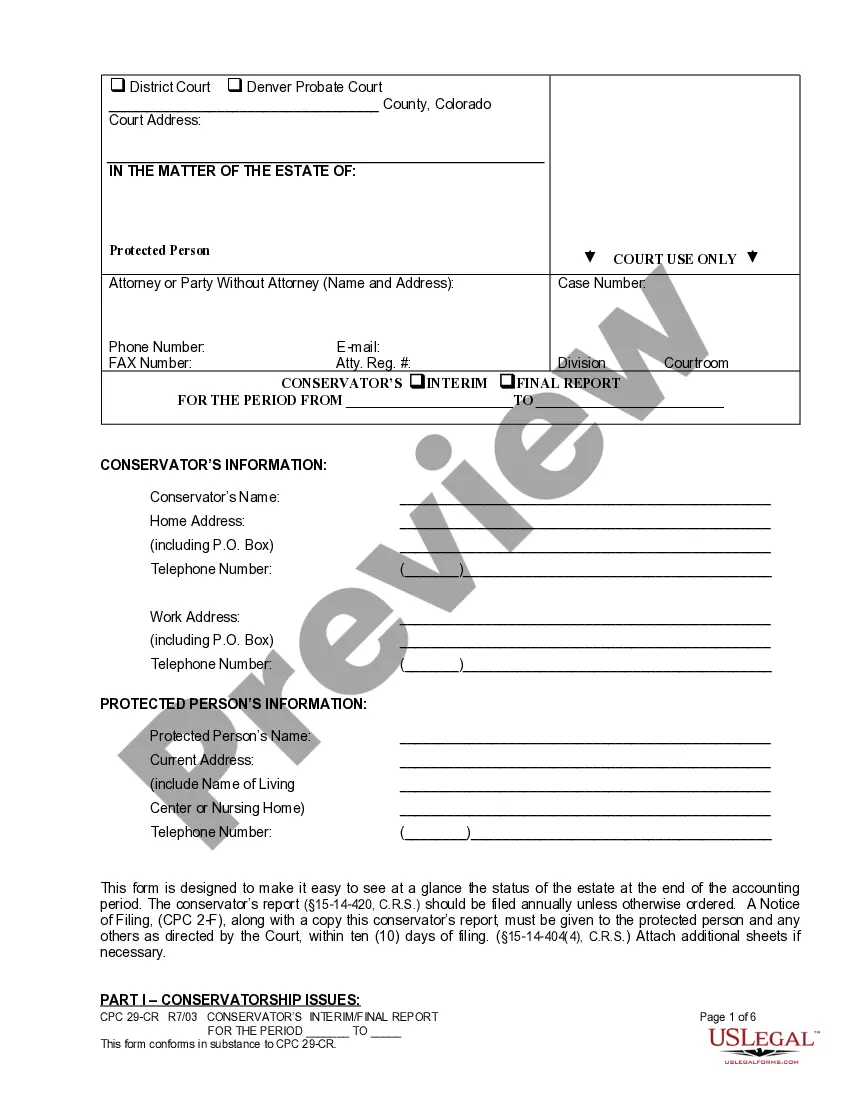

Choosing the right legal papers web template could be a have a problem. Needless to say, there are tons of layouts available online, but how do you get the legal kind you want? Use the US Legal Forms site. The services provides thousands of layouts, for example the Oklahoma Ratification and Approval of Indemnity Agreements, that can be used for enterprise and private requirements. All of the types are checked by experts and meet state and federal specifications.

If you are currently authorized, log in for your account and click the Down load switch to find the Oklahoma Ratification and Approval of Indemnity Agreements. Make use of your account to look through the legal types you possess purchased formerly. Go to the My Forms tab of your own account and have an additional copy from the papers you want.

If you are a fresh customer of US Legal Forms, here are straightforward directions that you can follow:

- First, ensure you have selected the appropriate kind for your metropolis/region. It is possible to examine the shape utilizing the Review switch and study the shape outline to make certain it will be the right one for you.

- In the event the kind is not going to meet your requirements, make use of the Seach discipline to obtain the correct kind.

- When you are positive that the shape is suitable, go through the Get now switch to find the kind.

- Pick the prices plan you desire and type in the essential information. Design your account and buy the order using your PayPal account or charge card.

- Pick the data file formatting and acquire the legal papers web template for your gadget.

- Comprehensive, modify and print out and sign the acquired Oklahoma Ratification and Approval of Indemnity Agreements.

US Legal Forms is definitely the greatest local library of legal types where you can find a variety of papers layouts. Use the company to acquire expertly-made documents that follow state specifications.

Form popularity

FAQ

15, § 219A. Noncompetition agreements: Unlawful Contracts ? Oklahoma. Prohibits noncompete contracts except those written to protect the sale of goodwill of a business, dissolution of a partnership or those that prohibit only the direct solicitation of established customers of the former employer.

CHARACTERISTICS OF A CONTRACT ? Parties capable of contracting. ? Consent. ? A lawful object; can't involve illegal activity. ? Sufficient cause or consideration.

A corporation shall have power to indemnify any person who was or is a party or is threatened to be made a party to any threatened, pending, or completed action, suit, or proceeding, whether civil, criminal, administrative, or investigative, other than an action by or in the right of the corporation, by reason of the ...

A corporation shall have power to indemnify any person who was or is a party or is threatened to be made a party to any threatened, pending, or completed action, suit, or proceeding, whether civil, criminal, administrative, or investigative, other than an action by or in the right of the corporation, by reason of the ...

In legal terms, an Act of Indemnity is a statute passed to protect people who have committed some illegal act which would otherwise cause them to be subjected to legal penalties.

In the indemnity clause, one party commits to compensate another party for any prospective loss or damage. More common is in insurance contracts, in exchange for premiums paid by the insured to the insurer, the insurer offers to compensate the insured for any potential damages or losses.

Contracts. §15-139. Seal - Necessity for seal abolished. All distinctions between sealed and unsealed instruments are abolished.

Indemnity is implicated when a person discharges another's duty: A person who, in whole or in part, has discharged a duty which is owed by him but which as between himself and another should have been discharged by the other, is entitled to indemnity from the other, unless the payor is barred by the wrongful nature of ...